Are you feeling overwhelmed by the complexities of insurance premium taxes? You're not alone! Many individuals and businesses face confusion when navigating the intricacies of tax regulations related to their insurance policies. In this article, we'll break down the essential details you need to understand and simplify the process for you, so keep reading!

Clear identification of policy details.

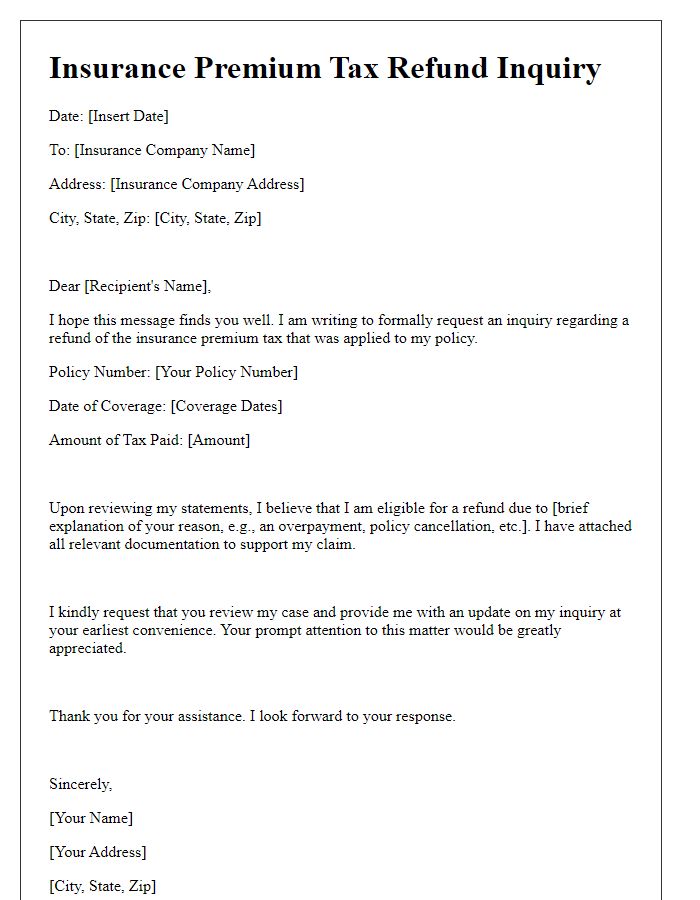

Insurance premium taxes play a significant role in determining the overall cost for policyholders, impacting various types of policies including auto insurance, health insurance, and homeowners insurance. Each state in the United States may impose different tax rates on premiums, often ranging from 1% to 4%, directly influencing the total premium amount. For example, New York State levies a 9% tax on most insurance policies. Policy details such as policy number, effective date, and coverage type are crucial for accurate assessment and proper inquiry at the insurance provider. Understanding these components ensures clarity in addressing discrepancies or requests related to billing statements or tax assessments. It is important during insurance premium tax inquiries to include precise policy details to ensure efficient resolution and compliance with local tax regulations.

Specific questions regarding tax computation.

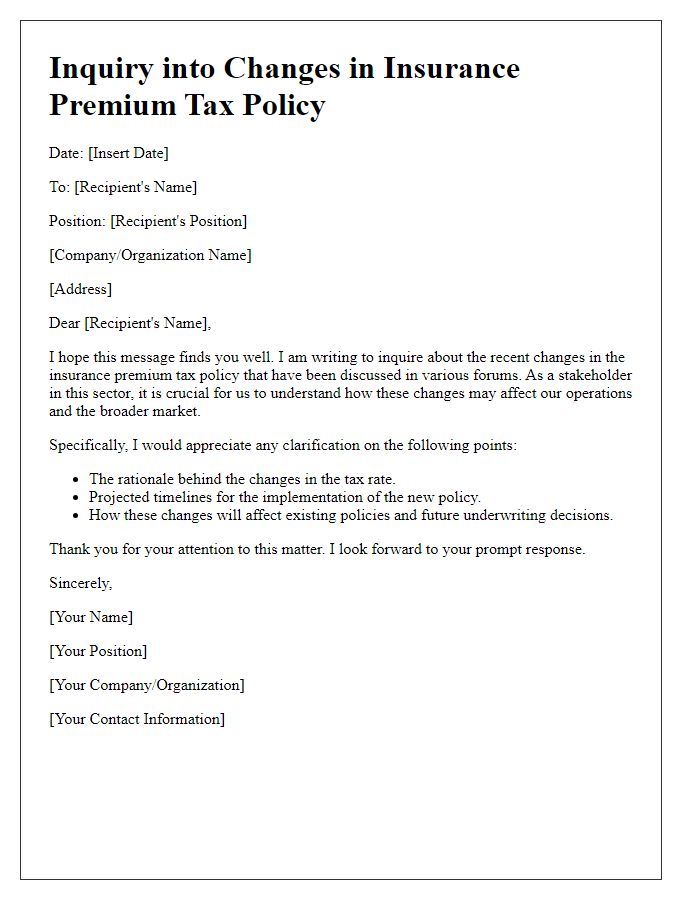

Insurance premium taxation involves specific calculations that can vary based on region and type of insurance. Premiums (monetary amounts paid for coverage), such as those for health, life, or property insurance, are subject to jurisdictional tax rates. For example, in certain states within the United States, the tax rate on insurance premiums may be 2% to 5%. Insurers must comply with these rates, often requiring clear documentation of gross premium receipts. Additionally, companies must distinguish between taxable and non-taxable premiums, as certain policies, like reinsurance, may be exempt. Detailed breakdowns in tax computation might involve calculations regarding surcharges or exemptions related to policy types. Local regulations, such as those governed by state insurance departments, also significantly influence tax obligations, making it essential for insurers to keep up-to-date with legislative changes affecting tax assessments.

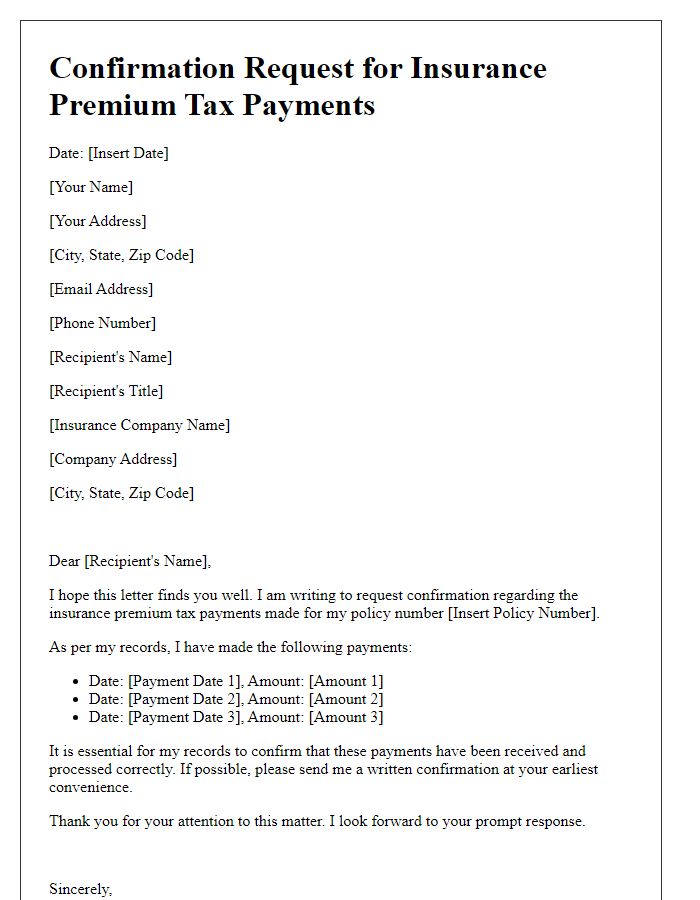

Contact information for follow-up.

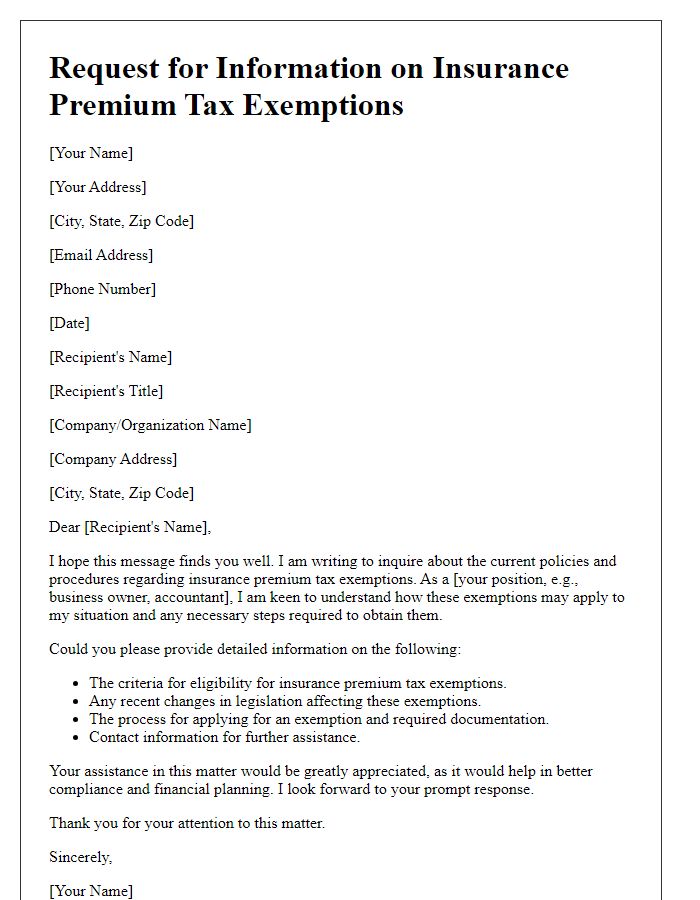

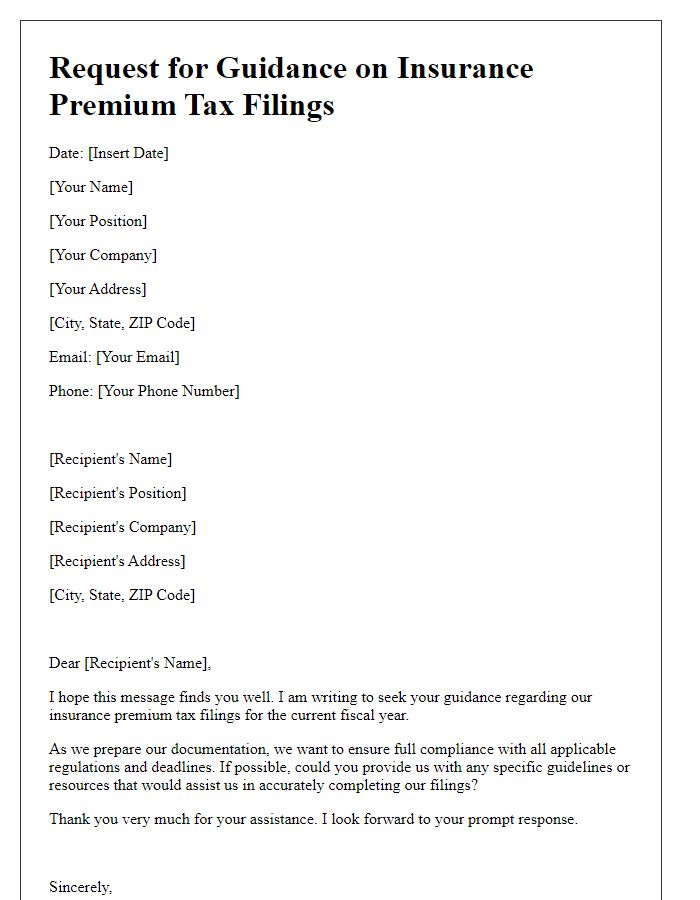

Navigating the intricacies of insurance premium tax inquiries necessitates precise documentation and clarity. An effective communication format includes your name, address, and phone number, allowing insurance companies or tax authorities to follow up efficiently. Including critical details, such as policy numbers or tax identification numbers, streamlines the process and reduces potential delays. Additionally, specifying the inquiry type, whether it's related to clarification of rates, exemptions, or payment processes, enhances the focus of the correspondence. Ensuring a polite tone fosters cooperative dialogue with industry professionals, resulting in more timely and accurate responses. Overall, maintaining comprehensive records and a clear structure is paramount for successful resolution of insurance premium tax issues.

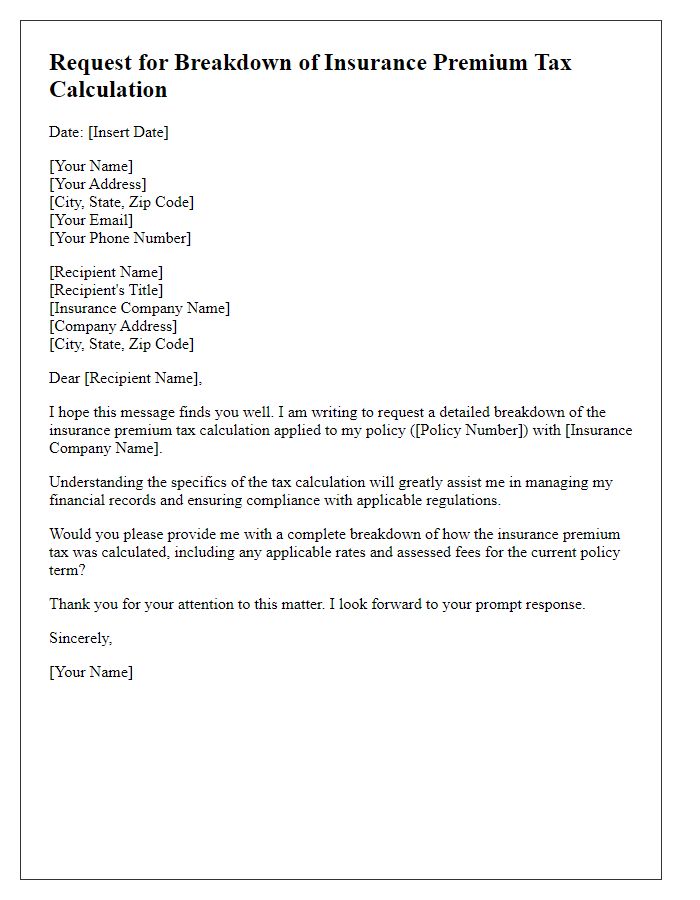

Request for detailed breakdown of charges.

Insurance premium taxes, often levied by state governments, can significantly impact overall policy costs. A detailed breakdown of these charges is essential for policyholders to understand the allocation of their premiums. For example, in states like California, which imposes a tax rate of 2.35% on gross premiums, clarity is necessary to identify how much of the premium contributes to this tax. Additionally, understanding fees associated with specific coverages, such as general liability or property insurance, is crucial for making informed decisions about coverage options. An itemized statement should include base premium amounts, applicable tax rates, additional surcharges, and other relevant fees, providing transparency and fostering trust between insurers and clients.

Polite and professional tone.

Insurance premium taxes are mandatory fees imposed by state and local governments, influencing insurance costs across the United States. These taxes vary significantly by jurisdiction, with rates ranging from 2% to over 6% in states like California and New York. Policyholders should note that these taxes can impact overall premium amounts, potentially increasing expenses for individuals and businesses alike. Understanding the implications of these taxes is essential for effective budgeting and financial planning when selecting insurance coverage. Additionally, staying informed about potential changes in tax regulations can help policyholders avoid unexpected costs in the future.

Letter Template For Insurance Premium Tax Inquiry Samples

Letter template of seeking information on insurance premium tax exemptions

Letter template of request for breakdown of insurance premium tax calculation

Letter template of request for guidance on insurance premium tax filings

Comments