Are you looking to add your spouse to your insurance plan but unsure how to go about it? Navigating the world of spousal insurance additions can be a bit tricky, but we've got you covered with a simple, straightforward approach. In this article, we'll guide you through the essential steps and provide a handy letter template to make your request seamless. So, grab a cup of coffee and let's dive into the details!

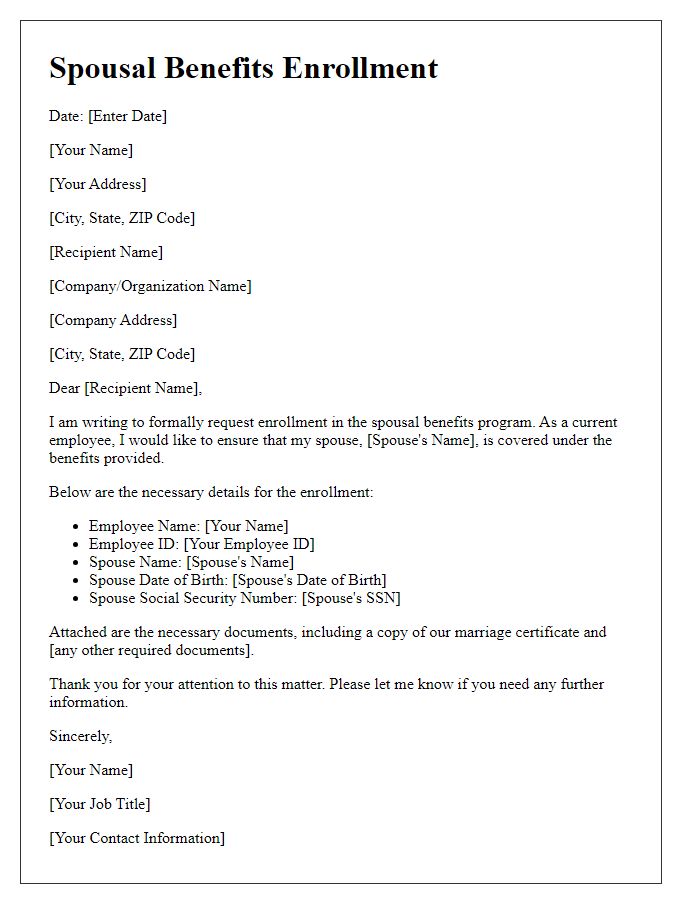

Personal Details

In the realm of insurance, requesting the addition of a spouse to an existing policy involves specific personal details to streamline the process. Policyholders typically must provide their full name, which verifies policy ownership, along with their date of birth to establish eligibility and ensure accurate age-related premiums. Address information serves as both correspondence routing and risk assessment for the insurer. Additionally, including the spouse's full name and date of birth is crucial, as this identifies the individual being added and allows the insurer to calculate applicable coverage amounts based on demographic factors. Furthermore, health information may be relevant, as it can affect underwriting decisions and premium calculations, with insurers requiring declarations on any pre-existing medical conditions. Accurate contact details, such as phone number and email address, facilitate communication throughout this addition process.

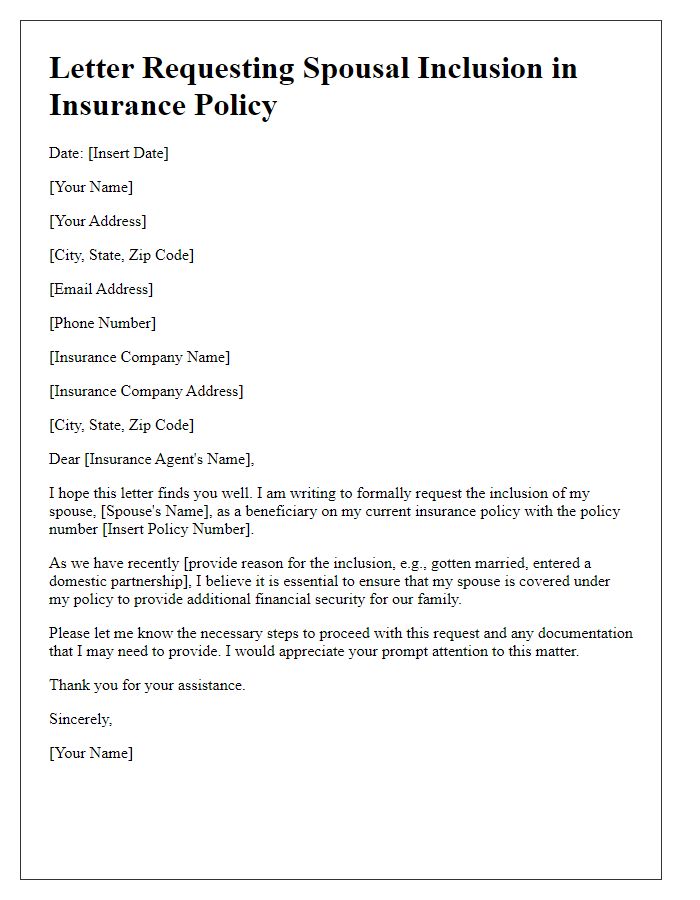

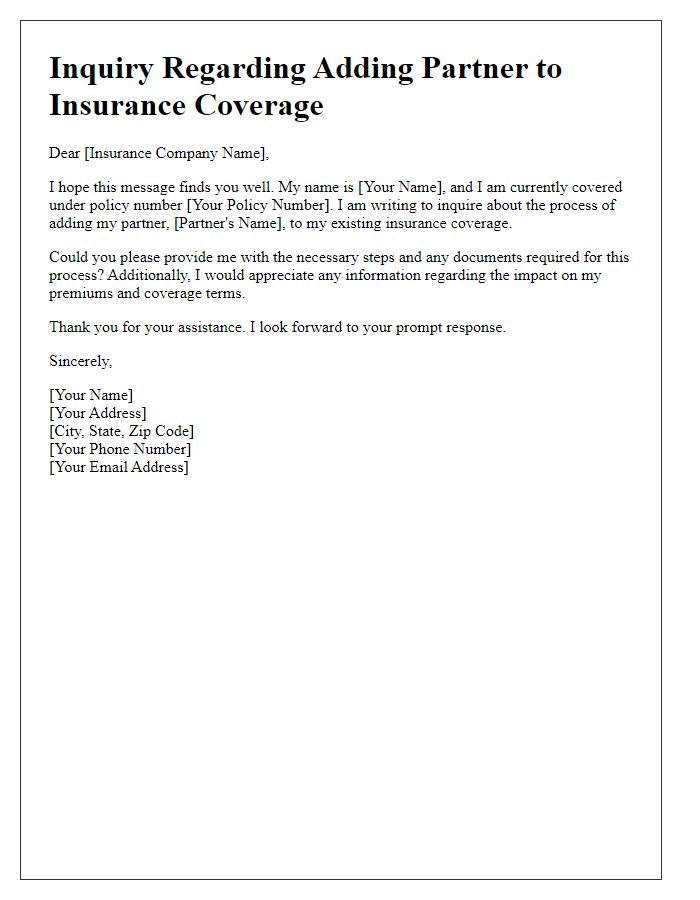

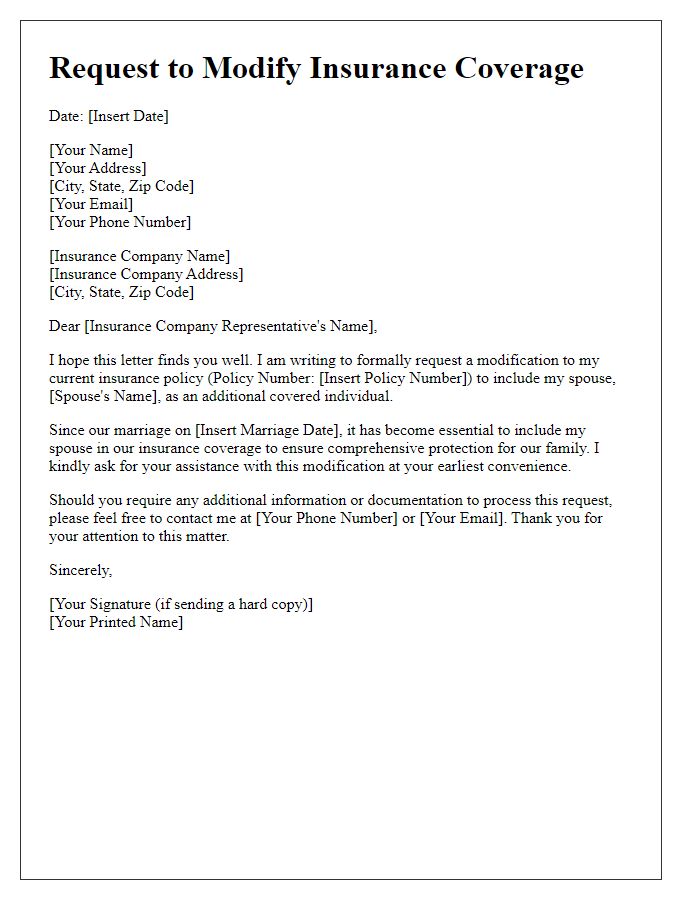

Insurance Policy Information

Spousal insurance addition requests often involve submitting specific details regarding insurance policy options. For instance, referring to insurance programs like group health insurance, policyholders may need to provide the insurance policy number, which typically consists of 10 to 12 alphanumeric characters unique to the coverage plan. Additionally, premiums, the amounts paid for coverage, which can vary widely based on factors like age and health status, require accurate documentation. Policies may also include terms that define eligibility criteria for spousal coverage, such as requirement of marriage certificates and proof of dependent status. Understanding the deadlines for enrollment, often set annually and sometimes with a 30-day window following a qualifying life event like marriage, is essential for compliance. Lastly, it is crucial to be aware of the benefits provided, including medical and dental coverage, which can significantly impact family health needs.

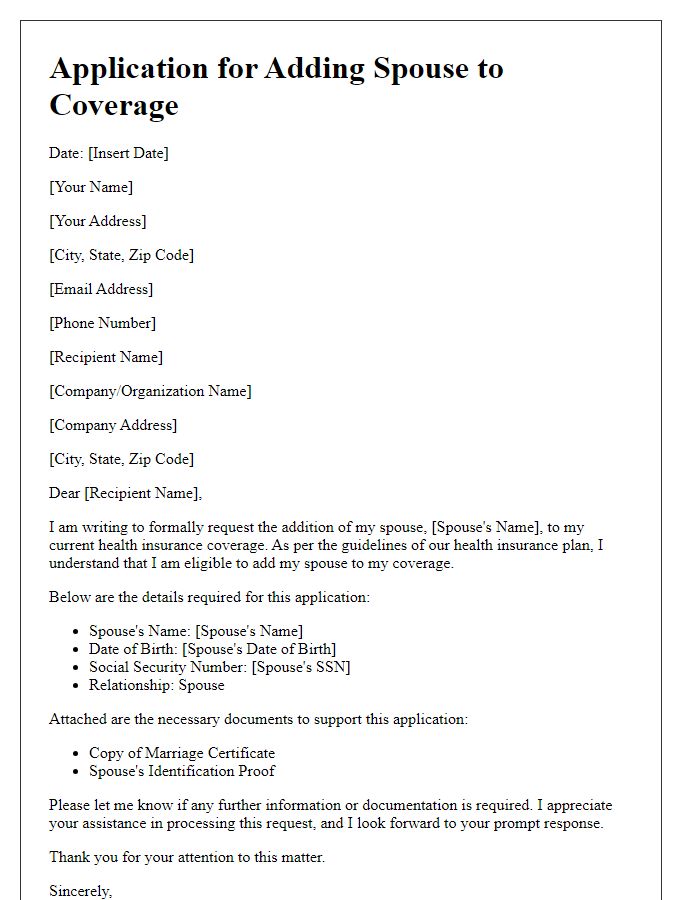

Spouse's Information

Submitting a request for spousal insurance addition requires accurate details about the spouse. Full name should include first name, middle initial, and last name. Date of birth is critical for determining eligibility; format as MM/DD/YYYY. Social Security Number aids in identification and records; handle with confidentiality. Marital status confirmation validates the relationship for coverage; specify "married" status. Address must include street, city, state, and zip code for correspondence purposes. Additional information might include employment details, such as employer name and job title, which may impact insurance options.

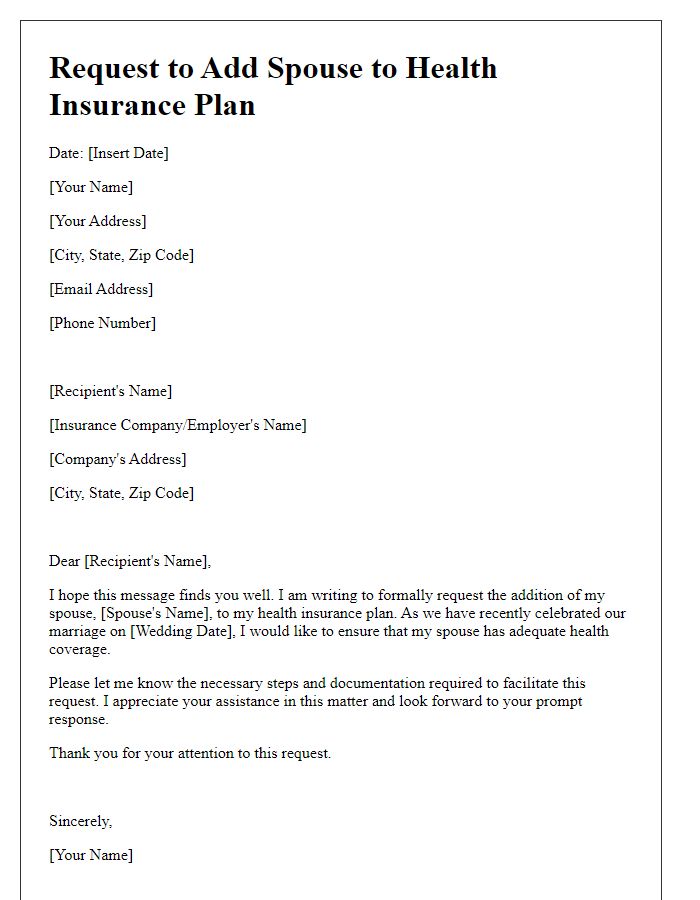

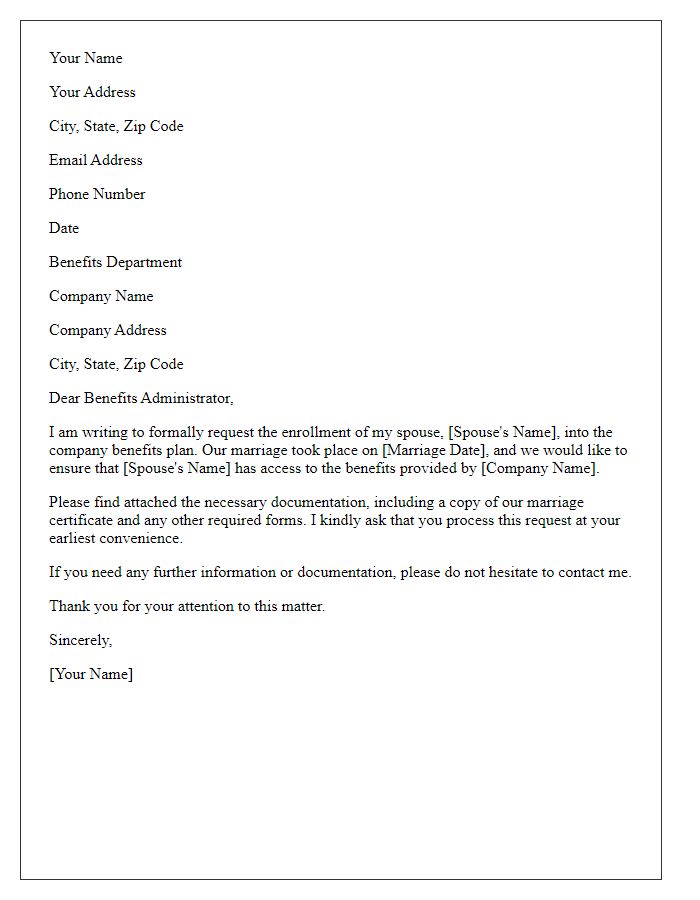

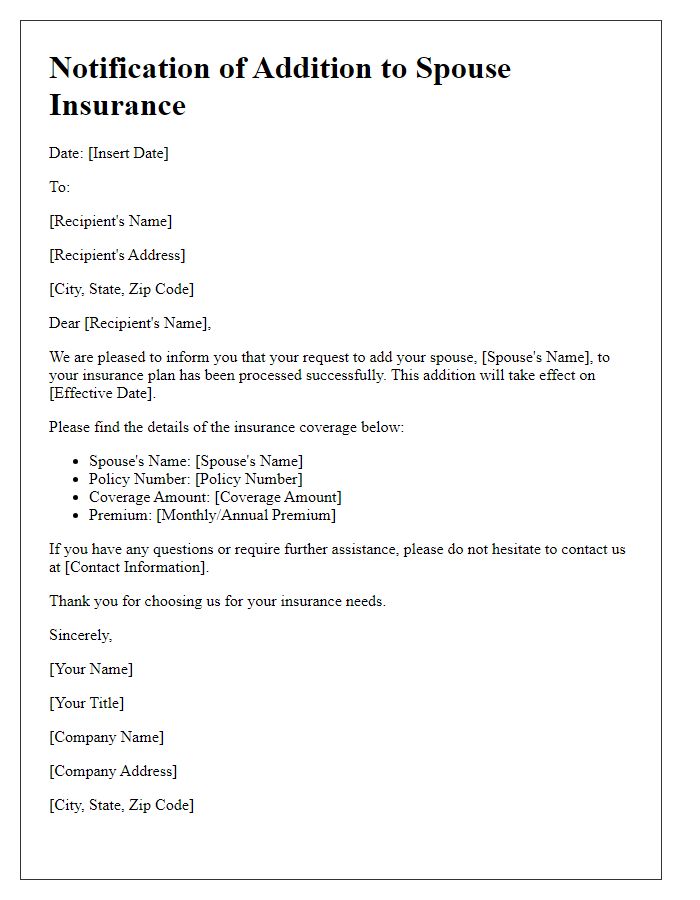

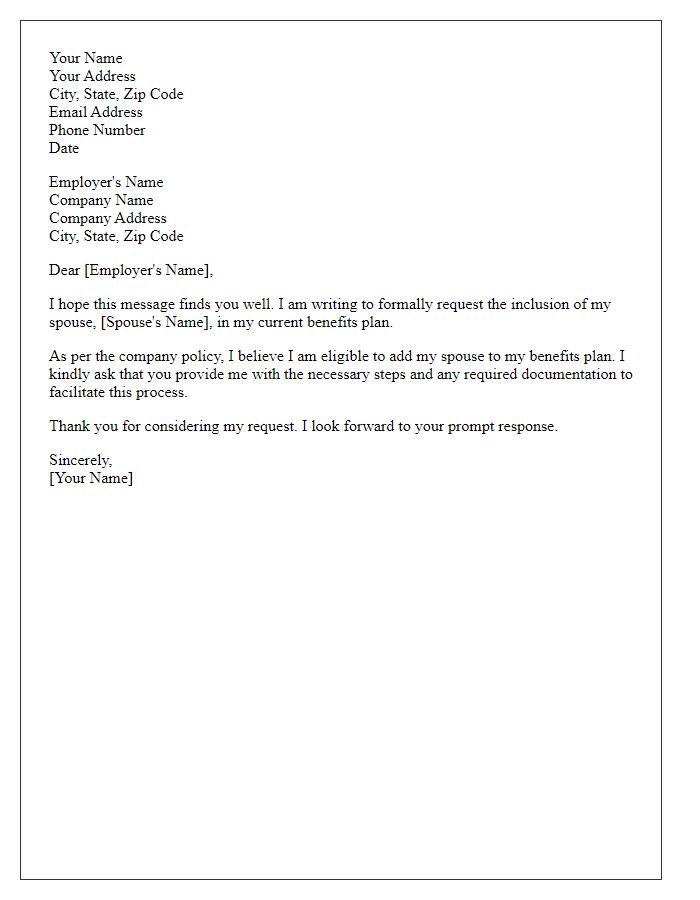

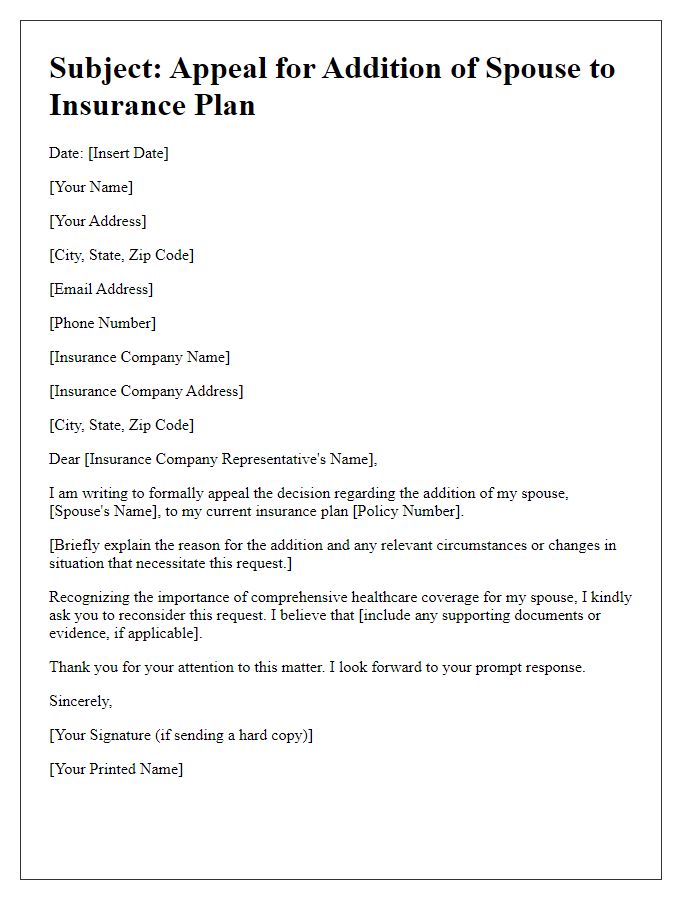

Request Statement

Requesting the addition of a spouse to an existing insurance policy can enhance coverage and provide financial security in unforeseen circumstances. The insurance plan, designated as a Family Health Insurance Plan, typically offers comprehensive benefits including hospitalization coverage, preventive care, and outpatient services for both partners. Details surrounding eligibility criteria, such as marriage certificate documentation and application deadlines, are pivotal to this process. Premium adjustments may occur post-application, reflecting the inclusion of an additional insured. Timely communication with the insurance provider, which could be located in any major city like New York or Los Angeles, is essential for a seamless transition.

Contact Information

Spousal insurance addition requests often require specific contact information for effective communication. The requestor's name (e.g., John Smith), address (e.g., 123 Elm Street, Springfield, USA), phone number (e.g., +1-234-567-8901), and email address (e.g., john.smith@email.com), along with the spouse's name (e.g., Jane Smith), social security number (e.g., XXX-XX-XXXX), and date of birth (e.g., January 15, 1985), are essential for processing. These details ensure timely updates regarding the status of the insurance addition and facilitate any necessary follow-ups or inquiries to the insurance provider.

Comments