Have you ever found yourself frustrated with a defective product that just didn't live up to its promise? Whether it's a faulty gadget or a malfunctioning appliance, dealing with unfortunate purchases can be a hassle, but knowing how to navigate the insurance claim process can make it easier. In this article, we'll walk you through a helpful letter template that you can use to file a successful defective product insurance claim, ensuring that you get the compensation you deserve. So, let's dive in and empower you with the knowledge to tackle your claim effectively!

Clear identification of policyholder and insured product details.

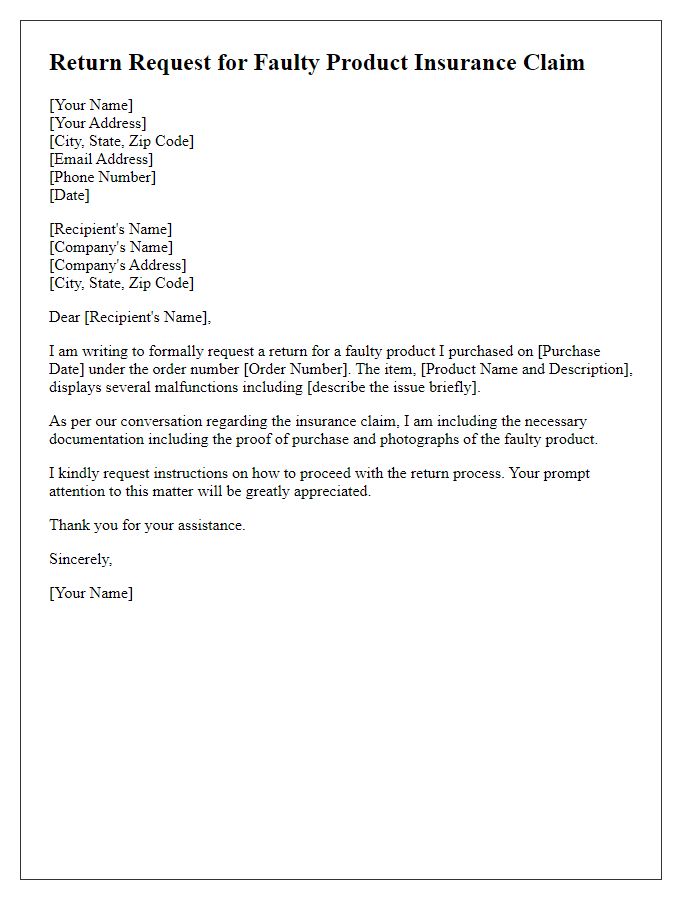

A comprehensive insurance claim should clearly document the identity of the policyholder alongside detailed information of the defective product. The policyholder's name, address, contact information, and policy number (issued by the insurance company, such as Allstate or State Farm) must be accurately listed. For the insured product, include its make (e.g., Samsung), model (e.g., Galaxy S21), serial number (unique identifier usually found on the device), purchase date (which may impact the warranty claim), and relevant details of the defect (such as screen malfunction or battery issues). In addition, it is beneficial to attach photographs of the defect, proof of purchase receipts, and any prior repair attempts to support the claim effectively.

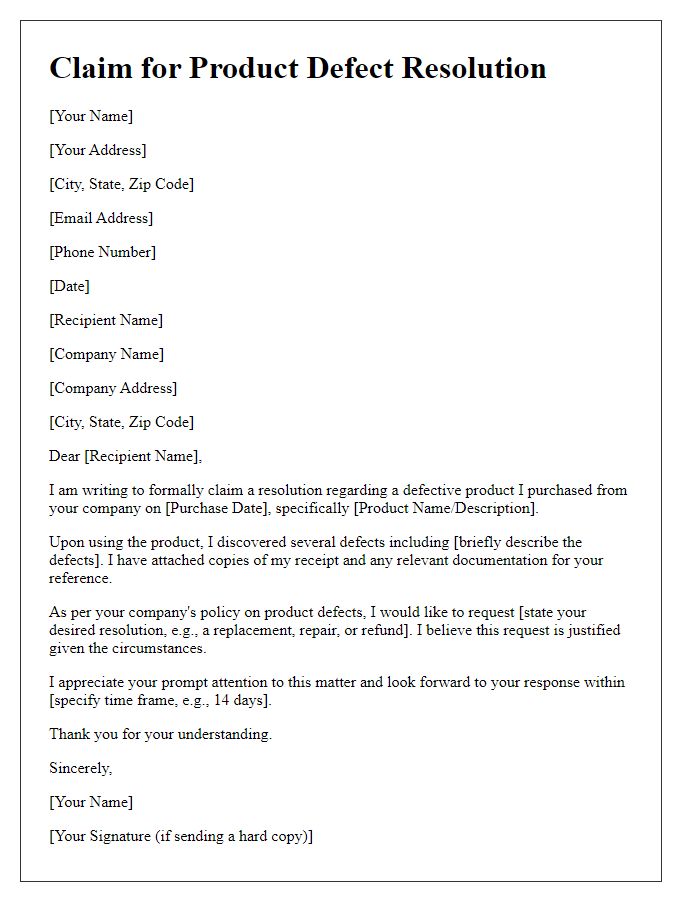

Precise description of the defect and its impact.

A defective dishwasher, specifically the model Bosch SHEM78W55N, exhibits a persistent leaking issue from its door seal, compromising its ability to wash dishes effectively. Water accumulates on the kitchen floor (averaging 2 liters per cycle), creating a hazard and potential water damage to surrounding cabinetry. The leaking impacts operational efficiency, resulting in an increase in water consumption, straining both household resources and utility bills. Additionally, the malfunctioning door seal (costing approximately $50 to replace) leads to poor cleaning results, requiring manual intervention for thoroughly cleaned dishes. This defect not only diminishes the appliance's performance but also poses a risk for mold development, necessitating immediate attention.

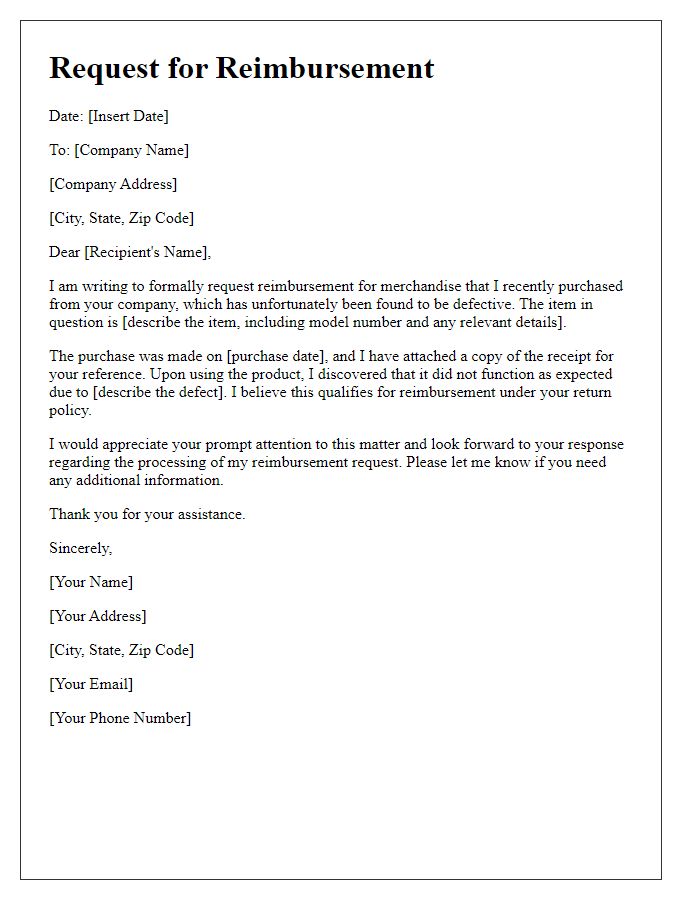

Supporting documentation and evidence, such as photos or receipts.

Submitting a defective product insurance claim requires comprehensive supporting documentation to validate the issue. Essential elements include clear photographs showcasing the defect, emphasizing specific areas of damage or malfunction. Photographic evidence should highlight product identification details like serial numbers and model information. Receipts or proof of purchase should accompany the claim, detailing date of purchase, retailer information, and transaction value--critical for verifying warranty eligibility. Additional documents may include warranty statements outlining coverage terms and conditions, enhancing the credibility of the claim. Collecting these elements can significantly expedite the claims process and support a successful resolution.

Claimant's contact information for follow-up.

Defective products often lead to significant frustration for consumers, impacting both daily life and financial stability. In 2023, for instance, approximately 25% of electronics purchased exhibited some form of defect within the first few months, prompting users to file insurance claims. Claimants must provide accurate contact information, including a phone number and email address for swift follow-up communications. This data is crucial for insurers to expedite processing claims and to facilitate potential refunds or replacements. It aids in maintaining transparency and ensures that consumers receive timely assistance regarding their defective items.

Specific request for compensation or resolution.

Submitting an insurance claim for a defective product involves outlining specific details. The product, often covered under warranty, may include items such as electronics (smartphones, laptops) or appliances (refrigerators, washing machines). These products can display issues affecting functionality, such as a laptop not powering on or a refrigerator failing to maintain temperature. The request for compensation could involve full reimbursement of the product's purchase price, repair costs, or replacement units. Clear documentation (receipts, warranty information) will be essential to substantiate the claim. Timelines for response from the insurance provider will vary, often within 30 days, depending on company policy and local regulations.

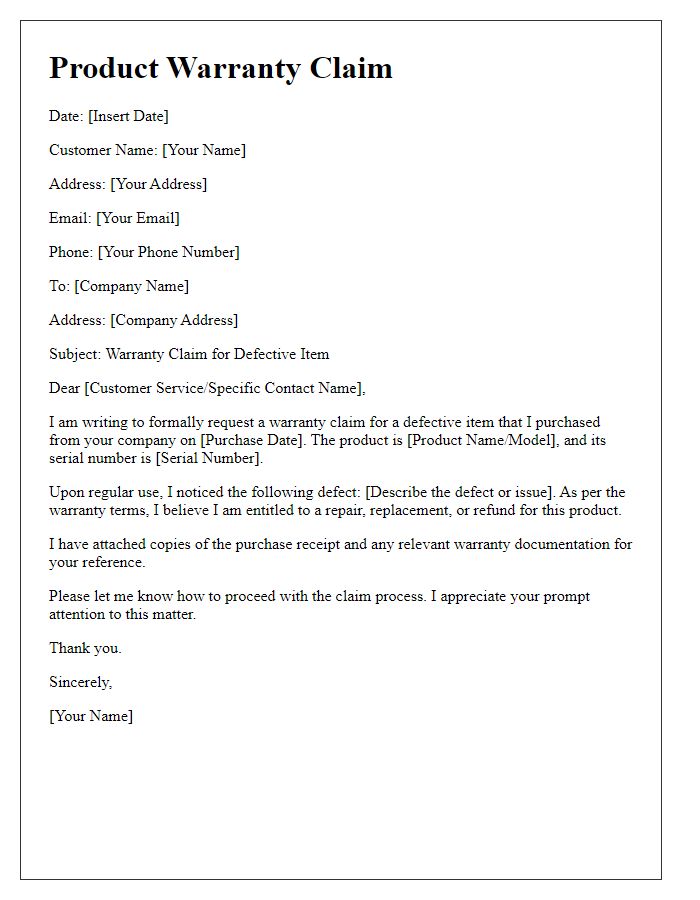

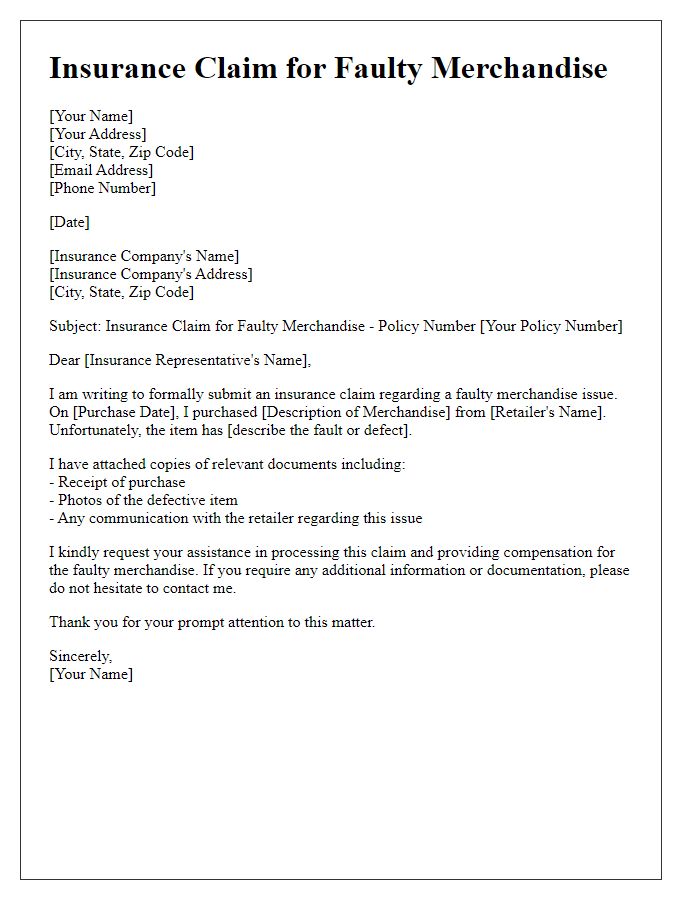

Letter Template For Defective Product Insurance Claim Samples

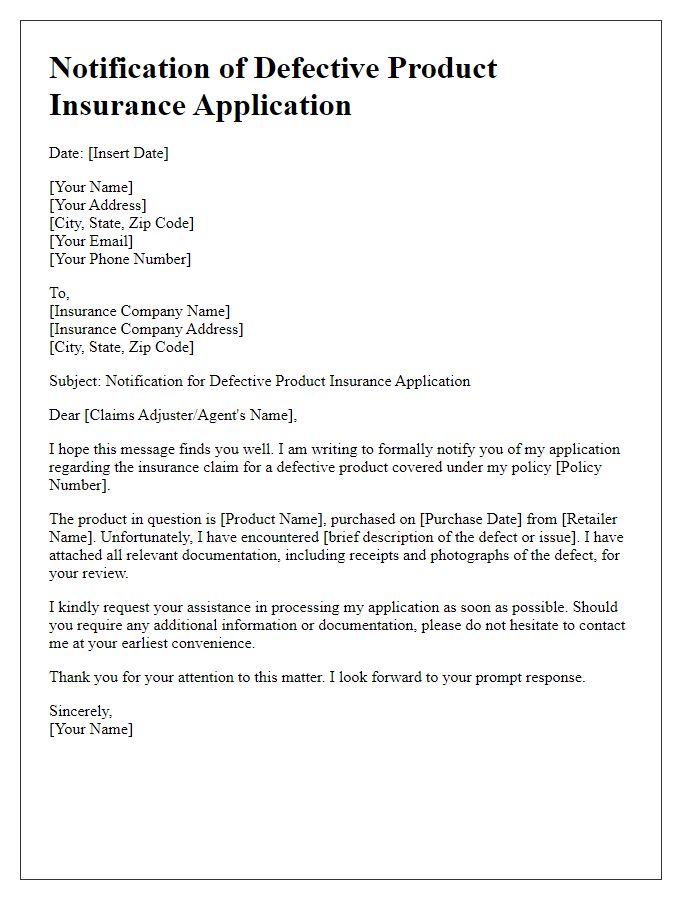

Letter template of notification for defective product insurance application

Comments