Are you feeling overwhelmed by the process of claiming a refund on your insurance premium? You're not alone; many policyholders find themselves navigating the complexities of insurance claims. Fortunately, with the right guidance and a solid letter template, you can streamline your request and increase your chances of success. Stick around to learn more about the essential components of an effective refund claim letter.

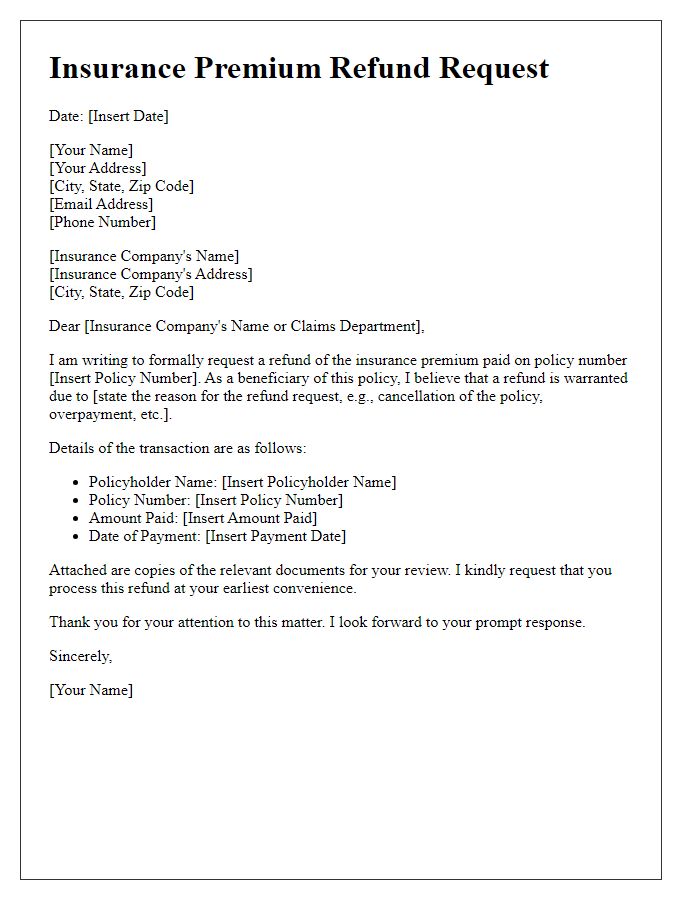

Policy Details: Include policy number, type, and coverage period.

Policy details for the insurance premium refund claim include the following: The policy number is 123456ABCD, representing a comprehensive car insurance policy. The coverage period extends from January 1, 2023, to December 31, 2023, encompassing full coverage for collision, liability, and comprehensive damage. This type of policy offers extensive protection against various risks associated with vehicle ownership, including theft, fire, and damage from natural disasters. The financial implications of the refund claim are significant, as the total premium paid amounts to $1,200, which warrants a review for eligibility under the insurance company's guidelines. The request for refund submission aligns with company protocols set forth in policy documentation.

Personal Information: Full name, contact details, and insured individual.

Submitting a claim for an insurance premium refund requires clear and complete personal information. Full name, including middle initial, should be included at the beginning of the document. Detailed contact information, including phone number and email address, must follow to ensure prompt communication from the insurance provider. Additionally, specifying the name of the insured individual, which may differ from the claimant, establishes clear identification and context for the claim. Accurate information facilitates processing and enhances accountability in handling the refund request.

Reason for Refund: Provide a clear explanation for the refund request.

Insurance premium refund claims often arise from specific circumstances, such as overpayment, policy cancellation, or changes in coverage needs. For instance, if a policyholder identifies an overpayment of $200 on a home insurance policy from XYZ Insurance Company in January 2023, this discrepancy should be detailed in the claim. Additionally, if the policyholder cancels the policy effective March 1, 2023, the request for a pro-rated refund based on the remaining coverage period is essential to mention. Relevant documentation, including premium payment records and cancellation confirmation, supports the refund request, ensuring clarity and precision in the communication with the insurance provider.

Relevant Documentation: Attach supporting documents such as proof of payment and cancellation confirmation.

Insurance premium refund claims require relevant documentation to support the request. Key documents include proof of payment, which typically includes receipts or bank statements indicating the transaction date and amount for the premium paid. Additionally, cancellation confirmation, often in the form of a formal letter or email from the insurance provider, should be included to validate that the policy was officially terminated. These documents serve to establish the legitimacy of the claim and facilitate the processing of the refund efficiently.

Desired Outcome: Specify the amount expected and preferred refund method.

Insurance premium refund claims often relate to adjustments or cancellations in policies. The expected refund amount typically aligns with overpayments or credits. Preferred refund methods often include checks, bank transfers, or credit towards future premiums. Documenting the policy number, dates of overpayment, and specific refund request can expedite processing. Clear communication with the insurance provider ensures a prompt response and resolution, helping clients regain funds efficiently.

Letter Template For Insurance Premium Refund Claim Samples

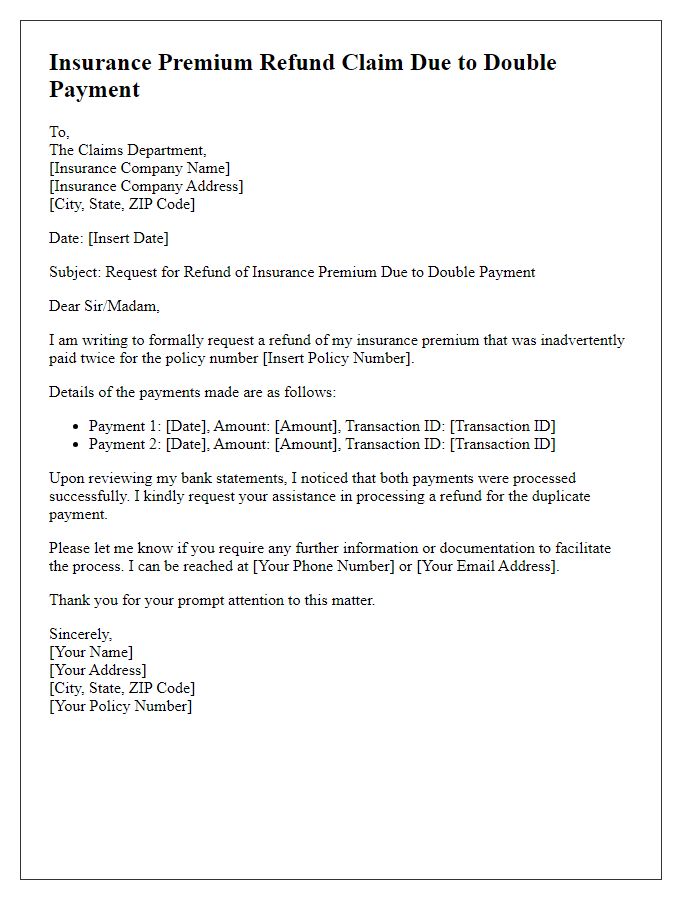

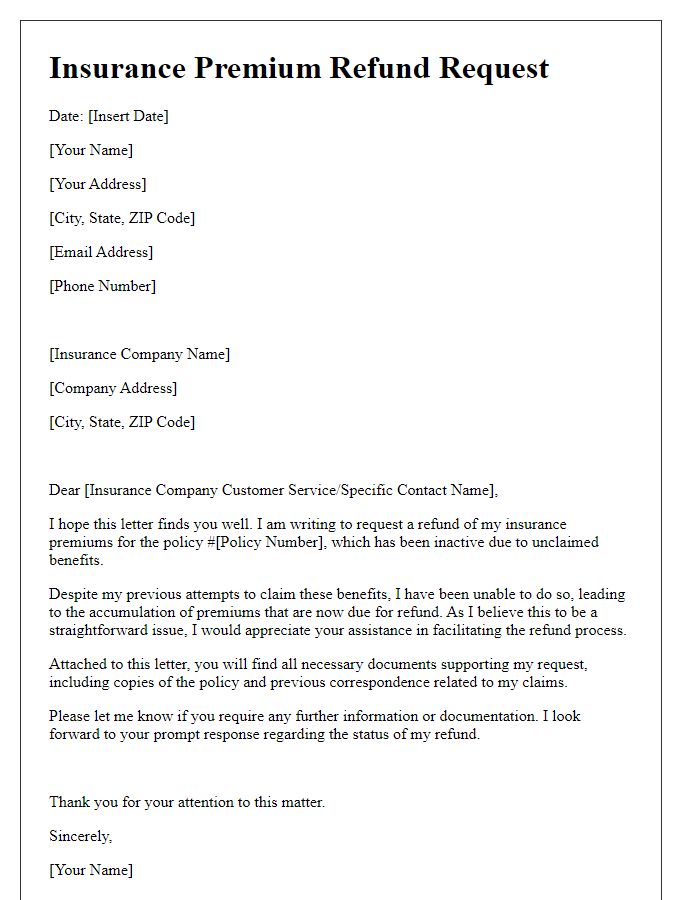

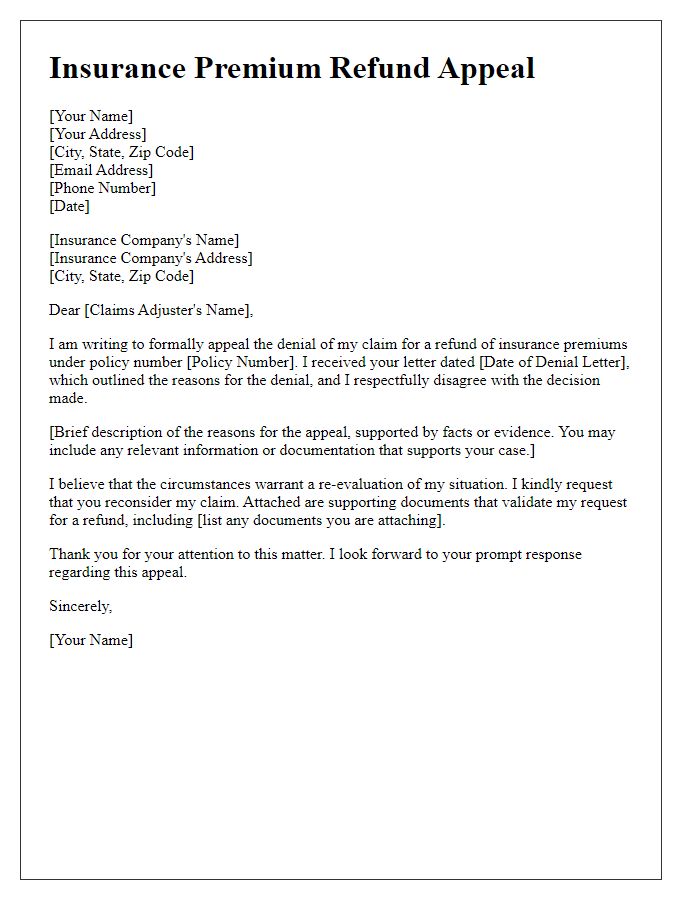

Letter template of insurance premium refund claim due to double payment.

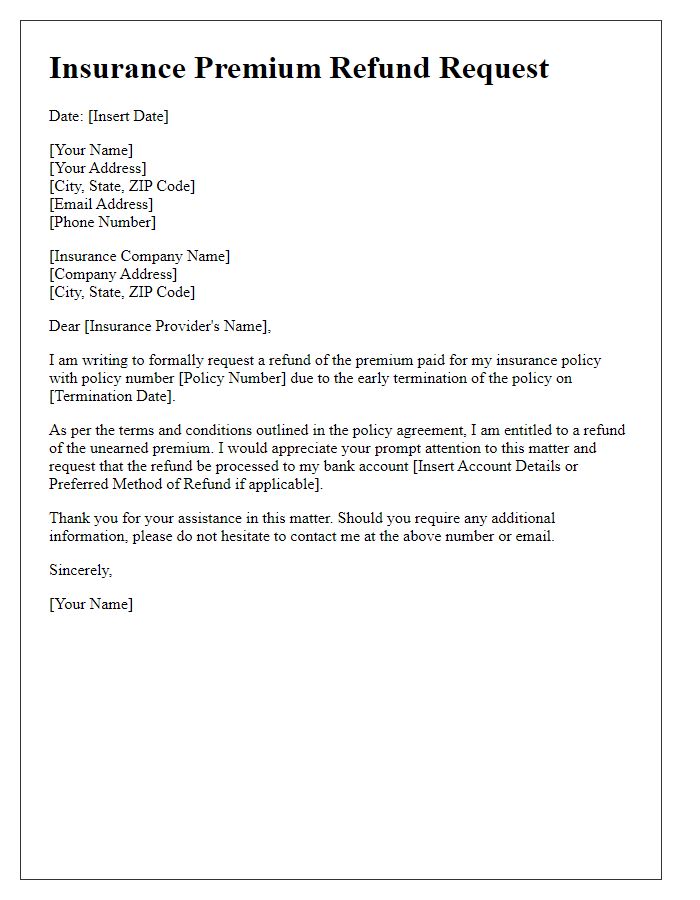

Letter template of insurance premium refund for early policy termination.

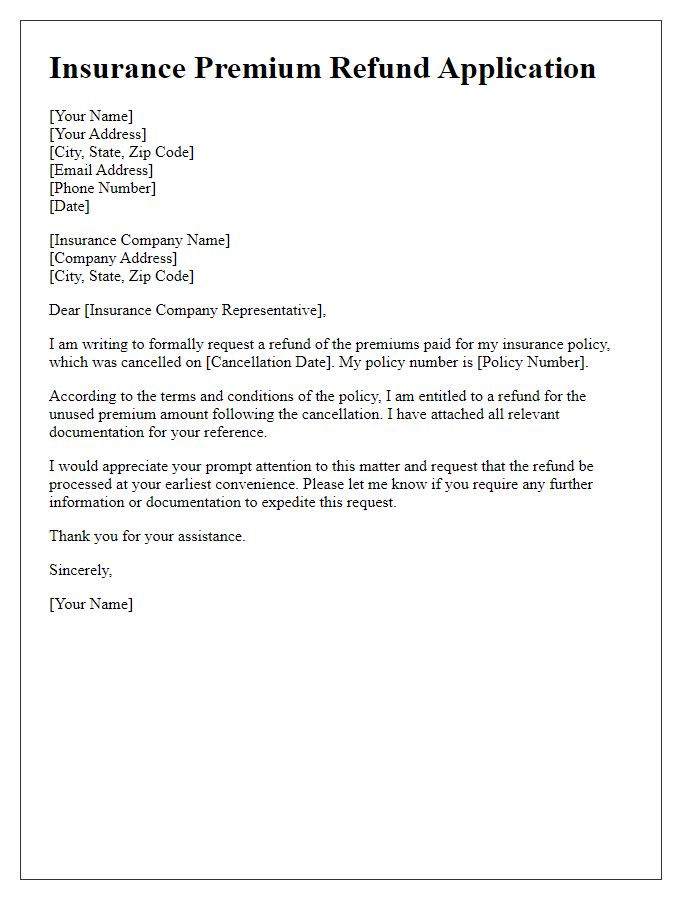

Letter template of insurance premium refund application following policy cancellation.

Letter template of insurance premium refund request based on service issues.

Letter template of insurance premium refund inquiry post overdue payment.

Letter template of insurance premium refund request due to inaccurate billing.

Comments