Navigating the world of commercial auto insurance claims can often feel overwhelming, but it doesn't have to be. In this article, we'll break down the essentials of writing a letter for your commercial auto insurance claim, making the process straightforward and manageable. Whether you're addressing an accident, theft, or damage, we'll guide you through each step to ensure your letter captures all necessary details. Ready to streamline your claim process? Let's dive in!

Policyholder Information

Policyholders of commercial auto insurance, such as small business owners or fleet operators, must provide crucial details for a seamless claims process. Essential information includes the policy number, typically a series of digits assigned at issuance, and the effective date of coverage, which signifies the initiation date of insurance protection, often indicated in MM/DD/YYYY format. The name of the policyholder, representing the individual or business entity insured, is critical, along with the contact information, comprising a valid phone number and email address for communication. Additionally, the vehicle identification number (VIN) is vital for accurately identifying the vehicle involved in the incident, ensuring correct claims processing. Other pertinent details may include the type of business, the primary use of the vehicle, and any additional drivers covered under the policy, which could impact claim outcomes.

Incident Details

A commercial auto insurance claim requires detailed documentation of incident specifics. The event occurred on September 15, 2023, near the intersection of Fifth Avenue and Maple Street in Springfield, during a rainy afternoon, which contributed to visibility issues. The insured vehicle, a 2021 Ford Transit, collided with another vehicle, a 2018 Toyota Camry, causing significant damage. The Ford Transit sustained an estimated $7,500 in repairs due to a crushed front bumper and a shattered windshield. The incident involved two parties, with the driver of the Toyota Camry reporting minor injuries, leading to medical consultations. Police report number 456789 was filed at Springfield Police Department, providing an official record of the event for validation. All relevant parties exchanged contact and insurance details, ensuring compliance with state regulations pertaining to accidents.

Vehicle Information

When filing a commercial auto insurance claim, providing comprehensive vehicle information is crucial for a smooth claims process. Essential details include the vehicle make, model, and year, such as a 2020 Ford Transit, which plays a significant role in determining coverage specifics. The vehicle identification number (VIN), a unique 17-character code, helps to verify ownership and registration status. Additionally, it is important to include the license plate number and current mileage, which could influence the assessment of wear and tear. Finally, mentioning any modifications or customizations, such as a fitted cargo rack or specialized refrigeration unit, can affect the claim.

Description of Damages

In a commercial auto accident case, the damages incurred can significantly impact the operational capacity of a business. The vehicle, a 2022 Ford Transit Van used for daily deliveries, sustained extensive body damage, particularly to the front bumper and left side panel, with an estimated repair cost of $4,500. The accident occurred on Main Street near the Central Business District on March 5, 2023, when another vehicle collided with the van in a rear-end collision. As a result of the impact, the van's rear doors are now misaligned, hindering access to the cargo area, which disrupts delivery schedules. Additionally, the incident caused damage to the integrated navigation system, with replacement costs estimated at $1,200. These damages not only impede daily operations but also lead to potential loss of business revenue due to delays in service.

Contact Information

In a commercial auto insurance claim, contact information plays a crucial role in ensuring seamless communication and swift resolution. Essential details include the business name, which identifies the entity involved, along with the policy number, a unique identifier for the insurance coverage. Also necessary are the contact person's name, providing a direct point of communication, followed by the phone number and email address, facilitating prompt responses. Additionally, the mailing address of the business, typically a physical location where correspondence can be sent, ensures that all relevant documents and notifications reach the intended recipients without delay. Accurate contact information streamlines the claims process, enabling insurers and claimants to remain coordinated throughout the resolution efforts.

Letter Template For Commercial Auto Insurance Claim Samples

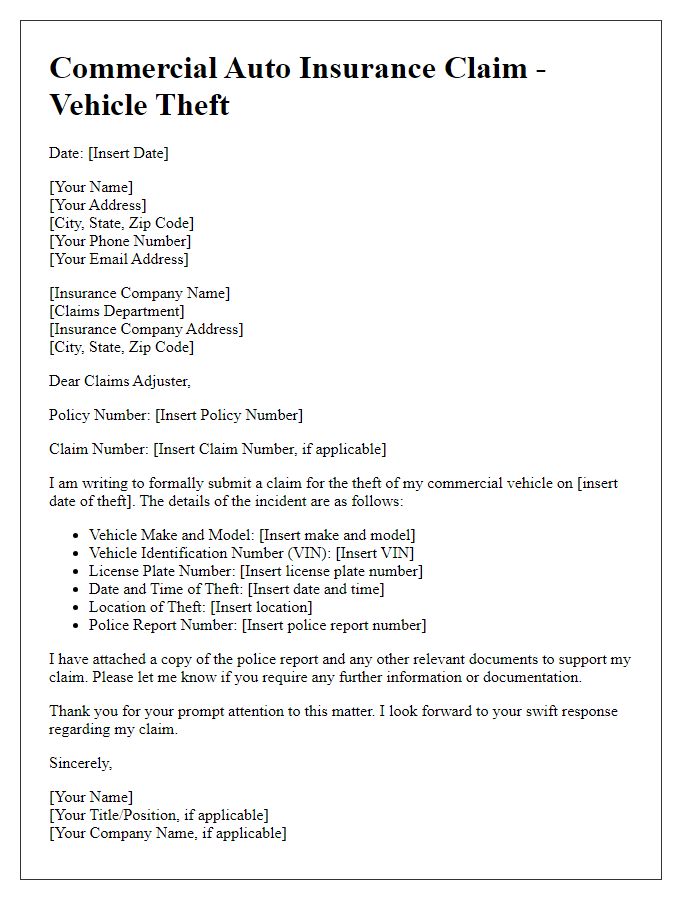

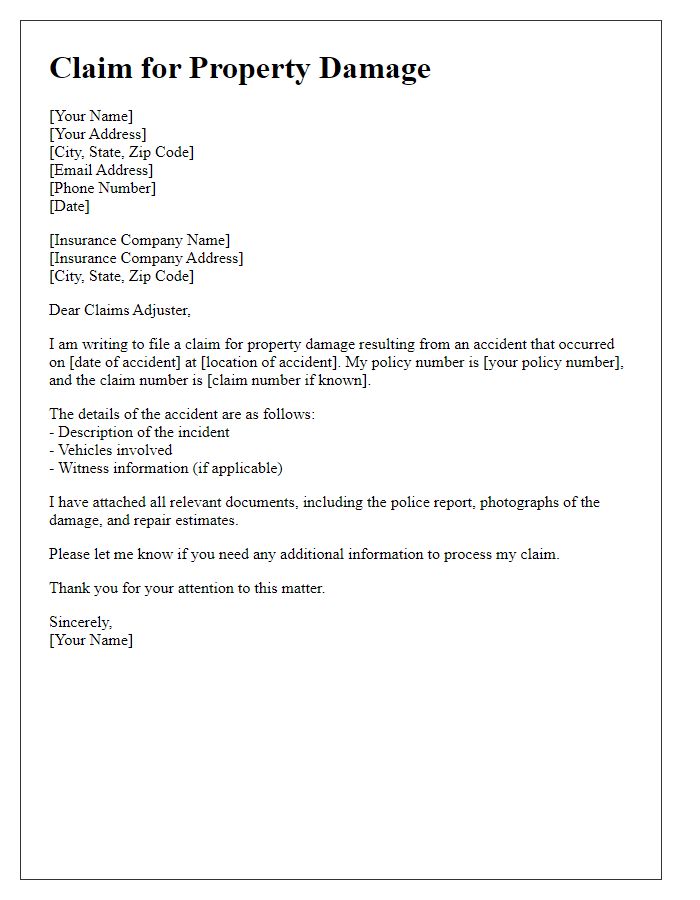

Letter template of commercial auto insurance claim for theft of vehicle.

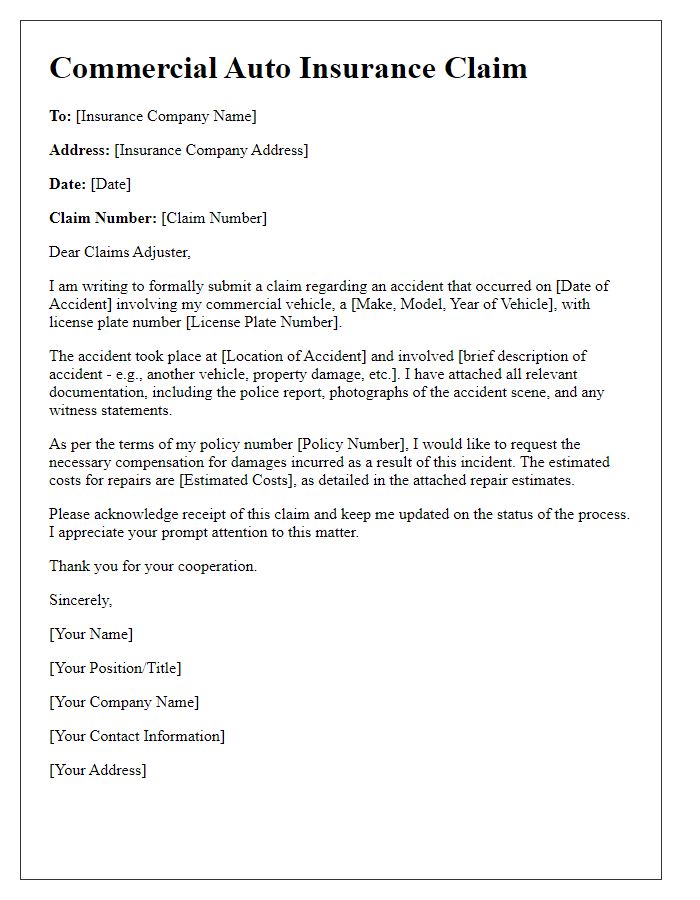

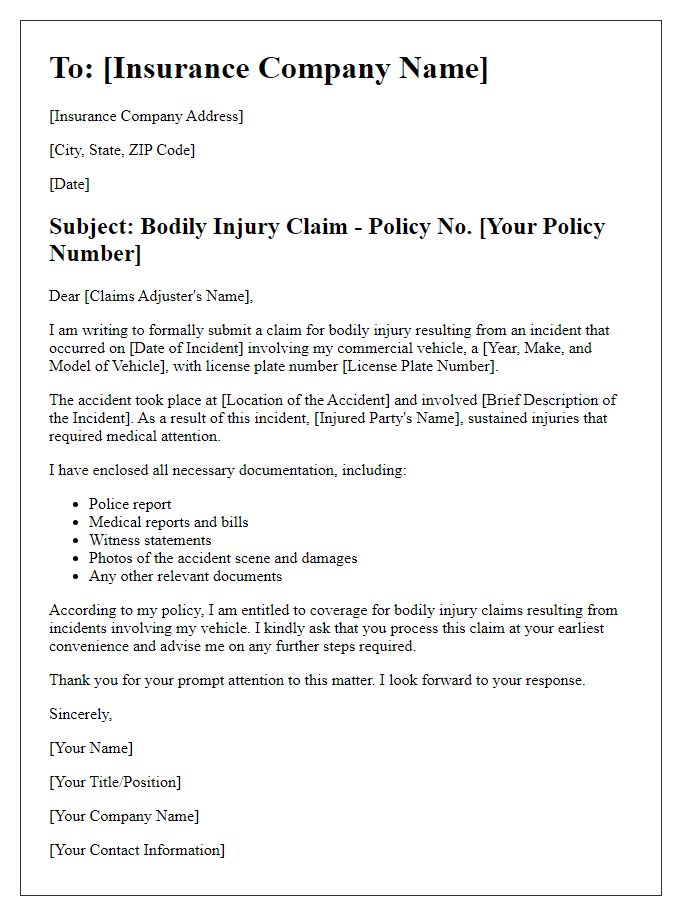

Letter template of commercial auto insurance claim for accident liability.

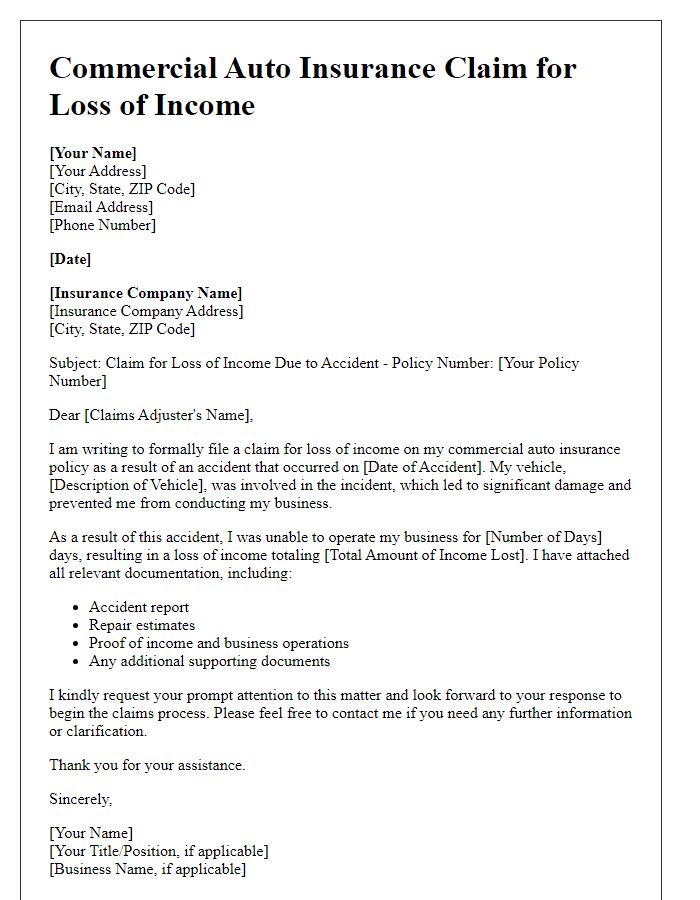

Letter template of commercial auto insurance claim for loss of income due to accident.

Letter template of commercial auto insurance claim for vehicle repair costs.

Letter template of commercial auto insurance claim for collision coverage.

Letter template of commercial auto insurance claim for uninsured motorist incident.

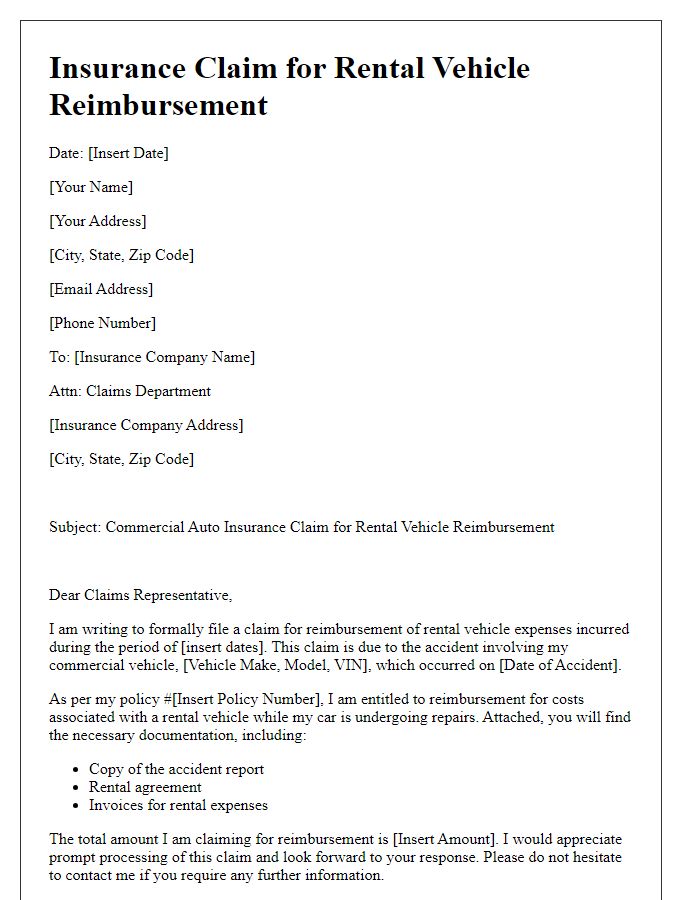

Letter template of commercial auto insurance claim for roadside assistance reimbursement.

Comments