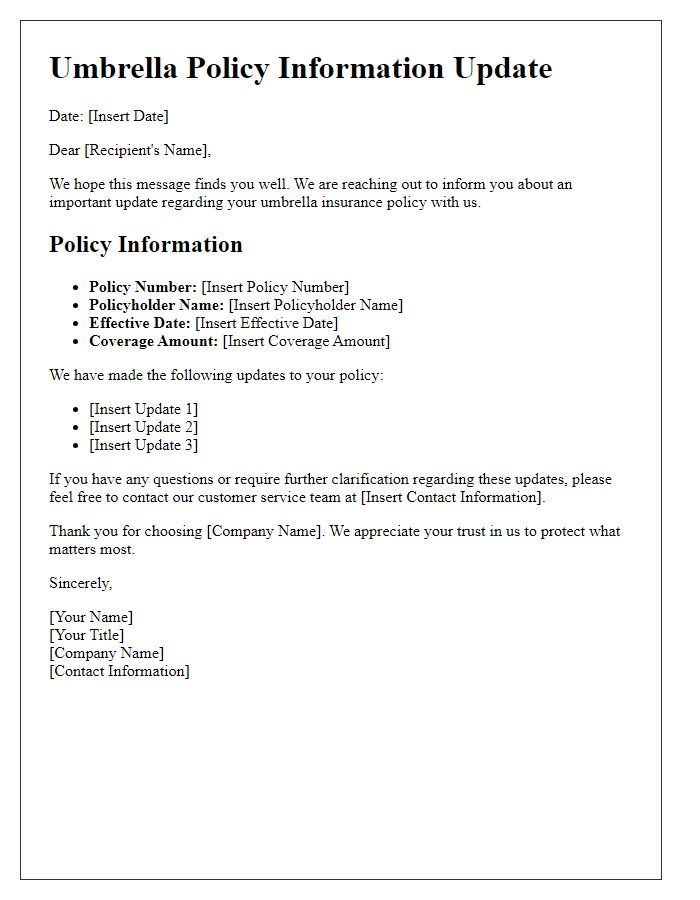

Are you considering an umbrella policy to enhance your insurance coverage? This comprehensive option provides an added layer of protection that safeguards your assets beyond standard limits, giving you peace of mind in today's unpredictable world. With an umbrella policy, you can shield yourself from unexpected liabilities and enjoy greater financial security. If you're curious about how an umbrella policy works and whether it's right for you, read on to explore the benefits and find out how to get started!

Policyholder Information

Policyholders seeking Umbrella Insurance (an additional layer of liability coverage) must provide essential information for effective service processing. Details include Policyholder Name (individual or entity insured), Policy Number (unique identifier for insurance contract), Contact Information (phone number, email address), and Mailing Address (physical address for official correspondence). Additional context can enhance the service request, such as Current Insurance Providers (companies offering primary coverage) and Coverage Limits (desired amount of additional liability coverage). A clear request statement also aids in processing, specifying the nature of the service needed, whether it's policy modification, renewal information, or claim inquiries.

Policy Number and Details

An umbrella insurance policy provides additional liability coverage beyond the limits of existing policies, such as homeowners or auto insurance. Typically, coverage amounts start at $1 million and can extend further, depending on the insurer. This type of policy is crucial for protecting assets and income in the event of lawsuits or significant claims. When requesting service, it's essential to include key details such as Policy Number, which serves as a unique identifier for the policyholder's account, along with relevant personal information and specifics regarding the request to ensure prompt and accurate assistance. Keeping track of these details streamlines the process when contacting customer service representatives.

Specific Service Requested

The umbrella policy is a crucial insurance product designed to provide individuals and families with additional liability coverage beyond the limits of standard policies. In the United States, the average umbrella policy provides an extra $1 million to $10 million in liability protection, extending coverage to incidents like lawsuits, property damage, and personal injury claims. Clients seeking this service often inquire about the specific terms, conditions, and exclusions associated with their policy, ensuring that their unique needs are met. Additionally, proper evaluation of existing home and auto insurance policies is necessary to ensure seamless integration of the umbrella policy, maximizing overall coverage while minimizing potential gaps. The request process typically involves submitting pertinent personal information, insurance requirements, and potential risks associated, facilitating a thorough assessment from the insurance provider to deliver an optimal solution.

Contact Information for Follow-Up

An umbrella insurance policy serves as an additional layer of liability coverage beyond standard home, auto, or renters' insurance. This type of coverage typically begins once the limits of primary policies are exhausted, often with coverage limits starting at $1 million. Policyholders frequently utilize umbrella policies to protect themselves from lawsuits, significant property damage, or other unforeseen financial burdens. Inquire about coverage specifics, exclusions, and renewal processes based on the issuing company, which might include well-known providers like State Farm or GEICO. Providing accurate contact information is vital for timely follow-up communications and support.

Signature and Date

A comprehensive umbrella insurance policy provides a critical layer of protection against significant liability claims that could exceed standard homeowners or auto insurance limits. This type of policy typically offers coverage in amounts such as $1 million or more, extending protection to various incidents, including personal injury and property damage. Request for an umbrella policy service often requires the inclusion of specific details, such as policyholder information, existing coverage limits (for instance, homeowner's insurance coverage at $300,000), and the date of the request, ensuring that the umbrella coverage aligns with underlying policies. Signatures validate the authenticity of the request, while the date reflects when the service was initiated, establishing a timeline for coverage commencement.

Comments