Are you curious about the intricacies of casualty insurance fraud investigations? Understanding the process can shed light on how insurers protect themselves and their clients from deceitful claims. This article will break down the essential components of these investigations, offering you insights into the methodologies used by experts in the field. So, grab a cup of coffee, and let's dive deeper into this fascinating topic!

Clear and Concise Subject Line

Casualty Insurance Fraud Investigation Notice: Immediate Attention Required

Detailed Claim Information

Casualty insurance fraud investigations often involve meticulously documented claims that require extensive detail for verification and analysis. Each claim should outline critical elements such as claim numbers, incident dates, and the specific nature of the injury or damage incurred. For example, the occurrence of the event must be documented with a timestamp, location name (such as Main Street in Springfield), and type (e.g., car accident, slip and fall). Medical records may include hospital names and patient identification numbers, along with attorney details if legal action is involved. Witness statements must provide contact information and testimonies. Additionally, photographs or videos of the incident scene are crucial to provide visual context, with specific references to angles and distances measured in meters or feet. Every document should adhere to the fraud investigation protocols and include timestamps to ensure authenticity. Overall, the detailed compilation of this information assists in the thorough assessment of the legitimacy of the claim filed.

Investigation Process Outline

Casualty insurance fraud investigations encompass multiple stages to ensure thorough analysis and resolution. Initial steps include Claim Submission Review, where submitted documents like accident reports and medical records undergo meticulous examination for discrepancies or red flags. Following this, Background Investigation is conducted, involving a search for prior claims or criminal history associated with the claimant, typically by utilizing public records databases and industry databases such as the National Insurance Crime Bureau. Surveillance activities may take place next, utilizing both stationary and mobile observation techniques to validate claimant behavior against reported injuries. In some cases, Expert Consultations occur, engaging accident reconstruction specialists or medical professionals for insights into the validity of claims. Documentation Collection constitutes a critical phase, where all gathered evidence is cataloged and synthesized for a comprehensive report. Finally, Review and Recommendations are formulated, leading to conclusions about potential fraudulent activities, followed by potential legal actions or further investigations based on findings. Each step adheres to legal and ethical standards to ensure fairness and proper adjudication.

Required Documentation and Evidence

Casualty insurance fraud investigations require comprehensive documentation and robust evidence to substantiate claims. Policyholder details such as name, address, and insurance policy number must be accurately recorded. Incident reports from law enforcement agencies, especially those filed with local police departments, provide crucial information regarding the circumstances surrounding the claim. Photographic evidence showing property damage, injuries, or relevant situational specifics strengthens the case, while medical records detailing any treatments or assessments following the incident are essential for validating personal injury claims. Witness statements, ideally documented on official stationery, can corroborate the details of the incident, offering additional perspectives for investigators. Financial records highlighting previous claims history and policy changes may reveal patterns indicative of fraudulent behavior. Lastly, expert assessments from professionals, such as forensic accountants or independent adjusters, can deliver key insights into the validity of claims, underscoring potential inconsistencies or red flags in the submitted information.

Contact Information for Queries and Updates

Casualty insurance fraud investigations require precise communication and up-to-date contact information. The agency's contact details should include a dedicated hotline, such as 1-800-123-4567, for real-time queries related to ongoing investigations. Additionally, email correspondence should be directed to fraudinvestigation@insuranceagency.com for documentation and case updates. It is essential to provide a physical address, like the Insurance Agency Headquarters at 1234 Elm Street, Suite 100, Cityville, State, ZIP, for submitting any supporting documents or formal correspondence. Keeping stakeholders informed with timely updates regarding case status, investigation findings, or any legal proceedings ensures transparency and maintains trust between the agency and the public.

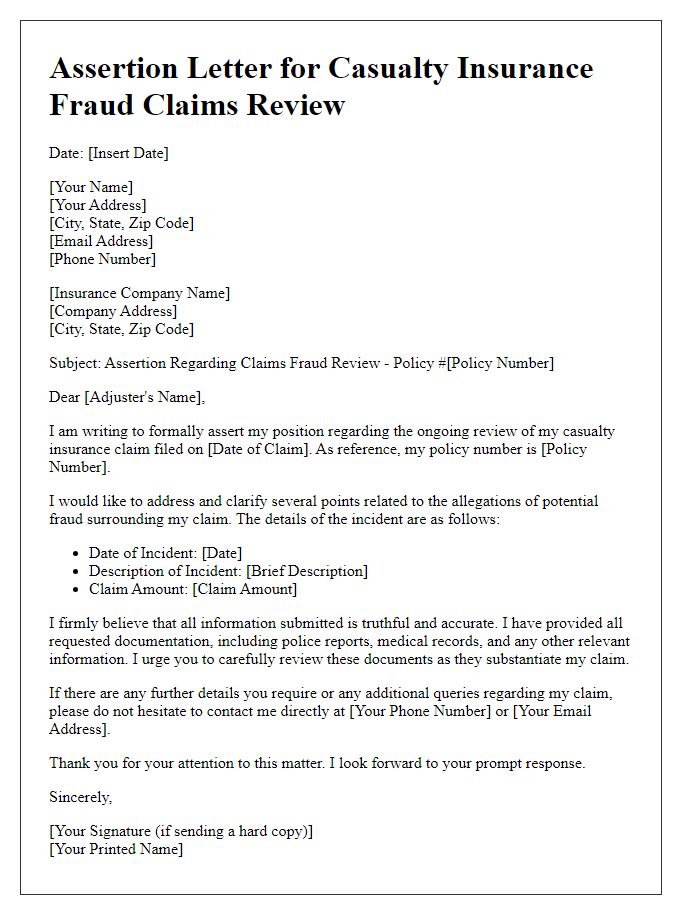

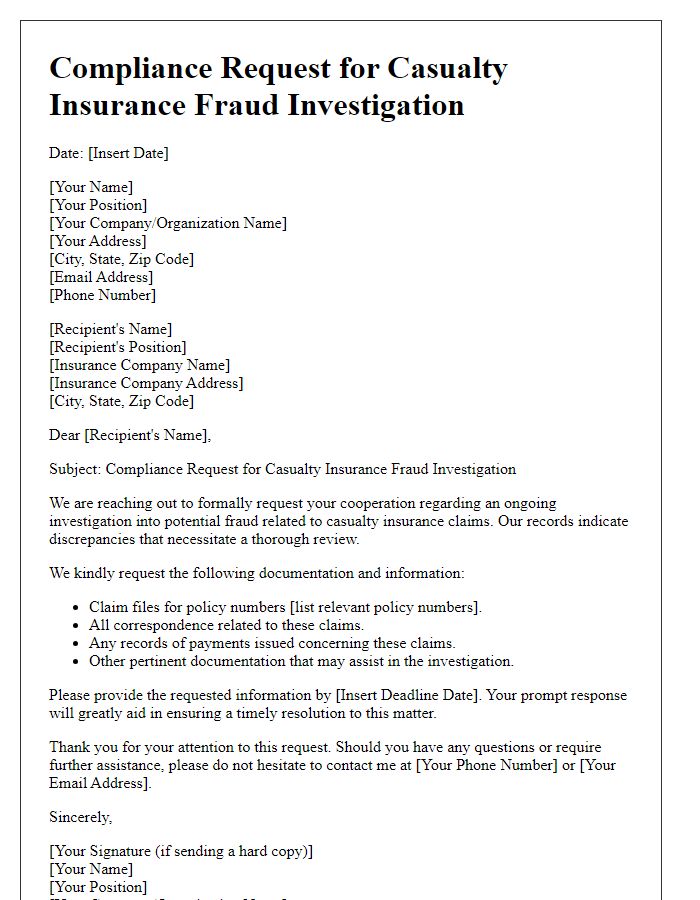

Letter Template For Casualty Insurance Fraud Investigation Samples

Letter template of notification regarding casualty insurance fraud investigation

Letter template of request for information in casualty insurance fraud case

Letter template of follow-up for casualty insurance fraud investigation status

Letter template of evidence submission for casualty insurance fraud investigation

Letter template of appeal in casualty insurance fraud investigation findings

Letter template of conclusion for casualty insurance fraud investigation report

Letter template of statement required for casualty insurance fraud assessment

Comments