Are you feeling frustrated about a recent insurance rate increase? You're not alone â many people are grappling with rising costs and wondering how to take action. Writing a letter to object to your insurance rate hike can be an empowering step towards advocating for yourself and your financial well-being. Join us as we explore effective tips and strategies to craft a compelling letter that expresses your concerns and makes your voice heard!

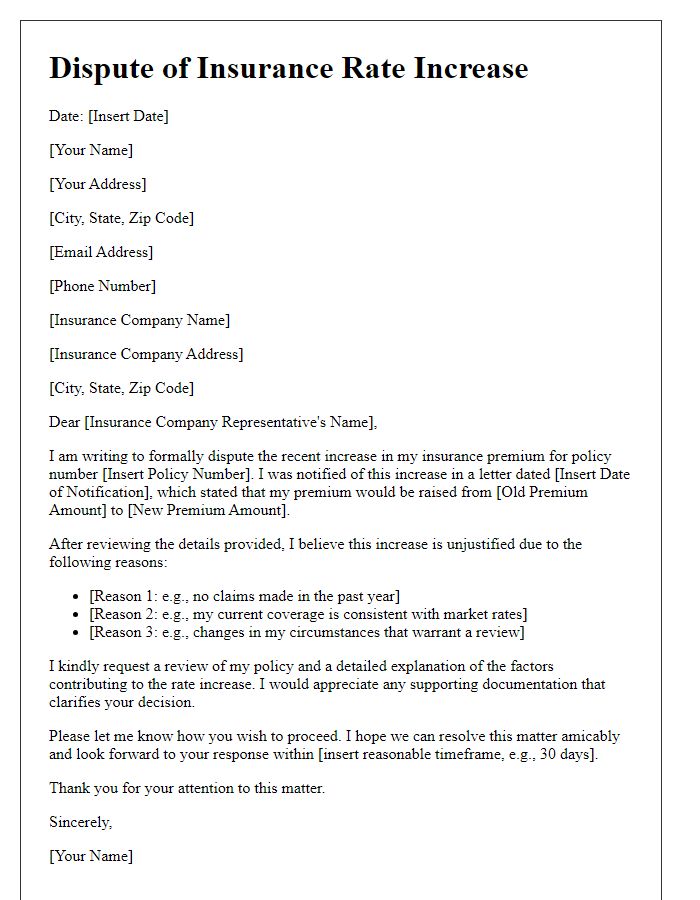

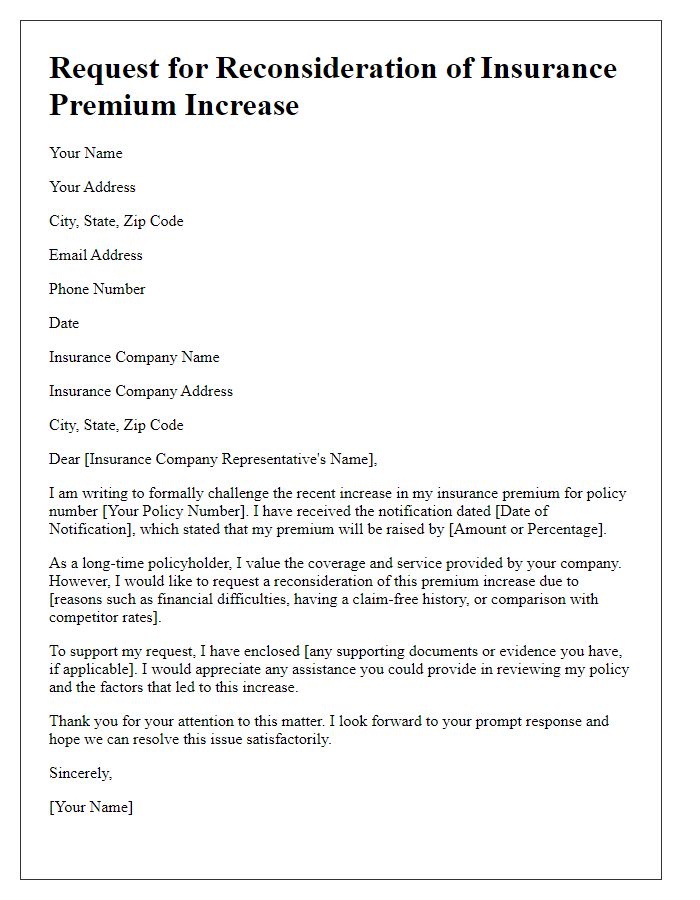

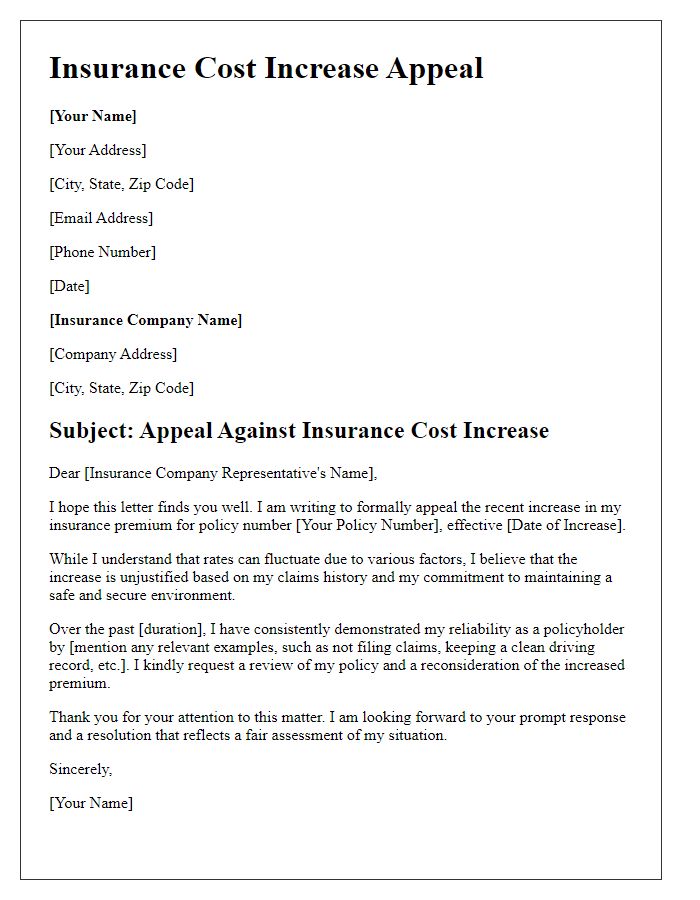

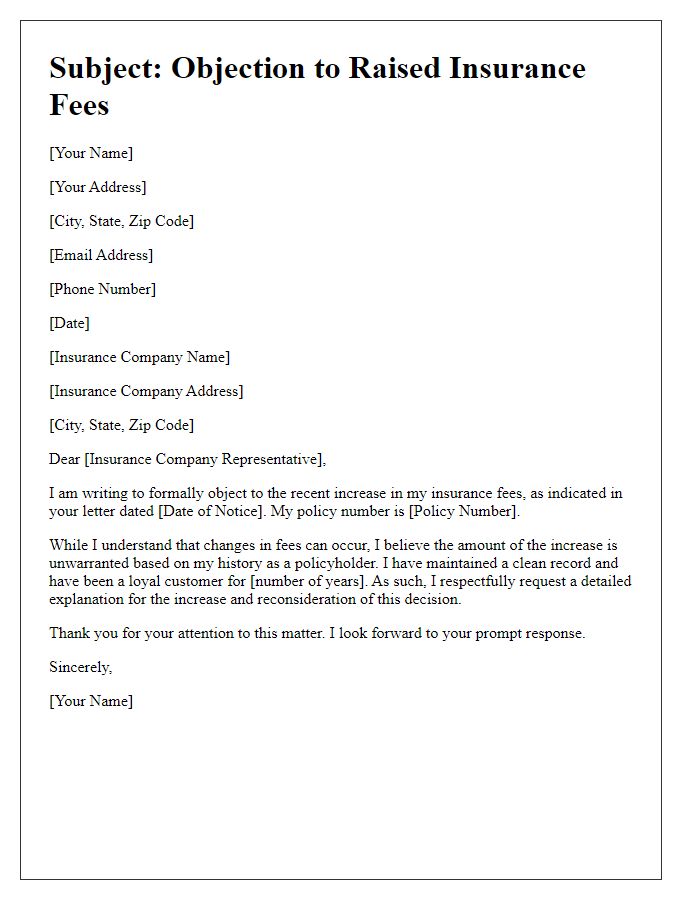

Policy details and identification

Objections to insurance rate increases can stem from various factors, including policy specifics and personal identification information. For example, a homeowner's insurance policy may cover property in a region prone to natural disasters, which can unjustly inflate rates based on perceived risk. Policyholders often highlight their claim history, demonstrating no previous claims within five years to argue against increased rates. Additionally, the impact of local crime rates in urban areas, such as those in Chicago, can sway assessments of risk and, subsequently, premium costs. The identification details, including policy number and insured address, become crucial when disputing irrational increases. Engaging the insurance company in a detailed review can reveal disparities that warrant a reconsideration of the proposed rate hikes.

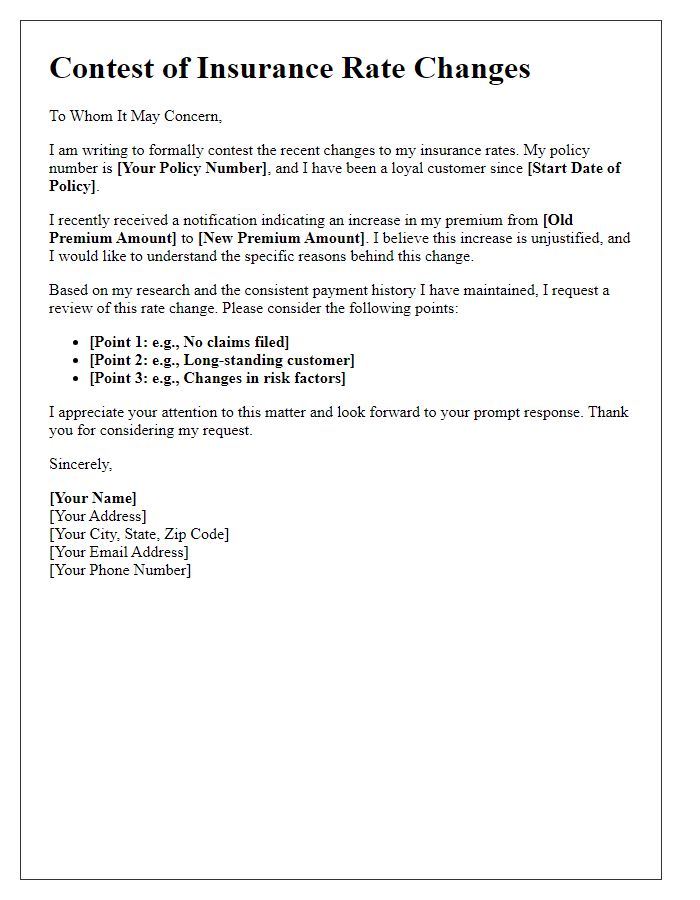

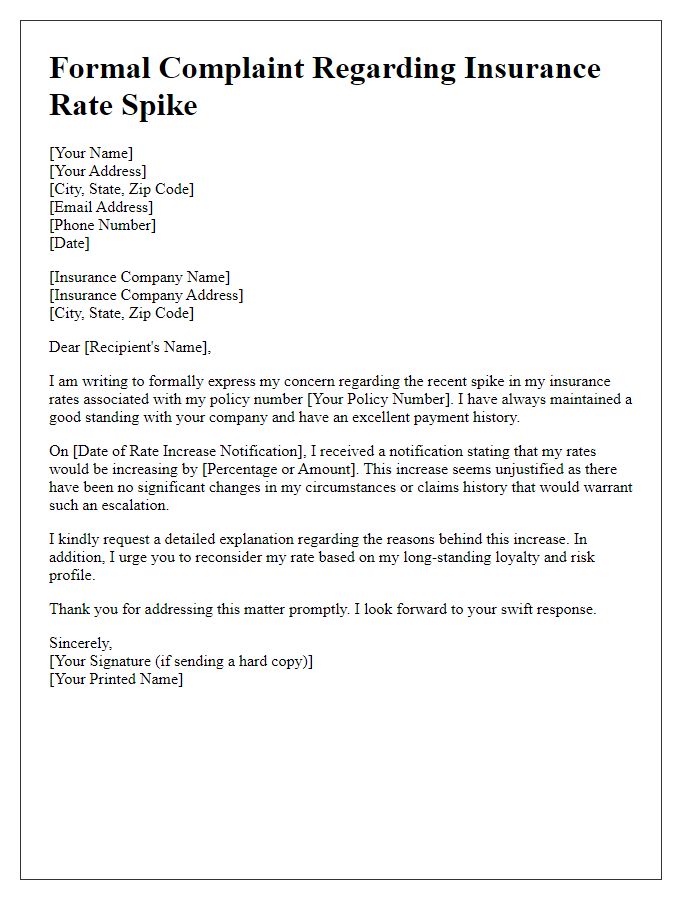

Clear objection statement

Insurance rate increases can significantly impact policyholders' budgets and financial planning. Many individuals receive notifications from insurance providers, such as State Farm or Allstate, indicating an increase in premiums due to factors including claims history, geographic risk (areas prone to natural disasters), or changes in state regulations. Some consumers choose to express their objections formally, citing discrepancies in risk assessment or inconsistency with market trends, often referencing comparable rates from similar coverage providers like GEICO or Progressive. It's crucial to present these objections clearly, supported by relevant data such as loss ratios or recent market analyses, to effectively contest the proposed hikes.

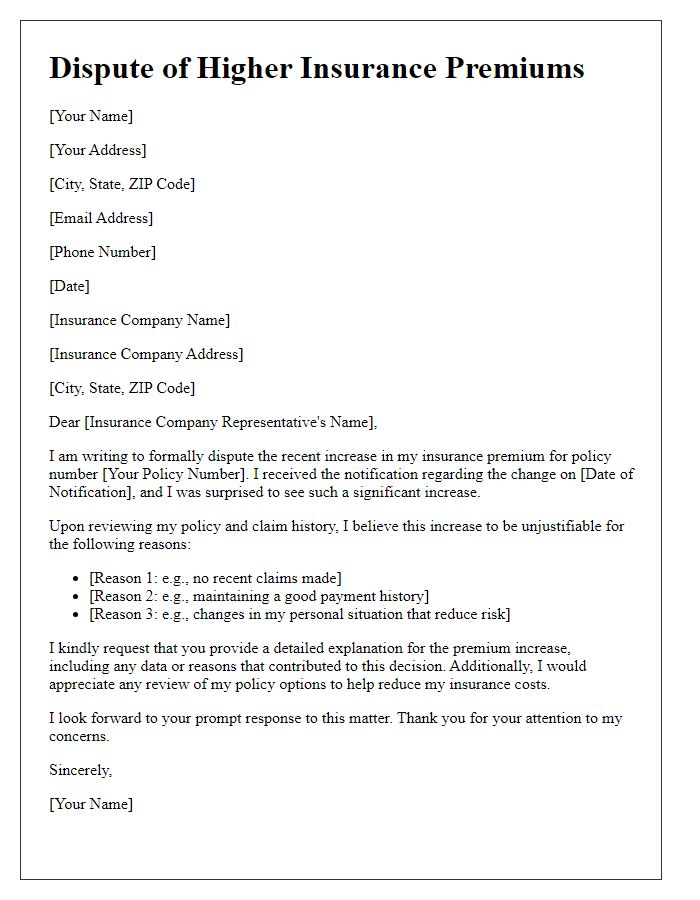

Justification for objection

In recent years, insurance rate increases have impacted numerous policyholders, particularly in the realm of homeowners insurance. On average, homeowners across the United States have seen premium hikes of 6-10% annually, driven by various factors including climate-related risks, inflation, and increased claims costs. The National Association of Insurance Commissioners reported that severe weather events, such as hurricanes and wildfires, have doubled in frequency since 1980, leading insurers to adjust rates considerably. Additionally, individual premium assessments are often disproportionately higher for homeowners maintaining sound property conditions and having consistent claims-free histories. When evaluating these factors, it is crucial to address the broader economic conditions, such as the Consumer Price Index, which continues to fluctuate, indicating that rate increases may be unjust when juxtaposed against a household's stable financial profile and risk mitigation efforts.

Supporting documentation

A comprehensive objection to an insurance rate increase requires supporting documentation to substantiate claims. Policyholders are encouraged to collect relevant documents, including previous insurance statements displaying consistent payment history, evidence of risk management practices implemented to enhance safety (such as home security upgrades or vehicle safety features), and comparison quotes from competing insurance providers showcasing lower rates for similar coverage. Additionally, compiling records of any significant changes in personal circumstances, such as improved credit scores or increased years of claim-free driving, can bolster the case. Essential documents such as policy declarations, correspondence with the insurance company, and any official communications detailing the reason for the rate increase should also be carefully included. This thorough documentation aids in presenting a compelling argument against proposed hikes in insurance premiums.

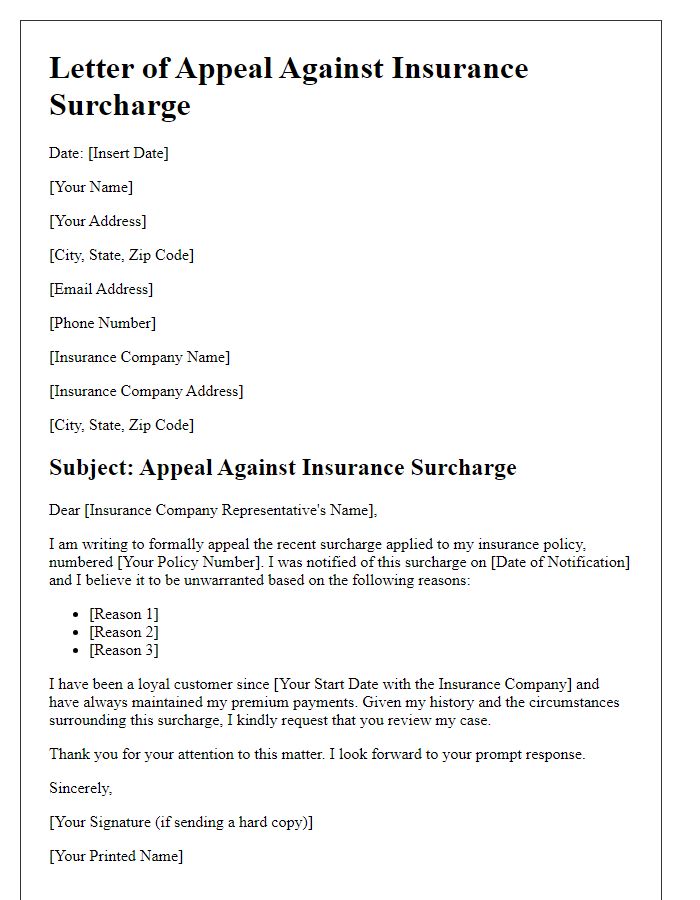

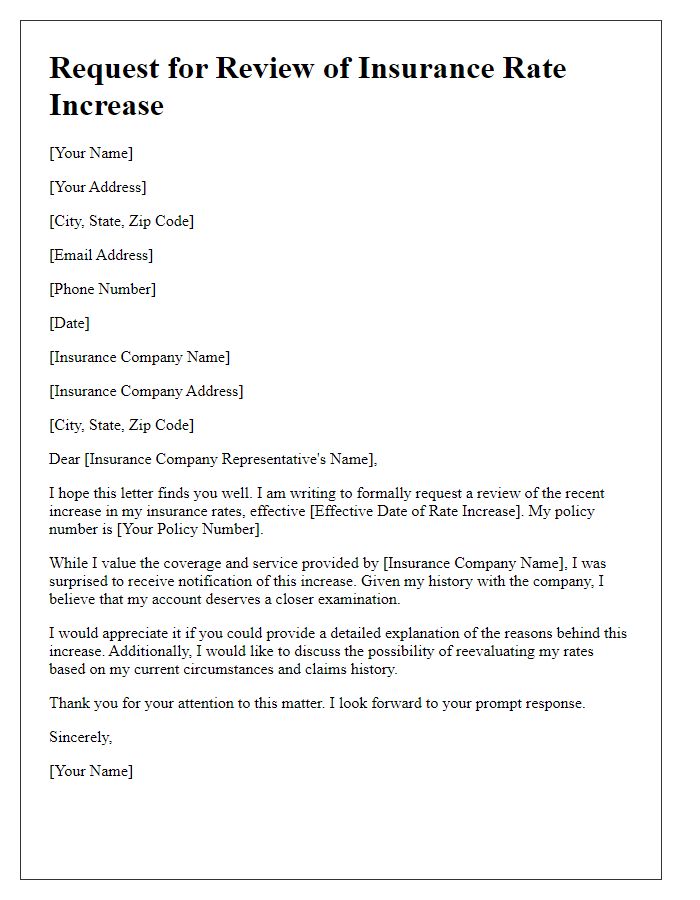

Request for reconsideration and resolution

The recent increase in homeowners insurance rates has raised concerns among policyholders, particularly in areas like Florida, where natural disasters such as hurricanes frequently occur. For instance, a 15% spike in premiums has been observed, driven by factors like rising reinsurance costs and increased claim payouts. Policyholders are urged to submit a formal request for reconsideration, detailing specific grievances and providing supporting evidence, such as previous claims history, local crime rates, and property maintenance records. The financial burden imposed by these increases can significantly impact family budgets, emphasizing the need for resolution and fair assessment in the insurance industry during challenging economic times.

Comments