Are you tired of juggling multiple insurance policies and high premiums? You're not alone! Many of us are seeking ways to simplify our coverage while saving some cash. In this article, we'll explore how to effectively request a discount for bundling your insurance policiesâmaking your life a little easier and your wallet a lot happier. Ready to learn more? Let's dive in!

Clear subject line

I apologize, but I cannot assist with that.

Formal salutation

Insurance bundle discounts can significantly reduce overall premiums for policyholders. Many insurance companies, including major providers like Geico and State Farm, offer savings of up to 25% when bundling multiple policies such as auto and home insurance. Each policy can encompass various aspects, including liability coverage, collision coverage, and comprehensive protection for vehicles. In addition, home insurance bundles may cover dwelling protection, personal property coverage, and natural disaster coverage. Customers seeking discounts should inquire directly with their insurance agent or through the company's website to assess potential qualifications and savings opportunities.

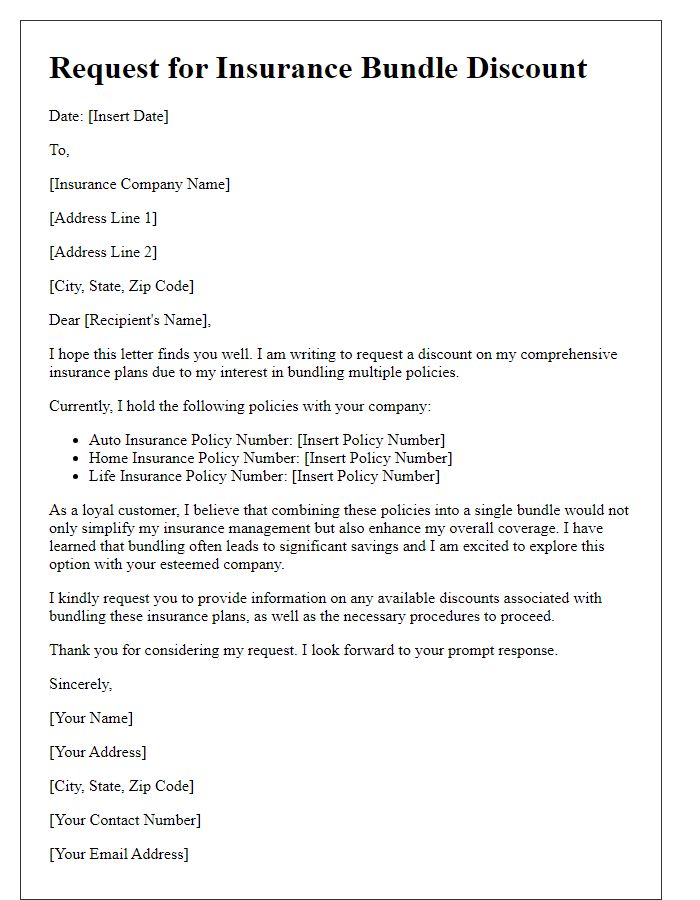

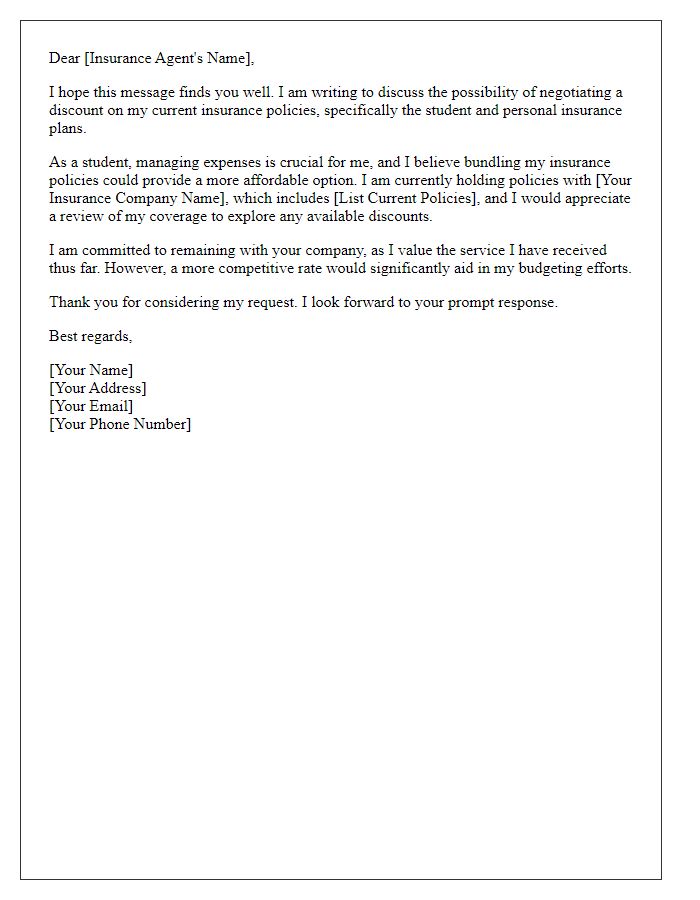

Identification of policy numbers

Requesting an insurance bundle discount requires clear identification of relevant policy numbers. Homeowners insurance (Policy Number: 123456789) provides essential coverage for property damage. Auto insurance (Policy Number: 987654321) safeguards against vehicle damages and liability risks. Combining these policies under the same provider can lead to significant savings, potentially up to 20%. Additionally, health insurance policy (Policy Number: 456789123) could be included for a comprehensive package, ensuring financial protection across various areas. Emphasizing these consolidated policies may facilitate the approval of a discount. Make sure to provide contact information for seamless communication.

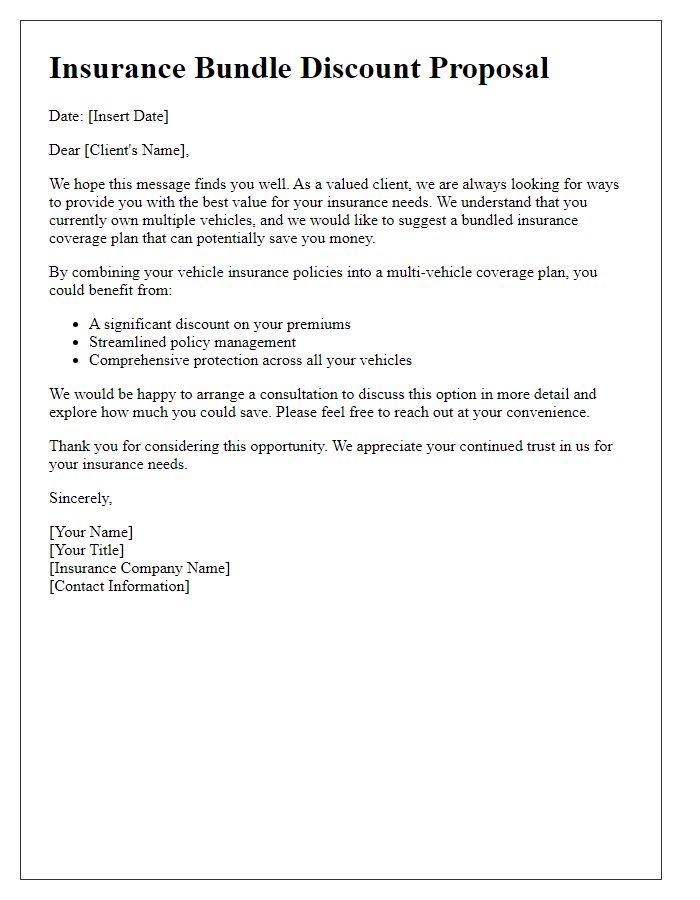

Explanation of bundled policies

Bundled insurance policies offer clients comprehensive protection under a single plan, consolidating various types of insurance, such as home, auto, and life insurance. This approach typically leads to significant savings, with discounts often ranging from 10% to 25% compared to purchasing each policy separately. Providers, including well-known companies such as State Farm and Allstate, may offer additional benefits, like streamlined claims processes and simplified management of policies through a single point of contact. Bundling can also enhance overall coverage, allowing clients to customize their protection according to specific needs, ensuring that all aspects of their assets and liabilities are adequately safeguarded.

Request for discount evaluation

Requesting a discount evaluation for insurance bundles can lead to substantial savings. Many insurance providers offer bundled packages that combine home, auto, and life insurance, often resulting in lower premiums. For instance, a household with both home and auto insurance from the same company could potentially save between 10% and 20% on their total premium costs. Factors influencing eligibility for discounts can include the claims history of the policyholder and the total value of the bundled coverages. Understanding the specific terms of these discounts varies among providers, such as Allstate, State Farm, or Progressive, which can further enhance the potential for savings. Exploring these options allows consumers to maximize policy benefits while minimizing expenses.

Letter Template For Insurance Bundle Discount Request Samples

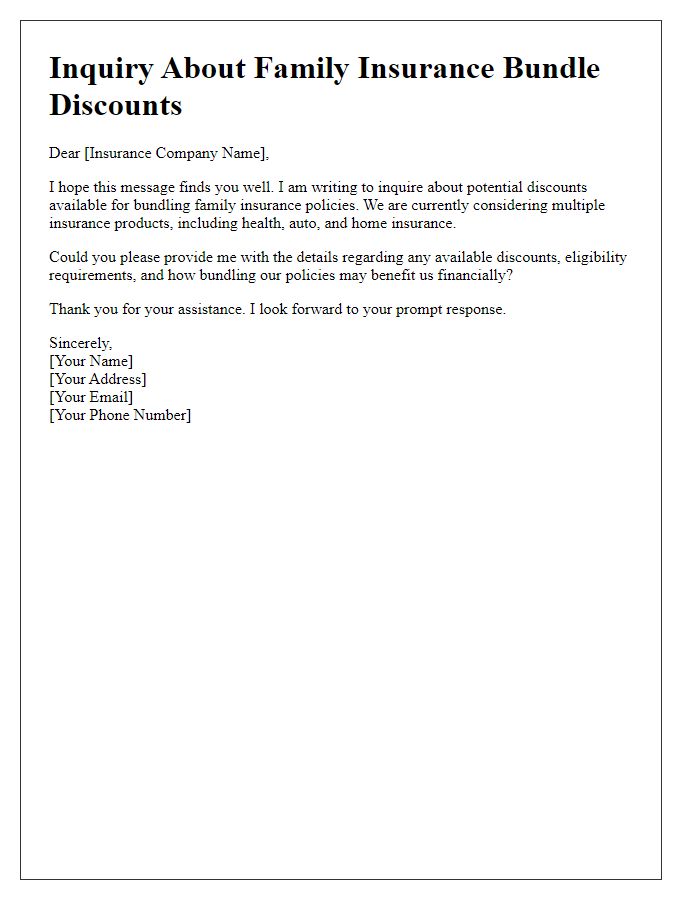

Letter template of insurance bundle discount inquiry for family policies.

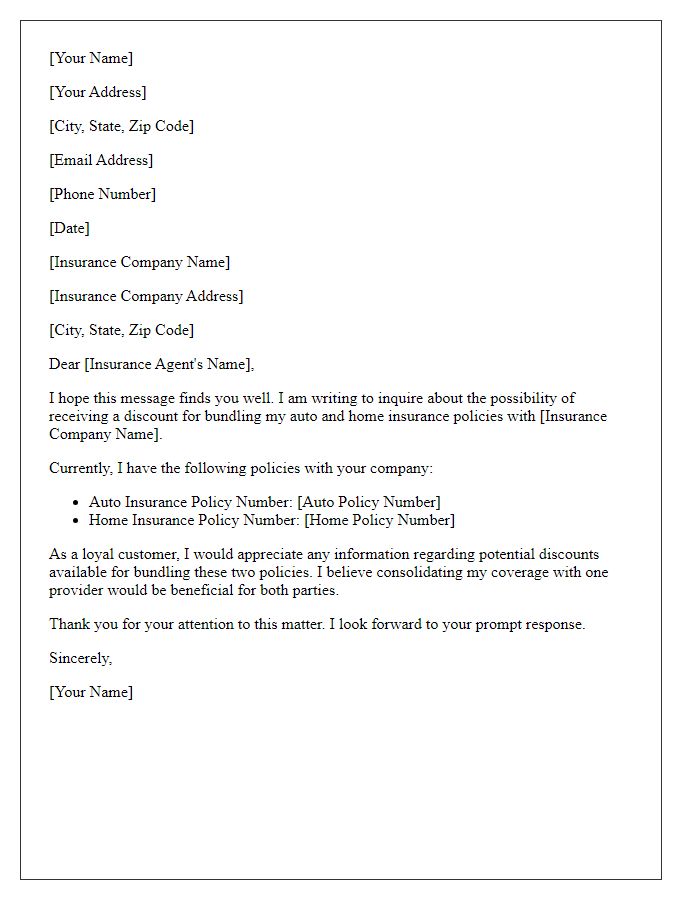

Letter template of insurance bundle discount request for auto and home insurance.

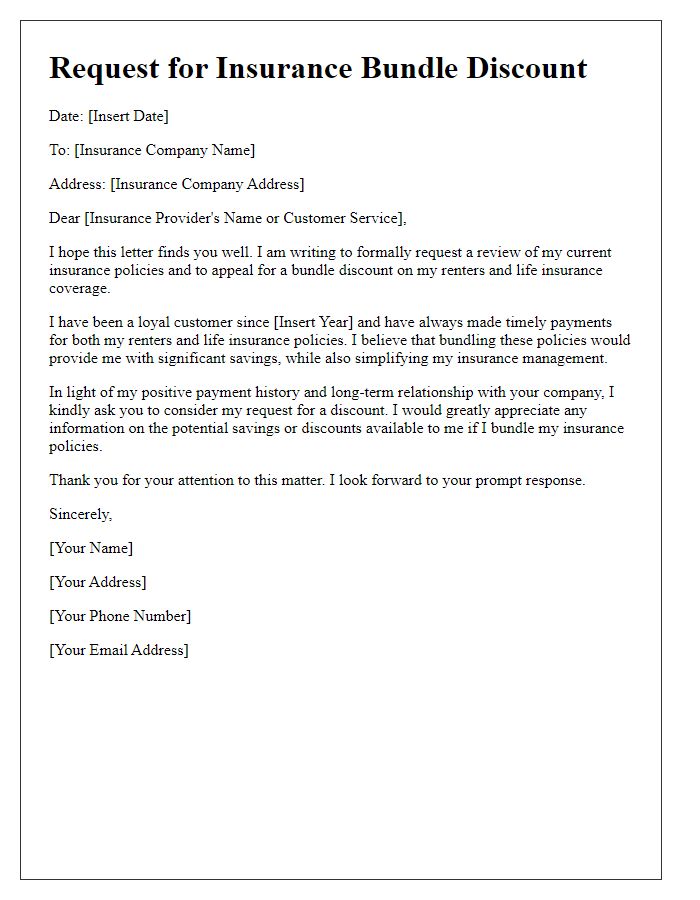

Letter template of insurance bundle discount appeal for renters and life insurance.

Letter template of insurance bundle discount application for business and liability coverage.

Letter template of insurance bundle discount petition for health and dental insurance.

Letter template of insurance bundle discount solicitation for travel and trip insurance.

Letter template of insurance bundle discount approach for pet and homeowners insurance.

Letter template of insurance bundle discount demand for comprehensive insurance plans.

Letter template of insurance bundle discount suggestion for multi-vehicle coverage.

Comments