When it comes to navigating the complexities of insurance claims, clear communication with your claims adjuster is key. Whether you're filing a claim for damage, liability, or other issues, having a well-structured letter can make all the difference in expediting the process. In this article, we'll explore the essential components of an effective letter template that ensures your message is both concise and persuasive. So, let's dive in and equip you with the tools to effectively communicate your needs!

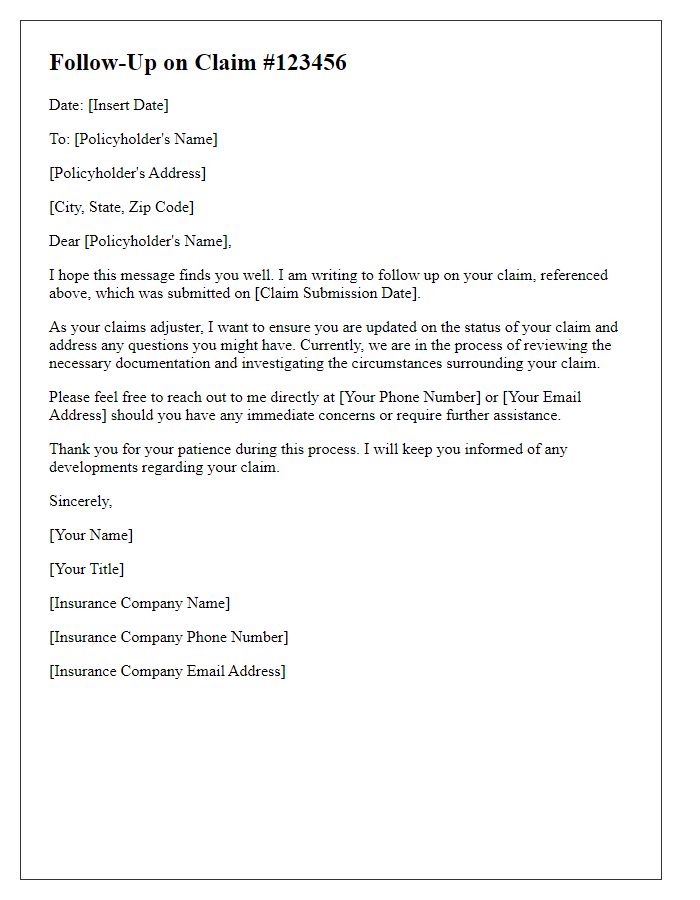

Clear Subject Line

A clear subject line is essential for effective communication with claims adjusters, such as "Claim Number 123456: Request for Additional Documentation." This concise subject directly references the specific issue, allowing the adjuster to quickly identify the topic. Including the claim number, which corresponds to a unique case in the insurance system, can streamline the review process. Additionally, clarity in the subject helps to prioritize communications, ensuring timely responses. Descriptive subject lines can improve organization and tracking, significantly enhancing the overall efficiency of the claims handling process.

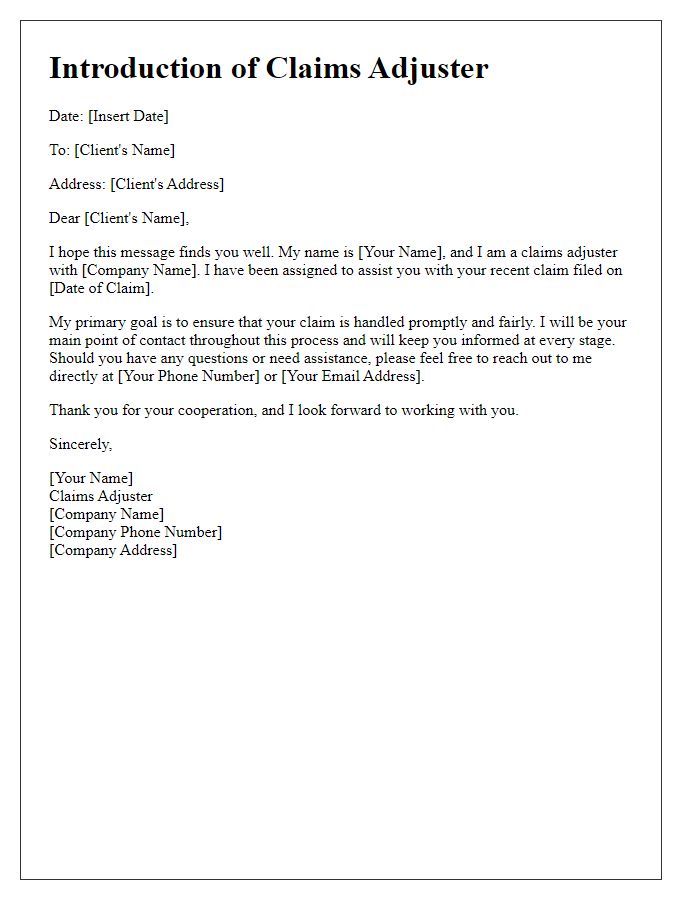

Policyholder Information

Policyholder information is crucial in the claims adjustment process, including personal details, policy number, and specific coverage types. Key details such as full name, contact number, and address should be accurately documented to ensure proper communication. Policy number serves as a unique identifier for the insurance policy, facilitating quicker reference and access to coverage details during claims processing. Noteworthy coverage types might include property damage, liability, or personal injury, which directly impact the claim evaluation. Additional documentation may be required, including incident reports, photographs, and witness statements, to validate the claim's authenticity and support the policyholder's case effectively.

Claim Details

A claims adjuster must accurately file and assess insurance claims to determine the validity and amount of compensation. Essential details include the claim number, which uniquely identifies the case for tracking purposes, and the date of the loss, establishing the timeline of the incident. The insured's policy number is crucial, providing information about coverage limits and specifics applicable to the claim. A detailed description of the incident, including the nature of the loss--whether it be property damage, personal injury, or liability--needs to be clearly documented. Additional information like location details (e.g., street address, city), involved parties, and any existing police reports (assigned report number) can significantly impact the claim's evaluation. Accurate documentation streamlines the process, ensuring that all aspects of the claim are thoroughly reviewed for a fair settlement.

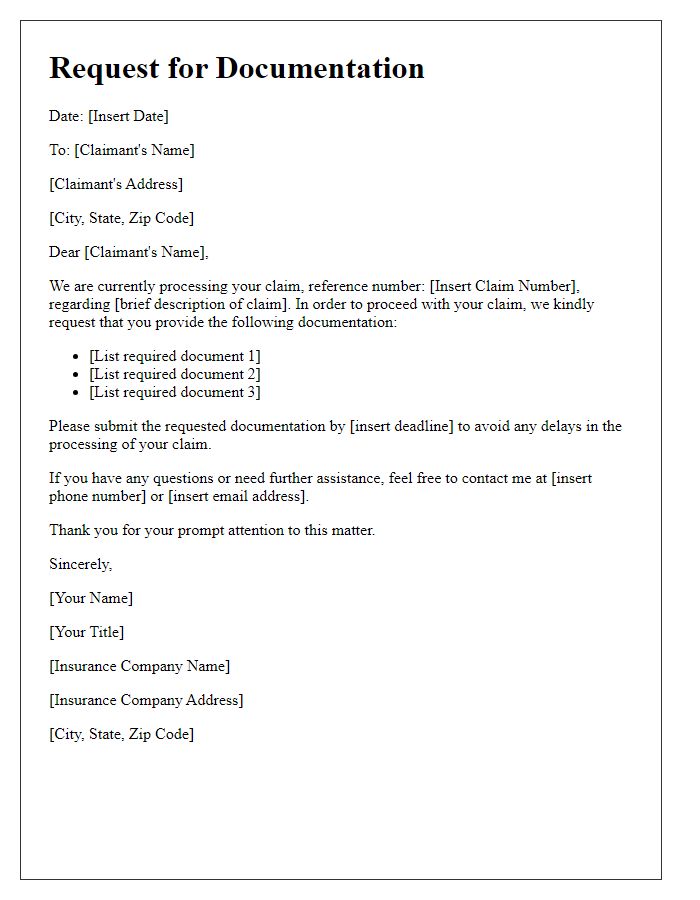

Supporting Documentation

Supporting documentation is crucial for a claims adjuster, such as invoices, photographs, and expert reports. Invoices provide clear evidence of incurred costs related to the claim, while photographs offer visual proof of damages or incidents, capturing the extent of loss. Expert reports from licensed professionals can strengthen the claim by providing analyses or assessments relevant to the situation. Additionally, police reports, witness statements, and medical records can further substantiate the claim, particularly in liability incidents, providing a comprehensive overview of the event and its repercussions. Collecting these documents ensures a thorough evaluation, aiding the adjuster in making an informed decision on the claim.

Next Steps and Contact Information

The claims adjustment process entails meticulous evaluations of documented evidence, such as medical records and repair estimates. Following the assessment, expected next steps include detailed communication from the claims adjuster outlining necessary documentation or additional information needed for a resolution. For timely inquiries, preferred contact channels often include direct phone lines, such as (555) 123-4567, or email addresses defined by the claims department. Timelines can vary, with claim resolutions typically ranging from four to eight weeks based on complexity and required information gathering. Keeping records of all correspondence, including dates and details, is instrumental in maintaining an organized claims file.

Comments