Are you a renter looking to protect your belongings? Understanding renters insurance can be a bit tricky, but it's essential for safeguarding your items against unexpected events like theft or fire. This article will break down the key aspects of renters insurance documentation, making it easier for you to navigate the process. So, grab a cup of coffee and let's dive in to learn how to secure your peace of mind with the right coverage!

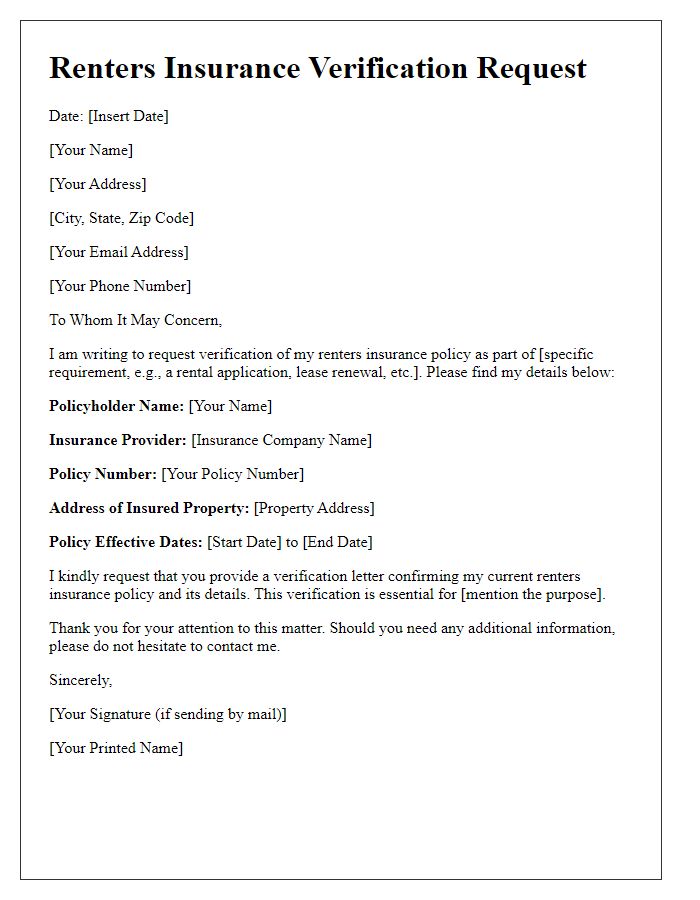

Policyholder Information

Renters insurance provides crucial protection for personal belongings against various risks, such as theft, fire, or water damage. Policyholder information includes essential details like name (John Smith), address (123 Main Street, Springfield), policy number (R123456789), and contact information (555-123-4567). Coverage amounts typically range from $10,000 to $100,000, depending on the value of possessions. Typical events covered under renters insurance are burglary incidents (reported at 1.4 million in 2020) and fire-related damages, which have caused an average of $10 billion in losses annually. Understanding these specifics is vital for policyholders to make informed decisions regarding coverage limits and exclusions.

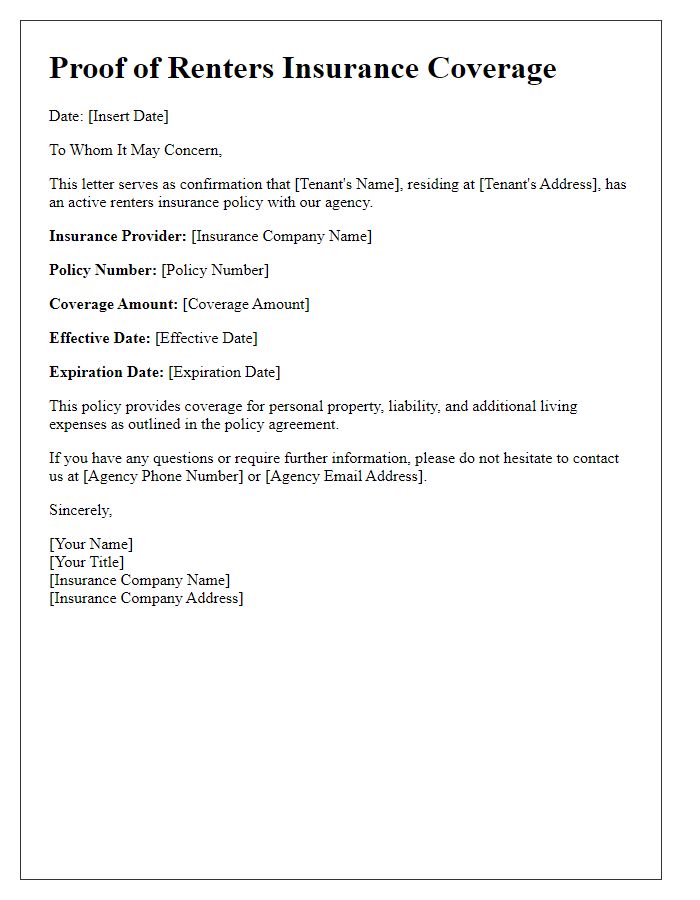

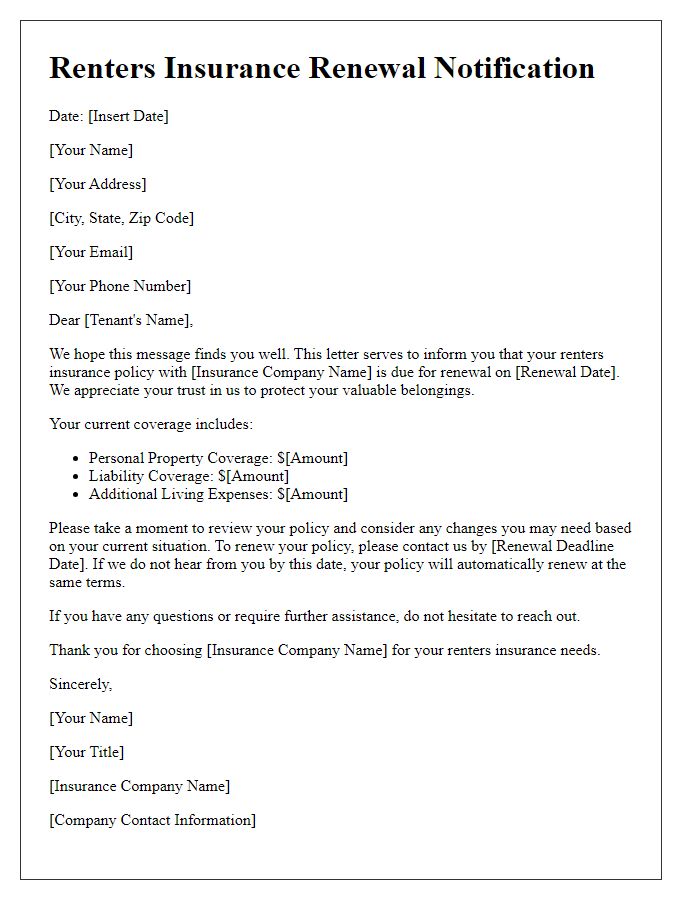

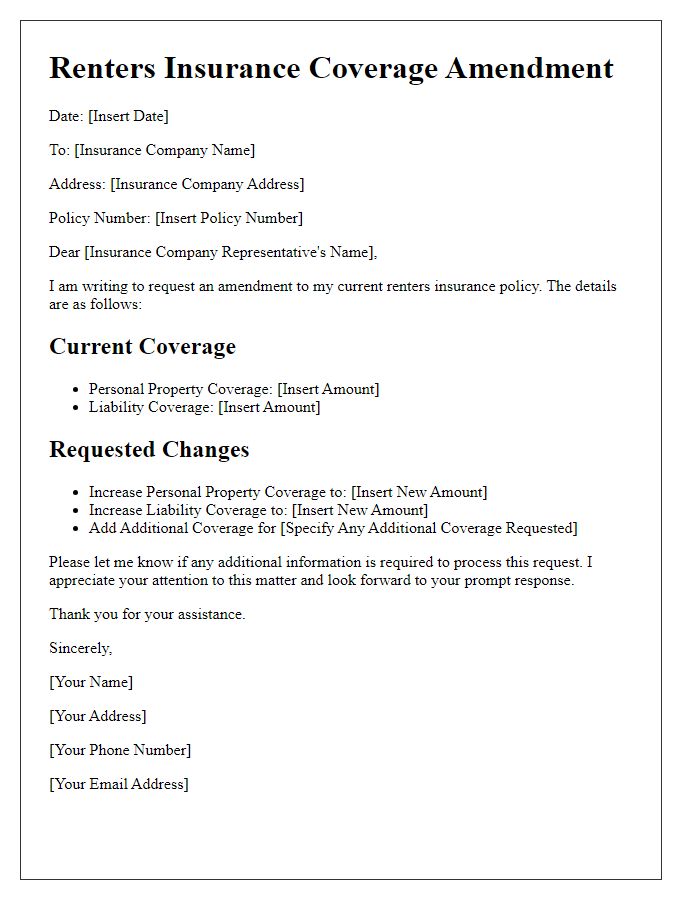

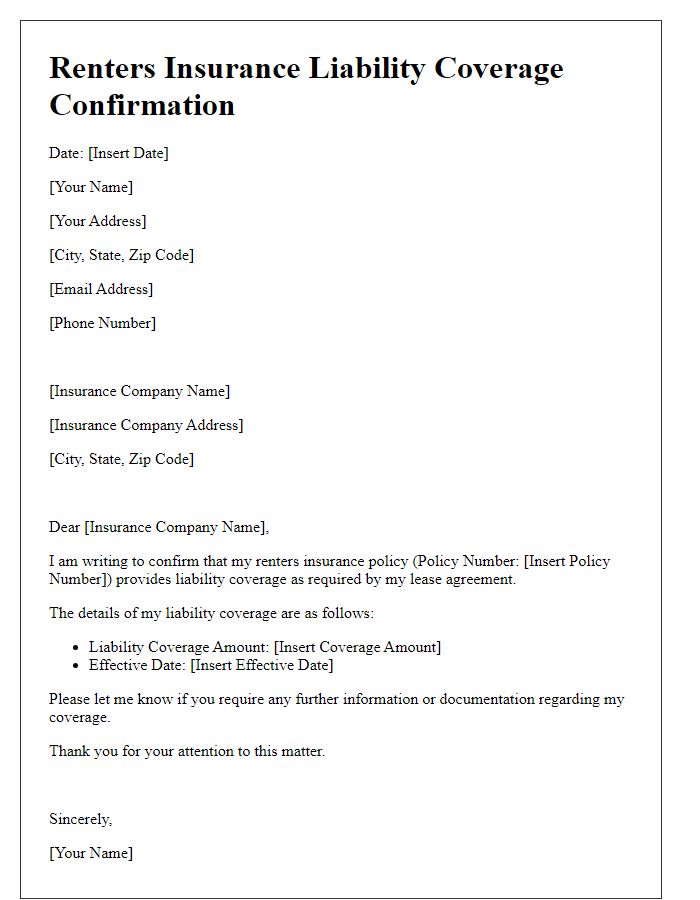

Insurance Coverage Details

Renters insurance provides essential coverage for personal belongings in the event of theft or damage. Standard policies typically protect items like furniture, electronics, clothing, and valuable possessions against perils such as fire, water damage from burst pipes, and vandalism. Coverage limits often range from $10,000 to $100,000, depending on the policy chosen. Additionally, liability coverage protects against legal claims if someone is injured in the rented space, with limits often starting at $100,000. Some policies may also offer additional living expenses coverage, which assists with costs incurred during displacement due to covered losses. Always review specific policy details and endorsements to understand exclusions and deductibles.

Property Address

Renters insurance provides crucial financial protection for tenants against unforeseen events affecting personal property. Common coverage options include protection from theft (with statistics indicating over 1.4 million burglaries annually in the United States), fire damage, and water damage (including flooding scenarios linked to natural disasters). In densely populated urban areas, the importance of understanding tenants' rights and responsibilities, as well as the specific property address (which can significantly influence policy rates), is critical for effective risk management. Collecting adequate documentation, such as incident reports or photographs of personal belongings, can facilitate claims processing and ensure swift reimbursement in case of losses.

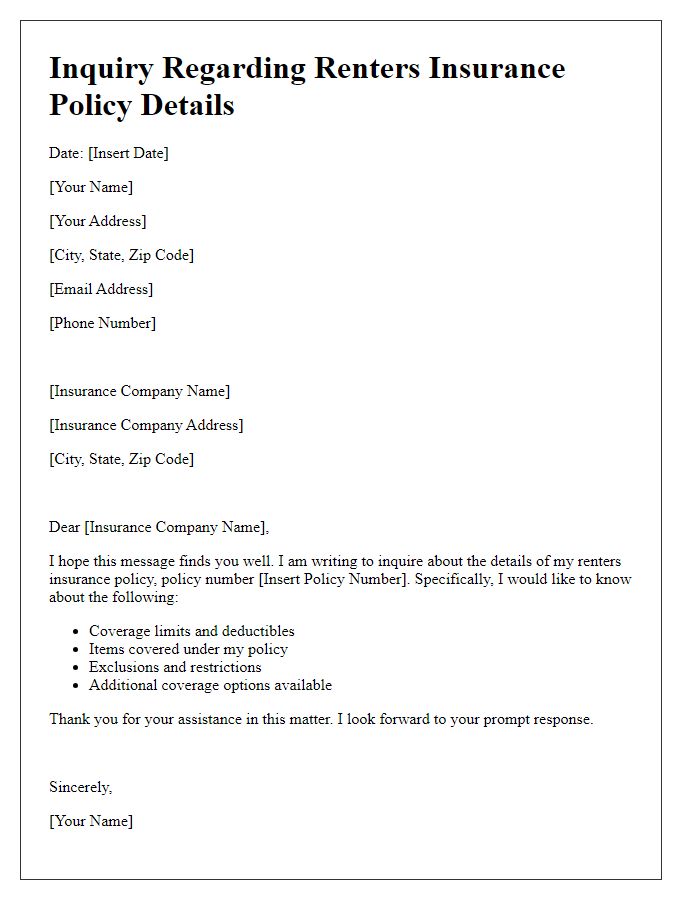

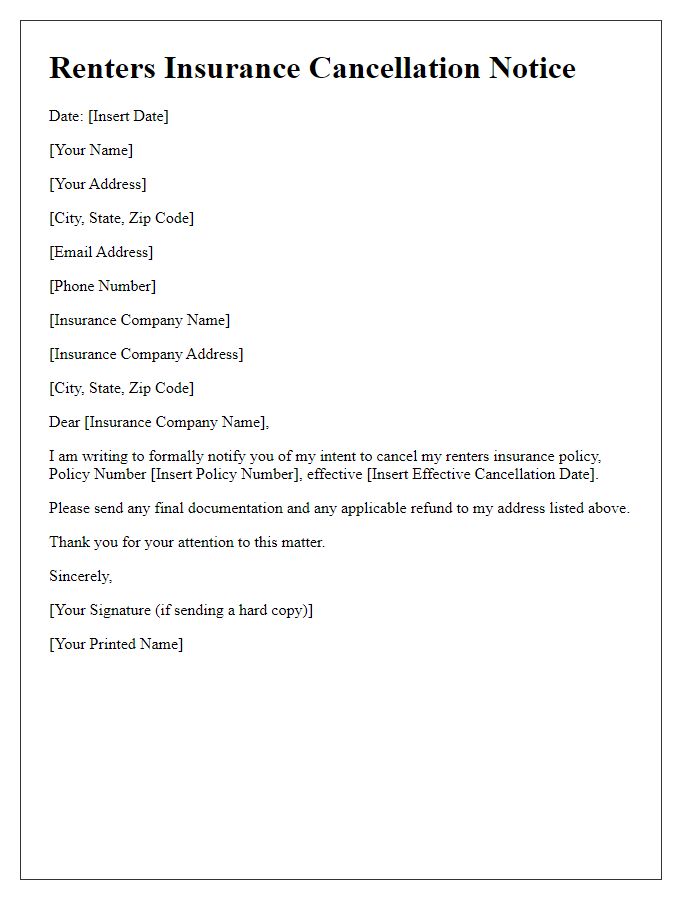

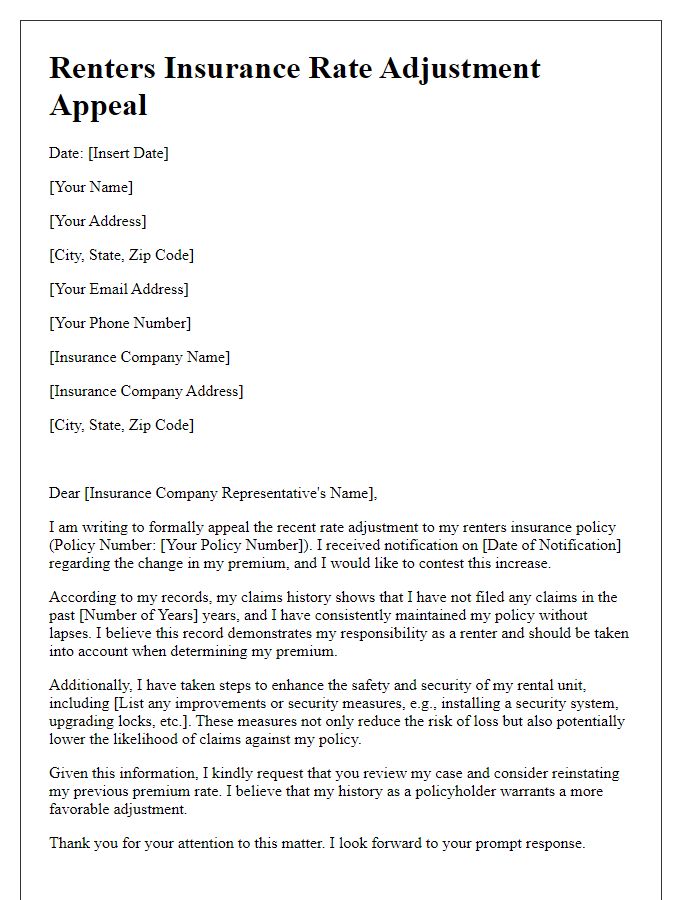

Policy Number

Renters insurance serves as a crucial safeguard for tenants residing in various types of rental properties such as apartments, condominiums, or single-family homes. It typically encompasses personal property coverage, providing financial protection against theft, fire, or water damage to possessions like electronics, clothing, and furniture. Policies may also include liability coverage, which protects against legal claims resulting from injury or damage to others while on the rented premises. For example, a policy number uniquely identifies each individual renters insurance plan, enabling swift claim processing and customer support. Understanding these facets of renters insurance can significantly enhance the safety and security for individuals and families in rental situations.

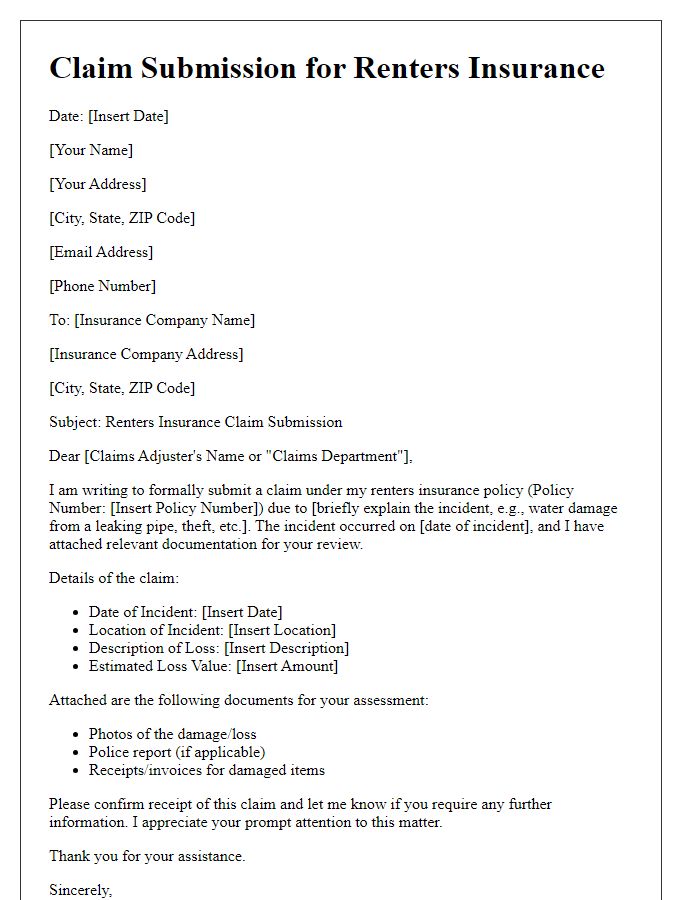

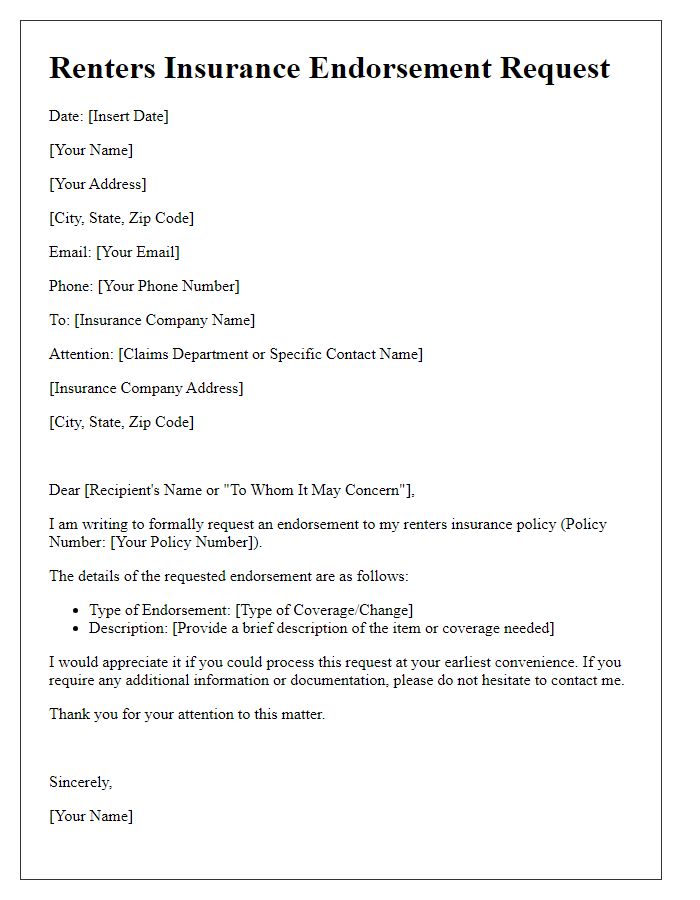

Contact Information for Claims

Contact information for claims under renters insurance policies, specifically those provided by companies like State Farm or Allstate, is crucial for prompt assistance. Policyholders need to access 24/7 claims assistance lines, typically found on the company's website or policy documents. For example, a prompt response may include calling a specific toll-free number, such as 1-800-STATEFARM for State Farm or accessing the Allstate mobile app for real-time support. Additionally, providing necessary documentation like police reports or photos of damages aids in speeding up the claims process. Keeping personal information such as policy numbers handy enhances the efficiency of communication with insurance representatives, ensuring a smoother claim experience.

Comments