Are you tired of unexpected vehicle repairs that seem to pop up out of nowhere? We know how important it is to keep your car running smoothly and to feel secure with your mechanical breakdown insurance in place. In this article, we'll guide you through the process of crafting the perfect letter to request coverage, ensuring you get the support you need when those unforeseen issues arise. So, buckle up and read more to learn how to navigate your insurance request with ease!

Policyholder Information

Mechanical breakdown insurance provides financial protection against unexpected repair costs for vehicles due to mechanical failures. Policies generally cover essential vehicle components, including the engine, transmission, and electrical systems. Policyholder information, such as name, address, contact number, and policy number, plays a critical role in processing claims effectively. Details including the make and model of the vehicle, along with the year of manufacture, are essential for accurately assessing coverage. Recent maintenance records can also substantiate the vehicle's service history, ensuring compliance with the insurance terms. Submitting a request typically requires documentation, such as repair estimates or invoices from licensed repair facilities, to validate the claim and expedite the reimbursement process.

Vehicle Details

Mechanical breakdown insurance offers protection for unexpected vehicle failures, particularly those related to essential components. For instance, an engine failure in a 2018 Toyota Camry could result in costly repairs, often exceeding thousands of dollars depending on the extent of damage. Additionally, transmission issues in a 2019 Ford F-150 can affect performance and safety, requiring immediate attention and significant financial outlay. When submitting a request for coverage, it is crucial to include vital vehicle details such as the Vehicle Identification Number (VIN), make, model, year, and current mileage, as insurance companies need this information to assess risk and determine eligibility for mechanical breakdown protection.

Breakdown Description

Mechanical breakdown insurance caters to unforeseen events that result in vehicle failure, often leading to significant repair costs. A typical breakdown may involve critical components like the engine, transmission, or fuel system. For instance, an engine failure in a sedate family sedan may occur due to a blown gasket, while a commercial truck might experience transmission issues impacting its delivery schedule. Damage to vital parts such as the alternator or starter can immobilize a vehicle, leaving commuters stranded or businesses disrupted. Repair costs for such mechanical failures can range from hundreds to thousands of dollars, depending on the severity and model of the vehicle. Comprehensive documentation, including repair estimates from licensed mechanics and photographs of the damage, often strengthens an insurance claim, ensuring prompt processing and reimbursement for policyholders.

Repair Estimate and Documentation

Mechanical breakdown insurance claims require detailed information for prompt processing. A repair estimate, typically issued by an authorized service center, outlines costs associated with parts and labor required for repairs. Documentation should include the vehicle identification number (VIN), mileage at the time of the breakdown, and a breakdown of charges detailing labor hours and components like engine parts or transmission systems. Supporting documents should encompass any warranty details and previous maintenance records, which may include oil changes or component replacements. Submitting all necessary paperwork expedites the review process by the insurance provider, ensuring a smoother claims experience.

Insurance Claim and Projected Costs

Mechanical breakdown insurance protects consumers from unexpected repair costs associated with machinery failure. Many policies cover extensive breakdowns in equipment such as compressors or generators. Documentation is crucial for a successful claim, including repair estimates from certified service centers. Costs associated with a typical mechanical failure can range from hundreds to thousands of dollars, depending on the equipment's make and model. Ensuring timely communication with the insurance provider can facilitate a smoother claims process, often taking around 30 days for approval upon submission of all required documents. Proper maintenance records can also play a significant role in substantiating the claim.

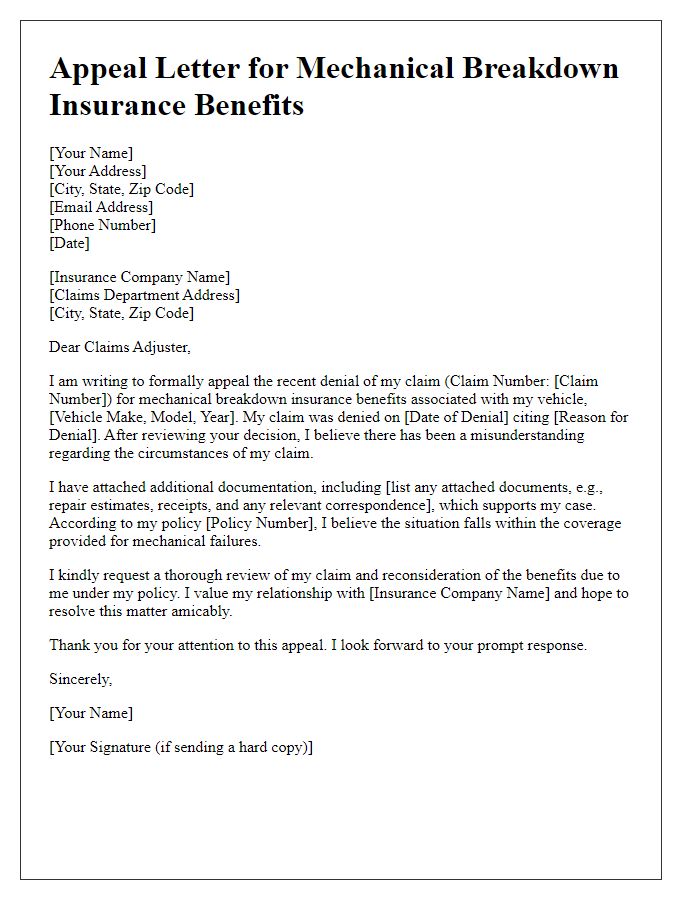

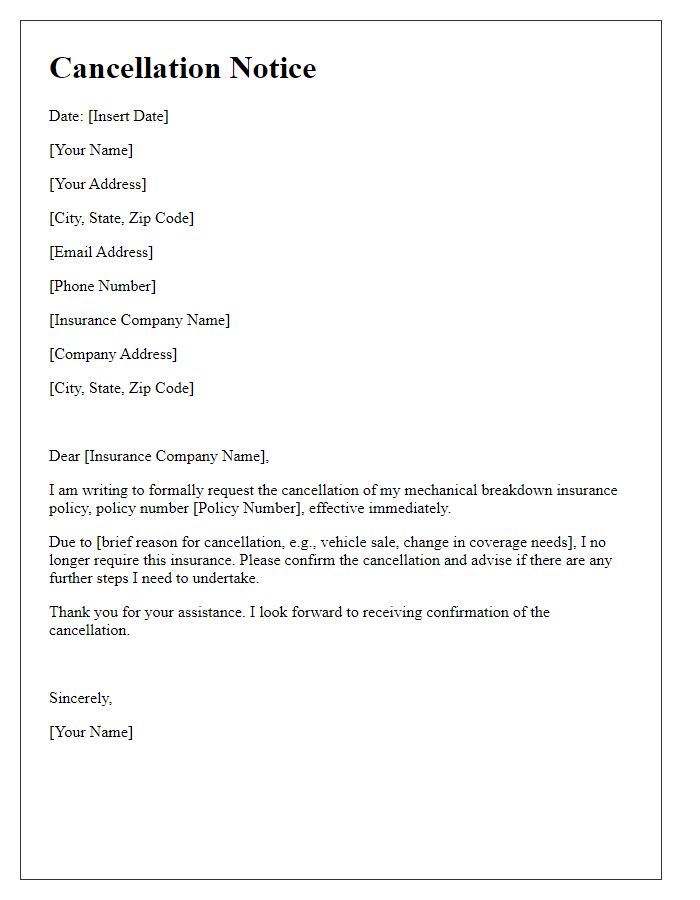

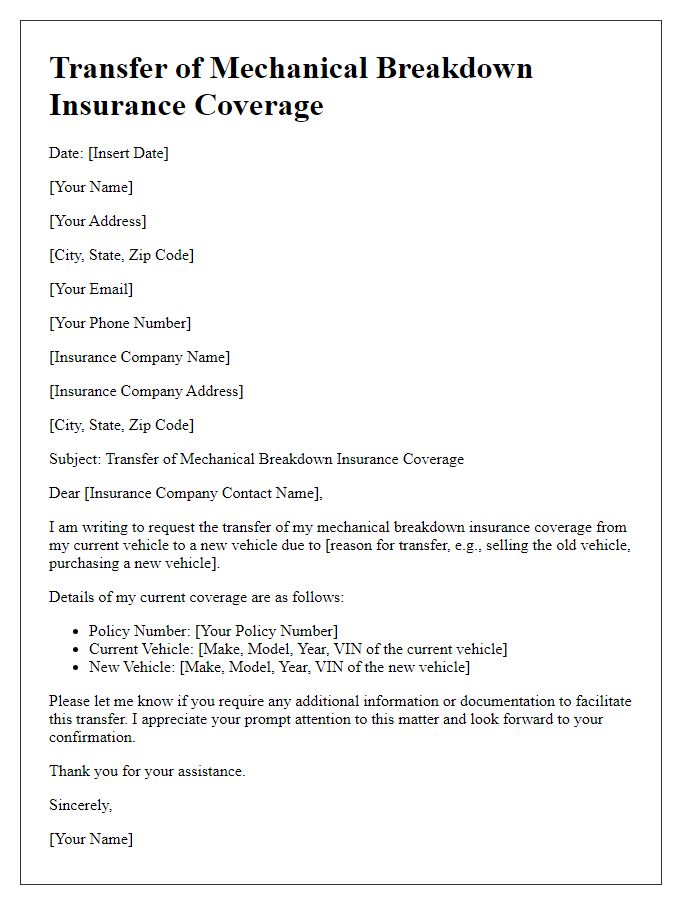

Letter Template For Mechanical Breakdown Insurance Request Samples

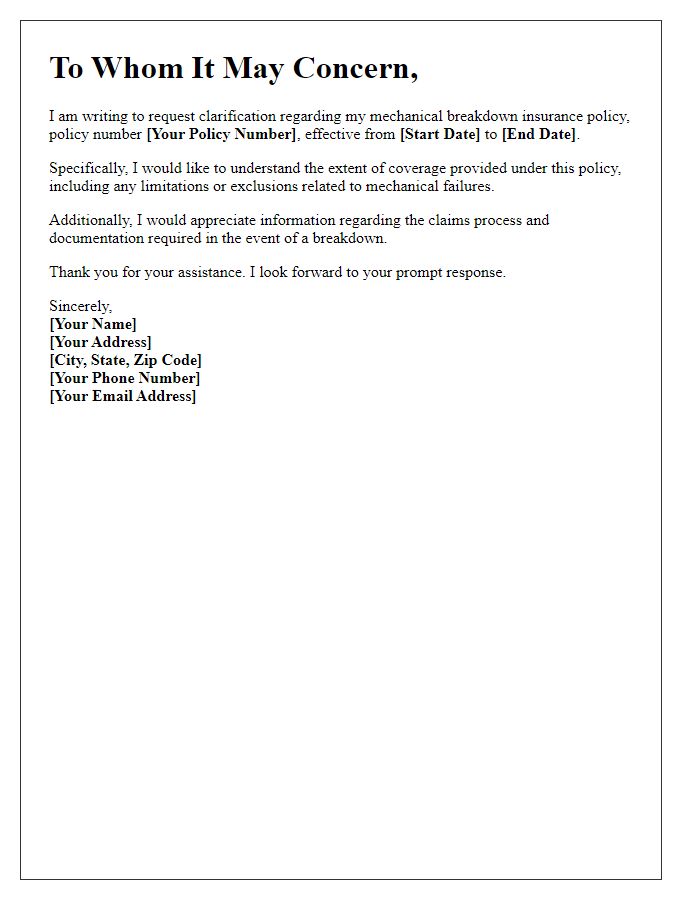

Letter template for mechanical breakdown insurance coverage clarification

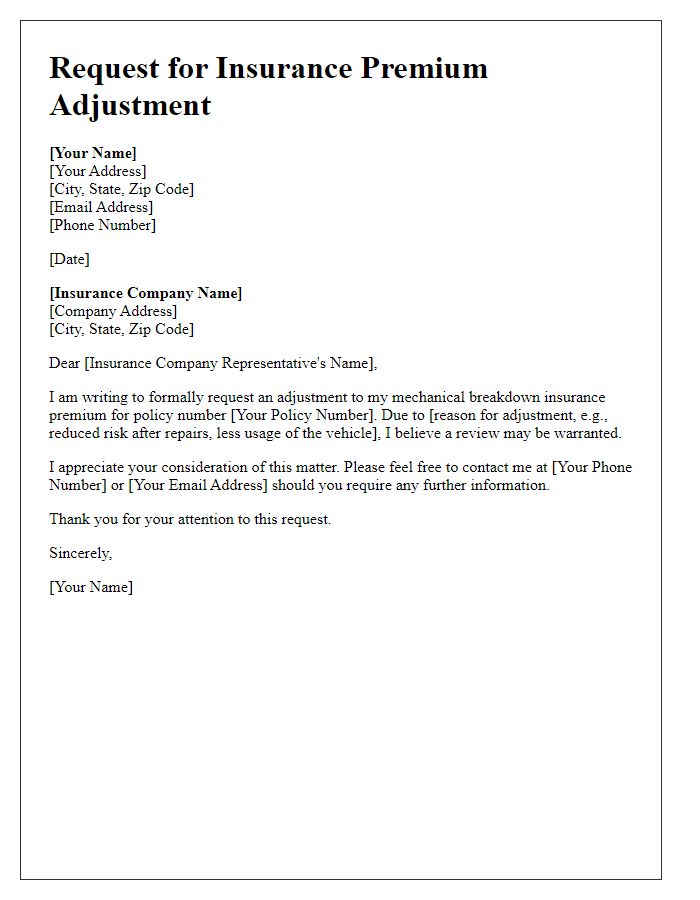

Letter template for mechanical breakdown insurance premium adjustment request

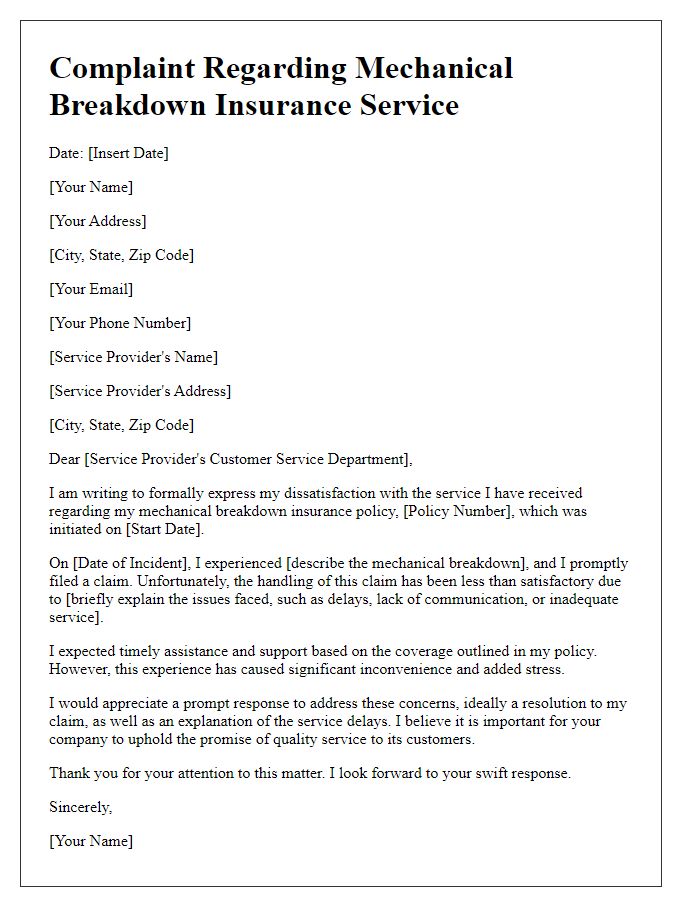

Letter template for mechanical breakdown insurance service provider complaint

Letter template for mechanical breakdown insurance documentation request

Comments