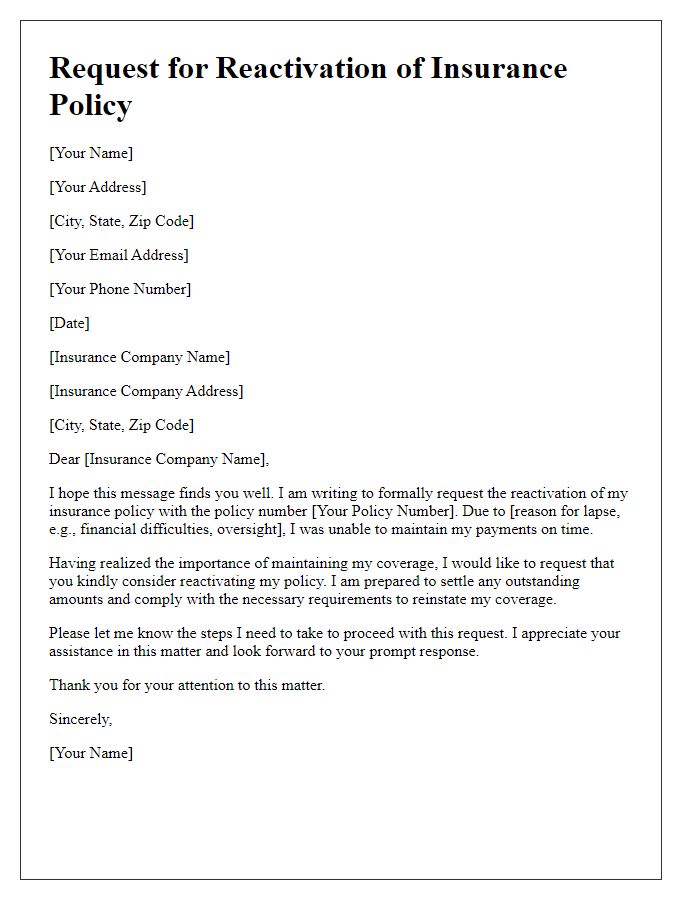

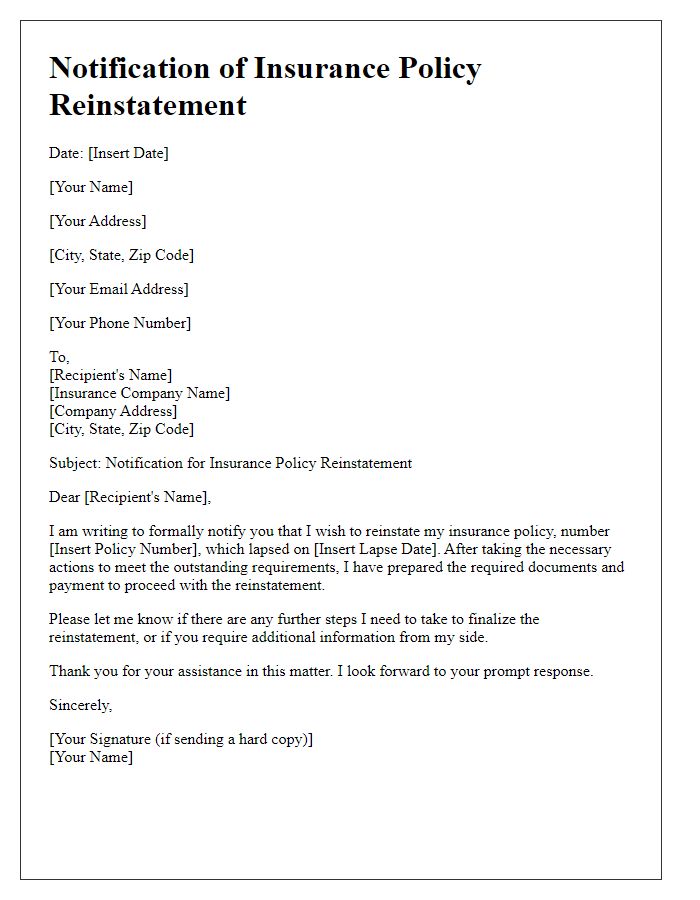

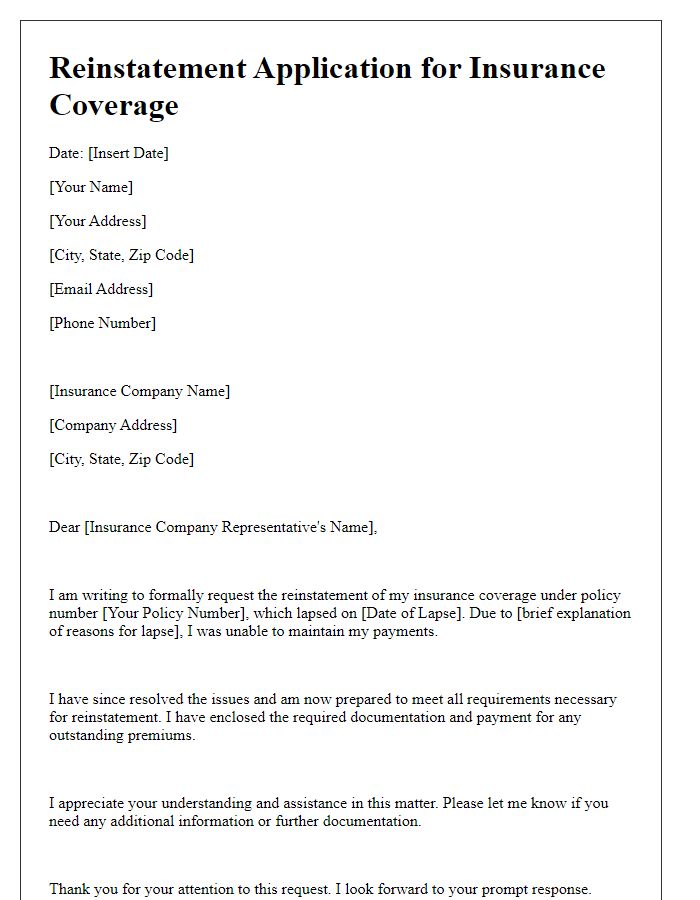

Are you feeling overwhelmed by the process of reinstating your insurance policy? You're not aloneâmany individuals face challenges when trying to navigate these requests. However, understanding the key elements of a reinstatement letter can simplify this task and make the process smoother. Join us as we dive into the essential components of an effective letter template for your insurance policy reinstatement request.

Policyholder Information

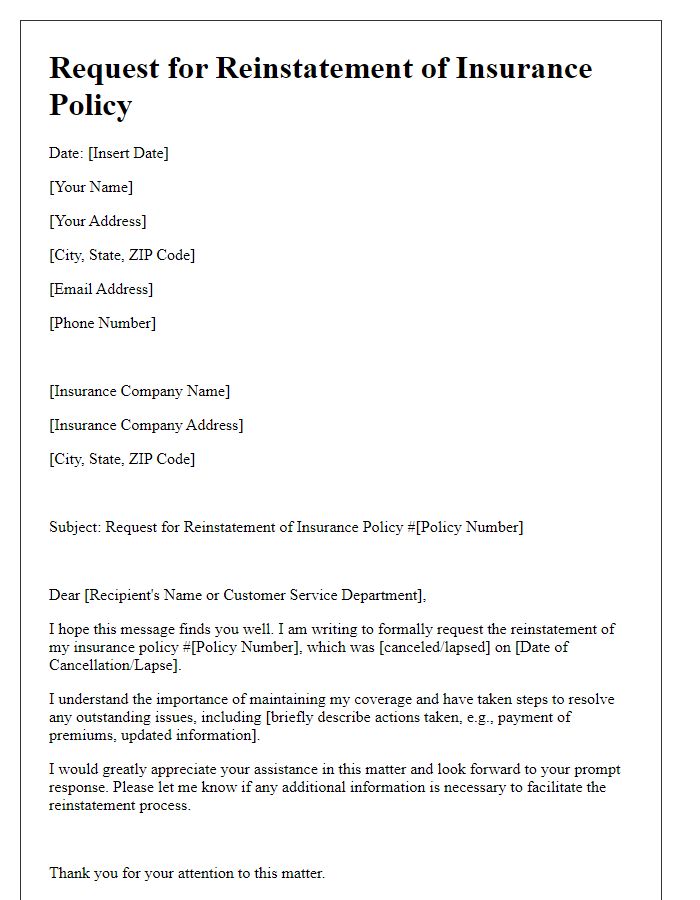

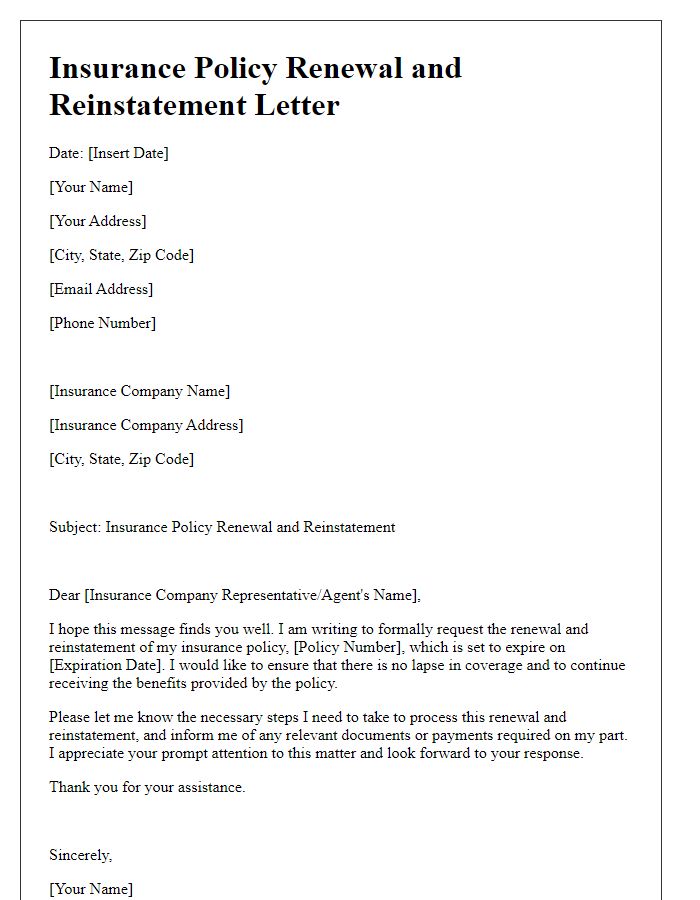

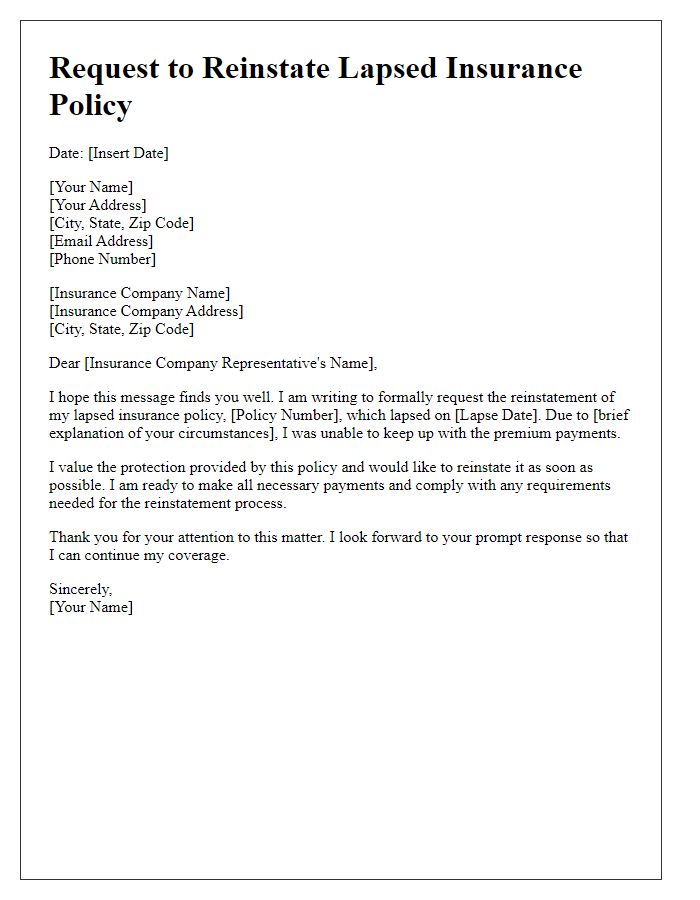

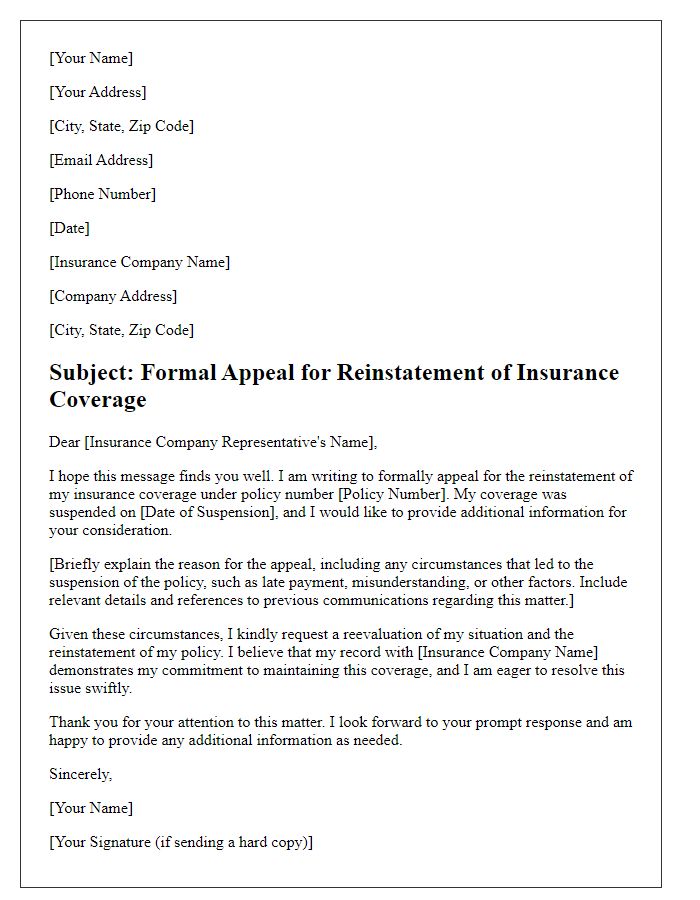

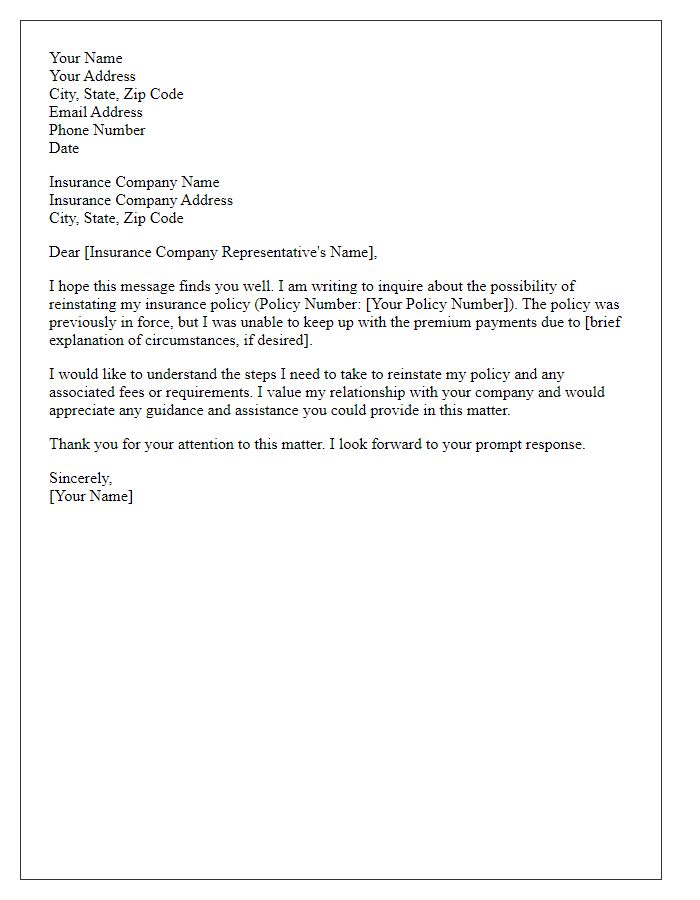

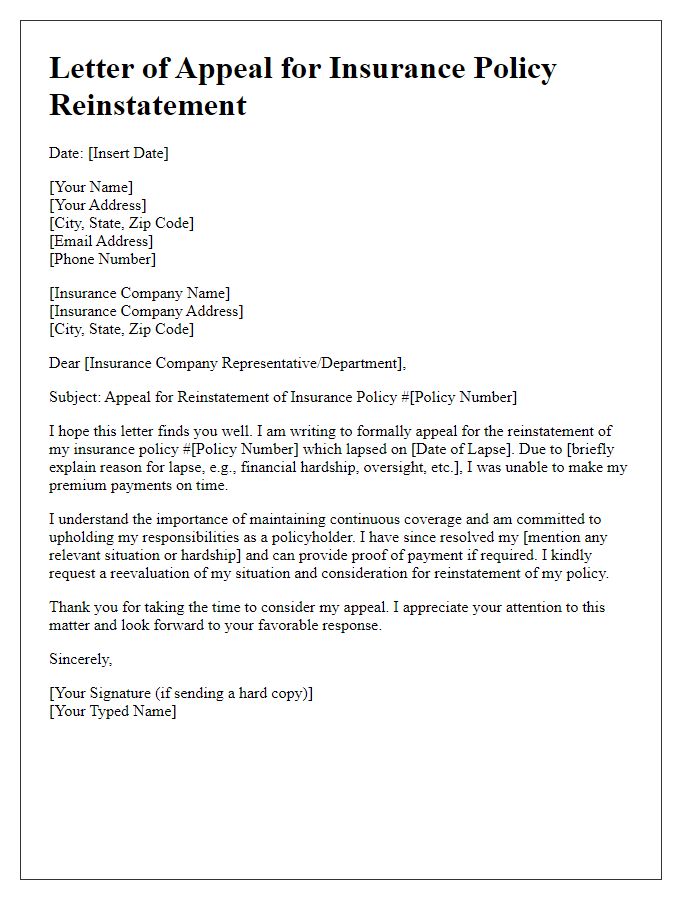

The process of insurance policy reinstatement involves several critical factors that policyholders must consider. A policyholder (individual or business entity owning the insurance policy) typically must provide relevant identification details like their full name, contact number, and certificate or policy number for reference. The insurance company (institution responsible for providing coverage) may examine previous payment history, including any lapses in premium payments, which can influence eligibility for reinstatement. Additionally, the policyholder might need to provide a written request outlining reasons for reinstatement, such as financial hardship or misunderstanding regarding payment deadlines. Detailed information related to personal circumstances and any supporting documents (proof of income, medical records) may be necessary to expedite the reinstatement process. Timeliness is crucial, as many insurers impose a reinstatement window post-policy expiration--often ranging from 30 to 90 days. Legal statutes governing insurance in specific jurisdictions may also apply, impacting policy renewal conditions.

Policy Number

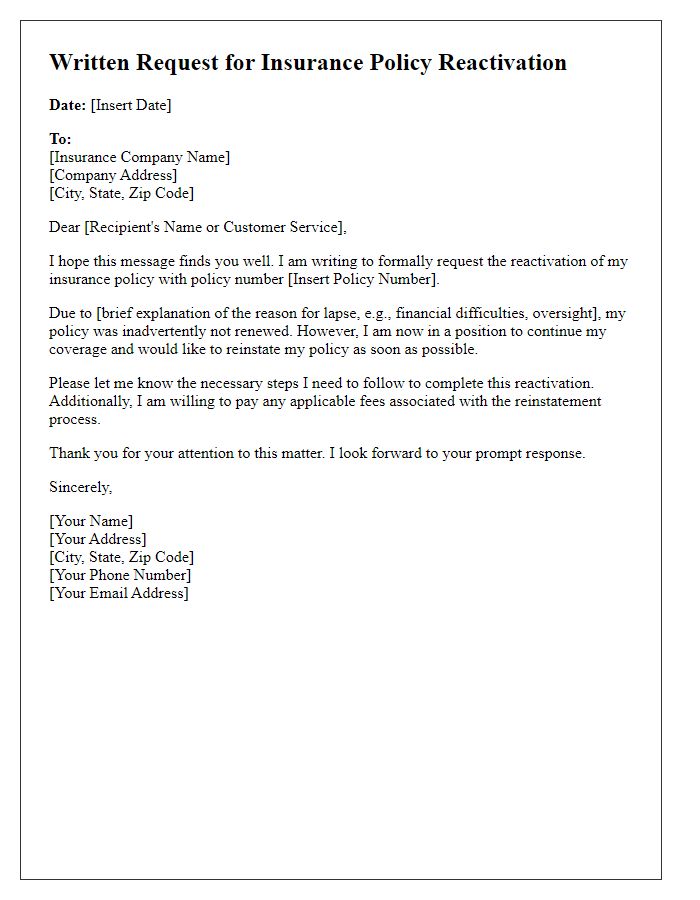

Insurance policy reinstatement requests often involve several critical factors such as policy number, coverage details, and specific dates. In managing these requests, providing the policy number (essential for identifying the specific coverage plan) is crucial. Detailed coverage information, including the type of insurance (e.g., auto insurance, health insurance, home insurance), ensures clarity. Dates of lapse, which may vary from a few days to several months, should be noted to assess reinstatement eligibility guidelines. Policies often have stipulated procedures that require a formal written request, sometimes necessitating additional documentation or explanations regarding the lapse in coverage, such as financial issues or personal circumstances.

Reinstatement Reason

A reinstatement request for an insurance policy often arises when policyholders face unforeseen circumstances leading to a lapse in coverage. Common reasons include financial hardships, such as job loss or medical emergencies, which can hinder timely premium payments. Additionally, administrative errors, like miscommunications or discrepancies in billing statements, can contribute to policy lapses. Providing these details ensures the insurer understands the context surrounding the request and highlights the policyholder's intent to maintain continuous coverage. It is crucial to address factors like the policy number, types of coverage affected, and the dates of lapse, as this information will facilitate a smoother reinstatement process.

Payment Details

Reinstatement of an insurance policy requires specific payment details to ensure continuity of coverage. The premium amount, due date, and payment method (such as credit card or bank transfer) are crucial elements. For instance, a typical monthly premium could range from $50 to $200 depending on the type of insurance, such as auto, health, or life. To maintain seamless coverage, it is essential to submit the payment before the grace period expires, which is often 30 days post due date. A confirmation of the transaction (receipt) may be required as proof of payment for the reinstatement process. Additionally, it's important to consider any potential late fees that could arise, which vary depending on the insurance provider's policies.

Contact Information

Insurance policy reinstatement requests often require detailed contact information. Include the policyholder's full name (e.g., John Smith), insurance policy number (specific to the individual), address (street, city, state, ZIP code), phone number (primary and possibly secondary), and email address (for electronic communication). Ensure accuracy in this information for seamless correspondence. Always consider adding the date of request and a preferred contact method for prompt responses. Providing additional identifiers such as Social Security number or driver's license number can also aid in verifying identity, depending on the insurer's requirements.

Comments