Are you looking to stay ahead of the game with your home insurance? Updating your policy is crucial to ensure you're adequately covered against unforeseen events. Whether you've made renovations, added valuable items, or simply want to adjust your coverage limits, taking the time for an insurance review can lead to peace of mind. Join us as we navigate the essential steps to update your home insurance policy and protect what matters most!

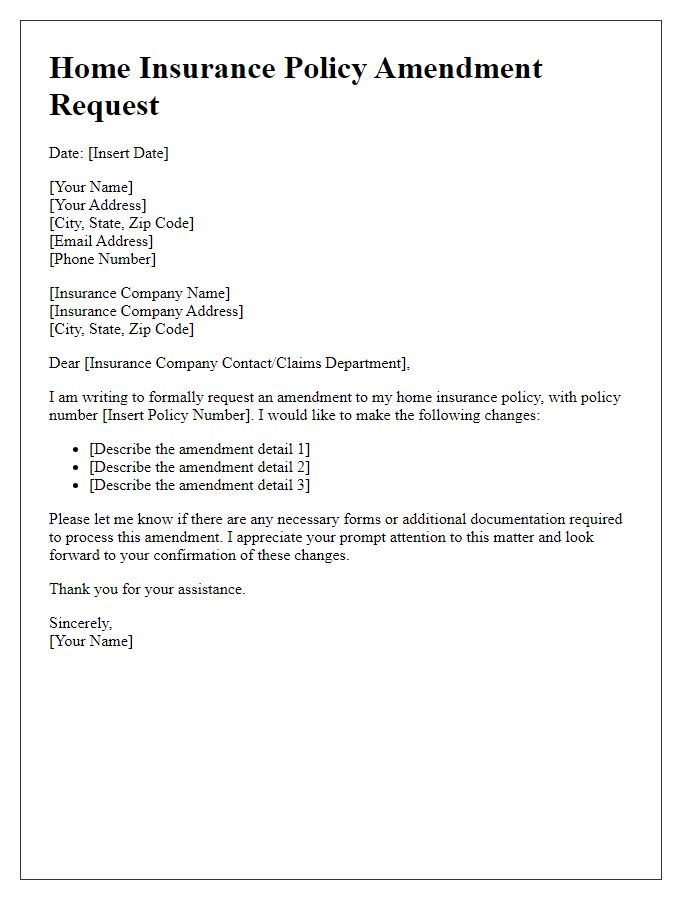

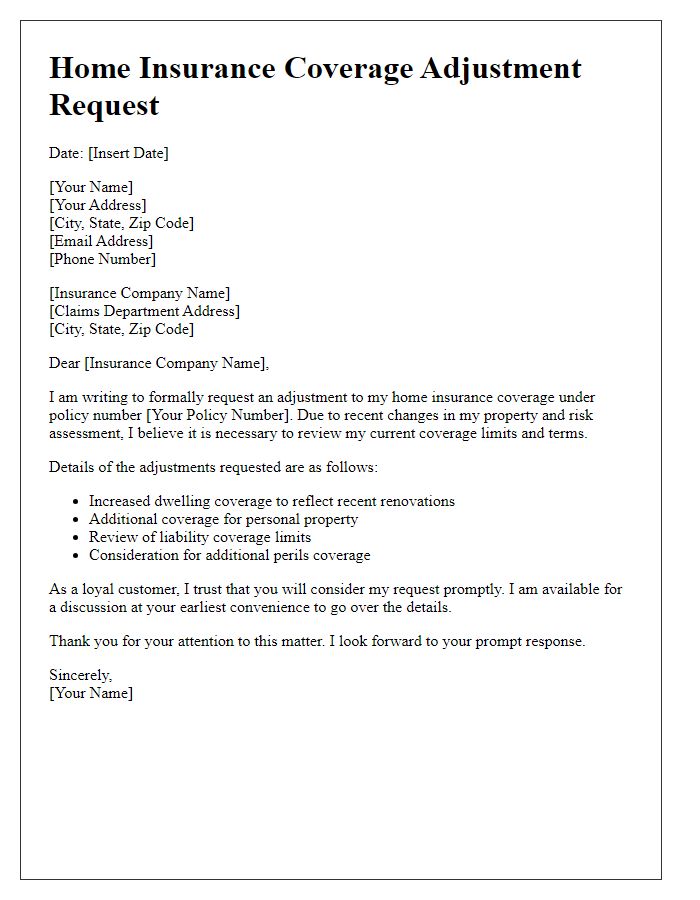

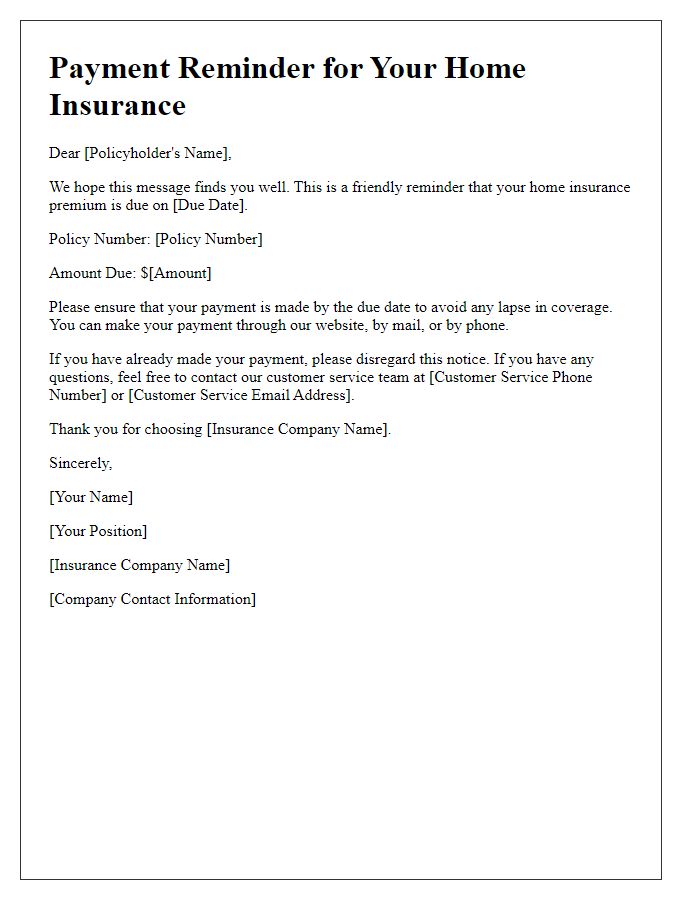

Policy Number and Details

Home insurance policy updates often require attention to specific details crucial for coverage. The policy number, typically a unique identifier for the insurance policy, ensures the correct account is referenced. Important details include the property address, which serves as the location being insured, and the coverage limits, outlining the maximum amount payable for damages. It's essential to mention any recent changes, such as renovations to windows or roofs, which can affect the overall value. Additionally, note any alterations in personal property values, such as newly acquired expensive electronics or collectibles, which should be documented for accurate replacement coverage. Always consider any changes in risk factors like neighborhood developments, which can influence premium rates.

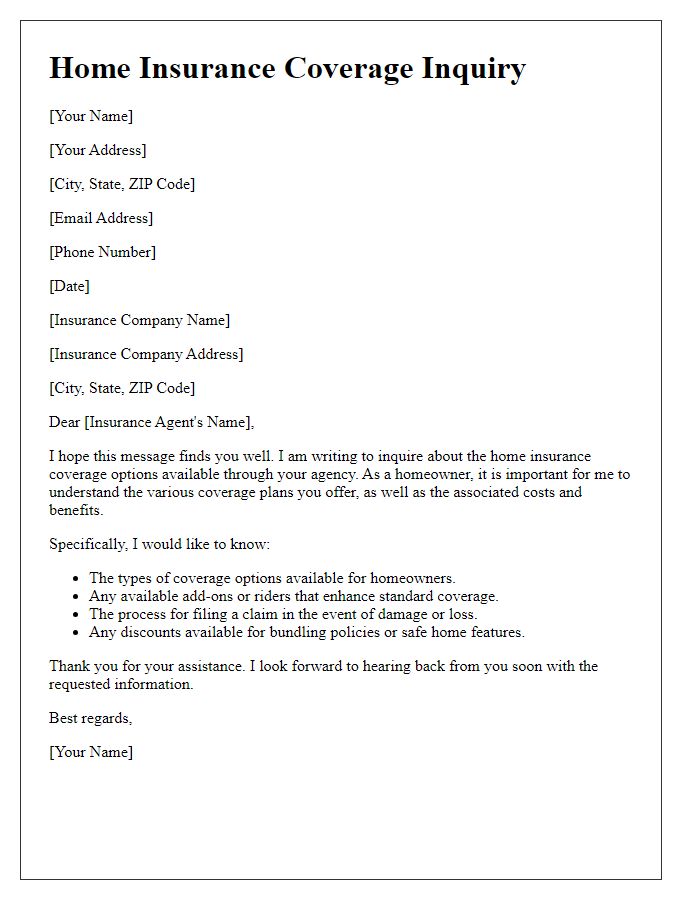

Updated Coverage and Limits

Home insurance policies can undergo vital updates, reflecting changes in coverage and policy limits to safeguard homeowners in various situations. Recent enhancements may include increased dwelling coverage, accommodating rising construction costs, particularly in urban areas like San Francisco where building materials fluctuate. Personal property limits might be adjusted, ensuring adequate protection for valuable items such as electronics and jewelry, with certain insurers offering up to $50,000 in additional coverage. Liability limits can also see increments, providing up to $1 million in protection against accidents on the property. Additionally, endorsements for natural disasters, like floods and earthquakes, can be incorporated, particularly relevant for residences in disaster-prone regions such as Florida. Regular policy audits and revisions are crucial for maintaining comprehensive coverage that reflects a homeowner's evolving needs.

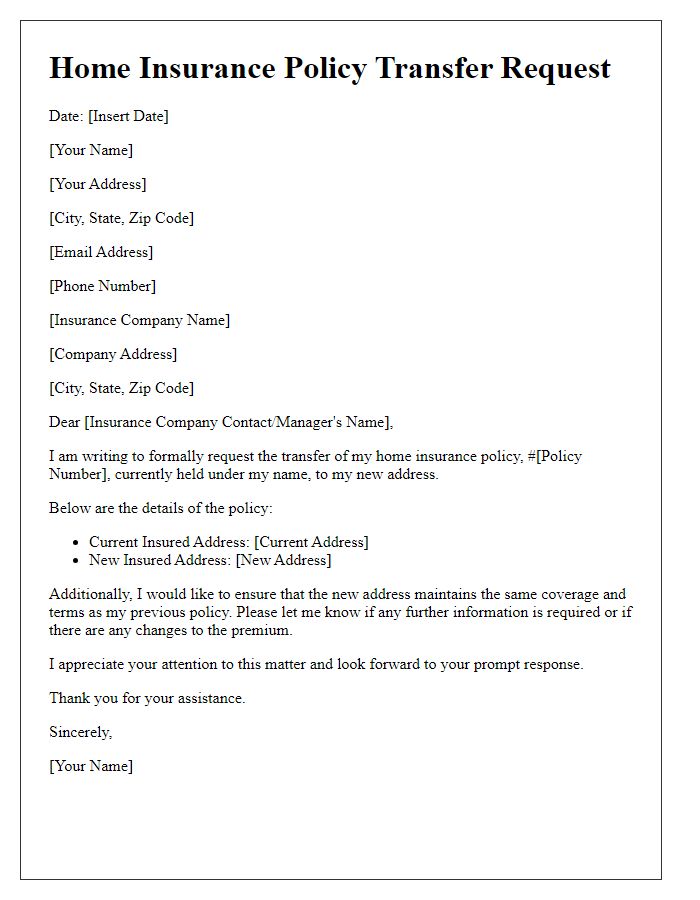

Reasons for Changes

Home insurance policy updates are crucial for ensuring comprehensive coverage of assets. Major life events such as marriage, childbirth, or relocation can influence changes in policy scope. The addition of new valuable possessions, like appliances or jewelry, especially those exceeding appraised values, necessitates an increase in coverage limits. Property modifications, such as renovations or additions, enhance home value, prompting necessary adjustments in policy terms to reflect current market conditions. Local factors affecting risk, including natural disasters (hurricanes, floods) or crime rates, should also be considered for revising coverage plans. Ultimately, these updates safeguard against potential losses while ensuring that policies align with homeowners' evolving needs.

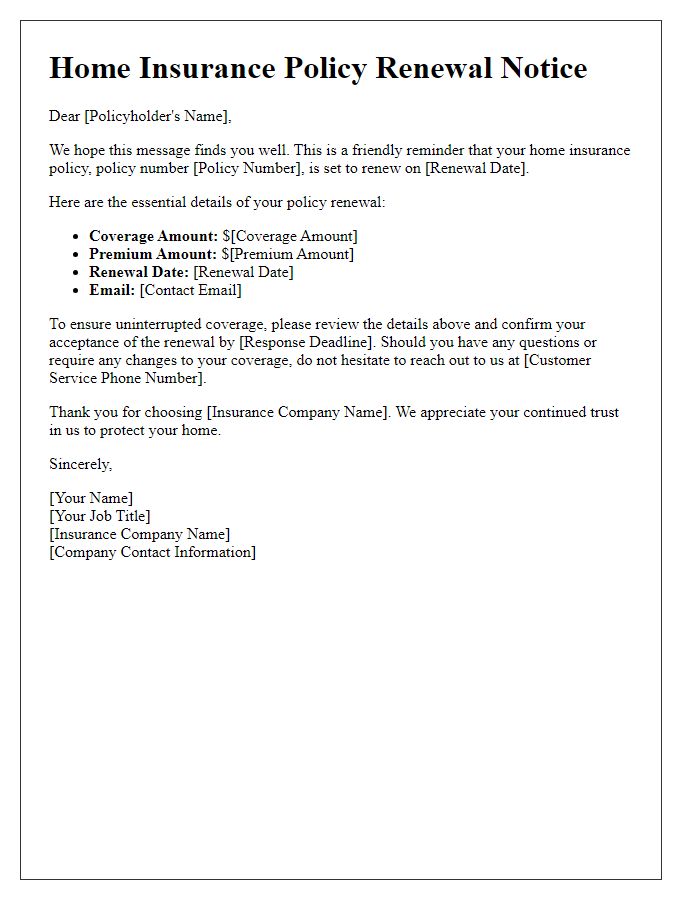

Effective Date of Changes

An update to a home insurance policy can significantly impact coverage and financial protection for homeowners. The effective date of changes is crucial, as it marks the moment when updated terms, conditions, and premiums come into effect. Typically, insurance providers send a notification to policyholders to outline alterations, including coverage limits, deductibles, and any newly included endorsements or exclusions. For instance, if a policyholder increases coverage for personal property from $100,000 to $150,000, the effective date of this change determines when the homeowner becomes eligible for the higher level of protection. This information can also affect monthly premium payments, reflecting adjustments based on the new risk assessment and value of the property insured. Understanding the effective date helps homeowners secure adequate coverage and maintain peace of mind regarding their assets.

Contact Information for Queries

Home insurance policy updates often necessitate clear communication avenues for policyholders. Include a dedicated customer service line operating Monday to Friday (9 AM to 5 PM) at a toll-free number such as 1-800-555-0199. For email inquiries, provide an address like support@homeinsure.com. Ensure that the mailing address for written correspondence is accurate, such as 123 Insurance Lane, Suite 100, New York, NY 10001. Consider listing a specific department for escalation, such as the Claims Department, which can expedite urgent matters. Additionally, highlight the use of online chat services available through the company's website, allowing for real-time assistance.

Comments