Are you concerned about insurance fraud and looking to make a report? You're not aloneâmany people find themselves unsure of how to navigate the process of reporting suspicious activity. Understanding the steps to properly document and submit your concerns can make a significant difference in combating fraud. Dive into our article to discover an easy-to-follow letter template that simplifies your submission process and helps protect your interests!

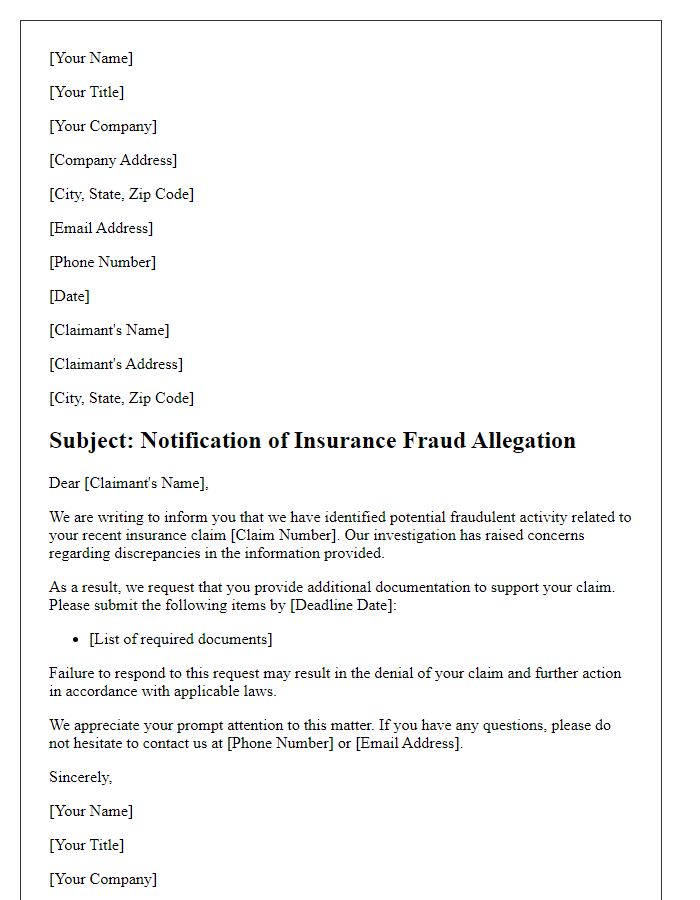

Policyholder Information

Submitting an insurance fraud report requires precise details to ensure effective processing. Include essential policyholder information, such as the full name of the policyholder, usually located on the insurance policy document. Provide the policy number, a unique identifier assigned by the insurance company for referencing, and contact details including a phone number and email address for follow-up inquiries. Additionally, include the address where the policyholder resides, which helps in verifying the individual's identity. Furthermore, specify the type of insurance involved, such as auto, home, or health, as this categorizes the fraud report for the appropriate department. Document the date when the alleged fraud occurred to establish a timeline of events. All of these elements contribute to a comprehensive report that aids insurance investigators in addressing fraud efficiently and effectively.

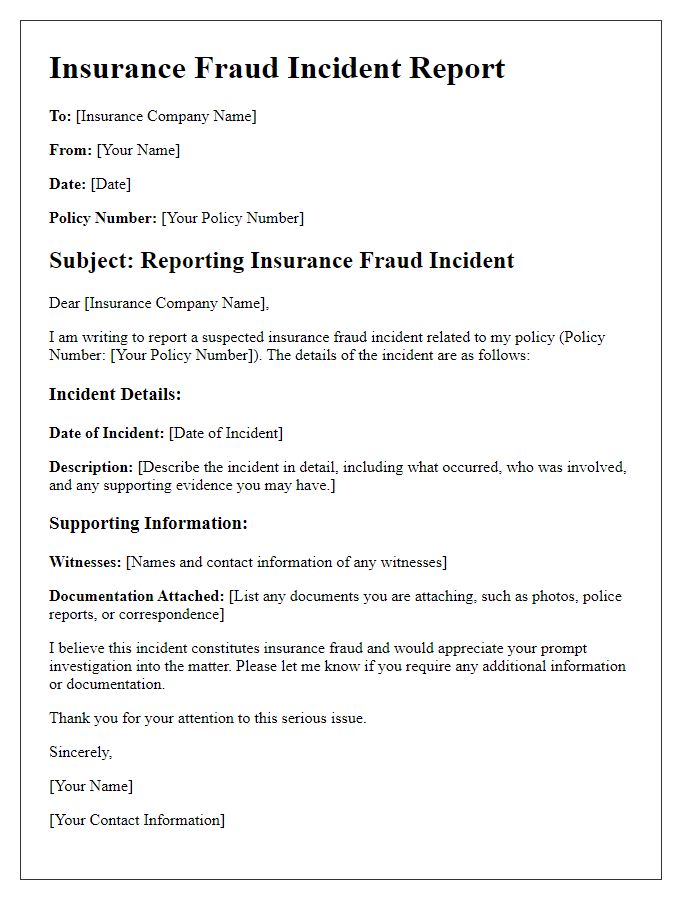

Incident Description

Fraudulent insurance claims often involve elaborate schemes designed to exploit the system. A common scenario includes staged accidents, where individuals intentionally create a car collision for financial gain. For instance, in a fictitious case in Miami, Florida, two drivers orchestrated a crash on US Highway 1, resulting in exaggerated injuries and unnecessary medical treatments, costing the insurance company over $500,000. In another event, a homeowner falsely reports significant property damage after a flood, despite no water entering the premises, aiming to collect on a high-value homeowner's insurance policy that totals $250,000. Detecting these fraudulent activities requires thorough investigation and analysis of discrepancies in claims and evidence provided.

Evidence and Documentation

Insurance fraud report submissions require meticulous documentation to substantiate claims. Essential evidence includes photographic documentation, such as high-resolution images of property damage or injuries, which can capture critical details for underwriting assessments. Detailed incident reports from law enforcement agencies, including case numbers, officer names, and crime scene addresses, add credibility to the claim. Additionally, receipts or invoices for repairs or medical treatments, along with witness statements, are vital; these should include contact information and signed declarations. Finally, a comprehensive timeline outlining the events leading to the claim, specifying dates and locations, provides context and clarity to facilitate the review process by insurance investigators.

Contact Information

Contact information for the submission of insurance fraud reports should include essential details like full name of the individual or entity reporting, residential address for correspondence, contact number for urgent queries, and email address for documentation purposes. Additionally, providing a specific insurance policy number can facilitate quick reference to the relevant account. If affiliated with an organization, including the organization's name and position or role of the individual submitting the report can enhance credibility and clarity. Moreover, ensuring all information is accurate and current helps expedite the fraud investigation process.

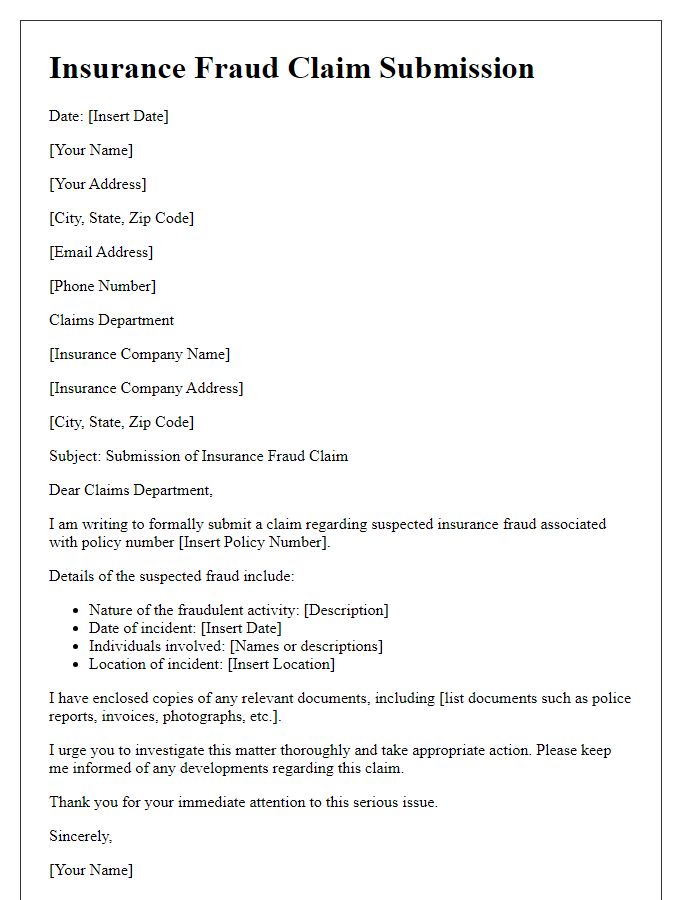

Signature and Date

Insurance fraud, a significant issue affecting the financial stability of insurance companies, can lead to increased premiums for consumers and loss of trust in the system. Documenting fraudulent activities, such as inflated claims or false documentation, is essential. Submission of a formal report, typically including details about the suspicious claim and any evidence collected, is crucial in the investigation process. Reporting instances by contacting local authorities or the insurance fraud division can aid in reducing fraudulent schemes, protecting honest policyholders. Timely action and structured reporting play vital roles in addressing the pervasive nature of insurance fraud.

Comments