Hey there! We're excited to connect with you about our recent policyholder satisfaction survey. Your feedback is invaluable to us, and we truly appreciate the time you took to share your thoughts. We've made some exciting changes based on what you've told us, and we can't wait for you to see how we're enhancing your experience. So, stick around to learn more about these improvements and what they mean for you!

Personalization

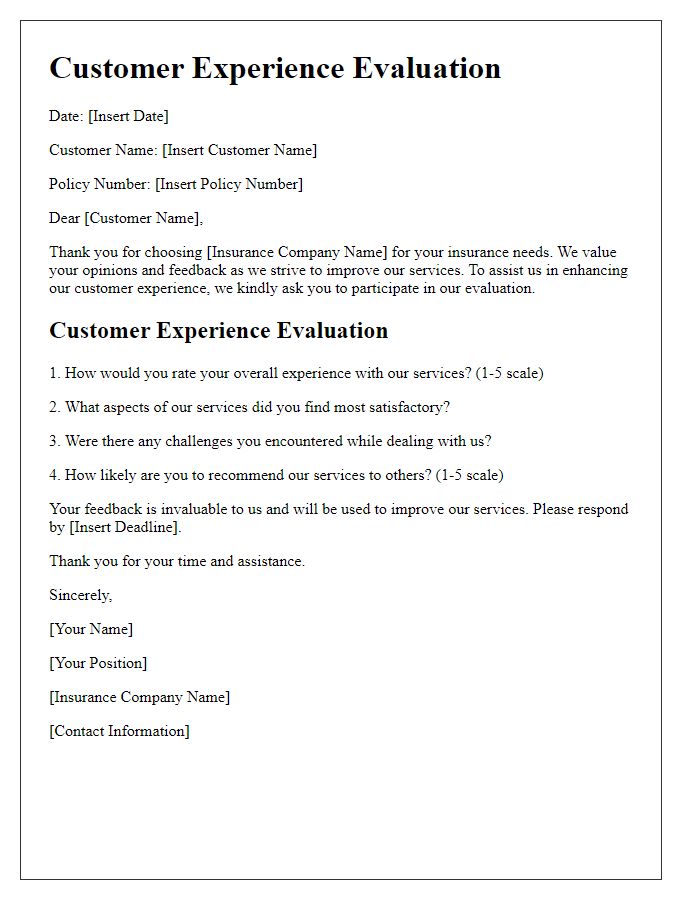

Personalized communication significantly enhances customer satisfaction in insurance policyholder surveys. Tailored responses address individuals by name, providing a sense of recognition and value. Incorporating specific details regarding policy options, claims history, or personal interactions fosters a connection. For instance, referencing recent claims or premium adjustments can demonstrate attentiveness to the policyholder's unique situation. Implementing personalized follow-ups based on survey feedback ensures continuous engagement, reflecting the company's commitment to meeting client needs. Moreover, offering customized recommendations for policy upgrades or coverage adjustments based on demographic data enriches the experience, leading to increased loyalty and retention among customers.

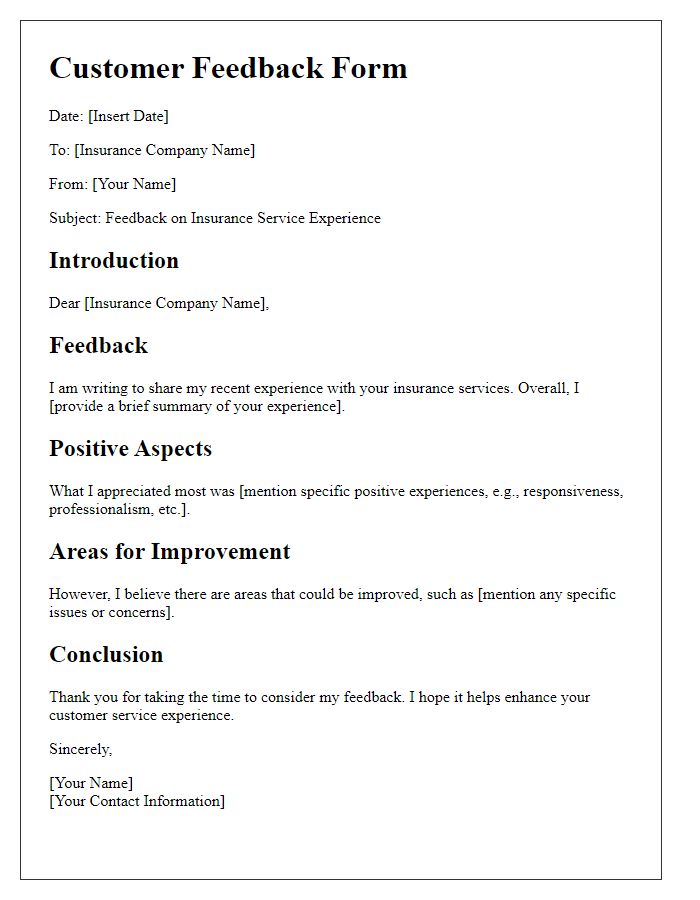

Acknowledgment

In recent years, policyholder satisfaction has become a focal point for insurance companies, emphasizing the importance of customer feedback in shaping policies and services. Effective acknowledgment of this feedback can enhance the overall experience for clients. Insurance providers often utilize structured surveys to gauge satisfaction levels across various categories, including claims processing, customer support, and product offerings. Gathering this valuable insight not only helps identify areas for improvement but also fosters long-term relationships with clients, ultimately leading to better retention rates. The survey results can highlight trends and inform future enhancements, ensuring that offerings remain competitive in a dynamic market.

Gratitude

Acknowledging customer feedback is essential for businesses to improve service quality. Thanking policyholders for their participation in satisfaction surveys fosters trust. Expressing gratitude highlights the importance of their opinions, which can lead to valuable insights for enhancing policy offerings. Recognizing their time spent contributes to a positive relationship between policyholders and the company. This approach reinforces the commitment to customer-centric service, encouraging future engagement in feedback initiatives. A heartfelt note of thanks sets the foundation for continued loyalty and satisfaction.

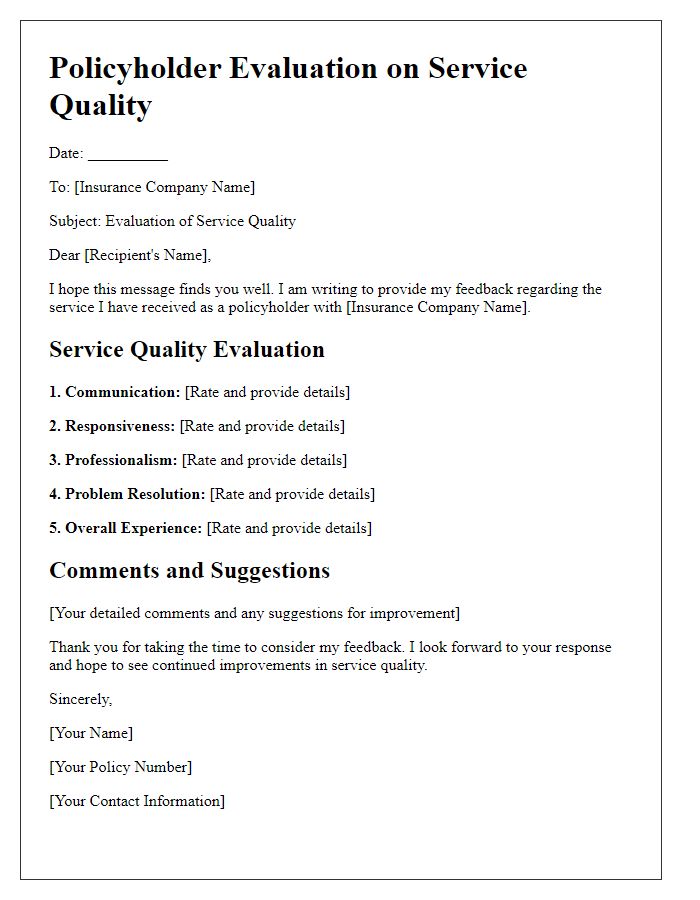

Clear Next Steps

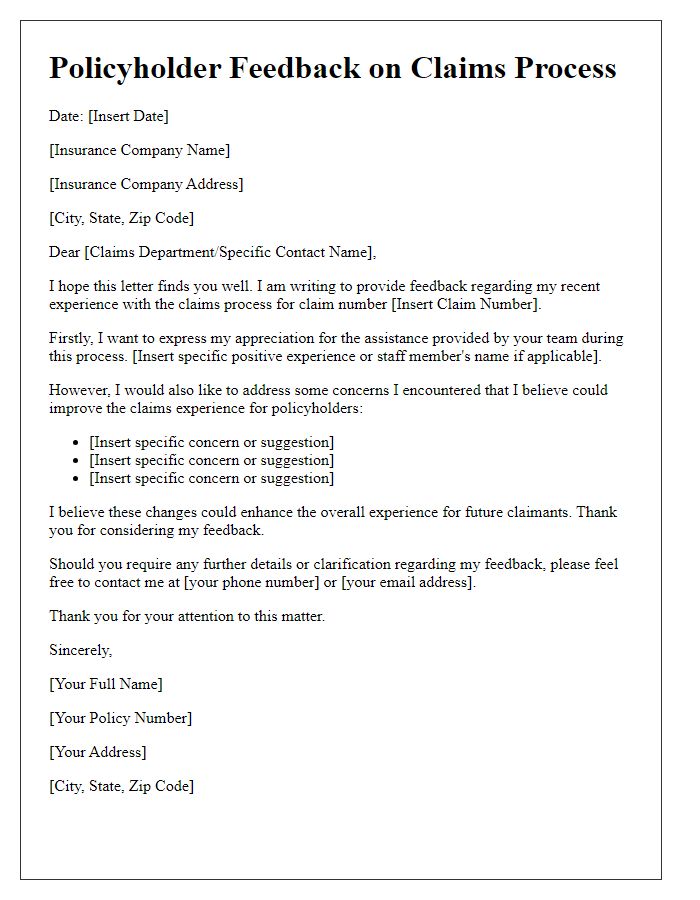

Customer satisfaction surveys play a crucial role in understanding policyholder experiences and improving insurance services. After analyzing survey results, direct engagement with policyholders through follow-up communications can enhance satisfaction. Actionable next steps should include addressing common concerns identified in the survey, such as claims processing (often a pain point), customer service interactions, and policy clarity. Implementing training programs for customer service representatives can improve service quality, while revising policy documentation can ensure clarity and transparency. Scheduling follow-up calls or emails to gather additional feedback after changes are made can demonstrate commitment to customer satisfaction, fostering loyalty and trust among policyholders.

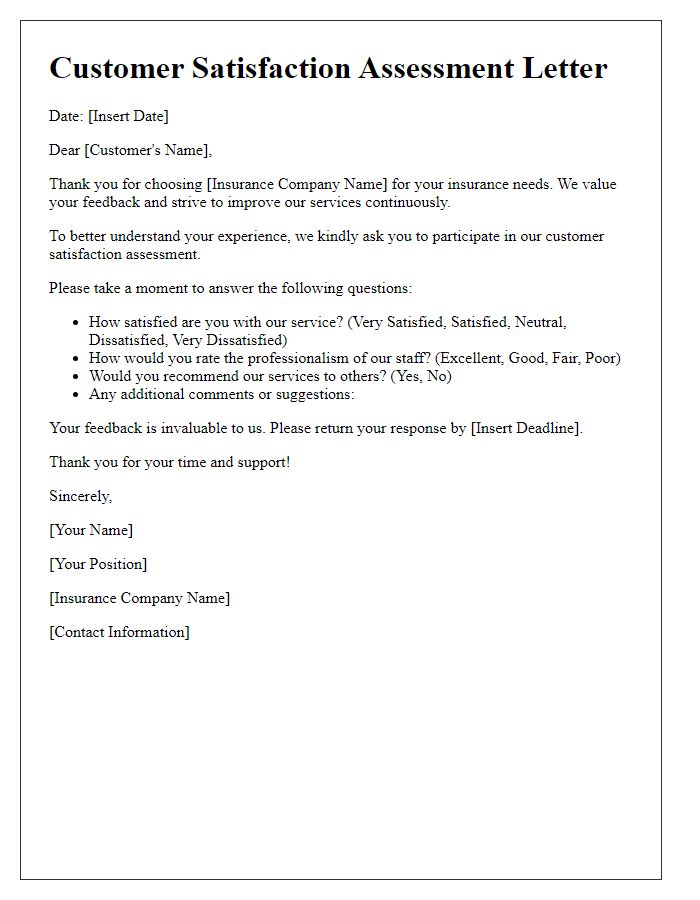

Contact Information

Policyholders have the opportunity to express their satisfaction through a survey conducted by insurance companies. This survey often centers around customer service experiences, claim processing efficiency, and overall coverage satisfaction. To provide valuable feedback, respondents typically include their contact information, such as email addresses or phone numbers, ensuring effective follow-up for further inquiries or clarifications. This data also aids insurance firms in analyzing trends, improving services, and enhancing policy offerings tailored to meet the needs of their clients. Consequently, strong communication channels between policyholders and companies foster a better understanding of customer expectations and drive continuous improvement initiatives.

Comments