Are you feeling overwhelmed by a recent deductible decision? You're not aloneâmany people find themselves facing unexpected costs and feel the need to appeal. In this article, we'll guide you through the process of crafting a persuasive letter for deductible reconsideration, ensuring that your voice is heard. So, grab a cup of coffee and let's dive into how you can effectively make your case!

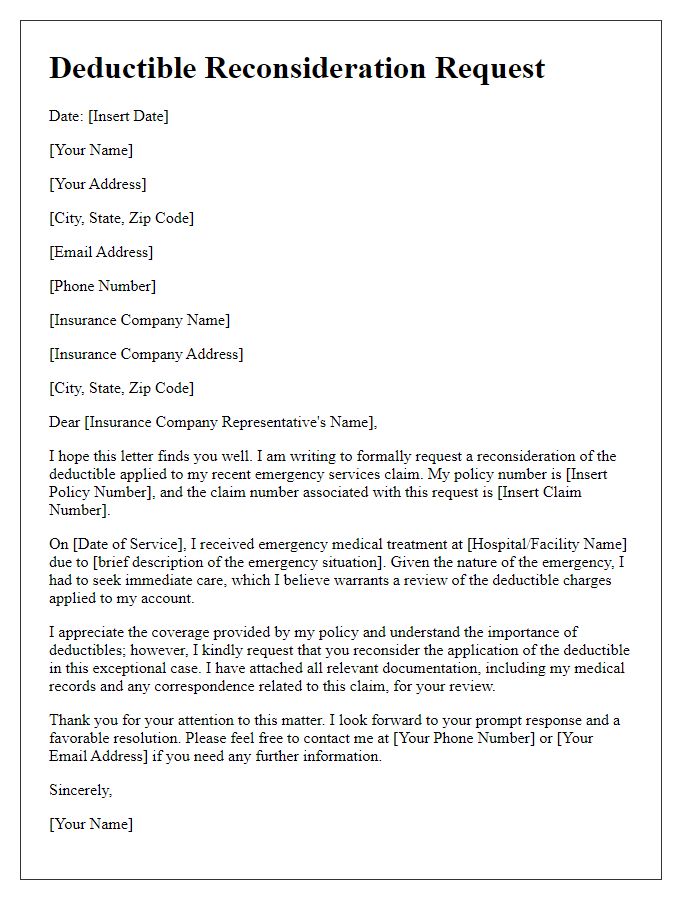

Clear subject line

A deductible reconsideration request involves addressing insurance claims such as medical expenses, property damage, or other costs that exceed a predetermined deductible amount. A clear subject line should outline the intent, such as "Request for Reconsideration of Deductible for Claim #123456." This ensures that the recipient quickly understands the purpose. Include essential details like the policy number, dates of service or damage, and the specific deductible amount in question. Additionally, providing a brief explanation of why reconsideration is warranted can strengthen the request, such as discrepancies in billing or unexpected circumstances that influenced the expenses incurred.

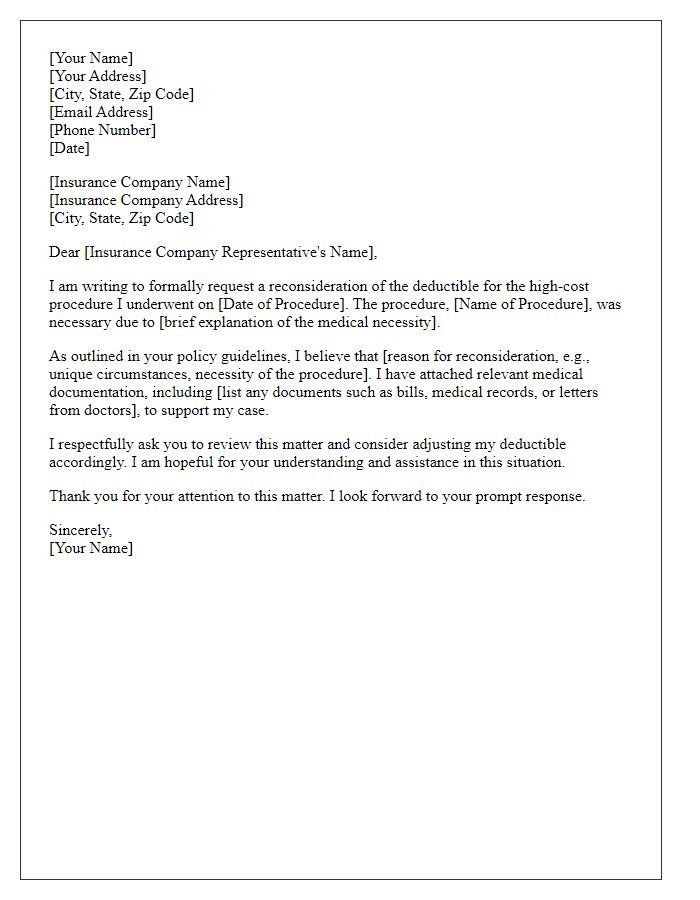

Personal information details

When submitting a deductible reconsideration request, include essential personal information for proper identification and processing. Use your full name, ensuring it matches the details on your account. Record your current address, including city, state, and zip code, to establish residency and association with the insurance policy. Provide your policy number (typically found on your insurance card) to facilitate quick reference. Include your contact number and email address to ensure easy communication from the insurance provider. Document any relevant claim number associated with the deductible in question for accurate tracking of your request.

Summary of the issue

A deductible reconsideration request involves reviewing the specifics of a medical bill or insurance claim initially denied coverage, potentially leading to unexpected financial burdens for patients. Common scenarios might include unexpected procedures conducted at facilities like Mercy Hospital in Chicago or out-of-network specialist visits that result in high deductible payments. Insurance policies often have stipulations, such as in-network requirements, which, if not met, can lead to elevated costs exceeding $2,000 for patients. Moreover, discrepancies in the billing codes used by providers--like a procedure coded as outpatient instead of inpatient--may also cause claims to be denied. Understanding the implications of these processes, including deadlines for appeals and necessary documentation such as itemized bills and prior authorization forms, is crucial in advocating for fair reimbursement or reduced out-of-pocket expenses.

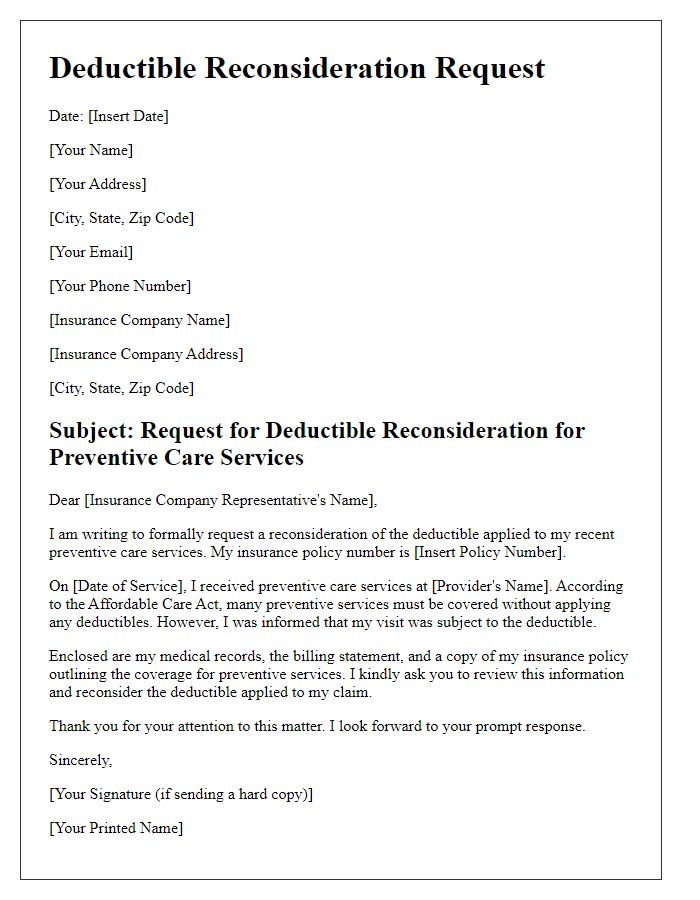

Justification for reconsideration

A deductible reconsideration request is crucial for individuals seeking adjustment on their health insurance claims. This request often stems from unexpected medical expenses incurred, such as emergency surgeries or extended hospital stays, which may exceed the initial deductible amounts. Key components to consider include policy details, such as the annual deductible limit set at $2,000 for individual plans or $4,000 for family plans, and specific out-of-network expenses that can further complicate reimbursement. Relevant documentation, like itemized bills from healthcare providers and detailed explanation of benefits (EOB) statements, is essential for supporting the claim adjustment. The reconsideration process involves submitting a formal appeal to the insurance company, which often adheres to regulations set forth by the Affordable Care Act. Timeliness is also pivotal, as requests typically must be submitted within a specified period, often within 180 days from billing or the date of service.

Contact information and closing statement

A deductible reconsideration request, typically related to a health insurance claim, often includes essential contact information such as the policyholder's name, insurance policy number, and a phone number for direct communication. The closing statement may express gratitude for reassessing the deductible, highlight the importance of prompt resolution, and encourage further communication to expedite the process. Providing a clear email address can facilitate quick responses regarding any additional documentation or questions regarding the reconsideration.

Letter Template For Deductible Reconsideration Request Samples

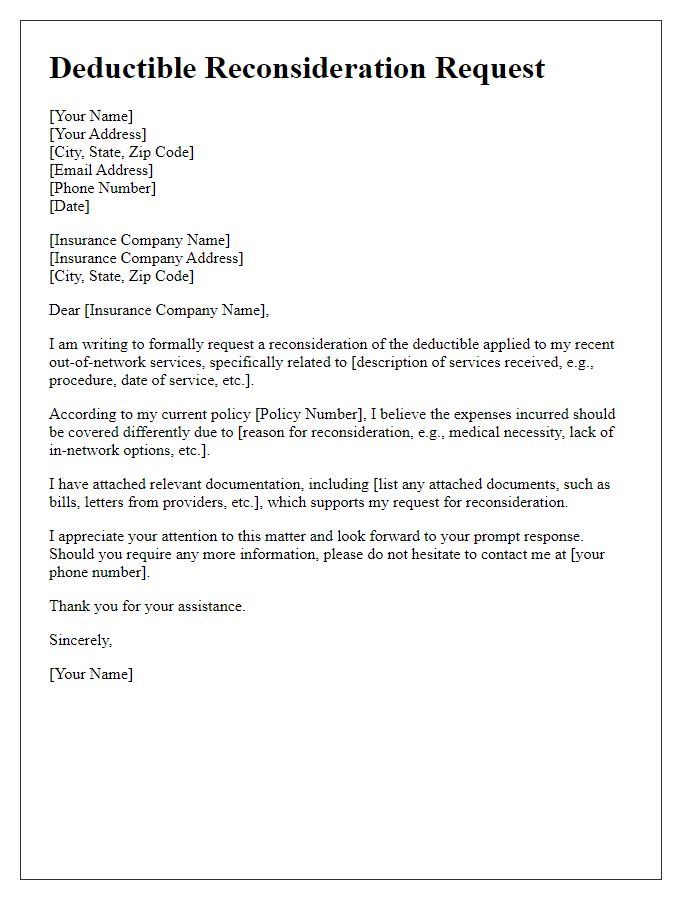

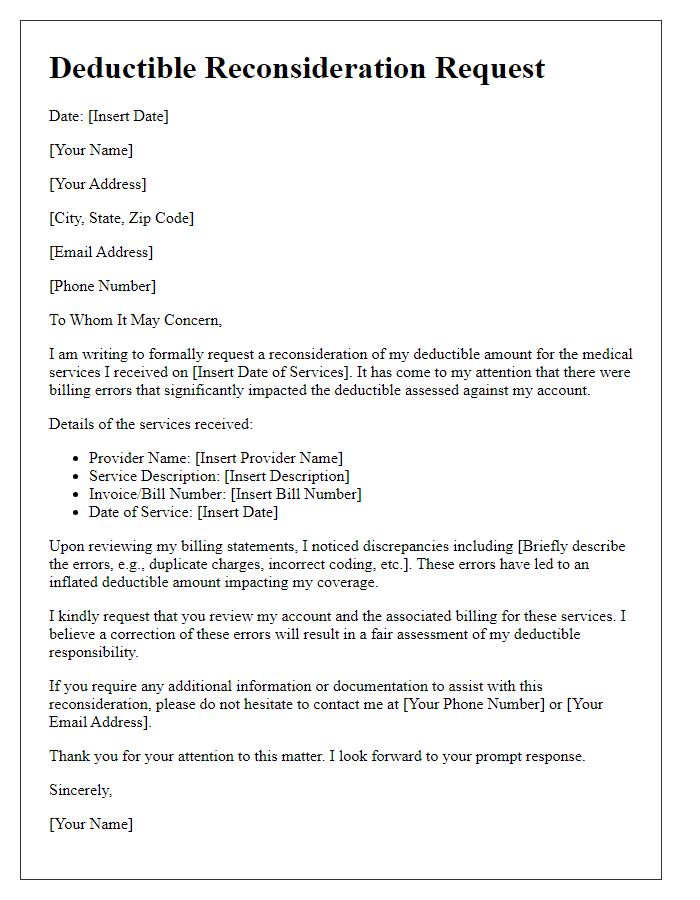

Letter template of deductible reconsideration for out-of-network services

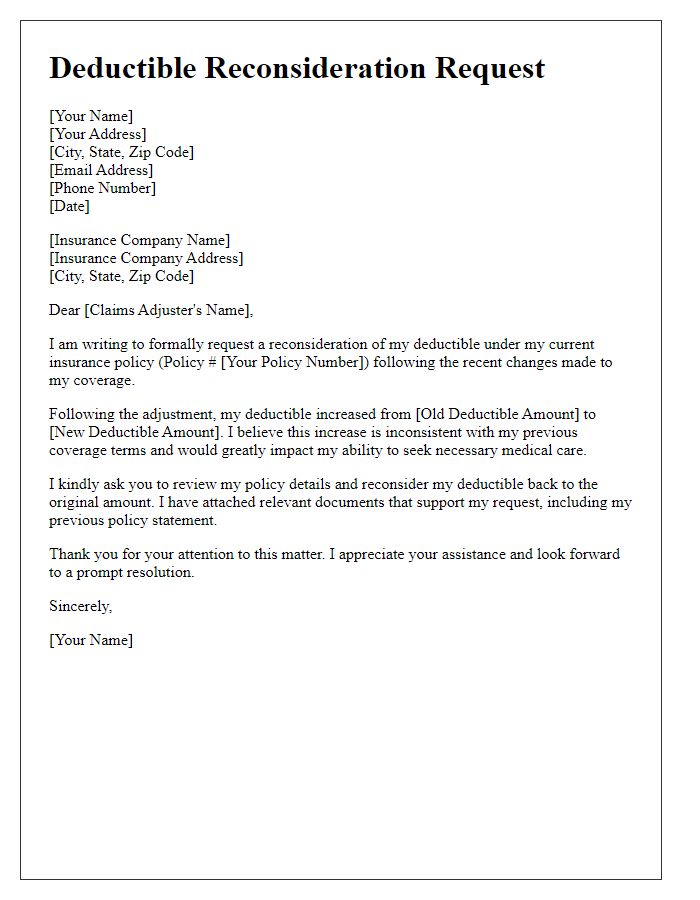

Letter template of deductible reconsideration after insurance policy change

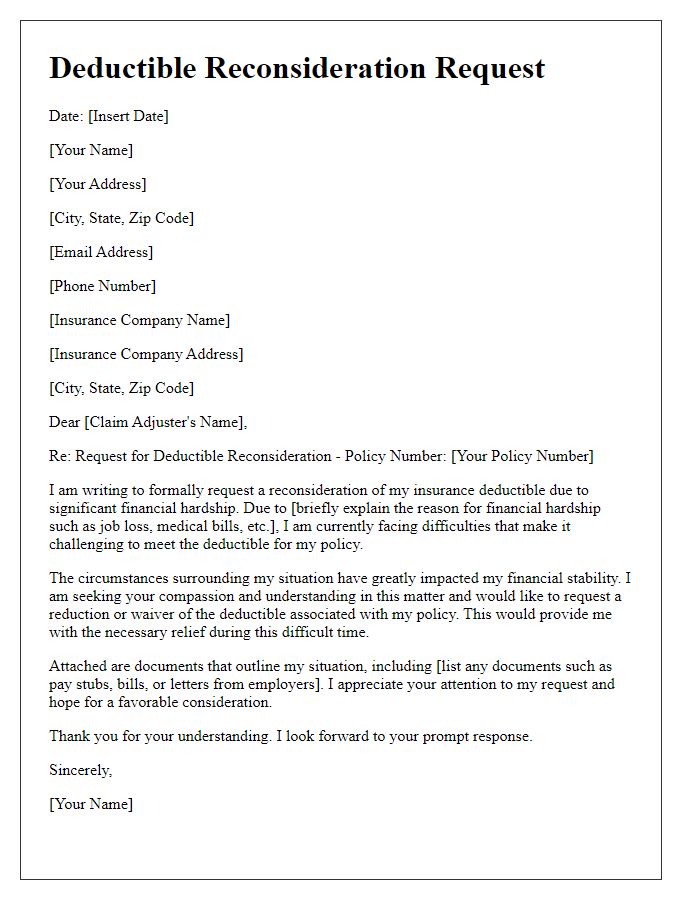

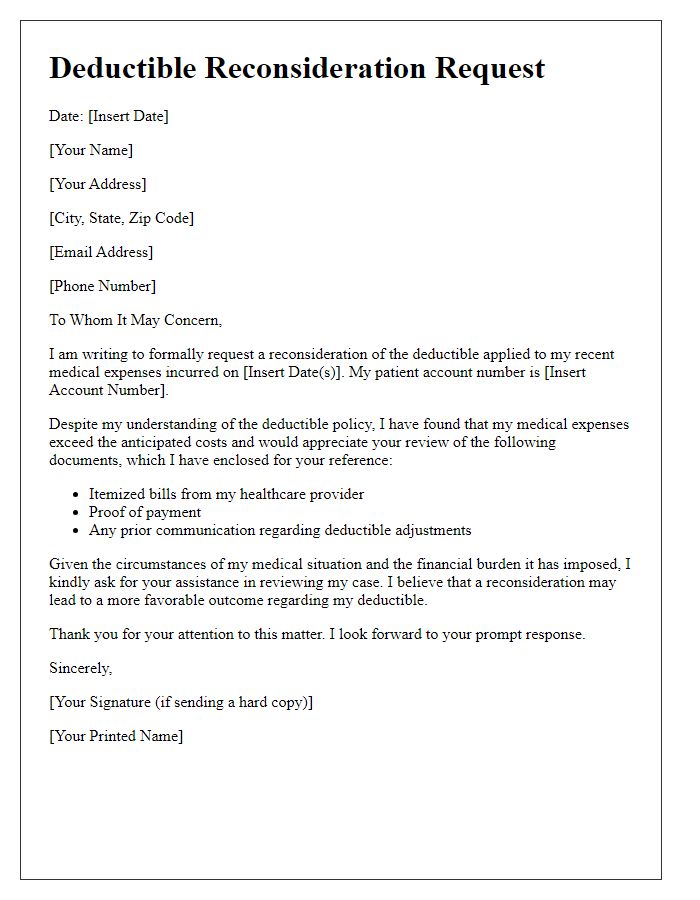

Letter template of deductible reconsideration based on financial hardship

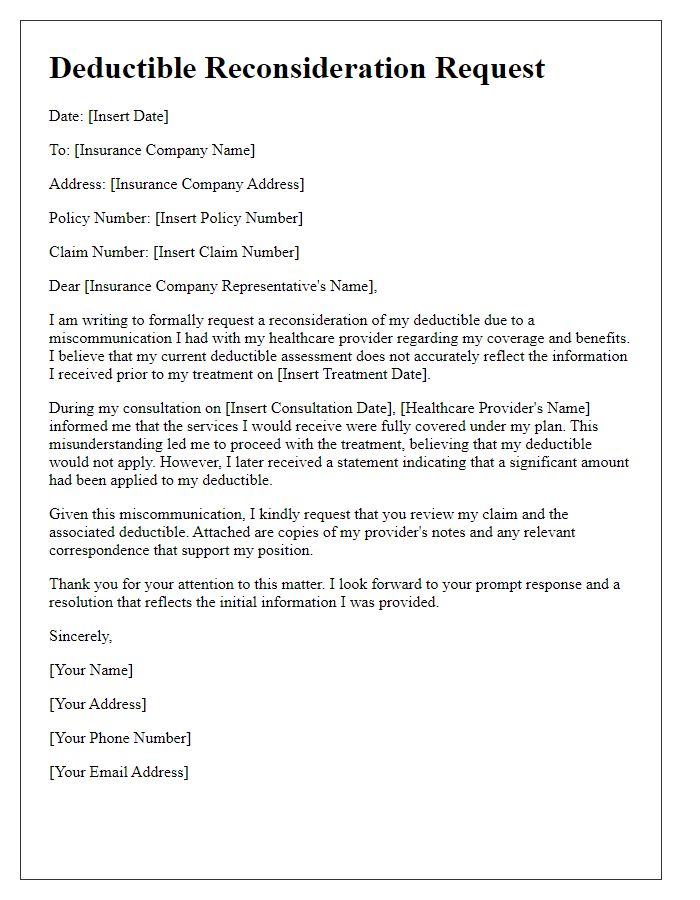

Letter template of deductible reconsideration due to miscommunication with provider

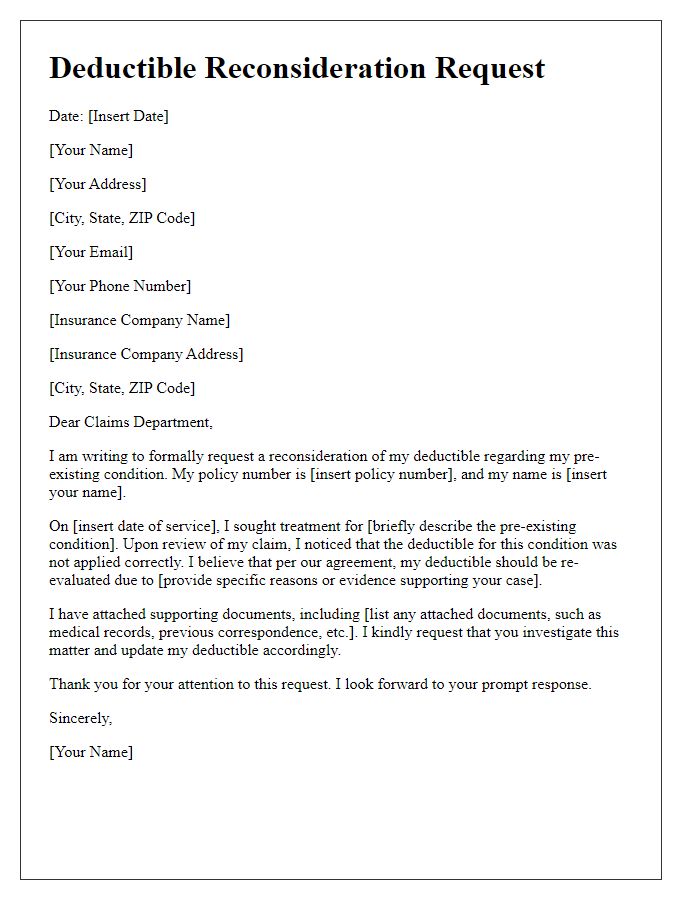

Letter template of deductible reconsideration for pre-existing conditions

Comments