Thinking about your earthquake insurance policy cancellation? It's a significant decision that can impact your finances and peace of mind, especially if you live in an area prone to seismic activity. Knowing the ins and outs of this process can help you make informed choices that align with your needs. Ready to explore the key factors and steps involved? Keep reading to find out more!

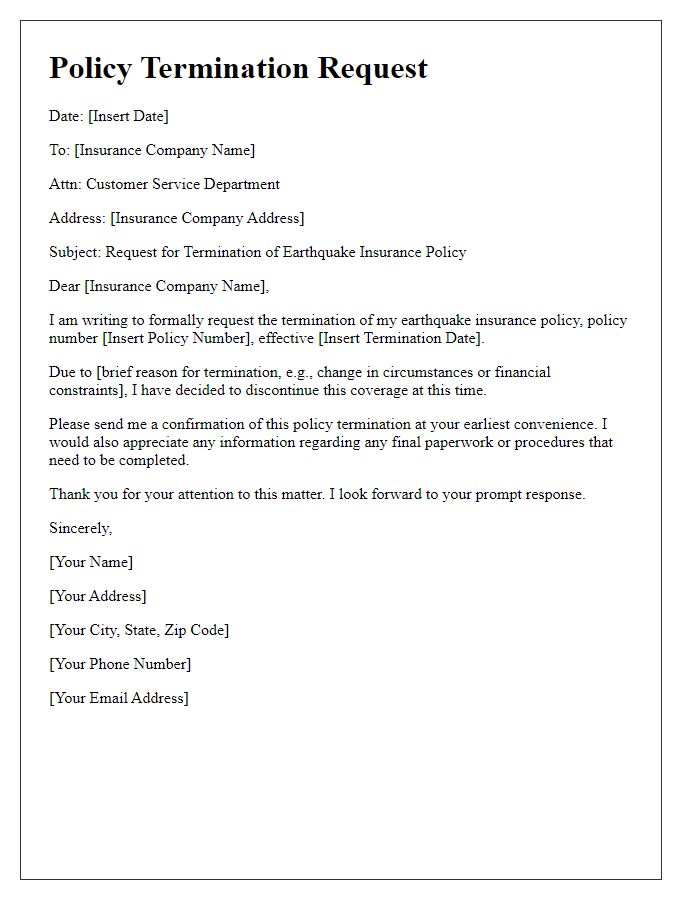

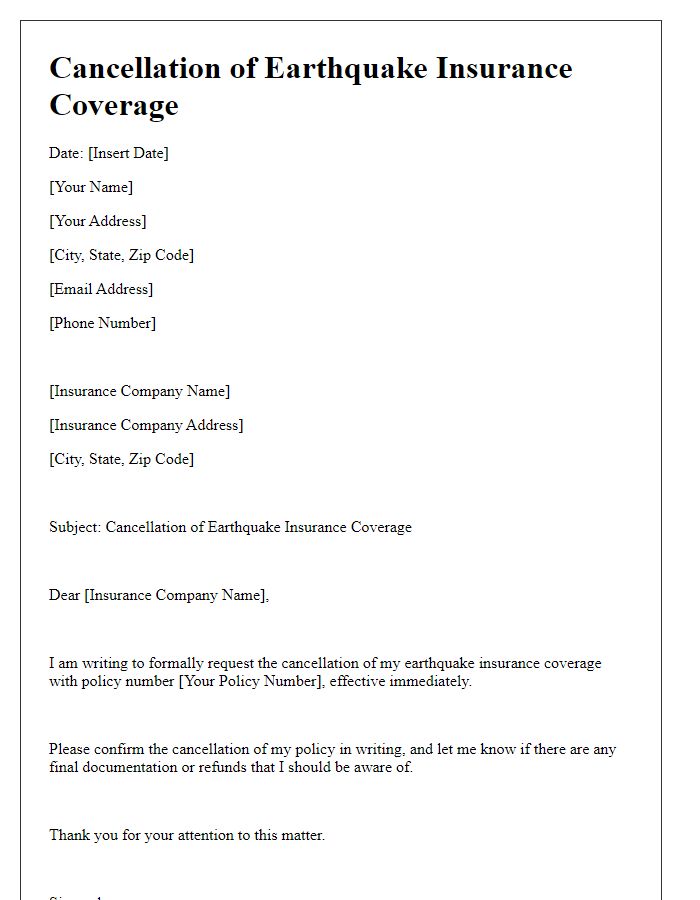

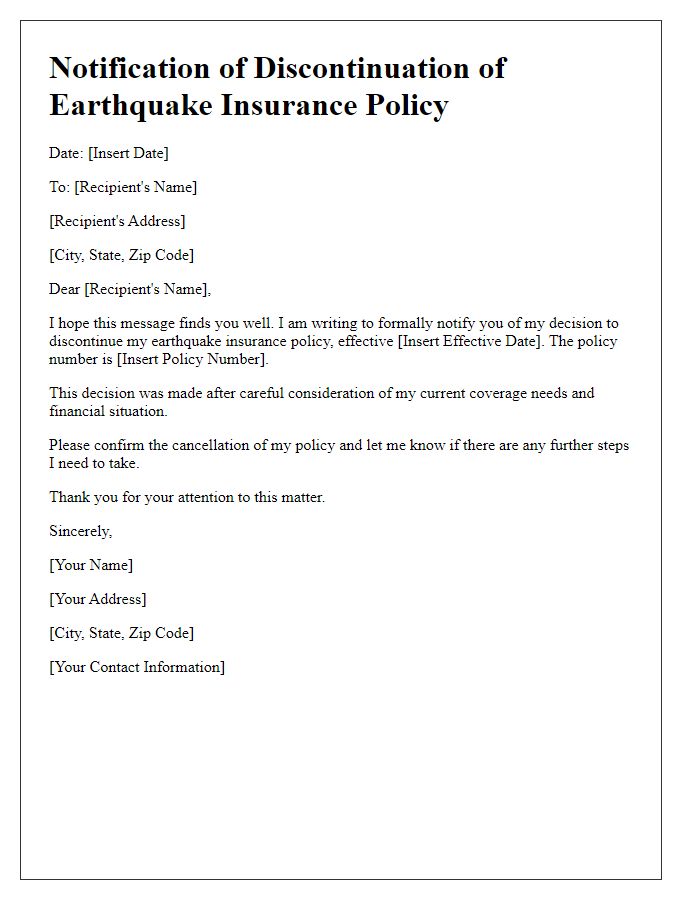

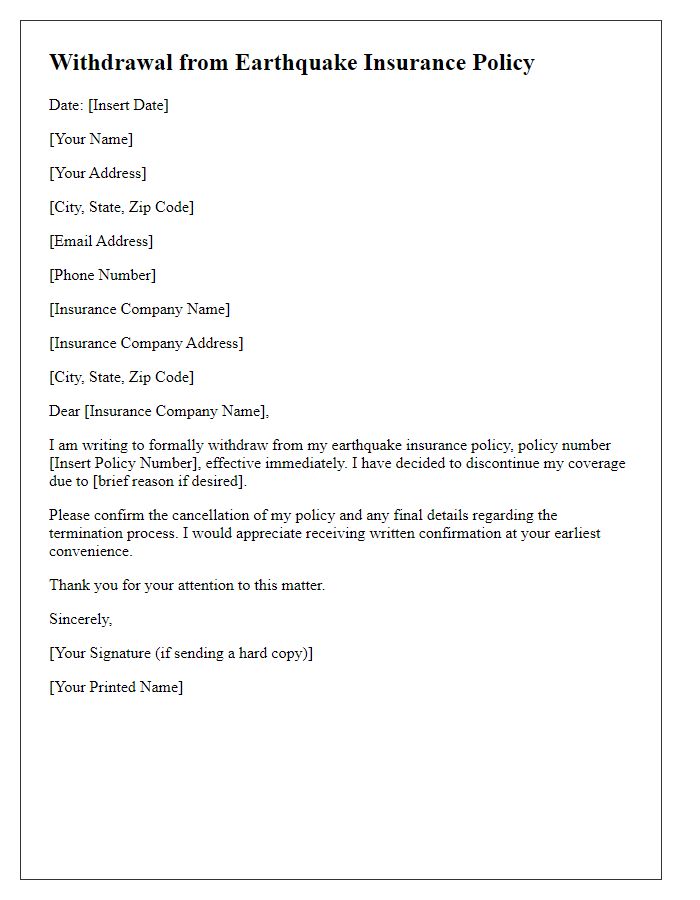

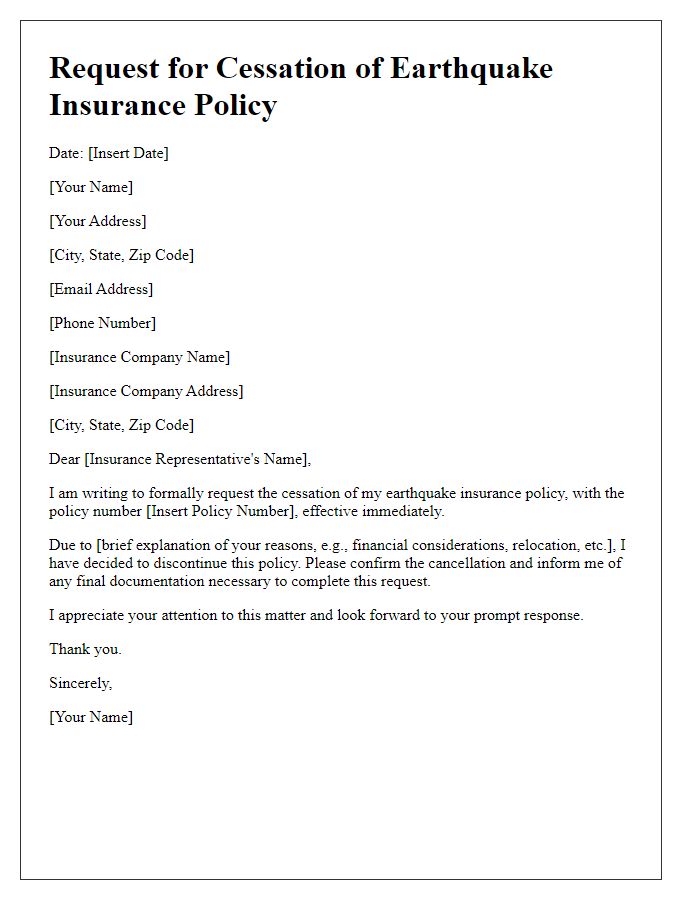

Policyholder's information (name, address, contact details)

In the aftermath of recent seismic events, policyholders often reassess their earthquake insurance policies for various reasons. Addressing the cancellation of an earthquake insurance policy requires clarity and adherence to protocols, especially for residents in high-risk areas like California or Japan where earthquakes are frequent. Details such as the policyholder's full name, residential address (including city and zip code), and up-to-date contact information (phone numbers and email addresses) are essential for processing the cancellation efficiently. Additionally, the specific policy number associated with the earthquake insurance must be referenced to ensure proper handling by the insurance provider. This information supports accurate record-keeping and helps avoid complications or misunderstandings during the cancellation process.

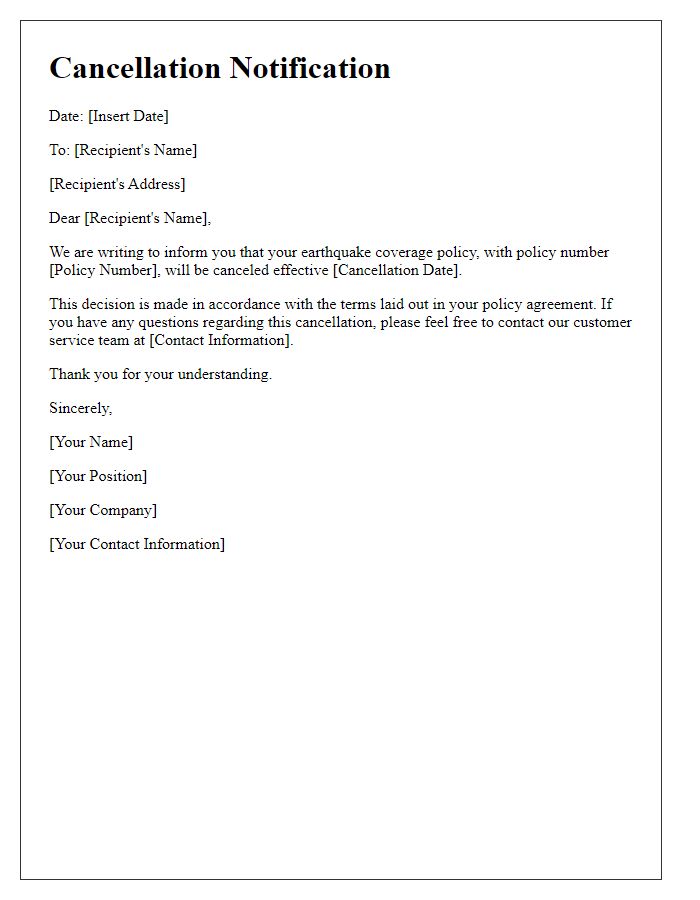

Policy number and insurance company details

The cancellation of an earthquake insurance policy can arise from various factors concerning property owners' circumstances. In California, for instance, where earthquake risks are significantly high due to tectonic activity along the San Andreas Fault, homeowners may choose to cancel their policy (Policy Number: 123456789) with XYZ Insurance Company, which has been operating since 1990 and specializes in natural disaster coverage. Property owners often reassess their financial commitments following major events like the Northridge earthquake in 1994, which resulted in widespread damage and policy re-evaluations. Cancellation could also stem from a change in residence, specifically moving to areas with lower seismic activity, thus rendering the insurance policy unnecessary.

Effective cancellation date

Earthquake insurance policies are vital protections against seismic events that can devastate properties, particularly in high-risk areas such as California, Japan, and Chile. When cancelling such a policy, it is crucial to specify the effective cancellation date to prevent coverage gaps. For instance, if an individual signs a cancellation request on January 15th, the effective cancellation date might be set for January 31st. This ensures that the property owner retains coverage until the date specified, safeguarding against potential losses from an earthquake occurring before cancellation takes effect. Additionally, understanding the insurer's refund policies and any potential penalties associated with early termination can affect financial decisions regarding future coverage, highlighting the importance of clear communication with the insurance provider.

Reason for cancellation (optional)

The cancellation of an earthquake insurance policy can stem from various reasons, including financial considerations or changes in property ownership. Policyholders often reassess their coverage based on current market conditions, such as a significant decline in premium rates or the availability of alternative coverage options in regions prone to seismic activity, like California and Japan. Decisions may also arise from a recent property renovation that enhances structural resilience against earthquakes, reducing the perceived need for additional coverage. Additionally, circumstances such as moving to a less earthquake-prone area may influence the decision to cancel an existing policy, which typically requires notification according to the terms of the insurance contract, ensuring all legal obligations are fulfilled.

Request for confirmation of cancellation

Cancellation of an earthquake insurance policy often involves clear communication regarding one's intent to terminate coverage. Policyholders should note the specific policy number, the name of the insurance company, and the effective date of cancellation. Providing a written request ensures that there is a formal record of the cancellation. Additionally, it is important to inquire about any potential refunds for premiums already paid and confirmation of the cancellation to prevent any misunderstanding in the future. Insurers usually have defined procedures for processing cancellations to maintain accurate records and avoid lapses in coverage.

Comments