If you've recently experienced the fury of a hurricane, you're likely facing both physical and emotional challenges in its aftermath. Navigating the complexities of your insurance claim can feel overwhelming, but it doesn't have to be. With the right guidance and a well-structured letter, you can effectively communicate your damages and expedite the claims process. So, let's explore the essential elements you need to include in your hurricane damage insurance claim letter to ensure you receive the compensation you deserveâread on to learn more!

Policy Information

Hurricane damage insurance claims often require precise documentation to expedite the process. Insurance policy details include the policy number, which uniquely identifies the insurance contract. Claimants must include the insurance company's name and contact information to facilitate communication. Coverage limits need to be clearly stated, indicating the maximum amount the insurer will pay for specific damage types. Additionally, the effective date of the policy marks when coverage began, while the expiration date shows when the policy term ends. Inspected damages should be documented alongside photographs and repair estimates to support the claim process effectively.

Description of Damage

Hurricane damage often manifests through extensive physical destruction, particularly in coastal areas such as Florida and Texas. High winds, reaching up to 150 miles per hour during Hurricane Laura in 2020, can rip off roofs, shatter windows, and uproot trees, causing significant structural issues. Water intrusion from flooding can lead to mold growth within 24 to 48 hours, damaging drywall and baseboards. Property contents, such as furniture and appliances, are susceptible to irreversible damage when submerged in saltwater, which can corrode steel components. Essential outdoor structures like fences and decks may also be compromised, necessitating repair or replacement. This severe impact underscores the urgency of filing an insurance claim to address the financial ramifications of such natural disasters.

Supporting Documentation

Hurricanes, such as Hurricane Ida in August 2021, can cause extensive damage to residential properties, potentially leading to substantial financial losses. Supporting documentation for insurance claims often includes photographs showing the extent of damage to structures, like roofs or windows, taken during and after the storm. Repair estimates from certified contractors in affected areas, such as New Orleans, help substantiate repair costs. Additionally, inventory lists of damaged personal belongings, including electronics and furniture, provide a comprehensive overview of losses. Weather reports from the National Weather Service detailing wind speeds (often exceeding 100 miles per hour) and rainfall amounts can strengthen the claim, illustrating the severity of the event. Lastly, communication records with the insurance provider can help track the claim processing stages, ensuring timely resolution.

Estimated Costs

Hurricane damage can result in significant financial burdens, especially when it comes to repairing properties affected by severe weather events. Estimates for repairs typically involve assessing structural damage to homes located in coastal regions, often ranging from several thousand to hundreds of thousands of dollars. Repair costs may include replacing roofs, windows, and siding, with prices for roof replacement averaging between $5,000 and $15,000 depending on the size and materials used. Additionally, water damage restoration, which can involve mold remediation and damage to floors, walls, and ceilings, may add another $3,000 to $30,000 to the overall cost. Furthermore, if electrical systems or plumbing are compromised, further expenses can escalate the estimates. Accurate assessments conducted by licensed contractors are crucial for filing insurance claims with coverage details typically outlined in standard homeowner's policies, as Title 627 of the Florida Statutes reveals the nuances of homeowner insurance in the event of natural disasters.

Contact Information

Hurricane damage can result in significant destruction to properties, particularly residential homes along coastlines. In 2022, Hurricane Ian impacted Florida, causing damages that reached approximately $50 billion. Homeowners often face challenges in documenting and claiming damages from insurance providers. Essential details, such as contact information (including name, address, phone number, and email), need to be meticulously gathered to ensure effective communication with insurance adjusters. Clearly outlining specific damages, such as roof destruction, flooding in basements, and broken windows, allows homeowners to support their claims more robustly. Documentation of losses, including photographs and repair estimates, strengthens the case for compensation from insurance companies.

Letter Template For Hurricane Damage Insurance Claim Samples

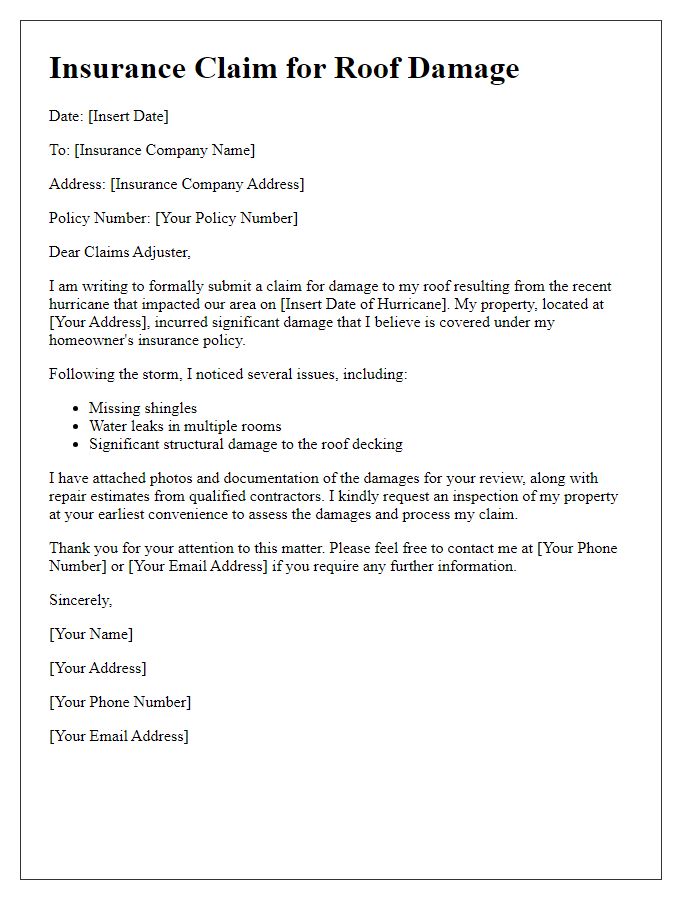

Letter template of hurricane damage insurance claim for residential property.

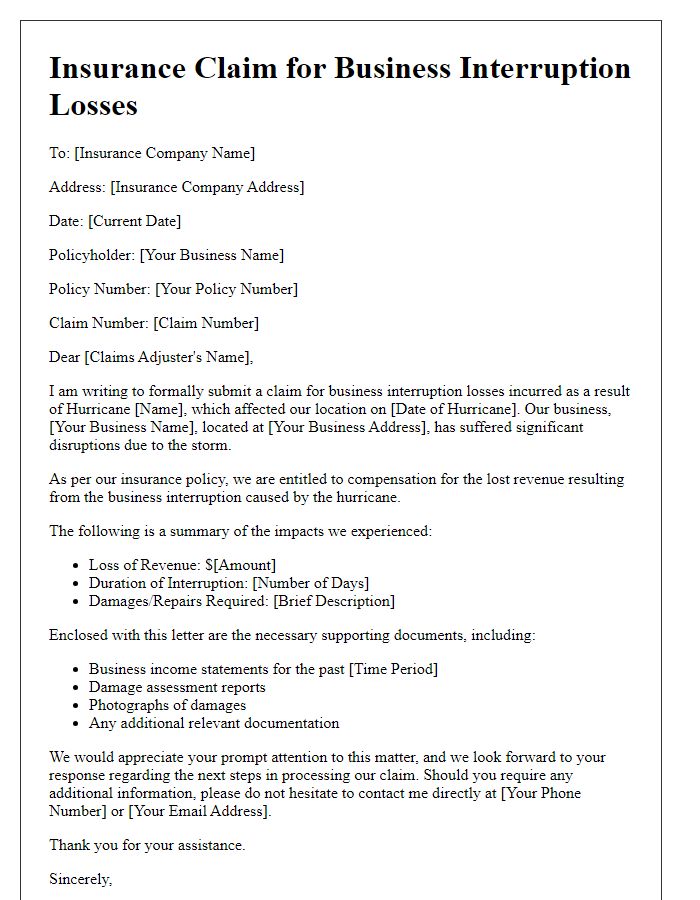

Letter template of hurricane damage insurance claim for commercial property.

Letter template of hurricane damage insurance claim for flooded basement.

Letter template of hurricane damage insurance claim for personal belongings.

Letter template of hurricane damage insurance claim for temporary relocation expenses.

Letter template of hurricane damage insurance claim for landscaping damages.

Letter template of hurricane damage insurance claim for structural integrity concerns.

Comments