Are you looking for peace of mind when it comes to life insurance? Guaranteed issue life insurance might be just what you need, offering coverage without the hassle of medical exams or health questionnaires. This type of policy ensures that you can secure a financial safety net for your loved ones, regardless of your health status. Curious to find out more about how to request guaranteed issue life insurance and its benefits? Read on!

Personal Information

Guaranteed issue life insurance offers a simple and straightforward way for individuals to secure coverage without undergoing medical exams or providing extensive health history. This type of insurance is particularly appealing to seniors, often aged 50 and above, who may face challenges obtaining traditional life insurance policies due to age or pre-existing conditions. The application process typically requires basic personal information, including the individual's full name, date of birth, and address, ensuring accurate identification and eligibility assessment for coverage decisions. Premiums may vary based on factors like age, coverage amount, and the specific insurance provider, with many policies easily accessible through several reputable companies across the United States, including AIG, Mutual of Omaha, and Gerber Life. Understanding the terms and conditions, along with potential exclusions, will also be essential for applicants before finalizing their policy selection.

Policy Details

Guaranteed issue life insurance policies offer coverage without medical underwriting, ensuring acceptance regardless of health status. These policies typically provide fixed death benefits, often ranging from $5,000 to $25,000, designed to cover final expenses such as funeral costs. Applicants must be within a specific age range, usually from 50 to 85 years old, depending on the insurer. Premiums can vary widely based on age and the chosen benefit amount, and they are generally higher compared to fully underwritten policies. Additionally, there may be a waiting period of one to two years before full benefits are available for natural causes, while accidental death may receive immediate coverage. It is essential to carefully review the terms and conditions outlined in the policy document to understand all provisions.

Beneficiary Designation

Guaranteed issue life insurance provides individuals with a means to secure coverage without the necessity of medical exams or health questions. This type of policy often appeals to seniors or those with pre-existing health conditions. Typically, beneficiaries may include spouses, children, or trusted relatives, ensuring financial protection in the event of the insured's passing. A beneficiary designation form is required to specify the individuals or entities entitled to receive the death benefit, with careful consideration given to naming contingent beneficiaries as well. Such measures can help avoid probate delays and ensure a swift transfer of funds. It is advisable to review and update beneficiary designations regularly, particularly after significant life events such as marriages, divorces, or births.

Medical Condition Statement

Guaranteed issue life insurance can provide important financial protection for individuals with pre-existing medical conditions. This type of insurance policy, designed for those who may have difficulty obtaining traditional coverage due to health issues, often requires a Medical Condition Statement to assess eligibility. Applicants with chronic conditions such as diabetes (affecting approximately 422 million people globally) or heart disease (responsible for nearly 18 million deaths each year) must detail their medical history comprehensively. Key elements to include are the medications currently prescribed, treatments undergone (like surgeries or therapies), and any ongoing health management plans. Providing accurate information can expedite the underwriting process, ensuring quicker access to life insurance benefits for policyholders and their beneficiaries.

Contact Information

Guaranteed issue life insurance offers coverage without medical exams or health questions, allowing individuals aged 50 to 85 to secure a policy. The typical coverage amounts range from $5,000 to $25,000, providing financial support for funeral expenses or outstanding debts. Major insurance providers such as Aetna, Mutual of Omaha, and Gerber Life offer these policies with guaranteed acceptance. Applicants must provide essential contact information including name, address, phone number, and email to facilitate the application process. Policies usually have a waiting period of two years before full benefits become available, addressing pre-existing conditions.

Letter Template For Guaranteed Issue Life Insurance Request Samples

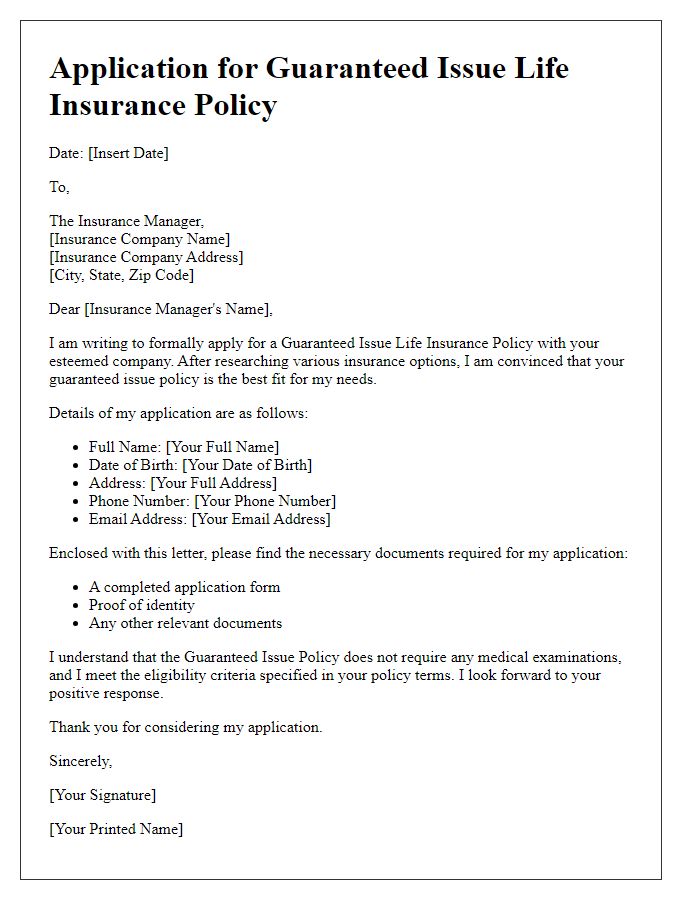

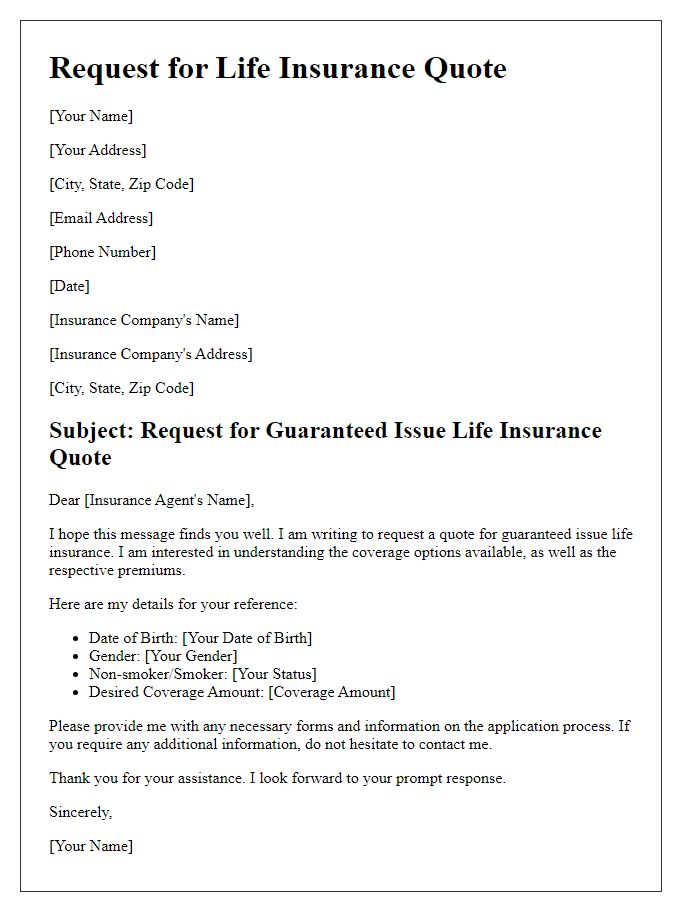

Letter template of application for guaranteed issue life insurance policy

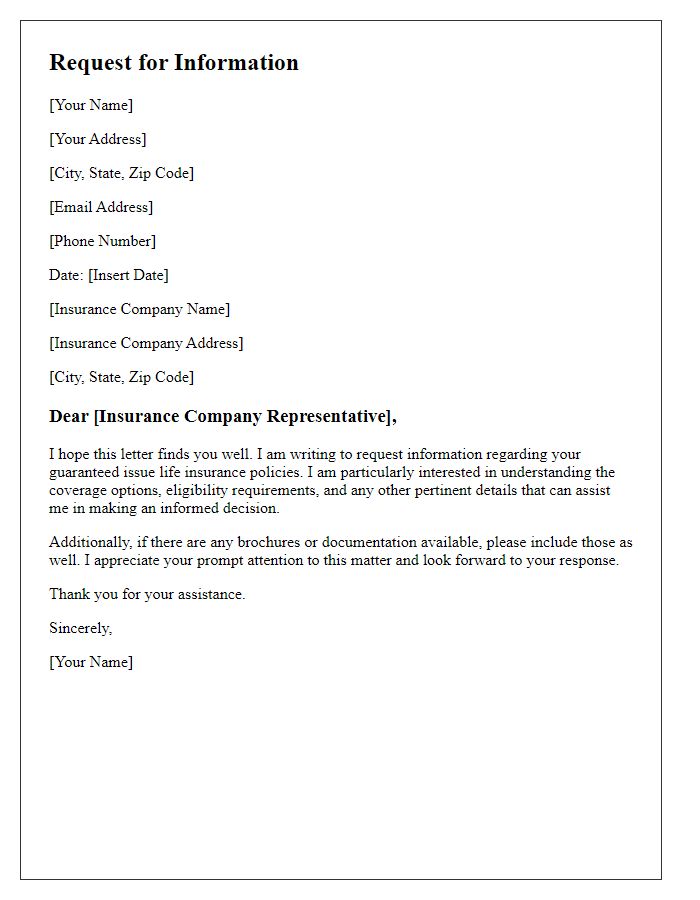

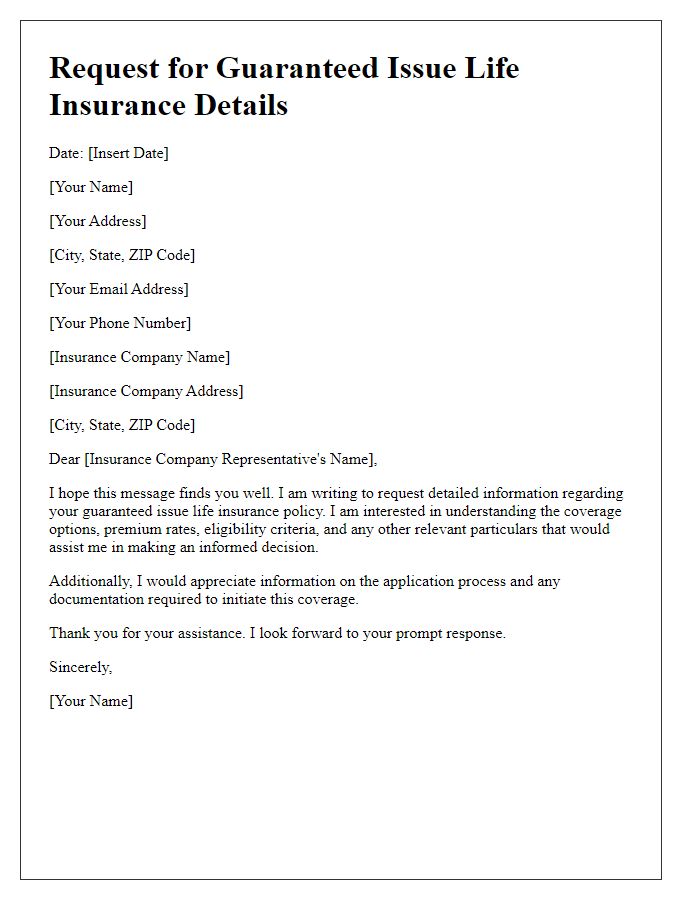

Letter template of request for guaranteed issue life insurance information

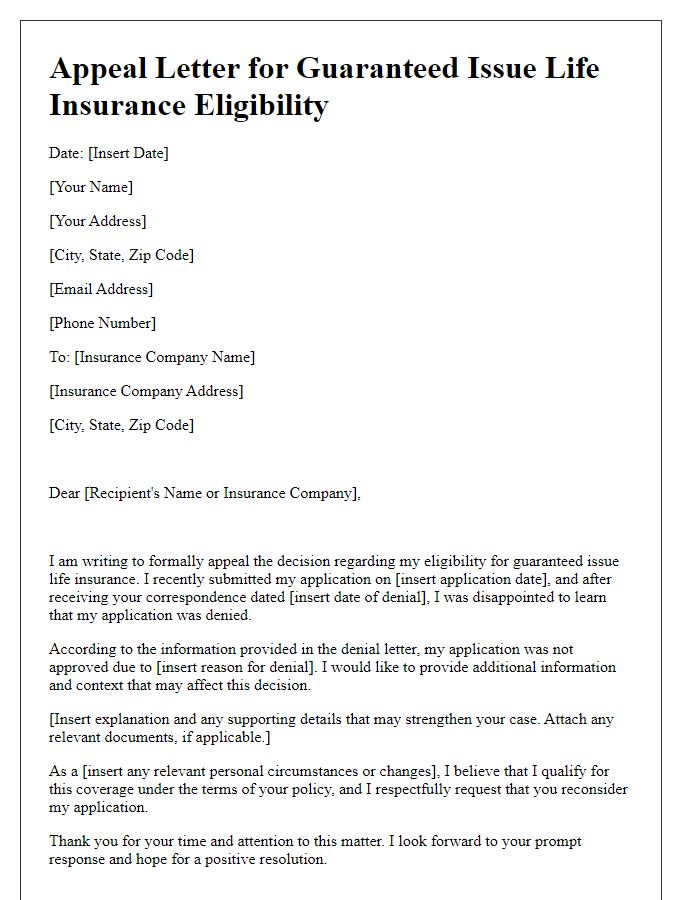

Letter template of appeal for guaranteed issue life insurance eligibility

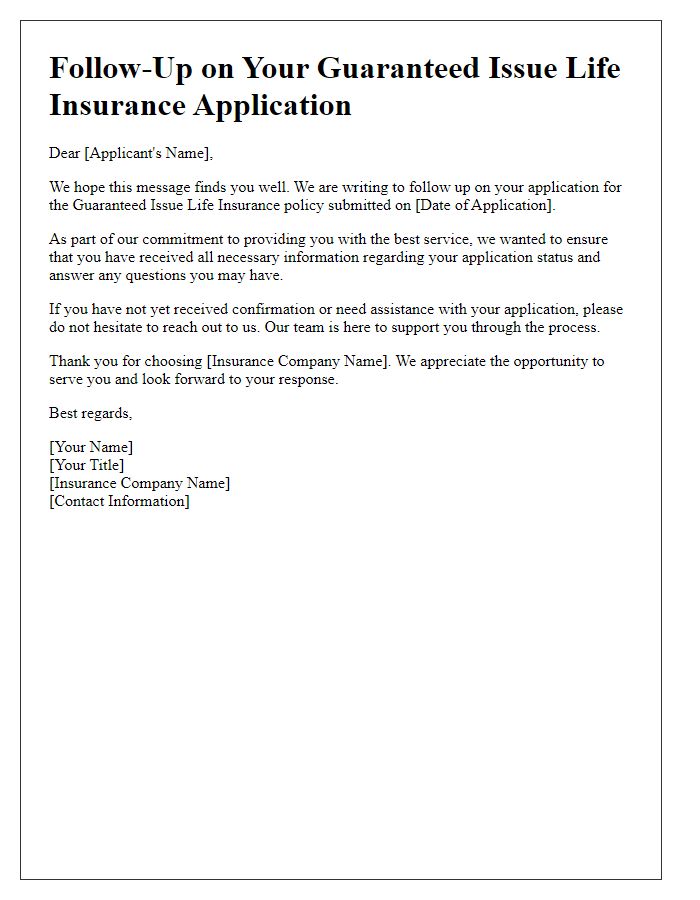

Letter template of notification for guaranteed issue life insurance application

Letter template of confirmation for guaranteed issue life insurance request

Comments