Are you considering surrendering your life insurance policy but unsure where to start? Navigating the process can feel overwhelming, but you're not alone in this journey. In this article, we'll break down the essential steps and key considerations to help you make an informed decision. So, grab a cup of coffee and let's dive deeper into the world of life insurance policy surrender!

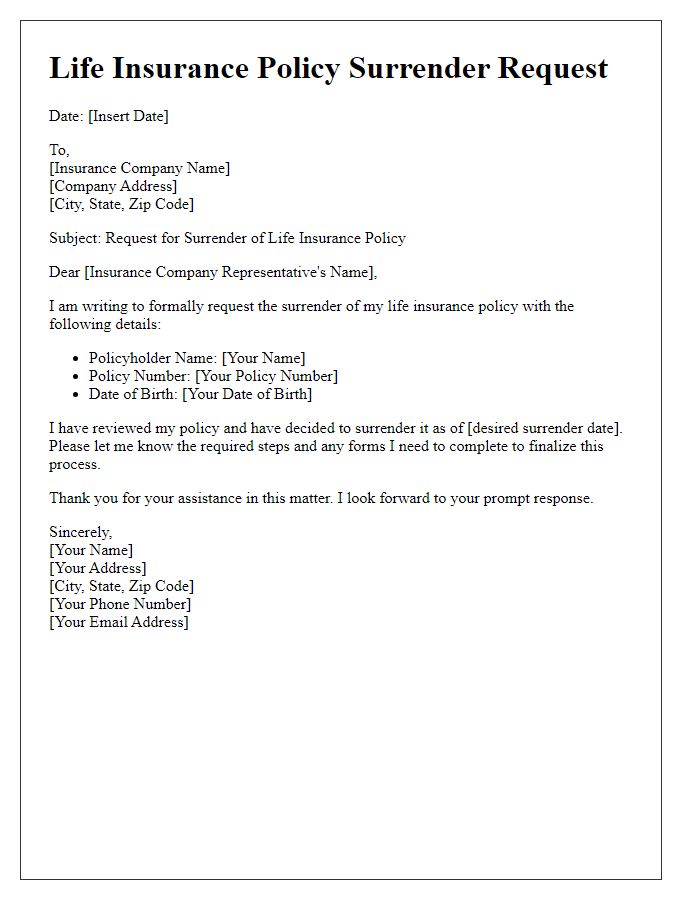

Policyholder Information

Surrendering a life insurance policy often involves submitting a formal request that includes specific details about the policyholder. The policyholder's information typically consists of the full name, residential address, date of birth, and contact information such as an email and phone number. Additionally, the policy number acts as a unique identifier for tracking the policy status during the surrender process. The inclusion of social security numbers may also be necessary for identification purposes, and a clear statement of the intent to surrender the policy is crucial, alongside any reason for the decision. More specific details, such as the policy type and coverage amount, can also aid in processing the request efficiently.

Policy Details

Surrendering a life insurance policy can provide policyholders with immediate cash value, especially for those facing financial difficulties or seeking to reallocate funds. The policy details include the policy number, typically a unique identifier assigned by the insurance company. The death benefit amount, designed to provide financial security to beneficiaries in the event of the policyholder's passing, is another crucial detail. Additionally, the cash value of the policy, which can vary based on factors such as the type of policy (whole life, universal life) and the duration the policy has been active, plays a significant role in the surrendering process. It's essential to consider any potential surrender charges, which can diminish the cash payout, as well as the tax implications on the amount received, particularly for gains exceeding the total premiums paid. Understanding these aspects ensures informed decision-making during the surrendering of a life insurance policy, affecting one's financial landscape.

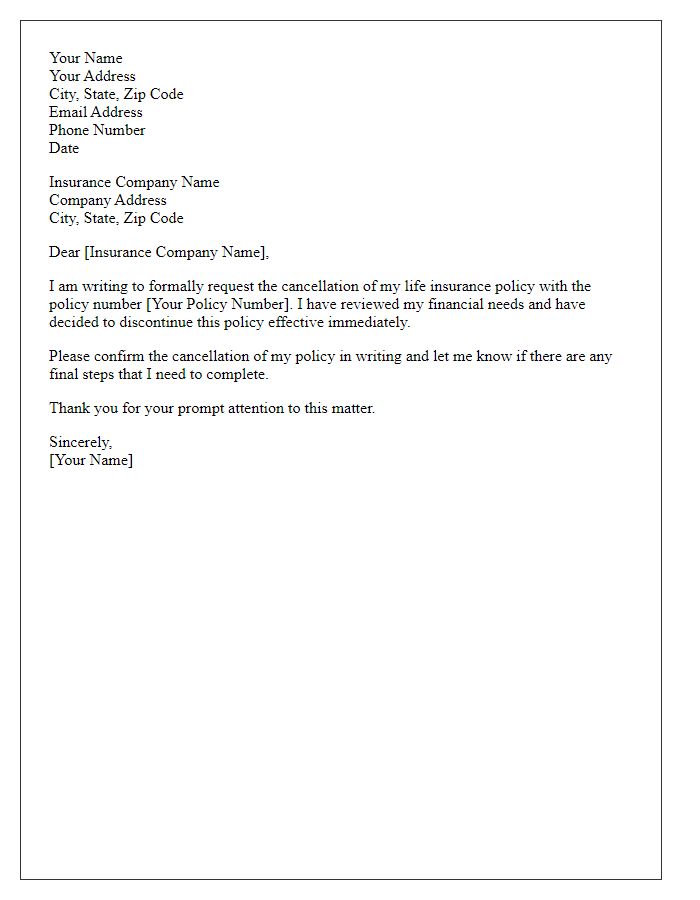

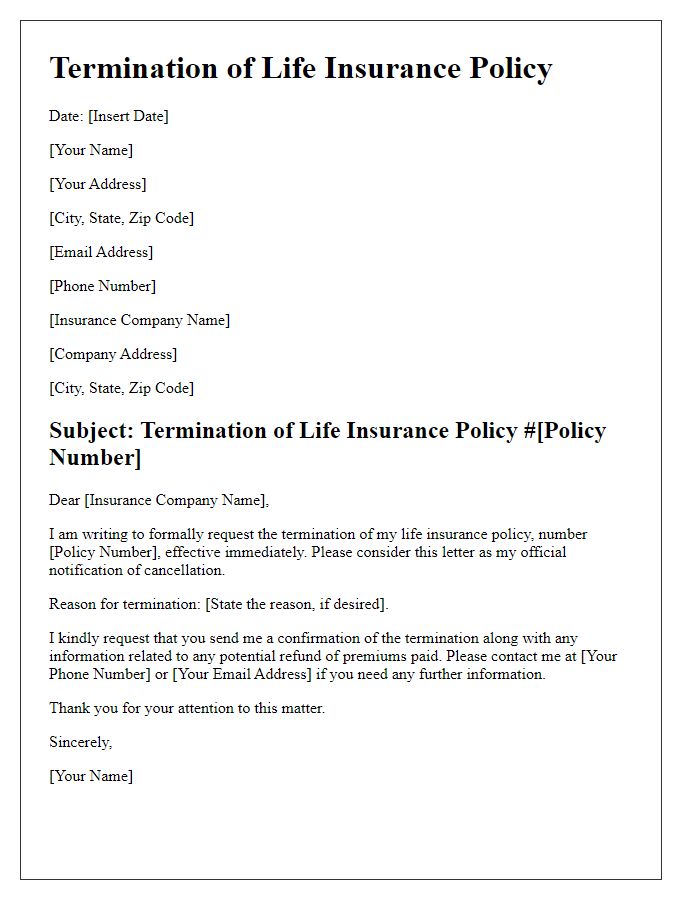

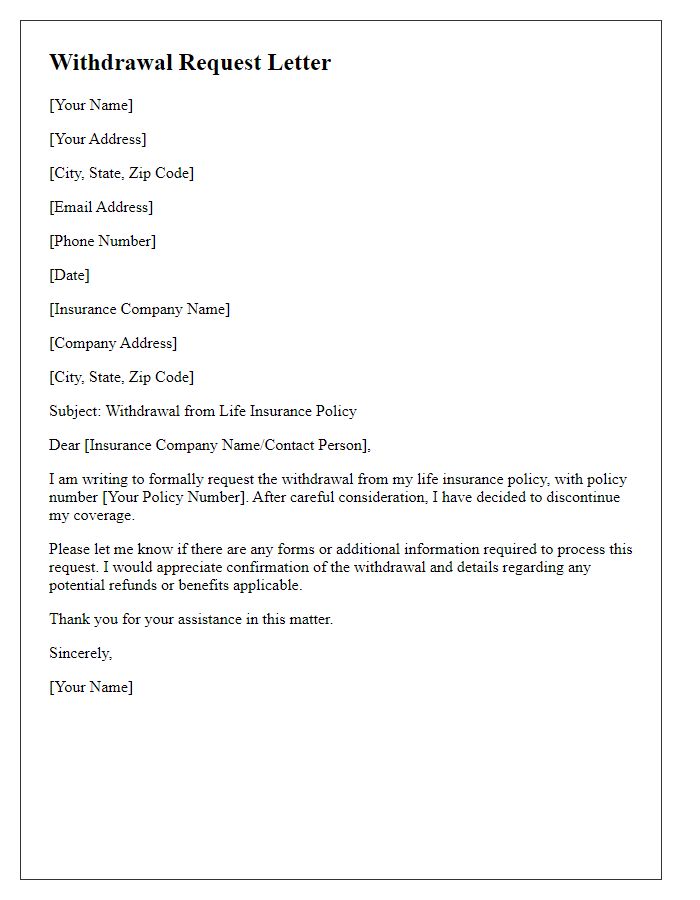

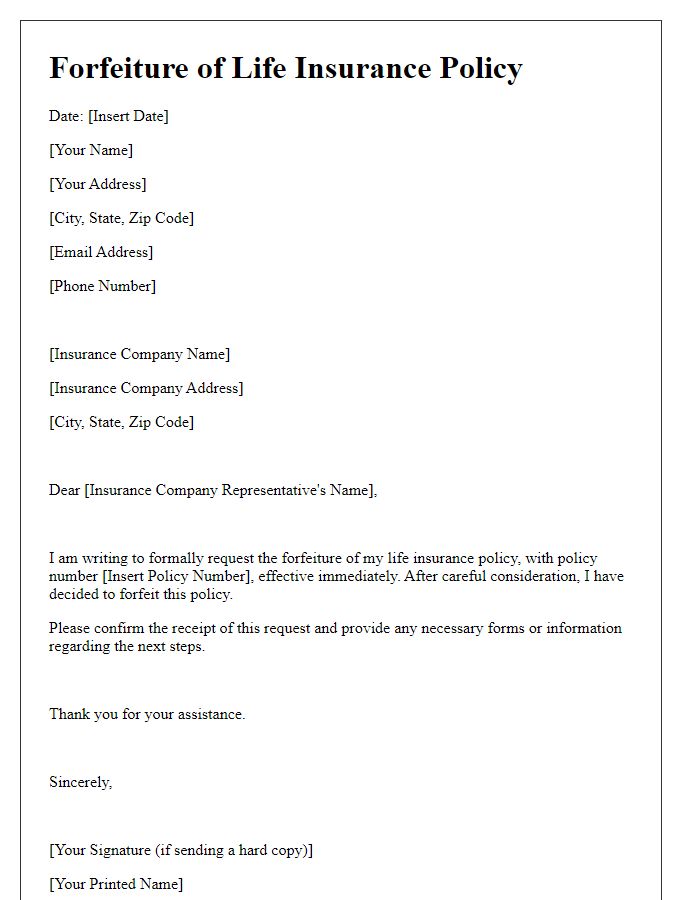

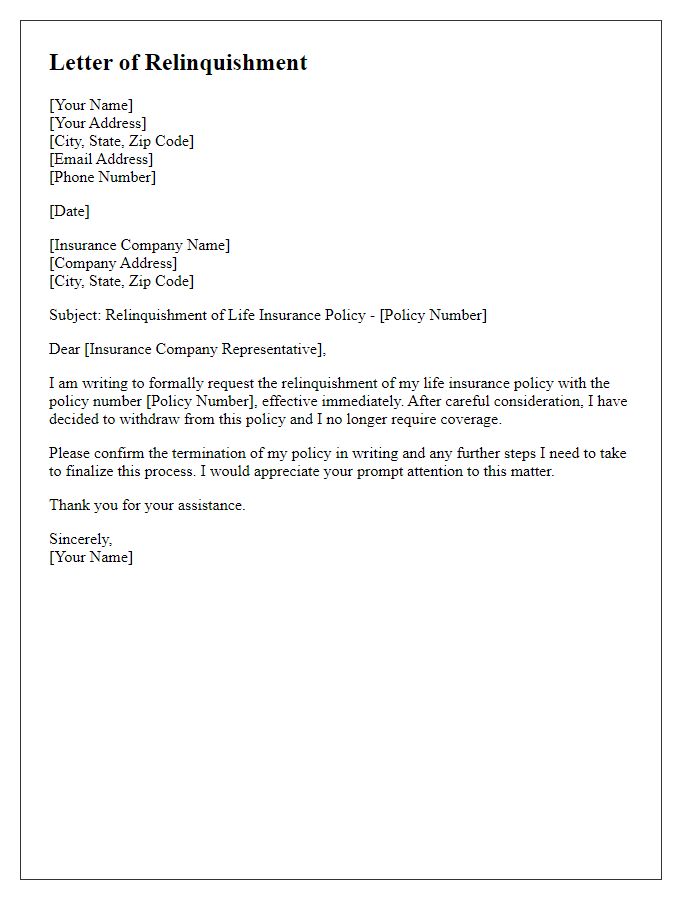

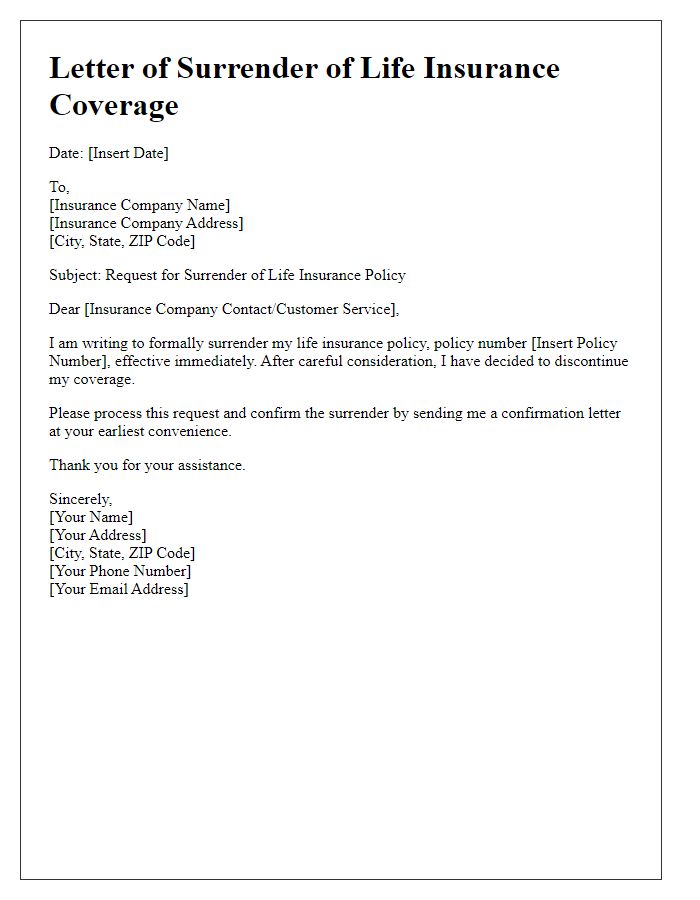

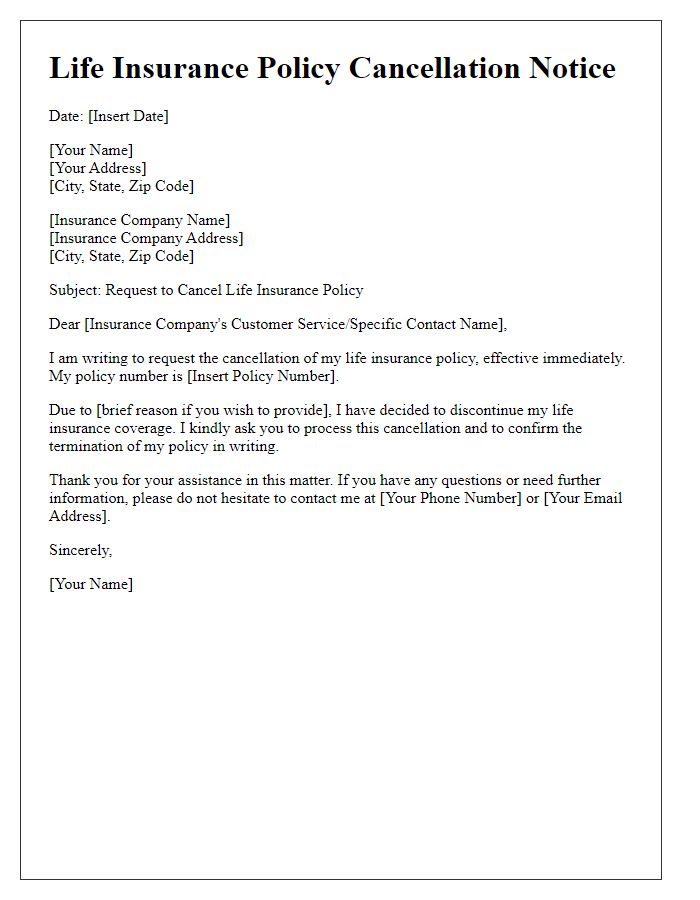

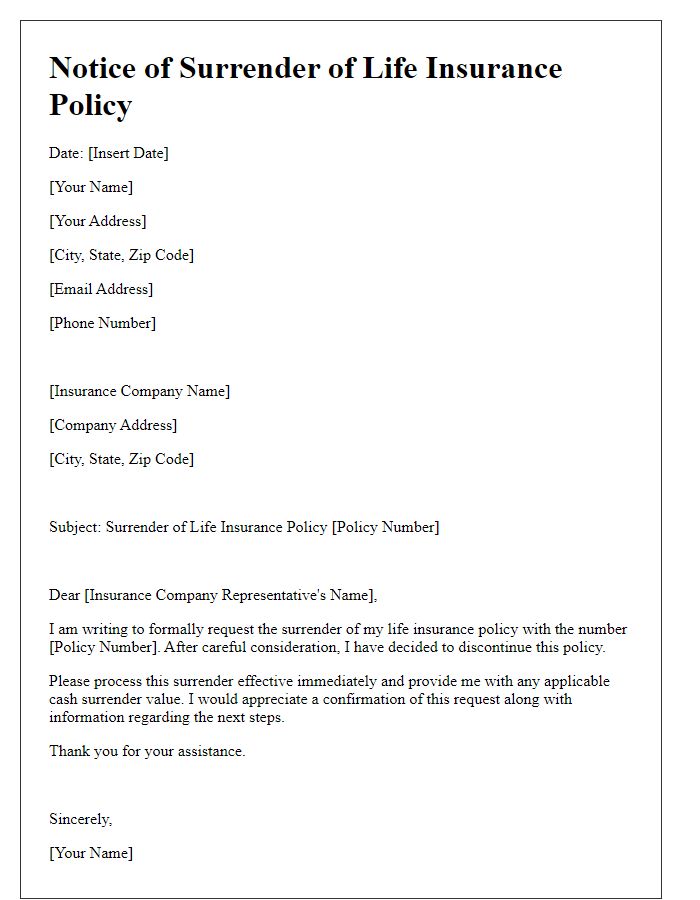

Surrender Request Statement

Surrendering a life insurance policy entails formally communicating the desire to terminate the insurance coverage and receive any potential cash value accumulated in the policy. The policyholder must identify crucial details, including their policy number, the issuing insurance company, and the effective date of the policy. Policyholders should express their intentions clearly, ensuring to provide relevant identification details. Thorough understanding of the financial implications, such as cash surrender values, potential tax ramifications, and penalties associated with early surrender is essential. Notifying the insurance provider through a written statement is crucial to expedite the surrender process. These actions guarantee that both parties have a clear understanding of the termination of the life insurance contract.

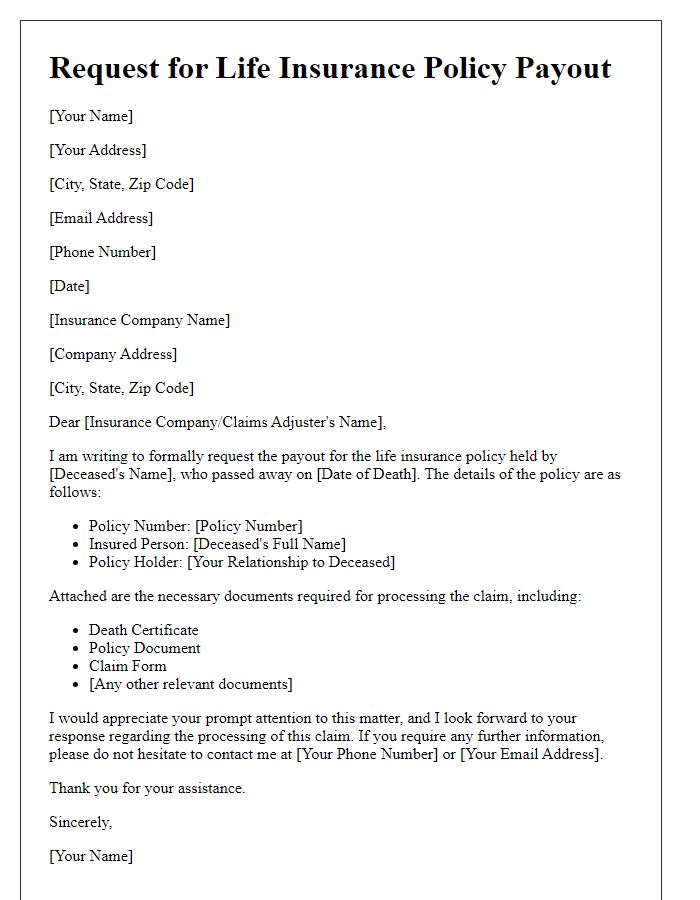

Payment Instructions

Surrendering a life insurance policy involves a series of steps that can impact the financial status of the policyholder. To initiate this process, the policyholder needs to provide specific payment instructions to ensure the prompt and accurate handling of any cash value associated with the policy. Often, the insurance company's headquarters, such as those located in major financial centers like New York or Chicago, will require the policyholder to submit a written request detailing the policy number and personal identification information. Payments are usually processed via direct deposit, check, or wire transfer, and the expected timeframe for processing can vary significantly depending on the insurer's policies--typically ranging from a few days to several weeks. Understanding the tax implications is also crucial, as surrendering a policy may have consequences that impact the policyholder's financial standing and tax filings.

Contact Information

When surrendering a life insurance policy, policyholders must consider various critical elements such as the insurance company's name, policy number, and personal identification details. The contact information should include the policyholder's full name, address (street name, city, state, zip code), phone number, and email address to ensure efficient processing. Including the insurance provider's customer service contact number and mailing address (specific to policy surrender requests) facilitates communication and expedites the surrender process. Additionally, it is important to state the policy's effective date and the reason for surrender to streamline the transaction.

Comments