Are you looking to enhance your corporate insurance benefits package? Crafting a compelling proposal can make all the difference in attracting top talent and ensuring your employees feel valued. In this article, we will guide you through customizing a letter template that effectively communicates the advantages of comprehensive insurance options for your workforce. Stay with us to uncover the key elements and tips for creating a standout proposal!

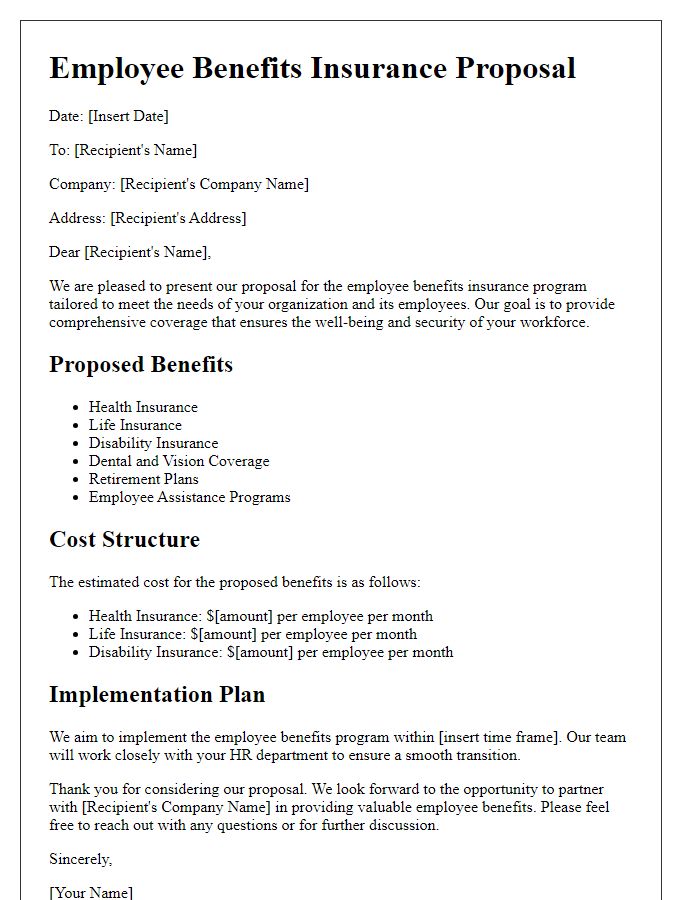

Introduction and Executive Summary

A corporate insurance benefits proposal serves as a strategic document designed to outline various insurance options tailored to meet organizational needs and employee welfare. This proposal highlights comprehensive coverage plans (such as health, dental, vision, life, disability insurance) aimed at enhancing employee satisfaction and retention rates. Research indicates that companies offering robust insurance benefits can reduce turnover by up to 25%, ultimately resulting in significant cost savings. Additionally, the proposal emphasizes alignment with corporate values and commitment to employee well-being, reinforcing the corporate image in competitive industries. Key statistics from industry reports underscore the impact of enhanced employee benefits on overall productivity, with companies noting an increase of 10-20% in employee engagement. This document serves as a foundational step towards fostering a healthier work environment, ensuring legal compliance, and promoting a culture of care and trust within the organization.

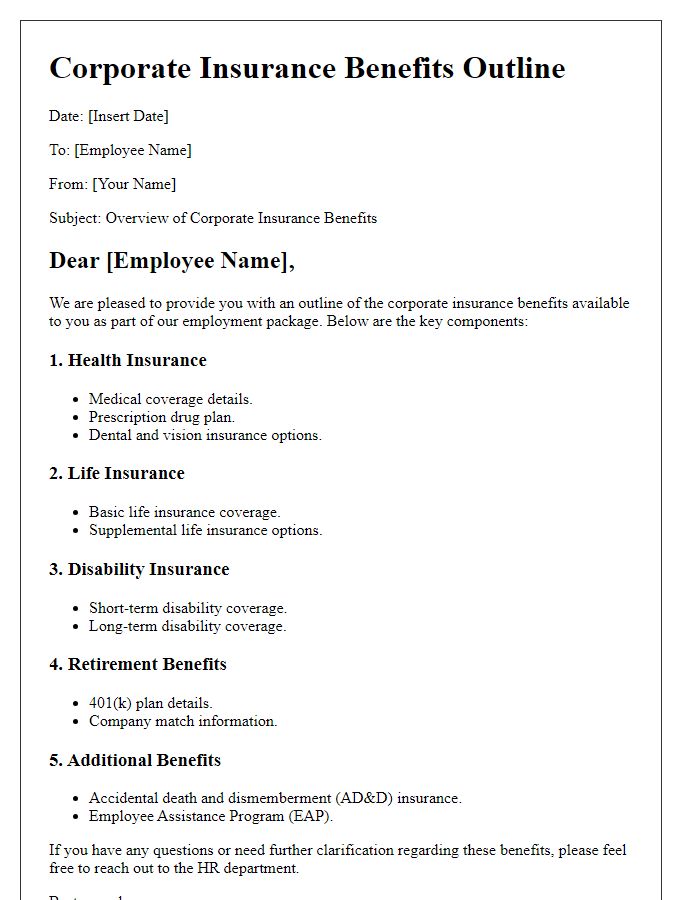

Detailed Insurance Coverage Options

Corporate insurance benefits can provide essential financial protection for employees and the organization. Comprehensive packages often include health insurance plans covering hospitalization, outpatient services, and preventive care, tailored to industry standards such as the Affordable Care Act in the United States. Life insurance policies offer peace of mind, typically amounting to one to three times the annual salary, ensuring beneficiaries receive adequate financial support. Disability insurance plans protect earning potential, providing up to 60% of an employee's income during long-term illness or injury. Additionally, options for dental and vision insurance enhance overall employee well-being, promoting a healthy workforce. Organizations in sectors like technology and finance often offer these coverage options as part of competitive employee benefits packages to attract and retain top talent.

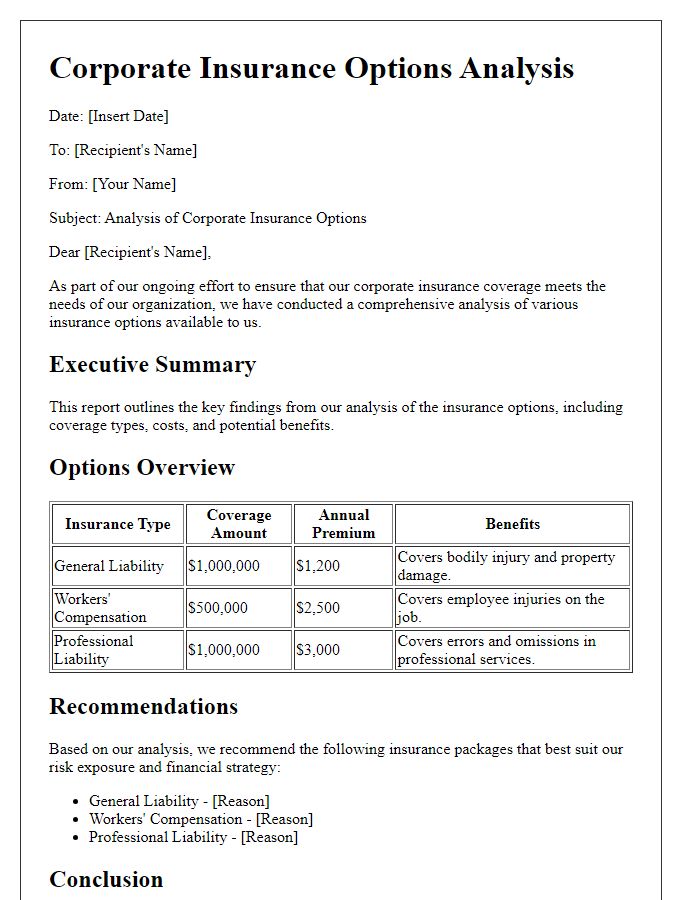

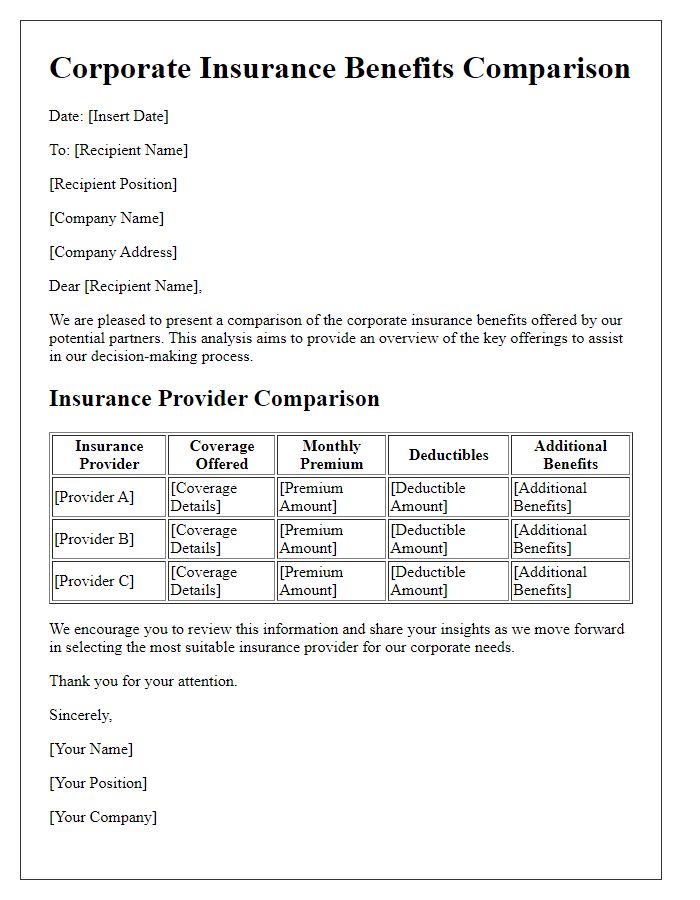

Cost-Benefit Analysis

A comprehensive cost-benefit analysis is essential for evaluating corporate insurance benefits, providing insight into financial investment versus potential risks mitigated. Employee health insurance plans typically range from $400 to $1,200 monthly per employee, influenced by factors such as age, location, and coverage options. An effective insurance program can result in reduced turnover rates, which statistically cost businesses 33% of an employee's annual salary. Moreover, a strong benefits package enhances employee morale and productivity, often leading to a 20% increase in overall performance metrics. Additionally, comprehensive coverage can lower absenteeism by 20%, translating to significant savings in operational costs. Incorporating wellness programs can lead to 3:1 ROI through decreased healthcare costs and improved employee well-being, further solidifying the business's financial advantages.

Implementation Timeline and Process

The corporate insurance benefits proposal for employees at XYZ Corporation encompasses a comprehensive plan to enhance employee satisfaction and retention through improved insurance coverage options. A detailed implementation timeline outlines key phases over a six-month period, starting with the initial assessment of current insurance policies by the benefits coordinator in January 2024. This phase includes gathering employee feedback through surveys, ensuring alignment with workforce needs. In March, the proposal for new insurance providers, based on competitive analysis and cost-effectiveness conducted by the HR team, will be presented to management. Following that, April will focus on negotiating terms with selected insurance companies, aiming for optimal coverage and pricing. May will involve drafting employee communication materials, prepping HR personnel for rollout. Finally, by June, the new corporate insurance benefits will be officially launched. This strategic approach aims to enhance the insurance offerings at XYZ Corporation, promote employee well-being, and streamline the benefits enrollment process.

Contact Information and Next Steps

Contact information serves as a crucial aspect of corporate insurance benefits proposals, ensuring clear communication channels. Essential details include the name of the benefits manager, company (e.g., XYZ Corp), phone number (e.g., +1-234-567-8901), and email address (e.g., benefits@xyzcorp.com). Next steps outline critical actions for stakeholders, such as scheduling a meeting by the end of the month (consider a specific date like October 31, 2023), conducting a preliminary benefits assessment, and preparing necessary documentation for review (such as employee census data, current policy details, and financial statements). This roadmap fosters engagement and collaboration, enhancing the efficiency of the proposal process.

Comments