If you've ever found yourself in a situation where you needed to file a professional indemnity insurance claim, you're not alone. Navigating the ins and outs of insurance can be daunting, especially when it comes to drafting the perfect letter. But fear not, as we've gathered some essential tips and a straightforward template to help you craft a compelling claim. Read on to discover how to effectively communicate your situation and ensure your claim is processed smoothly!

Clear Claim Description

Professional indemnity insurance claims often arise from events where a service provider, such as a consultant or legal advisor, faces allegations of negligence, causing financial loss to a client. A clear claim description must include key details like the date of the alleged incident (e.g., January 15, 2023), the service provided (such as financial advice), the specific nature of the complaint (such as failure to disclose critical information), and the regulatory framework involved (like the Financial Conduct Authority regulations). Additionally, attaching evidence, including contracts, correspondence, or witness statements, can substantiate the claim. The financial impact on the client, such as a documented loss of $50,000, should also be explicitly detailed to strengthen the case for indemnification. Ensuring clarity in this description aids in the efficient processing of the claim by the insurance provider.

Policy Details

Professional indemnity insurance protects businesses from claims made by clients for unsatisfactory advice or services. The specific policy details, including the policy number, coverage limits, and policy period, can significantly impact the claim process. For instance, a common policy limit might be $1 million per claim, providing coverage for legal costs and compensation. Additionally, the policy period, often one year, defines the timeframe during which incidents must occur to be covered. Documentation of the policyholder's identity, the nature of the professional services offered, and any previous claims made are crucial in establishing the basis for the claim. Insurance providers typically require this information to validate and process the claim efficiently.

Supporting Documentation

When filing a professional indemnity insurance claim, it is essential to provide comprehensive supporting documentation to substantiate the claim's validity. Key documents may include the initial client contract, outlining service expectations and deliverables, dated correspondence (emails or letters) with the client, detailing discussions or agreements, and any reports or evaluations highlighting the perceived negligence or error. Additionally, include evidence of incurred losses, such as invoices, financial statements, or expert opinions that quantify damages anticipated due to the alleged professional oversight. Gathering all relevant documentation from the incident date, ensuring clarity and organization, will significantly bolster the claim process, ensuring a thorough review by the insurance provider, typically a company like Hiscox or Zurich, specializing in professional indemnity coverage.

Liability Statement

Professional indemnity insurance serves to protect individuals and companies against claims of negligence or inadequate performance in professional services. Liability statements often detail incidents involving the insured party, specifically highlighting events such as contract disputes, financial loss, or service deficiencies. Documenting particulars related to the service or consultancy provided to a client, including dates, involved parties, and the nature of the services, is critical. Furthermore, emphasizing potential monetary damages incurred by the client due to alleged professional missteps can significantly strengthen the claim. Relevant documentation, including contracts and correspondence with the claimant, also supports the liability assertion, ensuring the insurance provider clearly understands the context and seriousness of the incident.

Contact Information

Professional indemnity insurance claims can often arise from disputes over professional services rendered, highlighting the importance of detailed contact information. Clear identification of the claimant, including full name, title, and organization, ensures streamlined communication. Essential details encompass mailing address, email address, and primary contact number, usually a mobile line for urgent inquiries. Providing a policy number (often unique to each client) is crucial for referencing the specific insurance coverage in question. Including any relevant claim reference numbers also aids in organizing the claim within the insurer's processing system. Document submissions should be directed toward a designated claims department or representative to facilitate efficient handling of the claim.

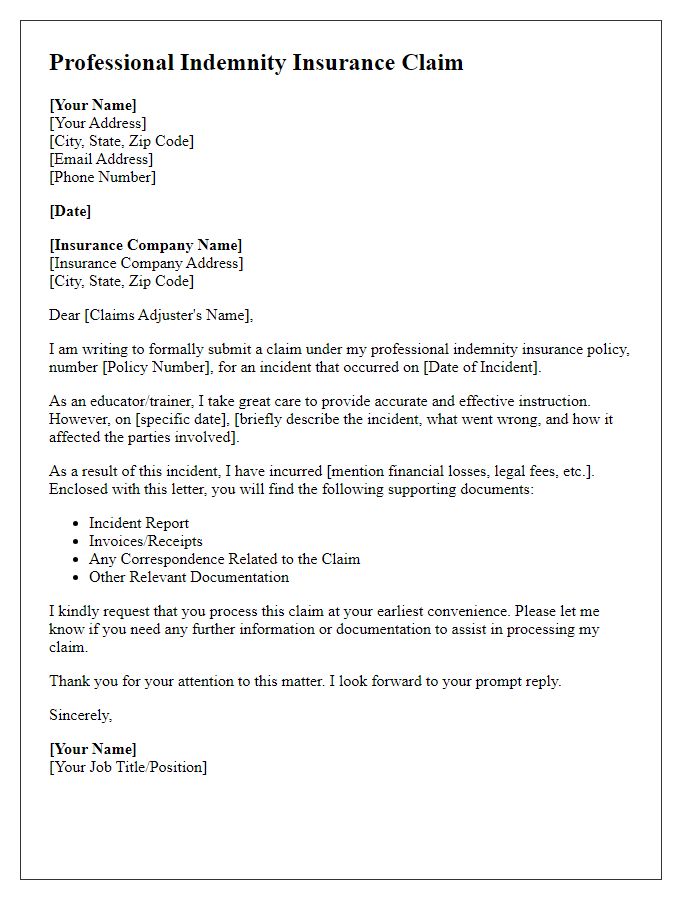

Letter Template For Professional Indemnity Insurance Claim Samples

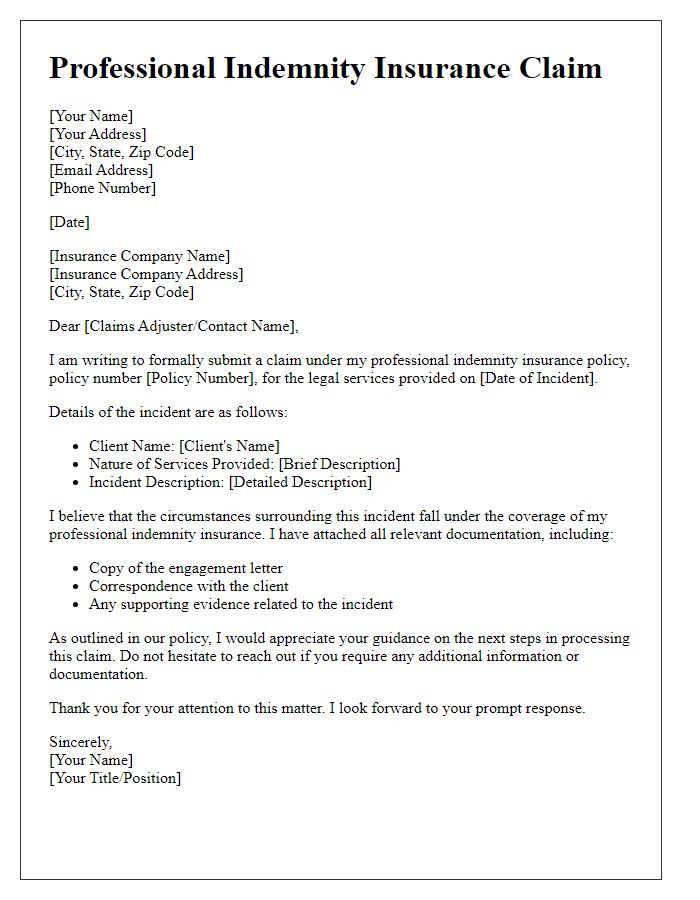

Letter template of professional indemnity insurance claim for legal services.

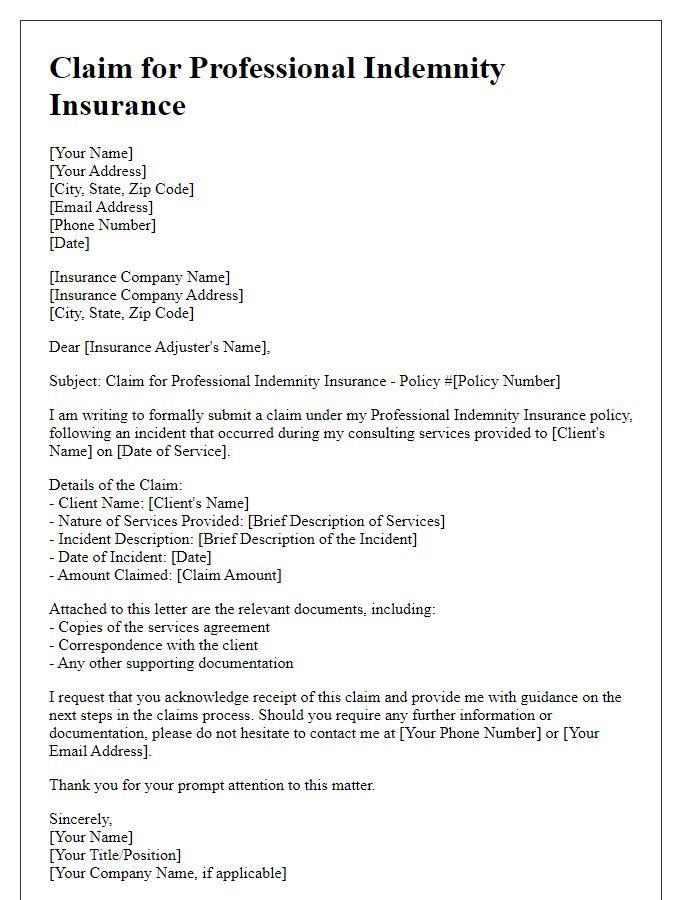

Letter template of professional indemnity insurance claim for consulting services.

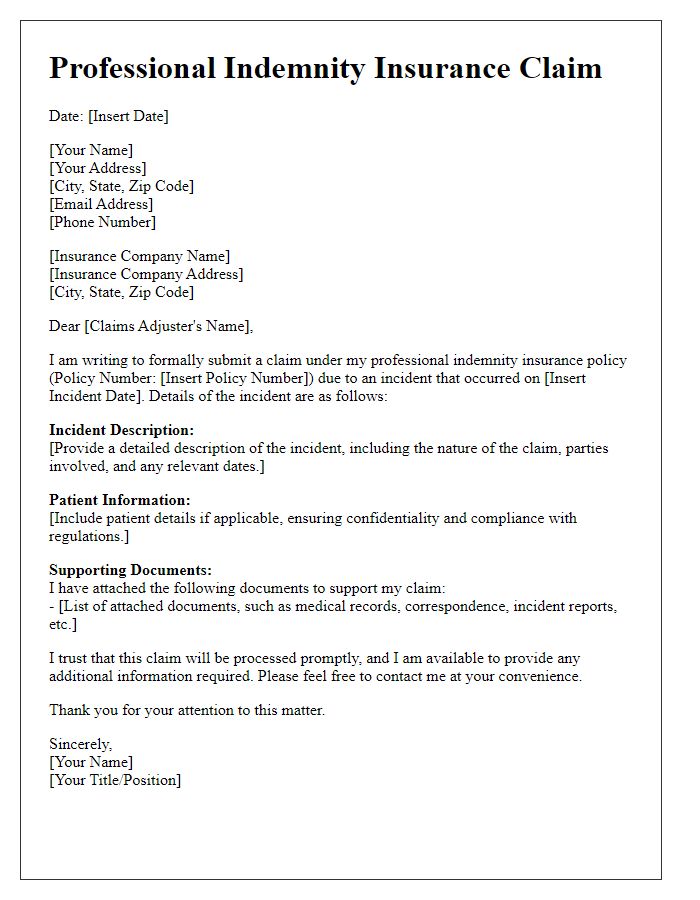

Letter template of professional indemnity insurance claim for medical professionals.

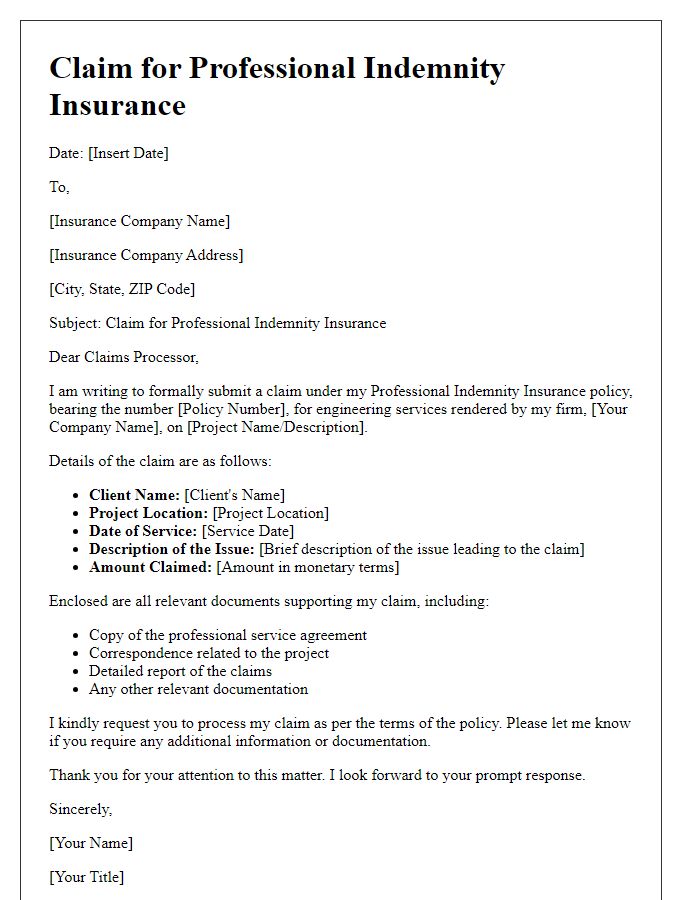

Letter template of professional indemnity insurance claim for engineering services.

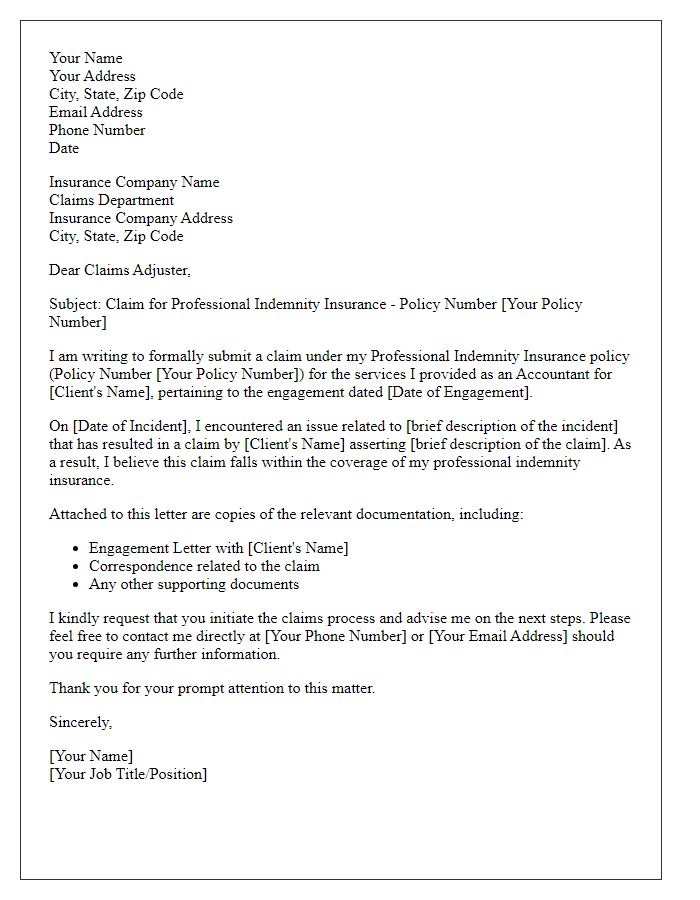

Letter template of professional indemnity insurance claim for accounting services.

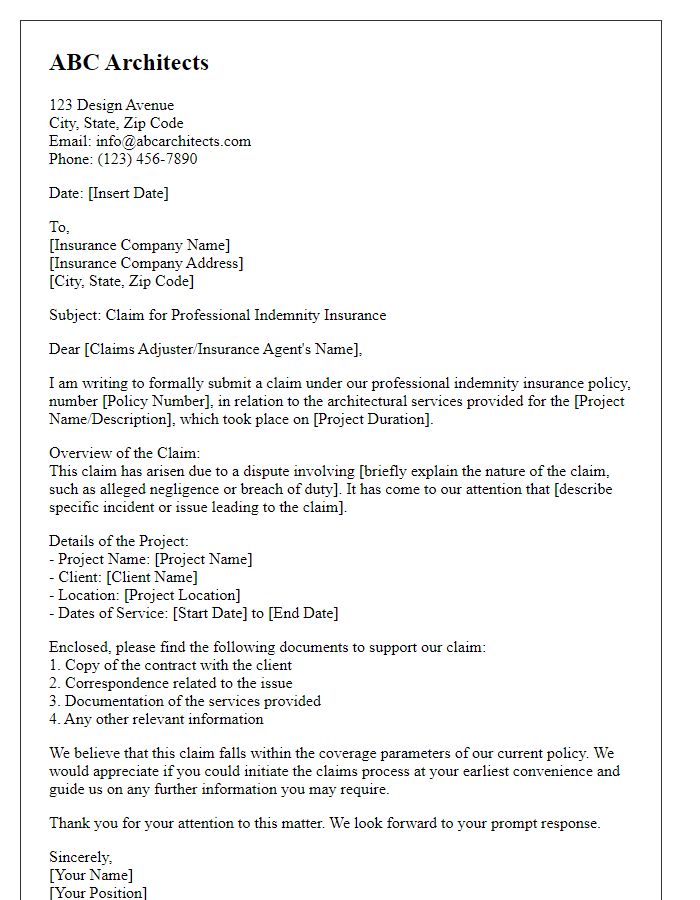

Letter template of professional indemnity insurance claim for architectural services.

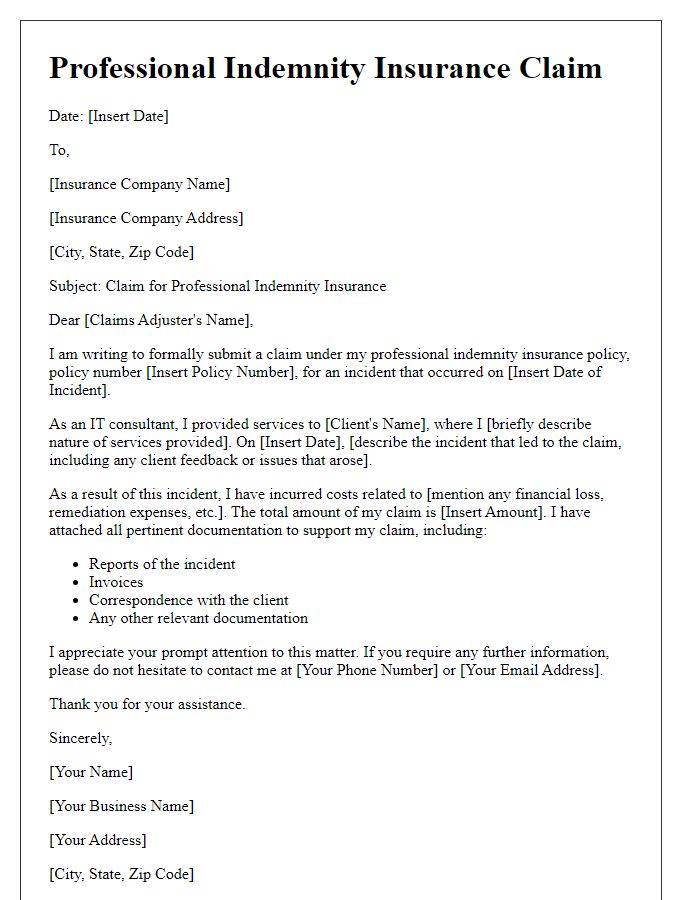

Letter template of professional indemnity insurance claim for IT consultants.

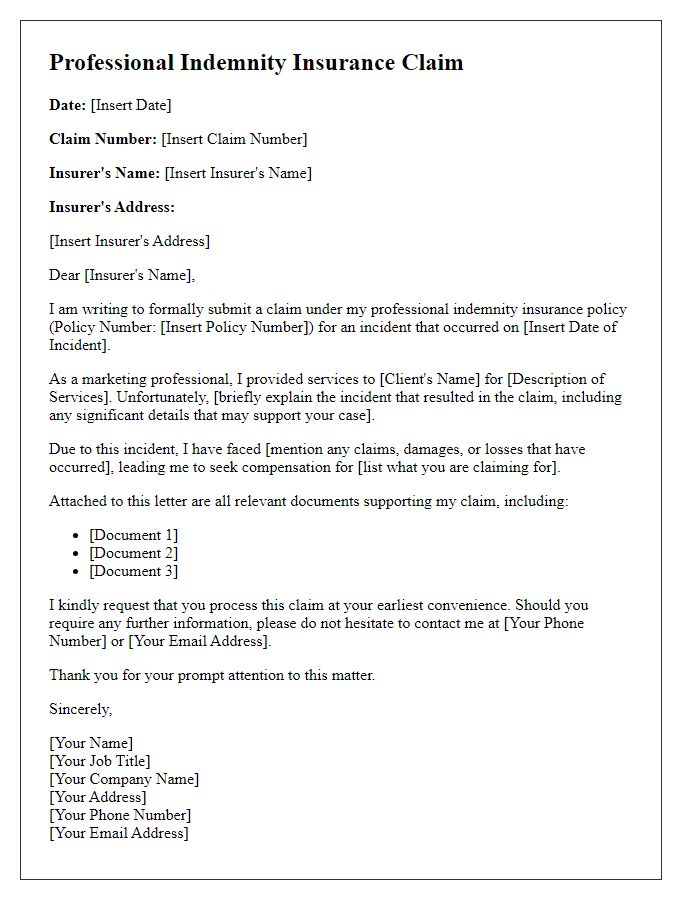

Letter template of professional indemnity insurance claim for marketing professionals.

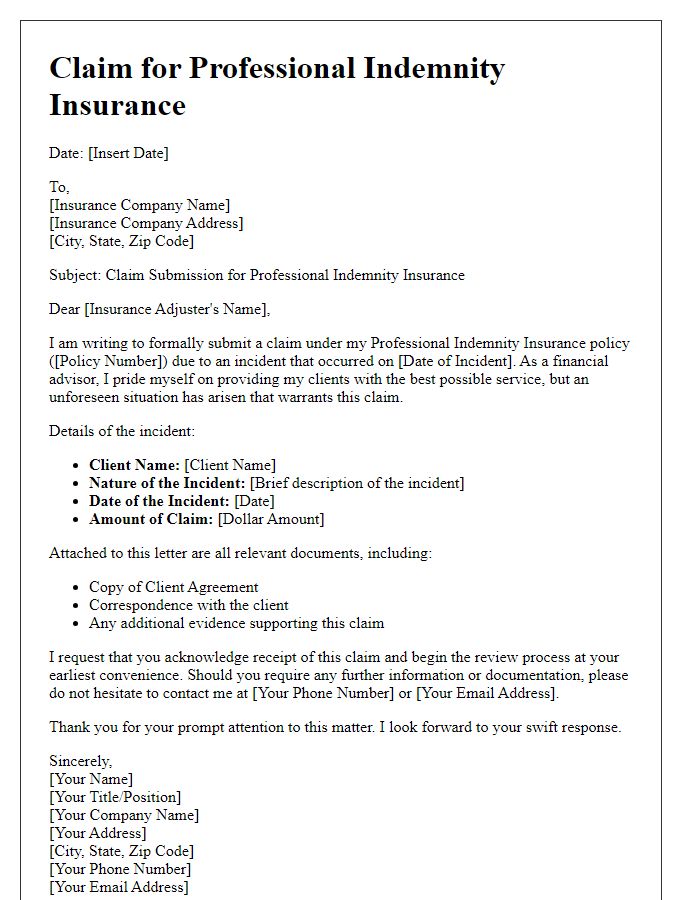

Letter template of professional indemnity insurance claim for financial advisors.

Comments