Have you ever found yourself tangled in the complexities of a marine insurance policy claim? Navigating through the ins and outs of maritime law and insurance can be quite daunting, but it doesn't have to be! With the right letter template in hand, you can streamline your claims process and get the support you need. Let's dive into the essentials that will help you craft an effective letter, so you can read more about making your claim with confidence.

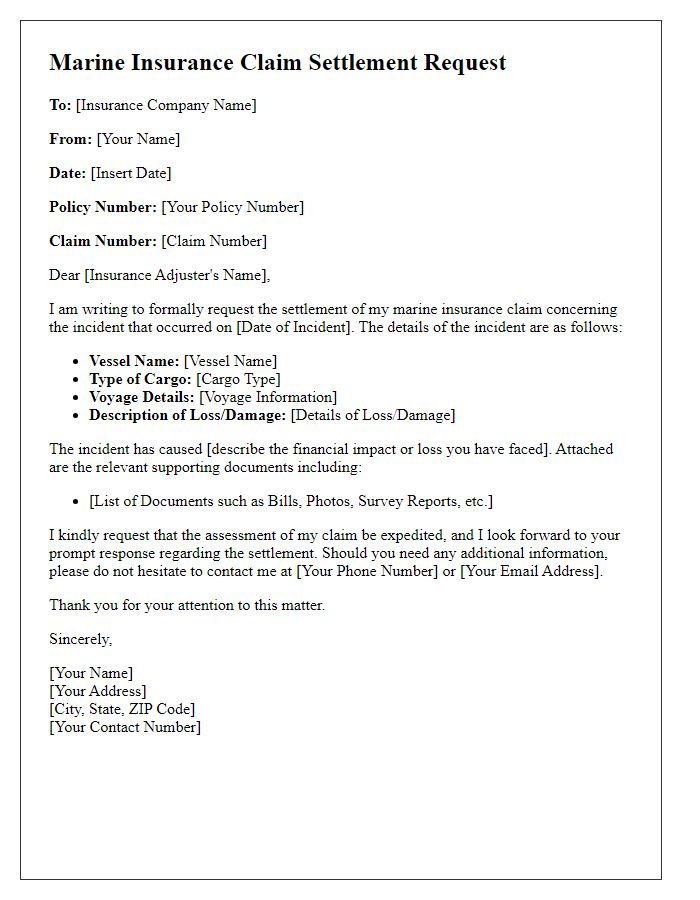

Policy details and claimant information

The marine insurance policy claim process requires detailed documentation to ensure prompt processing. Important policy details include the unique identifier, policy number (e.g., MIP123456), and coverage type (e.g., total loss coverage, partial loss coverage). Claimant information is crucial, comprising full name (e.g., John Smith), contact number (e.g., +1-234-567-8901), email address (e.g., john.smith@email.com), and mailing address (e.g., 123 Ocean Avenue, Newport, RI, USA). Additional context such as the date of incident (e.g., September 15, 2023) and vessel details (e.g., vessel name "Sea Explorer," registration number "TX7890") enhances understanding. Documentation should include incident reports, photographs of damage, and any correspondence with authorities or salvage companies to substantiate the claim.

Description of incident and loss

During a recent voyage from Hamburg to New York, the cargo vessel MV Ocean Star encountered severe weather conditions characterized by gale-force winds of 60 knots and towering waves reaching 30 feet. The incident occurred on October 12, 2023, approximately 150 miles off the coast of Nantucket. As a result of the tumultuous sea conditions, a shipping container filled with high-value electronics was dislodged from its stowage position. The container, which was secured according to industry standards, fell overboard into the Atlantic Ocean. The loss is estimated at $500,000, covering the cargo value and recovery operations, necessitating an immediate marine insurance policy claim under Clause 5.2 of the policy, which accounts for losses due to unforeseen maritime hazards.

Supporting documentation and evidence

Submitting a marine insurance policy claim requires substantial supporting documentation and evidence to validate the claim effectively. Essential documents include the original insurance policy (which outlines coverage details), a detailed claim form (with incident descriptions), photographs (showing damage to the vessel, cargo, or property), and an inventory list (itemizing the affected items along with their values). Additional evidence might encompass shipping logs (detailing the voyage and transactions), witness statements (from crew members or third parties knowledgeable about the incident), and repair estimates (from certified marine service providers). These documents collectively ensure a thorough and comprehensive assessment of the claim, improving the likelihood of a successful resolution.

Claim amount and justification

A marine insurance policy claim arises when incidents involving waterborne transportation, such as shipping, occur. Specific claim amounts depend on the assessed value of the insured cargo, typically documented in invoices or bill of lading. Justifications for claims often include water damage due to storms, theft during transit, or accidents at sea. Detailed documentation such as photographs, written reports from authorities, and invoices from damaged goods are critical to substantiate claims. The Maritime Insurance Act of 1906 stipulates various conditions under which claims may be honored, emphasizing the importance of timely notification to insurance providers within a stipulated period, usually within seven days of incident recognition. Accurate inventory records, alongside expert assessments from marine surveyors, play a crucial role in determining the legitimacy and evaluation of the claim amount.

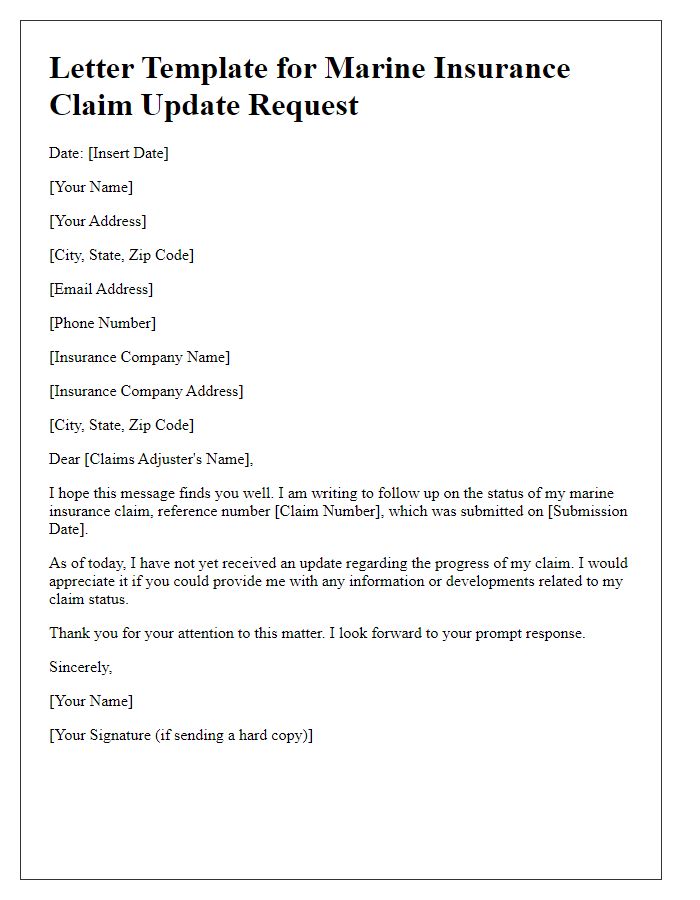

Contact information for follow-up

Marine insurance claims often involve extensive documentation to facilitate the recovery process. Effective communication is crucial, ensuring that policyholders provide comprehensive contact information. This includes the insured's name, mailing address, email address, and phone number, specifying primary and secondary contact points. Additionally, details about the insurance policy, such as the policy number, date of issuance, and coverage specifics, provide necessary context for claims adjusters. Accurate and easily accessible contact information streamlines follow-up inquiries, reducing response time and assisting in the efficient processing of claims related to incidents at sea, cargo damage, or vessel accidents.

Comments