Hey there! If you're navigating the world of insurance premium payments, it can sometimes feel overwhelming with all the paperwork involved. A well-crafted letter can make all the difference when it comes to providing evidence of payment and ensuring your coverage remains uninterrupted. In this article, we'll guide you through a simple yet effective template that you can customize to suit your needs. So, let's dive in and streamline your insurance correspondence!

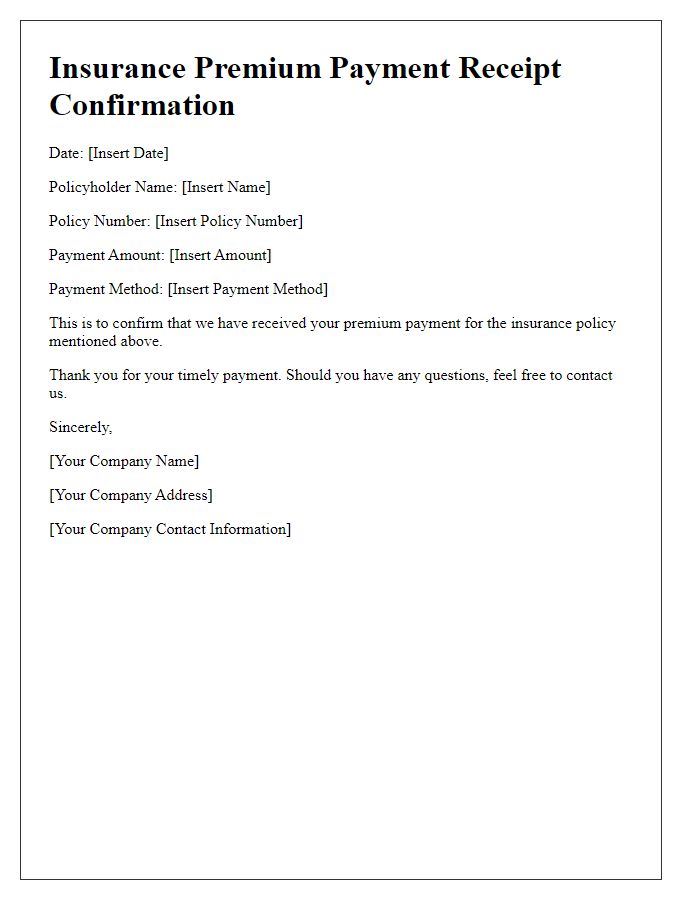

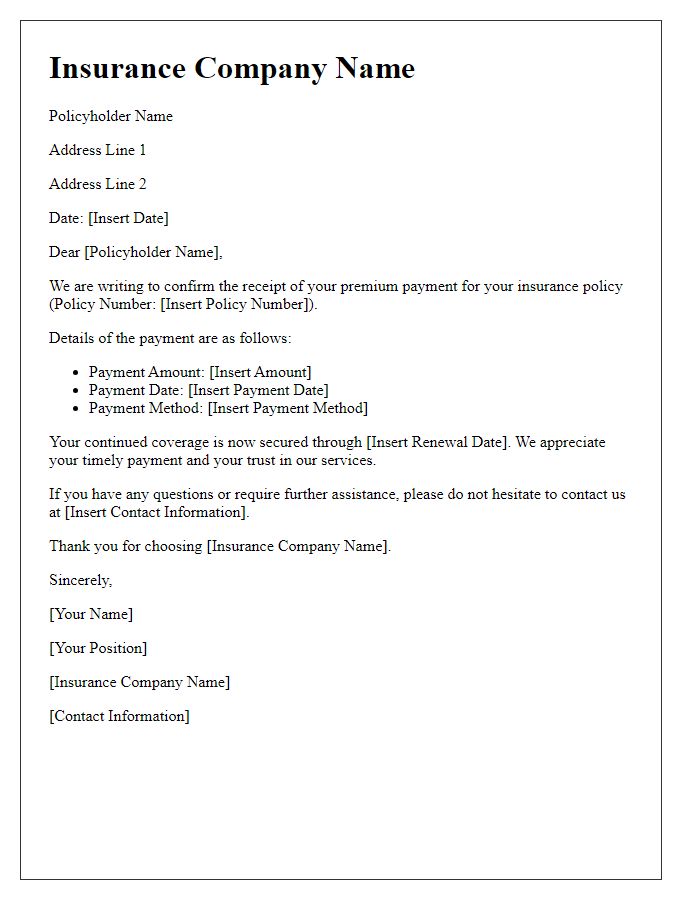

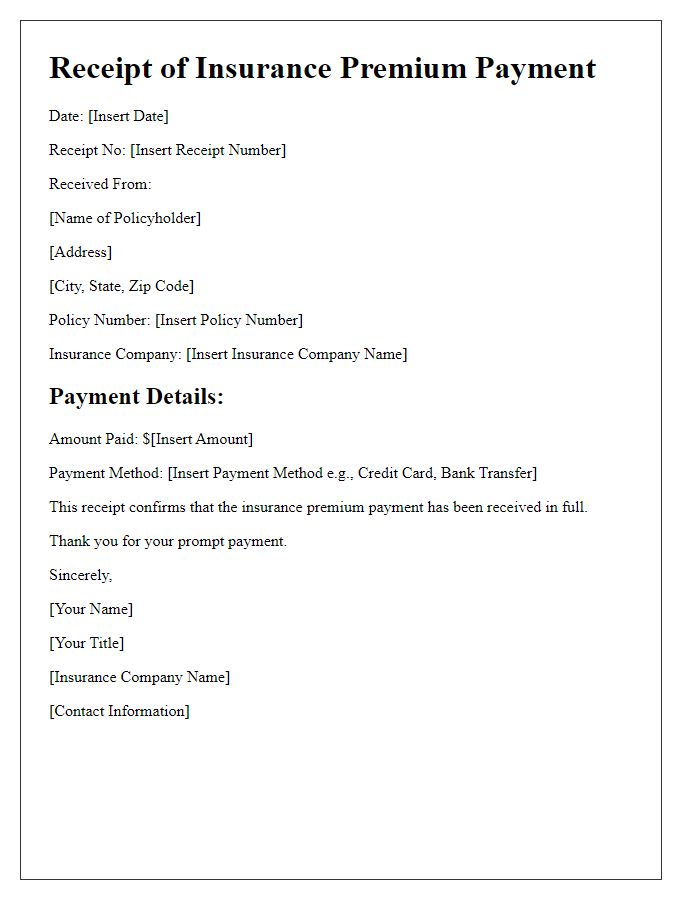

Policyholder Information

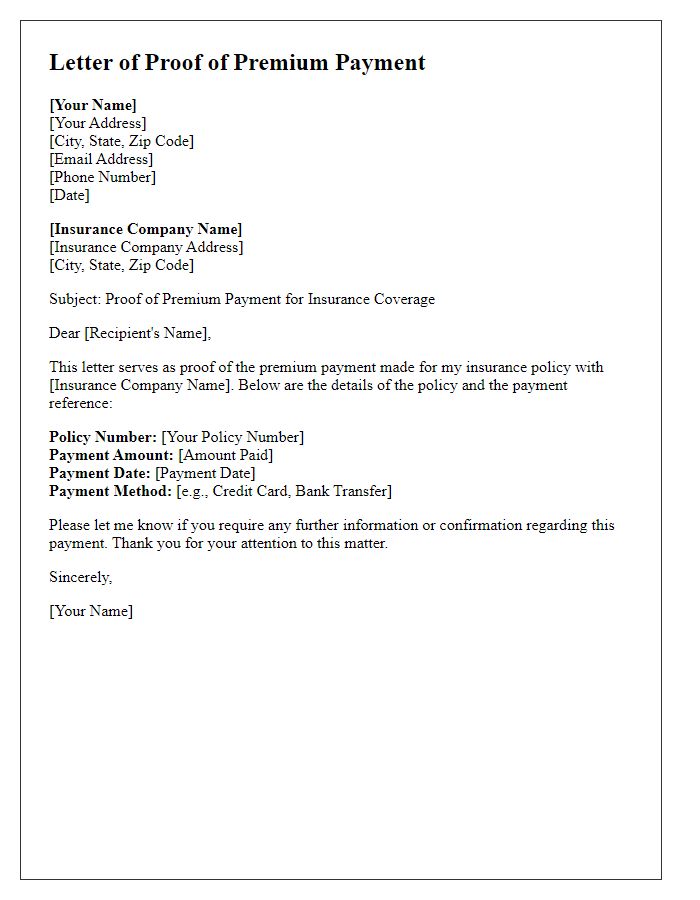

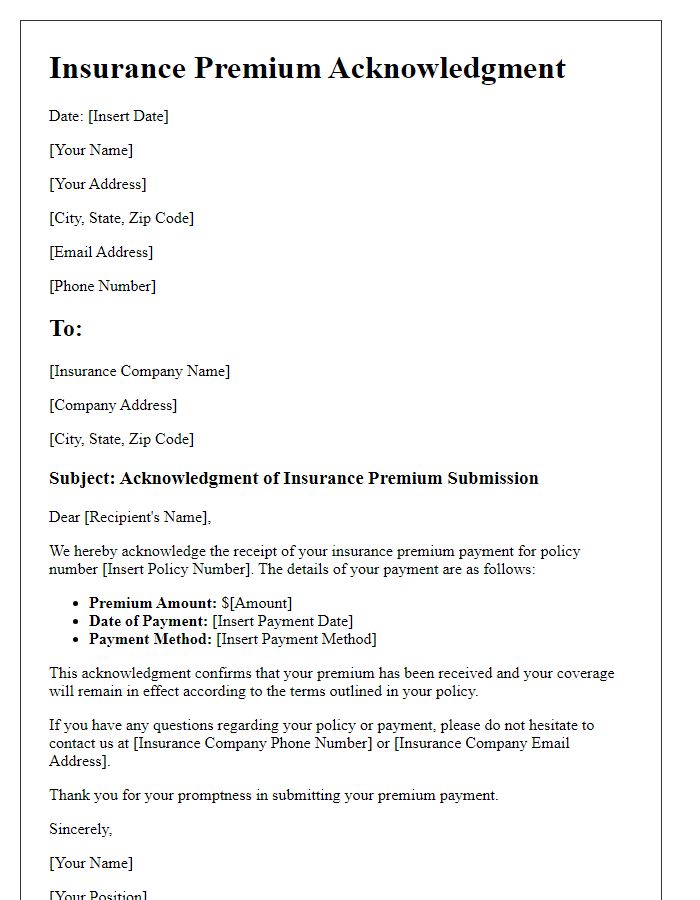

Policyholders seeking to provide evidence of premium payment for insurance policies should focus on documenting essential details. The insurance policy number, which uniquely identifies the contract between the policyholder and the insurer, is crucial. Payment dates, typically monthly or annually, should be clearly outlined to indicate compliance with premium requirements. Thorough records of transactions, such as bank statements or receipts, must be included to substantiate payment claims. Additionally, the insured individual's full name and contact information should be noted to facilitate communication with the insurance provider. This documentation serves as critical proof in any potential disputes or claims regarding policy status.

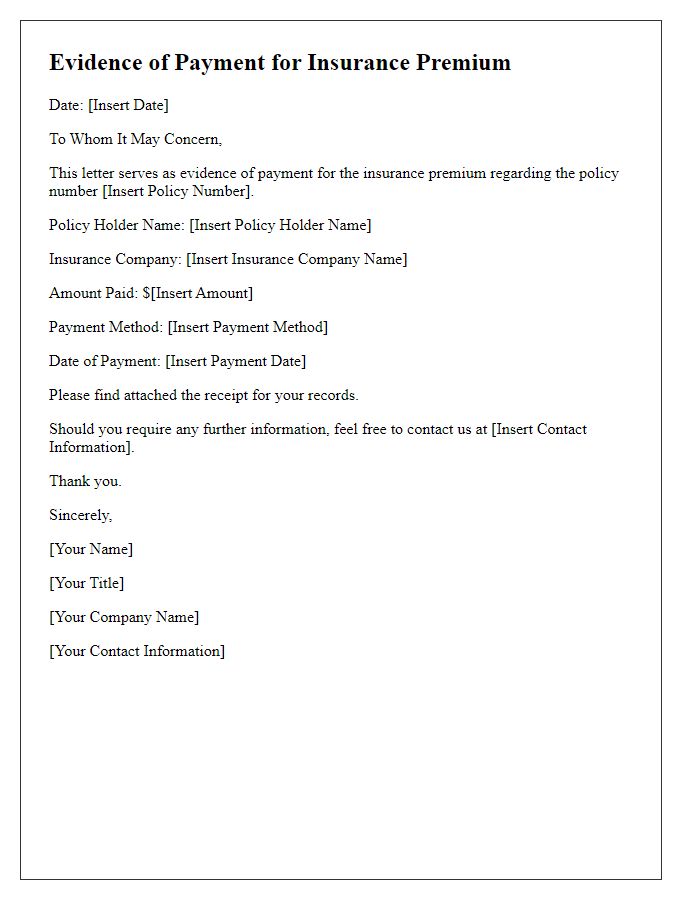

Policy Details and Number

Insurance policy details are essential for confirming premium payments and maintaining coverage. The policy number serves as a unique identifier, ensuring accurate tracking of payments. Premium payments typically occur on a regular schedule, often monthly or annually, and it is crucial to stay up-to-date to avoid lapses in coverage. Insurers may provide evidence of payments through official documents such as statements or receipts, which detail payment amounts, dates, and methods. This documentation is vital for policyholders to verify their compliance with the terms of their insurance contracts and for resolving any disputes regarding coverage or claims.

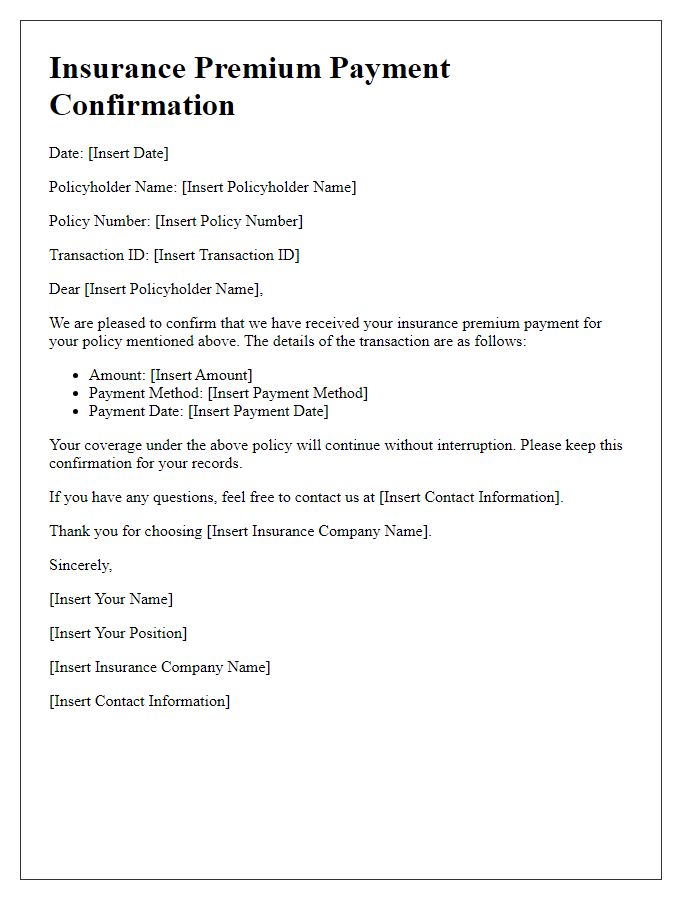

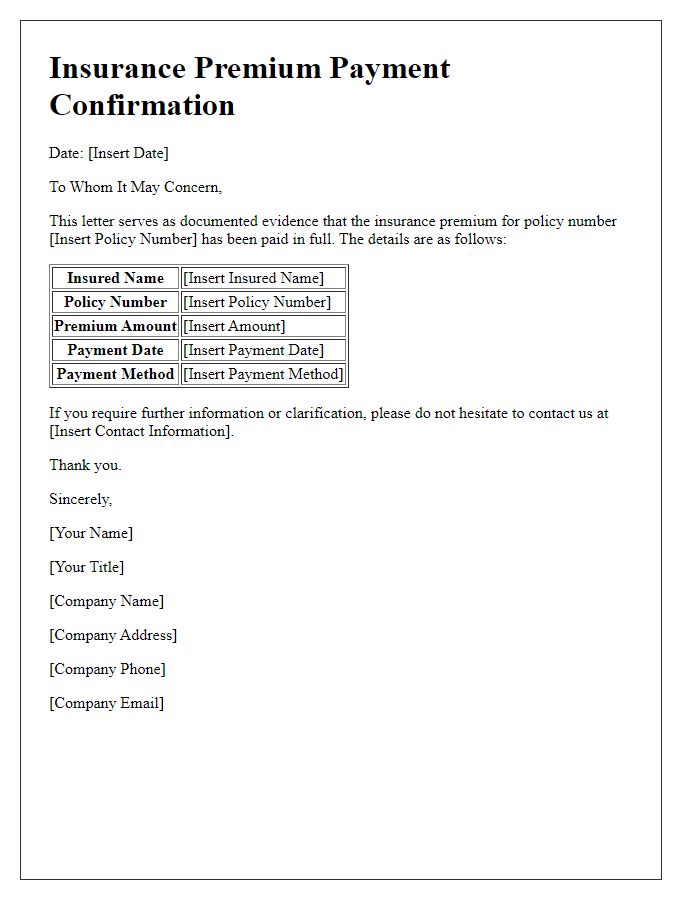

Payment Confirmation and Amount

Premium payment confirmations validate transactions made for insurance policies, serving as essential documentation in financial records. Confirmation receipts typically include vital details such as the payment date (often within the policy cycle), amount (often ranging significantly depending on coverage, e.g., $500 to $5,000), and payment method (credit card, bank transfer, etc.). Policyholders receive this confirmation from their insurance provider, confirming that premiums for specific policies, like life insurance or auto insurance, have been successfully processed. This evidence is crucial during claims processing or policy renewal periods, ensuring that clients maintain continuous coverage and protection, reflecting commitment to safeguarding against potential risks and unforeseen events.

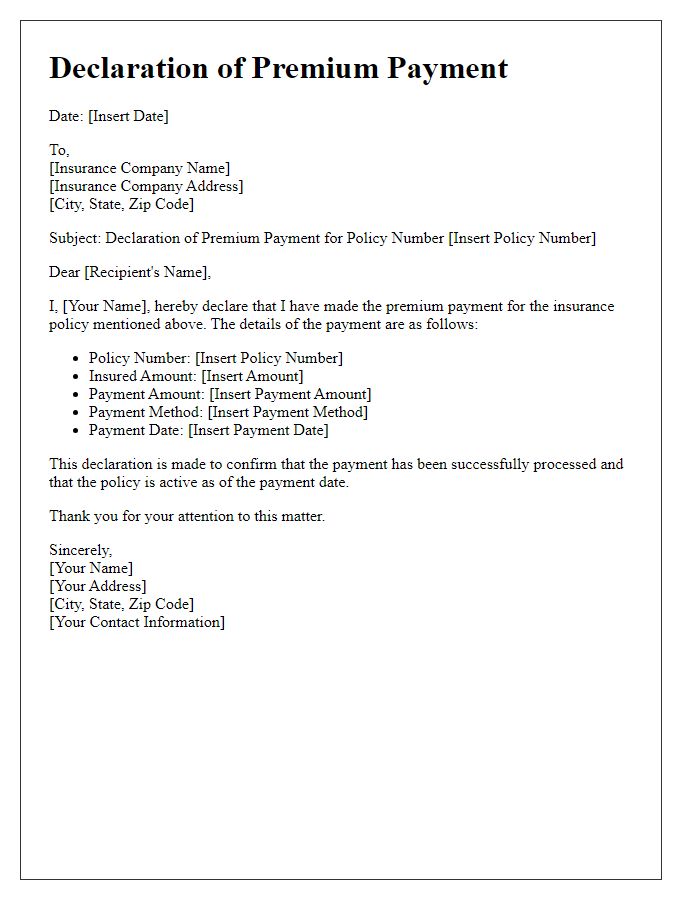

Coverage Period and Terms

Insurance premium payment evidence serves as documentation for verifying coverage duration and conditions of a policy. Relevant data includes the specific coverage period, which might span from January 1, 2023, to December 31, 2023, indicating a one-year term. Moreover, essential terms outline benefits such as liability limits ($1 million), deductible amounts ($500 per incident), and types of coverage, including property damage and personal injury. Each policy also specifies renewal requirements, which may necessitate payment of the premium by December 1 for uninterrupted coverage in 2024. Such documentation is crucial for policyholders when filing claims or providing evidence of active coverage to third parties.

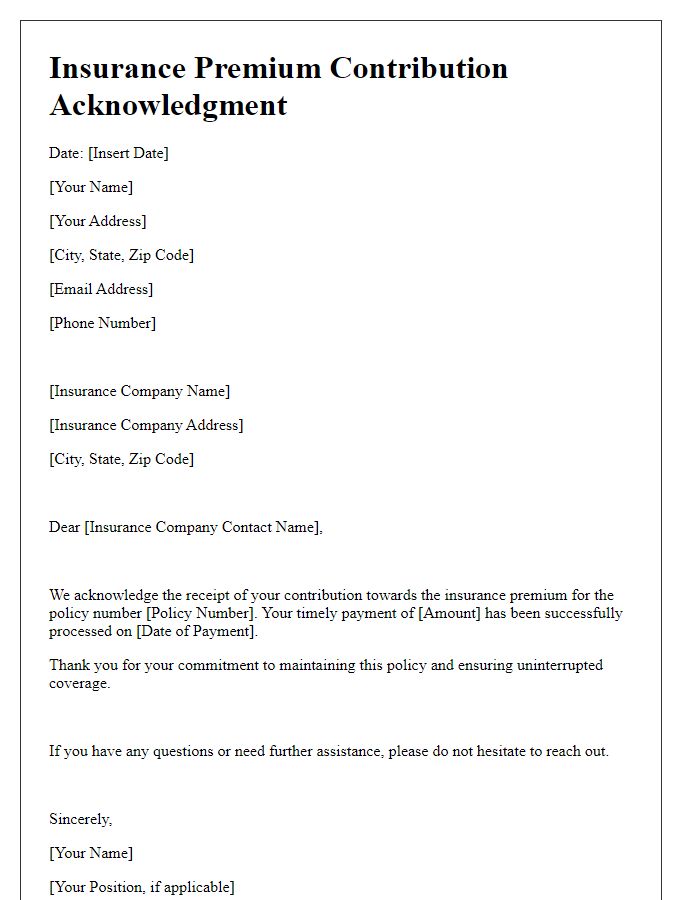

Contact Information for Inquiries

Premium payment evidence for insurance policies is crucial for maintaining coverage. Typically, this evidence is provided by the insurance company and includes vital details such as policy numbers, effective dates, and payment amounts. Inquiries regarding premium evidence can be directed to customer service departments or specific claims representatives. For instance, contacting the main office of a company like State Farm Insurance might involve calling their toll-free number, which is available 24/7, or emailing their support team for quick responses. It's important to have your policy number ready to expedite the inquiry process and ensure accurate assistance in verifying your premium payments.

Comments