Have you ever found yourself in that anxious moment when you realize your insurance policy might have lapsed? It can be a confusing time, especially if you're trying to understand the implications it has on your coverage. In this article, we'll navigate through the details of insurance lapses, what they mean, and how you can address them. So, if you're eager to learn more about ensuring your coverage stays intact, keep reading!

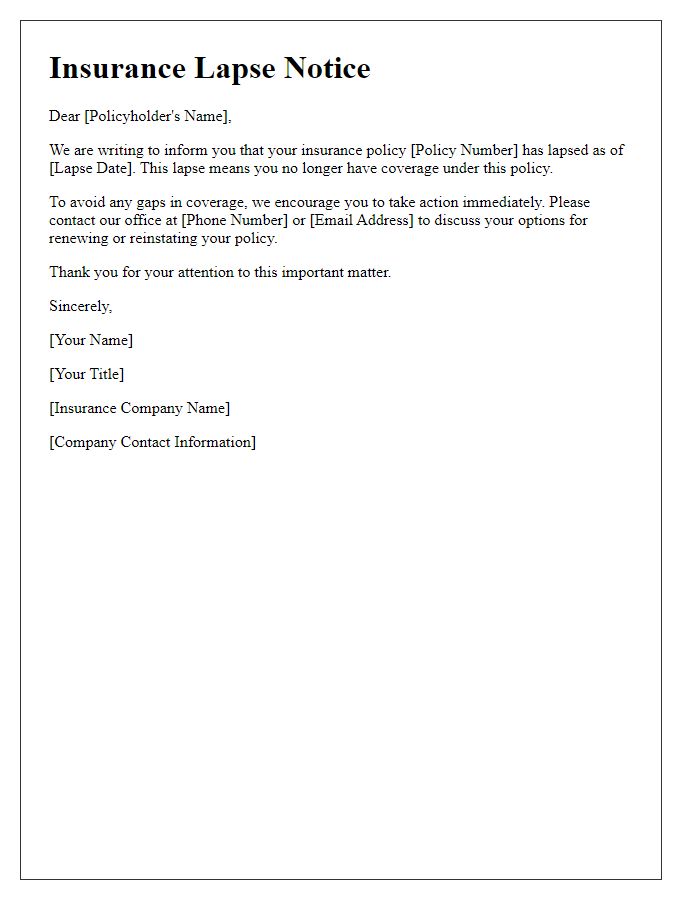

Policyholder Information

A confirmation of insurance lapse letter should include specific details to clarify the situation. Policyholder information typically consists of the policyholder's full name, policy number, and contact information. Important dates should be included, such as the date the policy was initially effective, the lapse date, and any relevant grace periods. It is also beneficial to outline coverage details, the consequences of the lapse, and action steps for policy reinstatement. Clear communication of itemized amounts due, like premium payments, enhances understanding. The document needs to reflect the issuing insurance company's official stamp or signature to maintain authenticity.

Policy Details

Insurance policy lapses occur when premium payments are missed, affecting coverage. Affected policies, such as life insurance or auto insurance, may have grace periods, typically ranging from 30 to 60 days. Policy numbers, like 123456789, and specific dates, such as the last payment on October 1, 2023, are crucial for accuracy. Insurers, including major firms like Allstate or State Farm, usually notify clients via email or postal mail. Upon confirmation of lapse, clients may have options to reinstate coverage, often requiring payment of back premiums within a stipulated timeframe. Understanding the implications of a lapse is essential to avoid potential financial risks and maintain coverage continuity.

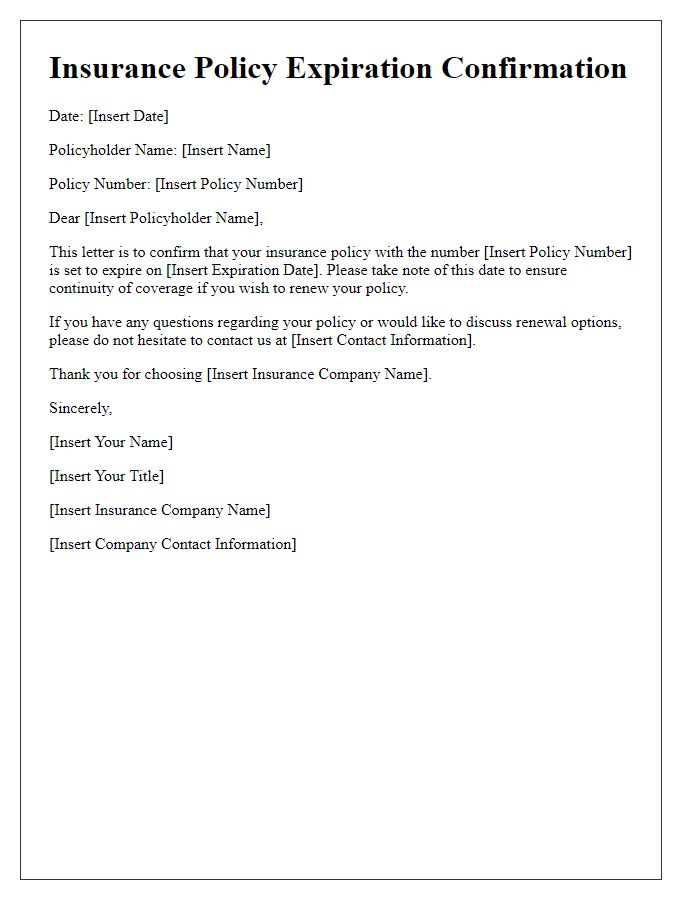

Effective Date of Lapse

Insurance policies can undergo lapses, which can significantly affect coverage continuity. A lapse in insurance, often due to non-payment, may occur as early as a month after the due date, depending on the insurer's grace period--typically ranging from 10 to 30 days. The Effective Date of Lapse indicates the specific day the coverage ceases, which may have financial implications and lead to potential liability if an incident occurs during the lapse. Policyholders should carefully monitor billing statements and reminders sent by insurance providers to prevent lapses and maintain essential protections in areas such as auto, health, or home insurance.

Reason for Lapse

An insurance lapse occurs when a policyholder fails to make premium payments, resulting in the temporary loss of coverage. Common reasons for this lapse include unexpected financial hardships, personal emergencies, or simple oversight. Policyholders may experience an accidental lapse if they mistakenly overlook the due date for premium payment, which can happen amidst busy schedules or significant life changes. In some instances, policyholders may intentionally choose to let their insurance lapse due to dissatisfaction with the policy's terms or benefits. It's essential for policyholders to be aware of grace periods provided by insurance companies that allow them to reinstate coverage without penalties, typically within 30 days after the missed payment.

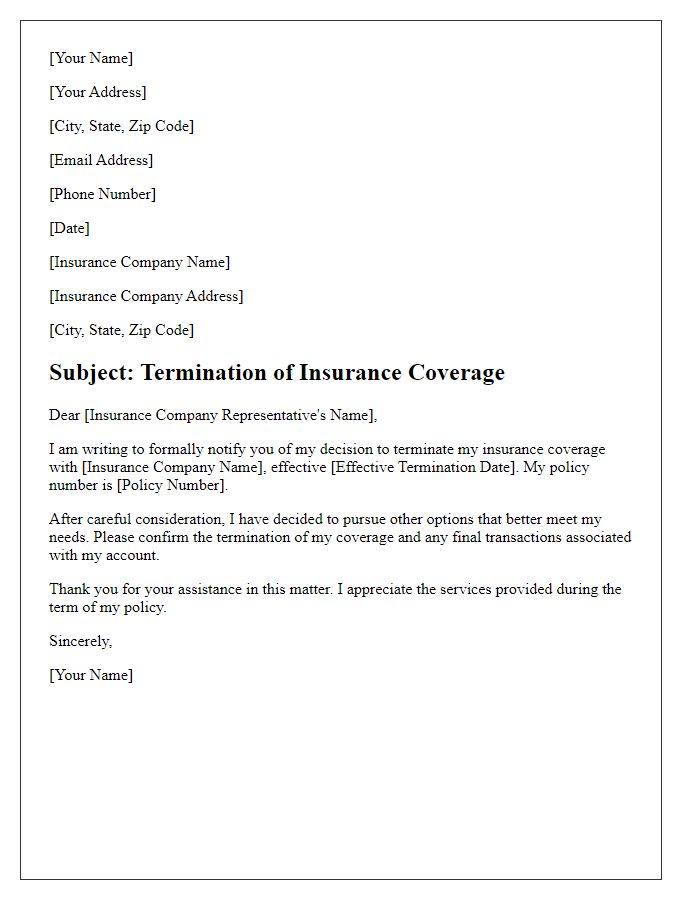

Contact Information for Queries

In insurance policies, a lapse occurs when premium payments are overdue, leading to the termination of coverage. For example, health insurance plans in the United States, such as those managed by Aetna or Blue Cross Blue Shield, allow a grace period of 30 days for premium payments, after which the policy may lapse. Lapsed coverage means that the insured parties may face significant financial risks, especially in events like accidents or medical emergencies. To address any queries regarding lapsed insurance policies, customers are encouraged to contact the service representatives at 1-800-123-4567 or reach out via email at support@insurancecompany.com. It is crucial to rectify lapses promptly to avoid gaps in coverage and maintain protections against unforeseen events.

Comments