Are you curious about how supplemental insurance can enhance your financial security? It's no secret that navigating the world of insurance can be complex, and understanding your supplemental benefits is essential for making informed decisions. With updates regarding policies and coverage options, it's crucial to stay informed of what's available to you. If you want to learn more about leveraging these benefits effectively, keep reading!

Clear Subject Line

Supplemental insurance benefits provide added financial protection for unforeseen medical expenses, enhancing standard health insurance plans. Comprehensive packages can include critical illness coverage, which typically pays out a lump sum for diagnoses like cancer or heart attack, with annual premium costs ranging from $200 to $500 depending on age and health status. Additionally, accidental injury benefits often cover specific incidents such as fractures or hospital stays, with payouts averaging $1,000 for emergency room visits. Understanding the details of local regulations and state mandates, such as the Affordable Care Act provisions, is crucial for navigating supplemental insurance options effectively.

Policyholder Identification

Supplemental insurance benefits play a crucial role in financial protection for policyholders, covering additional healthcare costs not met by primary insurance plans. An effective policyholder identification process includes key details such as policy number, issuance date, and individual personal information (name, address, contact number), ensuring accurate processing of claims. Clear communication of benefit updates can assist in understanding coverage limits and conditions, including any changes in deductible amounts, co-pay percentages, or benefit maxima, crucial for financial planning. Regularly updating policyholder records helps maintain the integrity of supplemental insurance services, fostering trust and satisfaction among clients.

Updated Benefit Details

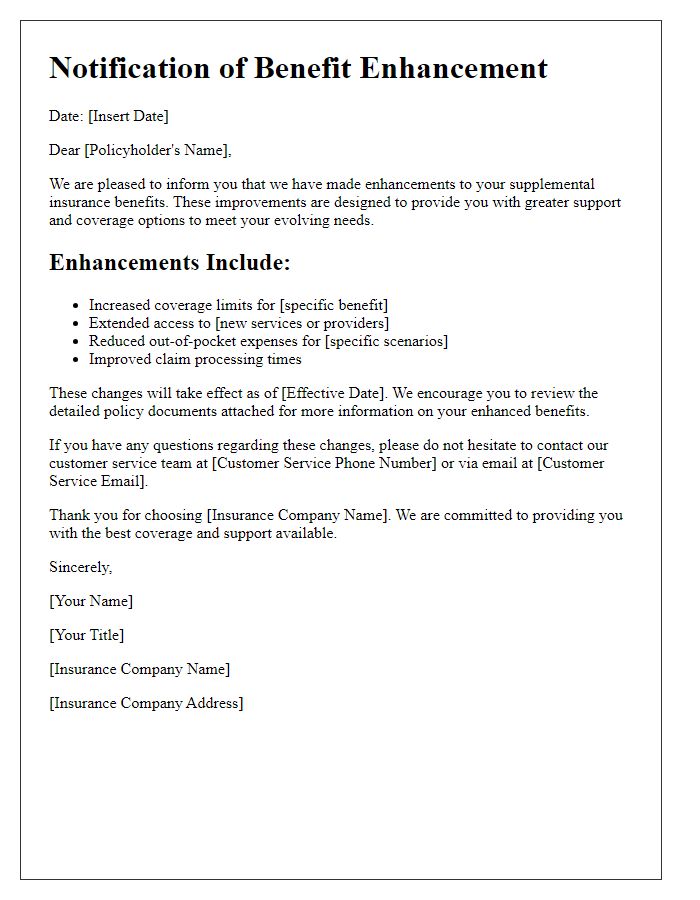

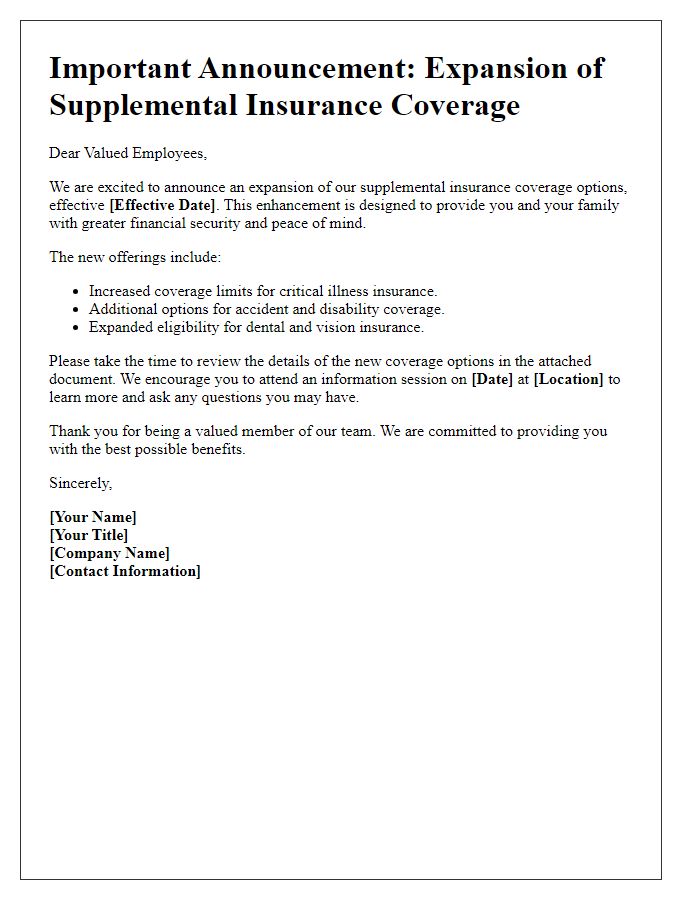

Supplemental insurance policies often undergo annual reviews, adjusting coverage levels and premiums. Recent updates to the supplemental insurance policy reflect changes effective January 1, 2024. Key enhancements include increased coverage limits for critical illnesses, now offering up to $100,000, and expanded access to telehealth services without deductibles. Additionally, the outpatient surgical benefit has been raised to cover up to 90% of costs, with a maximum out-of-pocket expense set at $500 per event. These developments aim to provide greater financial protection and improved healthcare access for policyholders while navigating potential medical expenses. Ensure to review the updated policy documents for complete details.

Impact on Premiums

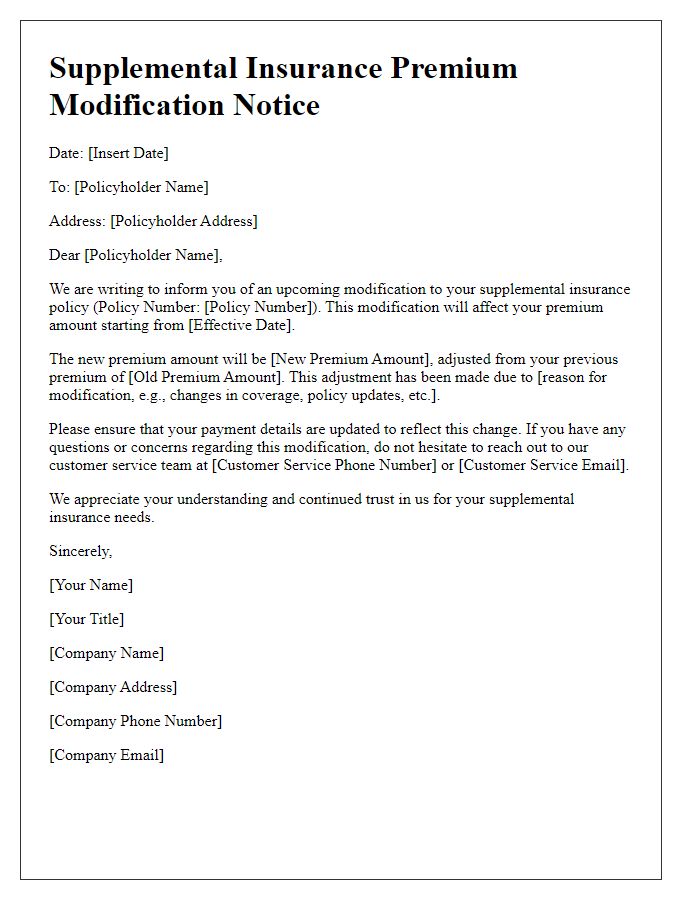

Supplemental insurance benefits play a crucial role in providing additional financial coverage beyond primary insurance plans. Various types of supplemental insurance, such as critical illness, accident, and dental plans, can impact monthly premiums significantly. For instance, a critical illness policy can increase premiums by 10% to 30% based on coverage limits and individual health factors. Insurance providers, like Aetna and UnitedHealth Group, may adjust rates annually, often due to changes in national healthcare costs or claims experiences. It is vital for policyholders to review their benefits regularly, especially during open enrollment periods, to understand the implications on premiums and ensure they are receiving optimal coverage tailored to their specific needs.

Contact Information for Inquiries

Supplemental insurance benefits often require clear communication for inquiries. Policyholders should have access to essential contact information, which includes a customer service phone number, typically available during standard business hours (e.g., 9 AM - 5 PM EST) for personalized assistance. Additionally, an email address dedicated to inquiries can facilitate communication for those preferring written correspondence. Some companies provide an online portal, allowing users to submit inquiries directly, track their requests, and access frequently asked questions. Including the physical address of the company's headquarters may also be beneficial for formal correspondence or documentation submissions. Always ensure that contact details are up-to-date to avoid any delay in resolving inquiries related to supplemental insurance benefits.

Letter Template For Supplemental Insurance Benefit Update Samples

Letter template of supplemental insurance benefit enhancement notification.

Letter template of supplemental insurance coverage expansion announcement.

Letter template of supplemental insurance premium modification information.

Letter template of supplemental insurance benefit increase notification.

Comments