Are you confused about your dental insurance coverage? You're not alone! Many people find it challenging to navigate the ins and outs of their policies, especially when it comes to understanding what's covered and what isn't. Join us as we break down everything you need to know about dental insurance coverage and how to make the most of your benefitsâkeep reading to learn more!

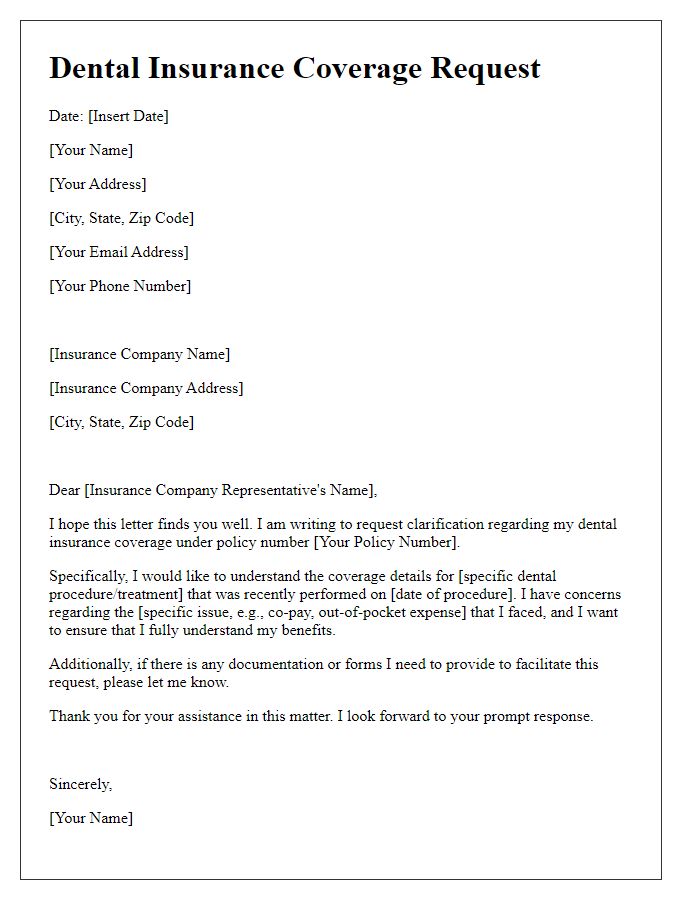

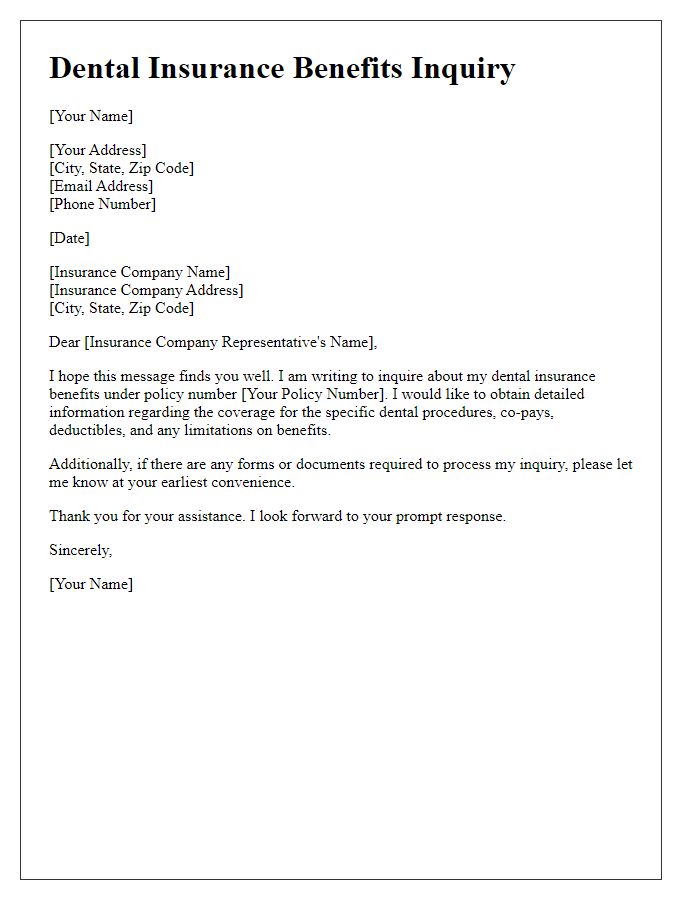

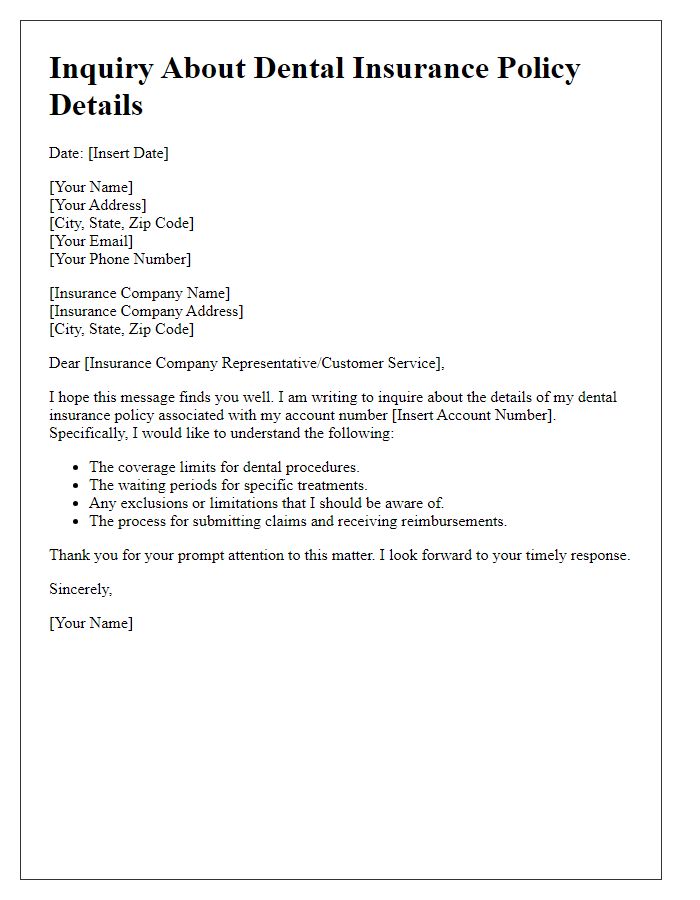

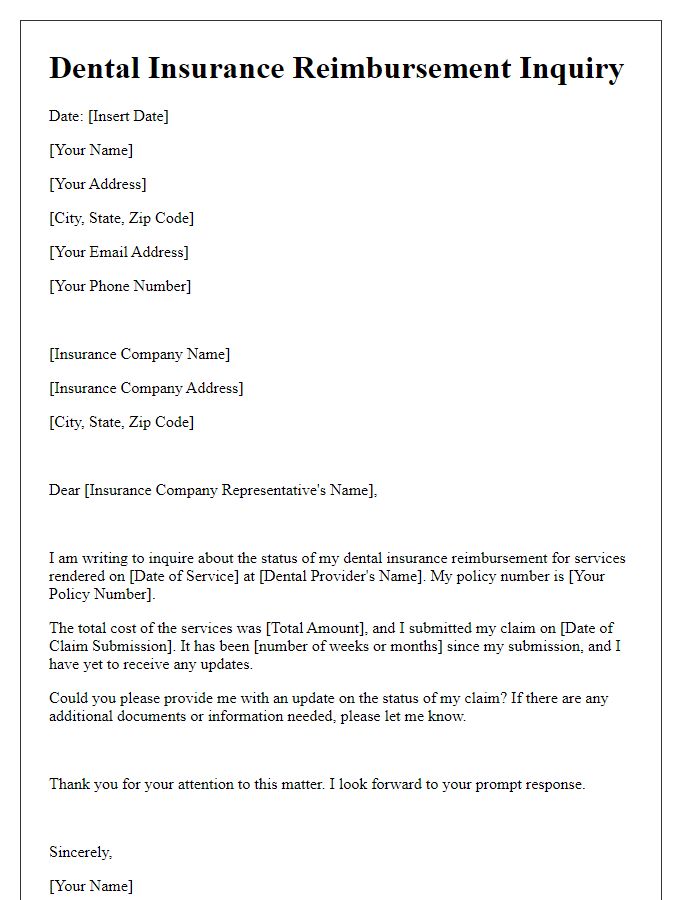

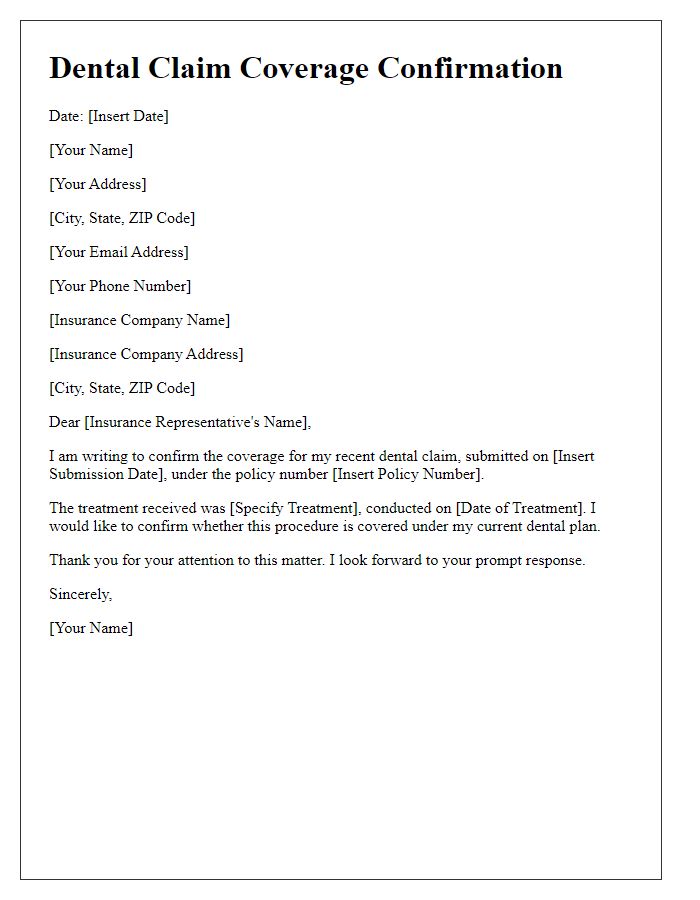

Clear Subject Line

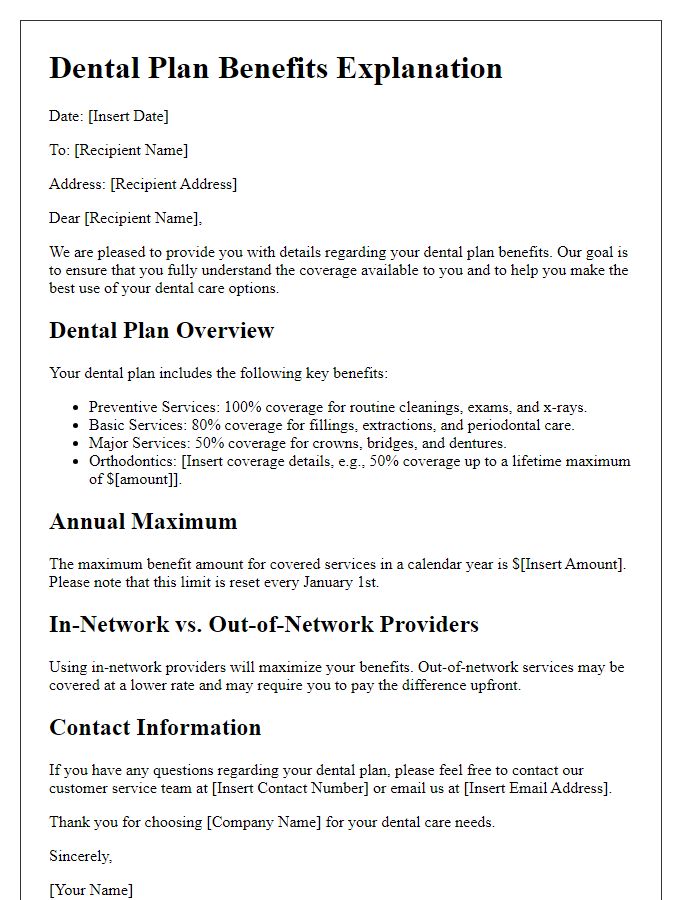

Dental insurance coverage inquiries often involve specific details such as plan benefits, waiting periods, and exclusions. Knowing the type of coverage, such as preventive services, restorative treatments, or orthodontics, is crucial. Patients should include personal information like policy numbers and the context of their request to ensure a swift response. Information regarding specific dental procedures, like crowns or root canals, along with associated costs, aids in providing clarity. Additionally, understanding policy limits and deductibles can influence decisions about necessary dental care, ensuring informed choices based on the insurance details. This inquiry helps navigate the complexities of dental insurance policies to maximize benefits.

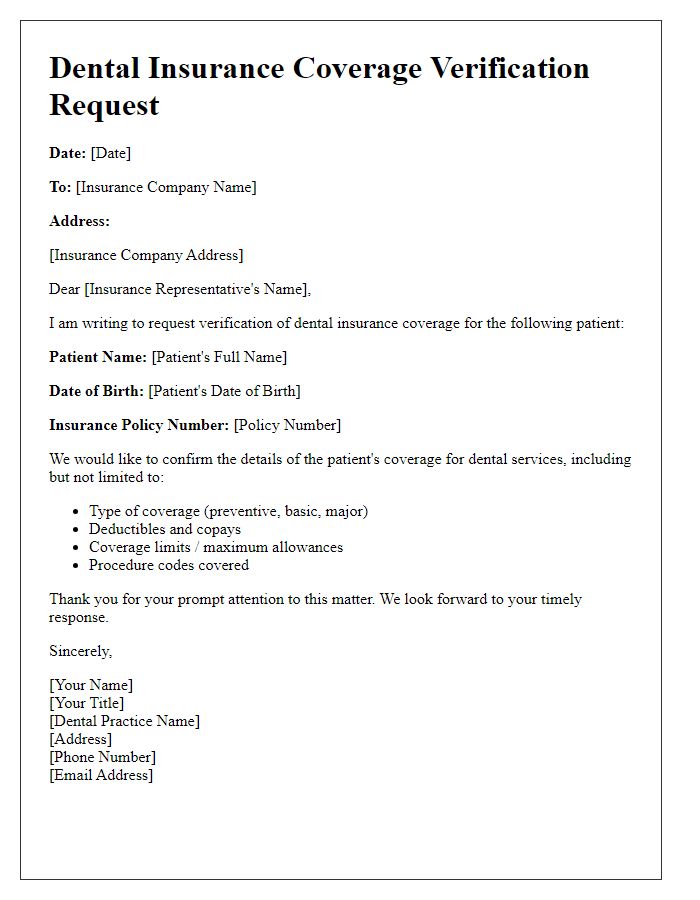

Sender's Personal Information

Inquiring about dental insurance coverage involves understanding specific details related to the policy. Various providers, such as Delta Dental or MetLife, offer different coverage plans across the United States. Important details include the person's name, policy number, and contact information (such as a phone number with a specific area code). Additionally, the date of the inquiry, which influences the terms of coverage, and the specific dental services required, such as root canals or crowns, should be noted. Gathering this information helps clarify coverage limits, co-payments, and any waiting periods associated with services.

Dental Procedure Details

Inquiry regarding dental insurance coverage can provide clarity on specific procedures like root canals, crowns, or orthodontics. Common procedures, such as a root canal, typically involve multiple visits and costs averaging around $1,000 in the United States. Dental crowns, intended to restore damaged teeth, can cost between $800 and $3,000, depending on materials used (porcelain vs. metal) and complexity. Orthodontic treatments, like braces, can range from $3,000 to $7,000, significantly affecting patients' financial planning. Coverage details often include deductibles, co-pays, or lifetime maximums, varying by insurance provider, such as Delta Dental or MetLife. Reviewing policy documents and contacting representatives can ensure understanding of coverage limits, waiting periods, and exclusions for specific procedures.

Insurance Policy Information

When considering dental insurance coverage, it's essential to gather detailed information about the specific plan, including the policy number (often a combination of numbers and letters unique to the individual), premium costs (monthly fees), deductible amounts (costs before coverage begins), and co-payment details (fixed fees for services). Additionally, verify the inclusivity of major dental services, such as root canals, crowns, and orthodontic treatments, and whether the plan dictates any limitations, such as waiting periods for certain procedures. Coverage limitations can vary significantly between different plans offered by providers like Delta Dental or Aetna, and understanding these intricacies can dramatically impact whether chosen dental services are financially manageable. Confirming in-network versus out-of-network dentist coverage is crucial, as this can affect the overall out-of-pocket expenses for care received.

Specific Coverage Questions

Dental insurance coverage inquiries often arise when individuals seek clarity on specific services. Common questions include routine check-ups (typically covered twice a year) and procedures like fillings or crowns, which may depend on plan details. The percentage of coverage for procedures, such as endodontics (root canals), varies widely; plans may cover 50% to 100%. Additionally, orthodontic treatments like braces may have waiting periods or lifetime maximums (often around $1,500). Coverage limitations related to pre-existing conditions or age factors can also impact available services, making it essential to understand benefits and exclusions fully.

Comments