Are you looking to protect your valuable goods during transit? Understanding the process of activating goods-in-transit insurance can save you from unexpected losses and ensure peace of mind while shipping your products. In this article, we'll walk you through a simple letter template that makes it easy to request insurance coverage for your shipments. Read on to discover how a well-structured letter can safeguard your assets and streamline your shipping experience!

Policyholder's contact information

Goods-in-transit insurance provides protection against loss or damage to items while they are being transported. This type of insurance is essential for businesses shipping valuable goods, such as electronics, textiles, or machinery. The policyholder's contact information typically includes the full name, phone number, and email address for effective communication during claims. Additionally, the mailing address may be required for correspondence. Activate your coverage by providing essential details, ensuring peace of mind regarding any unforeseen events during transit, including theft or accidental damage during transportation.

Detailed description of goods

Activating goods-in-transit insurance requires a detailed description of the items being shipped. For example, a wooden antique cabinet from the 19th century (originating from France, valued at $3,000) requires specific documentation. Additionally, electronic goods such as a series of high-end laptops (including two MacBook Pro models valued at $2,500 each, equipped with the M1 chip) must be noted for their importance and sensitivity. Fragile items like glass sculptures (made by a renowned artist, valued at $1,200 each) should be described in detail, including their dimensions and special handling instructions. The description should also include the shipping route, estimated value of all items (totaling approximately $12,400), and specific packaging methods employed to ensure safety during transit.

Transit and coverage period

Goods-in-transit insurance provides essential protection during transportation of valuable items. Coverage typically begins once the goods are loaded onto the transportation vehicle (such as a truck or cargo ship) and lasts until they are safely delivered to their final destination (e.g., warehouse or retail store). Standard policies often cover risks such as theft, damage, or loss during the transit period, which can include various events like natural disasters or accidents. Specific terms of coverage, including limits and exclusions, may vary depending on the policy provider and items insured, ensuring tailored protection according to the nature of the goods, like electronics, machinery, or perishable foods.

Value of goods and coverage amount

Goods-in-transit insurance protects valuable shipments and minimizes financial loss during transportation. Coverage typically includes protection against theft, damage, or loss, with insured items often valued at thousands of dollars, depending on the nature of the goods. For instance, electronics like laptops may require coverage amounts up to $50,000 to account for potential risks. Other items, such as fragile glassware or perishable goods, may necessitate customized policies that consider the specific vulnerabilities associated with transportation. Insurance terms often specify geographic boundaries, with policies applying within defined routes, such as interstate or international shipping corridors, ensuring comprehensive compensation in the unfortunate event of an incident.

Insurance policy number and company details

Goods-in-transit insurance offers protection for valuable shipments during transportation, safeguarding against loss or damage. Proper activation of this insurance requires specific information including the insurance policy number (a unique identifier assigned to each policy) and details of the insurance company (such as name, address, and contact information). Ensuring accurate documentation enhances claims processing efficiency in the event of incidents affecting the cargo while in transit, thus providing financial security for businesses reliant on timely deliveries.

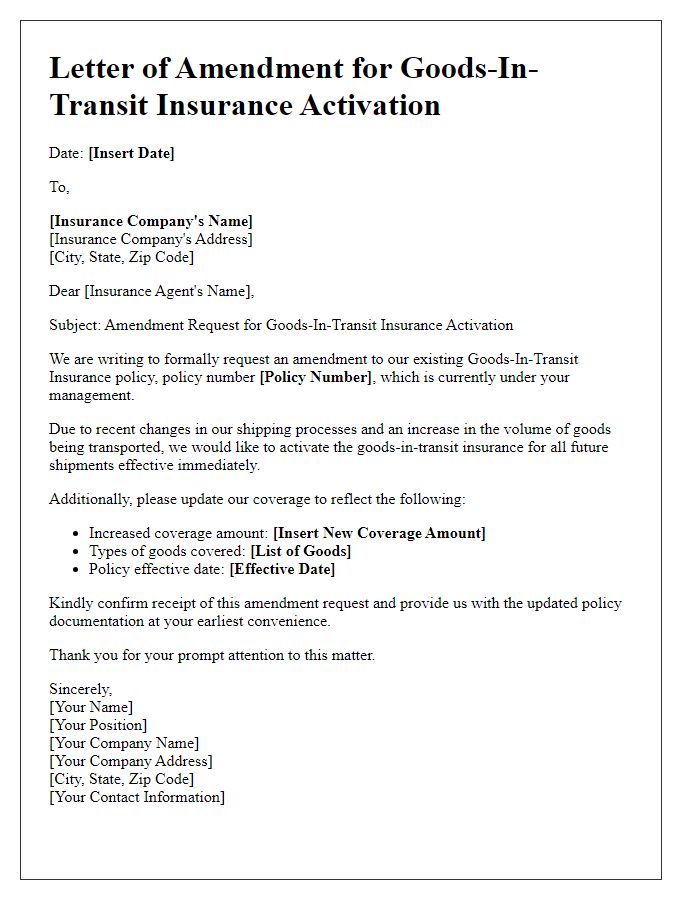

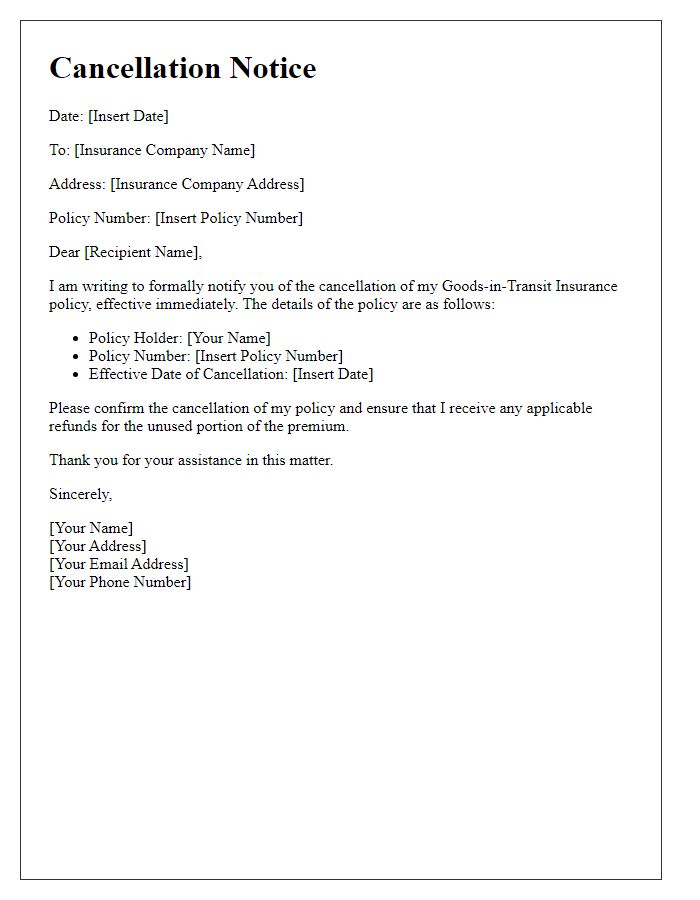

Letter Template For Goods-In-Transit Insurance Activation Samples

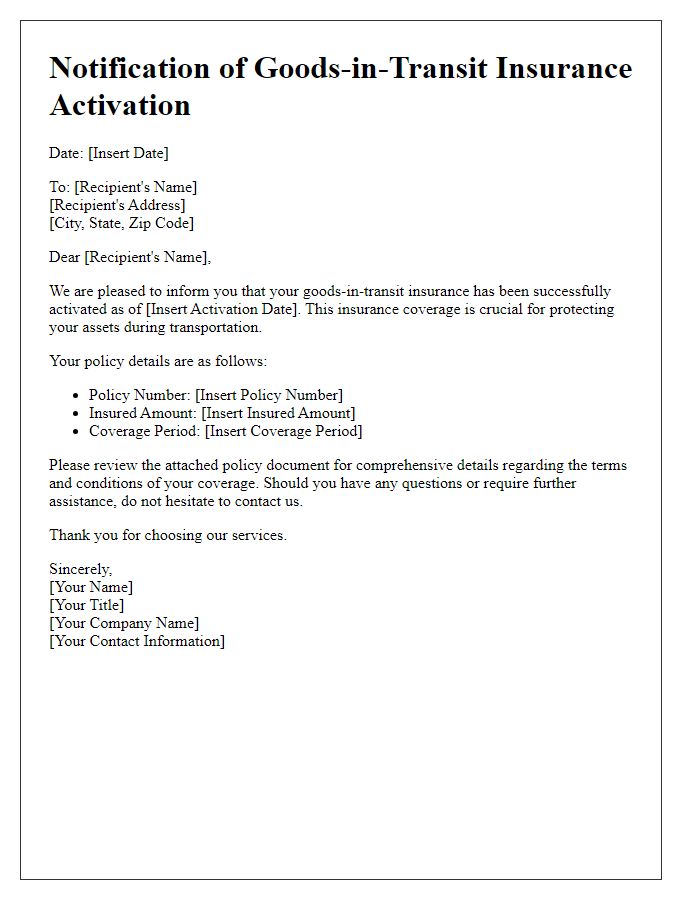

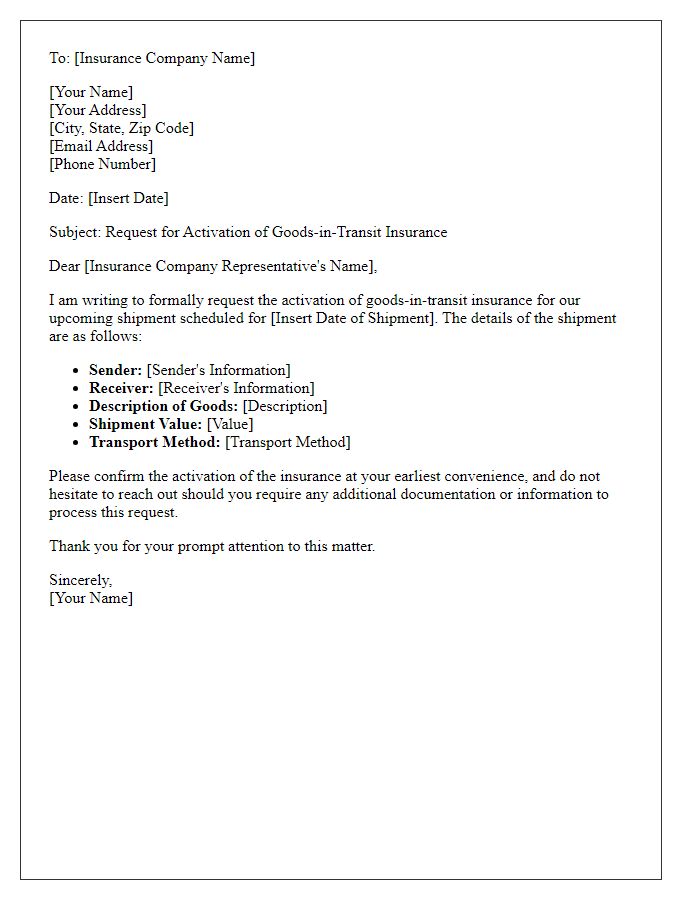

Letter template of notification for goods-in-transit insurance activation

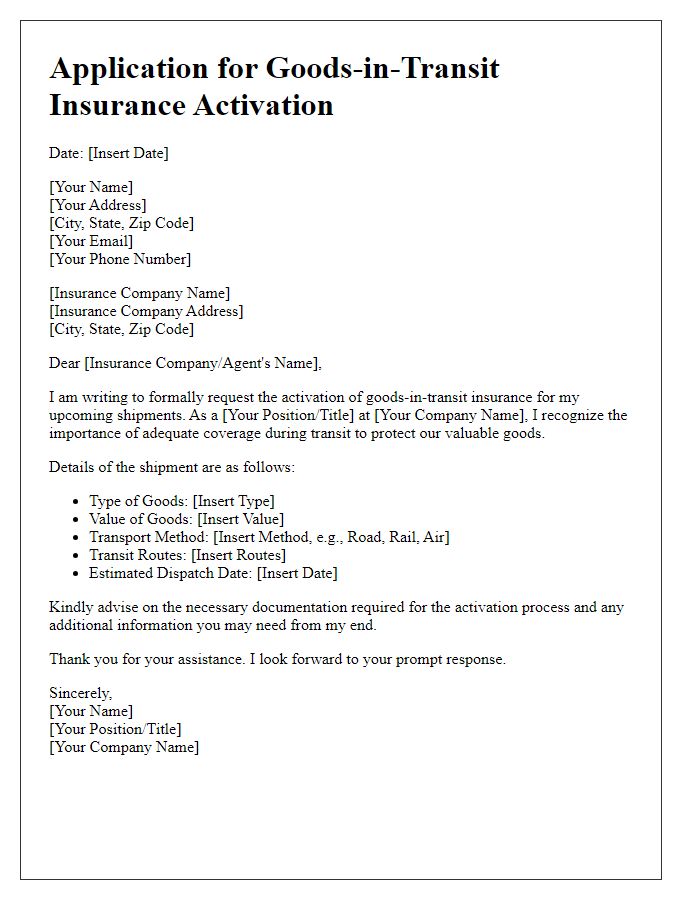

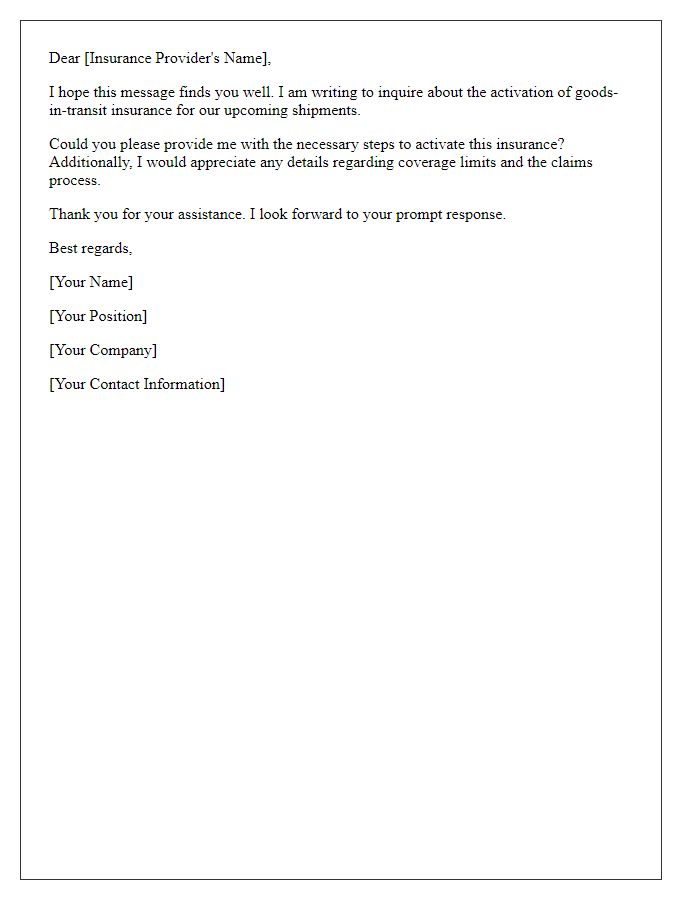

Letter template of application for goods-in-transit insurance activation

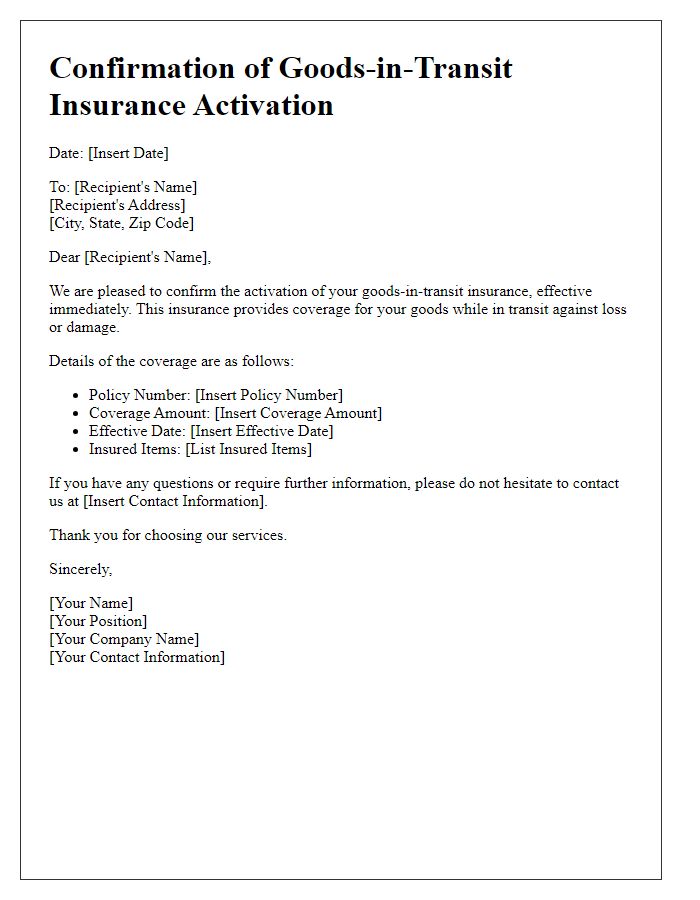

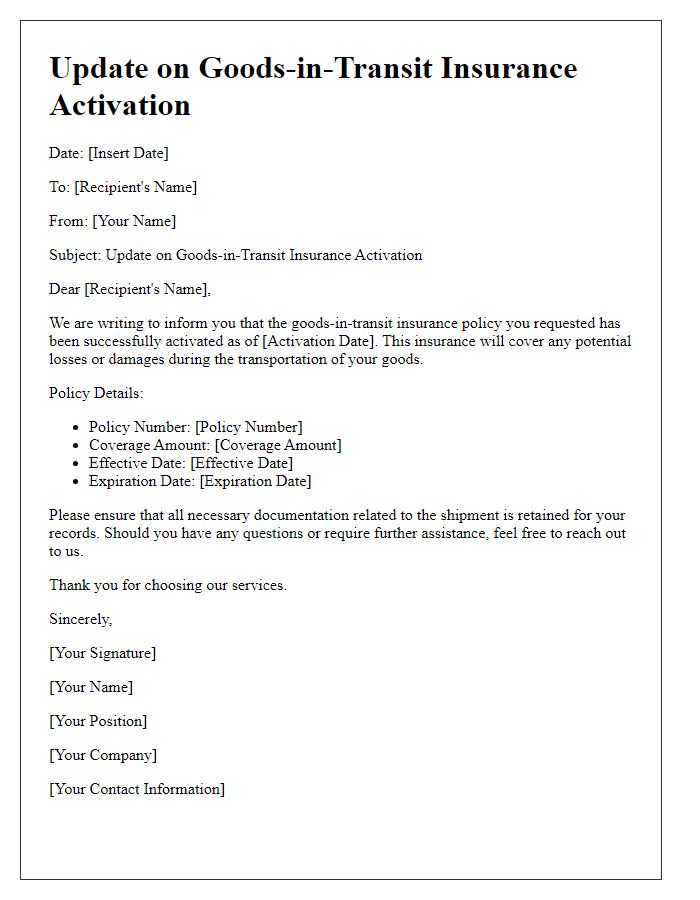

Letter template of confirmation for goods-in-transit insurance activation

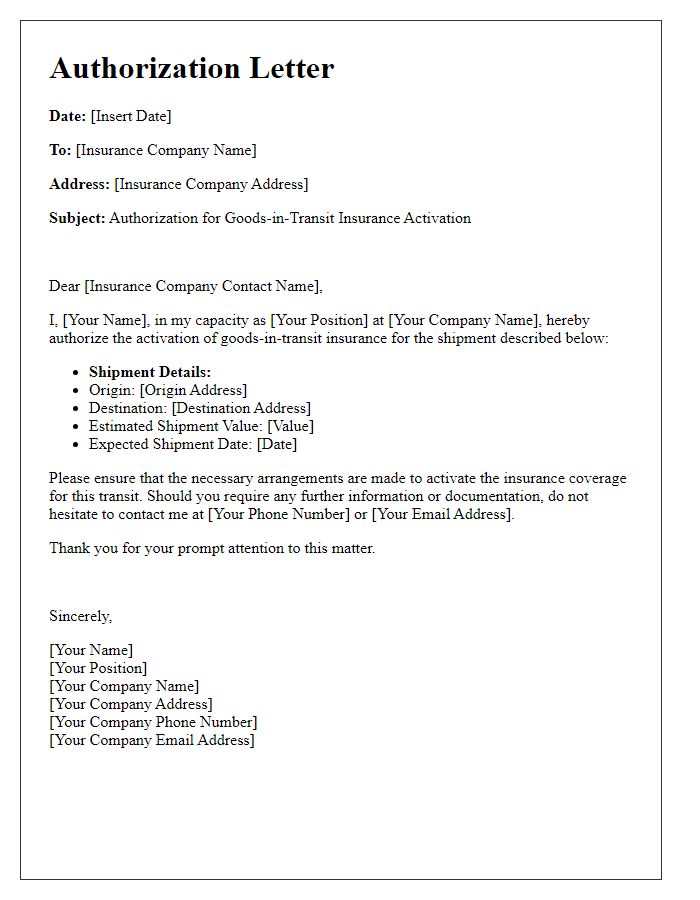

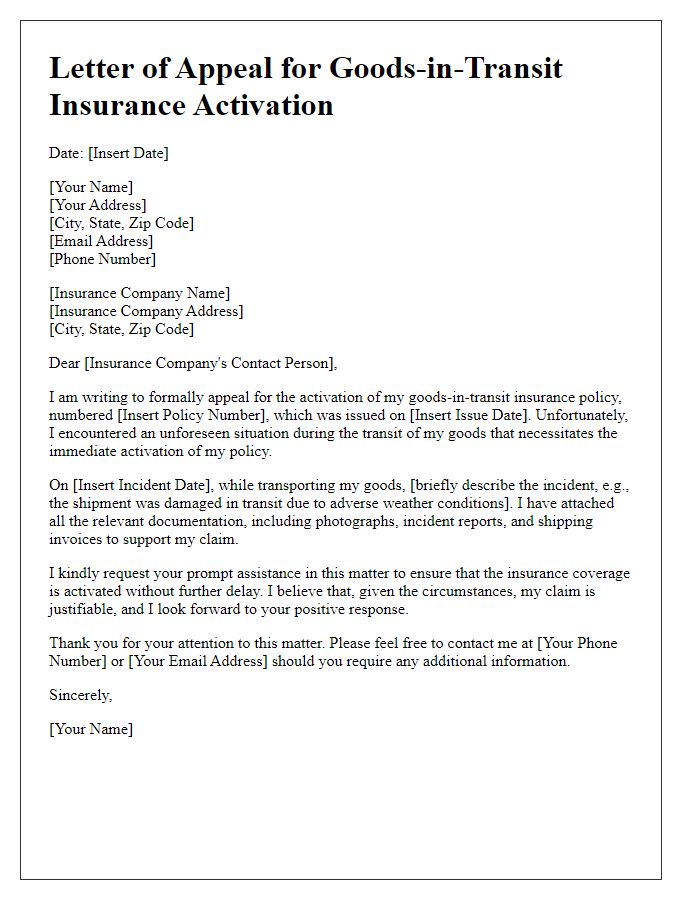

Letter template of authorization for goods-in-transit insurance activation

Comments