Are you feeling overwhelmed by rising insurance rates? You're not aloneâmany of us are navigating the complexities of an ever-changing insurance landscape. In this article, we'll guide you through the ins and outs of crafting a compelling letter to request a reconsideration of your insurance rates. Ready to explore how to make your case effectively? Let's dive in!

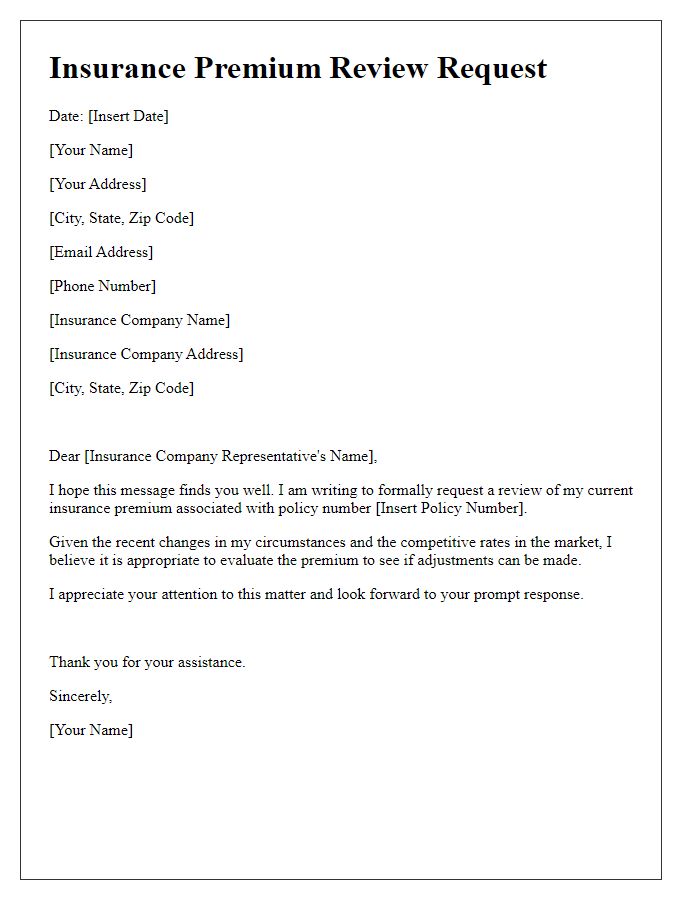

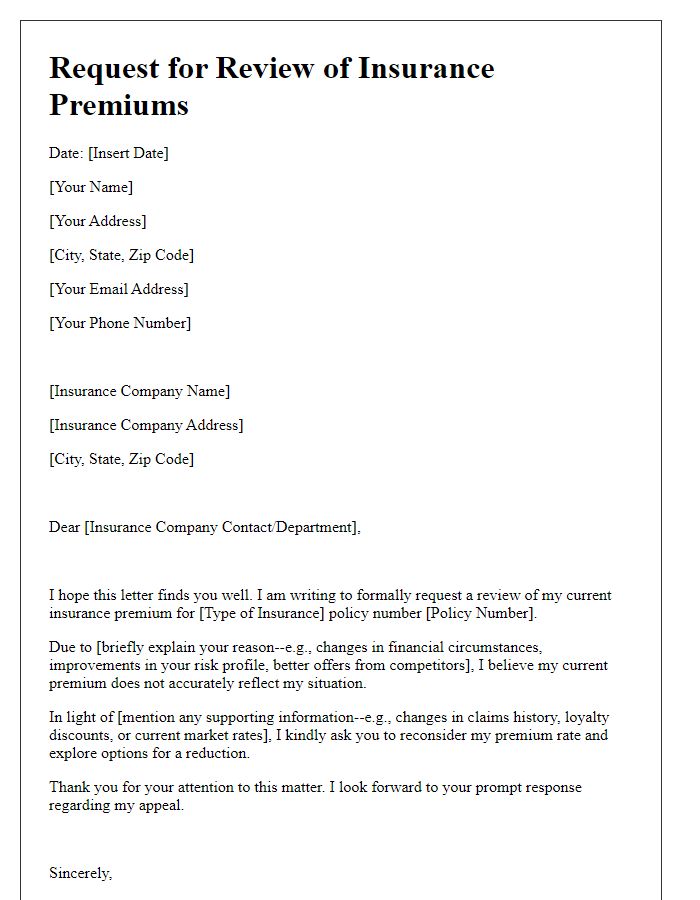

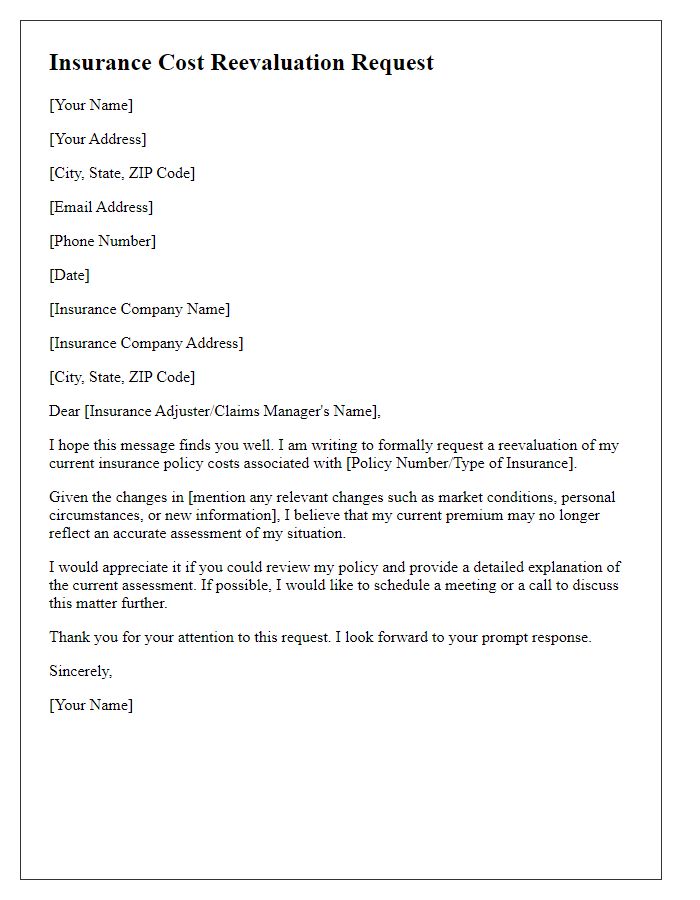

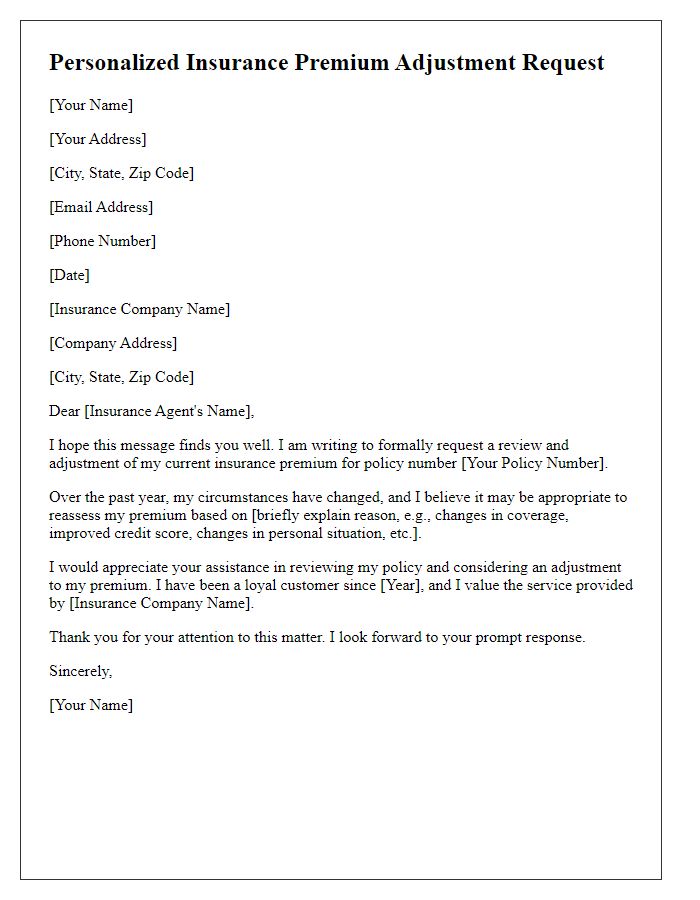

Policyholder Information

In the context of insurance rate reconsideration requests, policyholder information serves as a critical element that influences the evaluation process. Essential details include the policyholder's name, which identifies the individual or entity covered by the insurance policy. The unique policy number, typically assigned by the insurance company, distinguishes the specific insurance contract and facilitates easier reference during review. The contact information, such as phone number and email address, ensures that the insurance agent or representative can communicate promptly regarding the request. Furthermore, including the address associated with the policyholder aids in confirming residency, particularly relevant for home and auto insurance policies, which may be affected by local factors such as crime rates or natural disaster risks. Lastly, the date of the policy inception provides context to the duration of coverage, potentially influencing the reconsideration of premium rates based on changes in the policyholder's circumstances or market conditions.

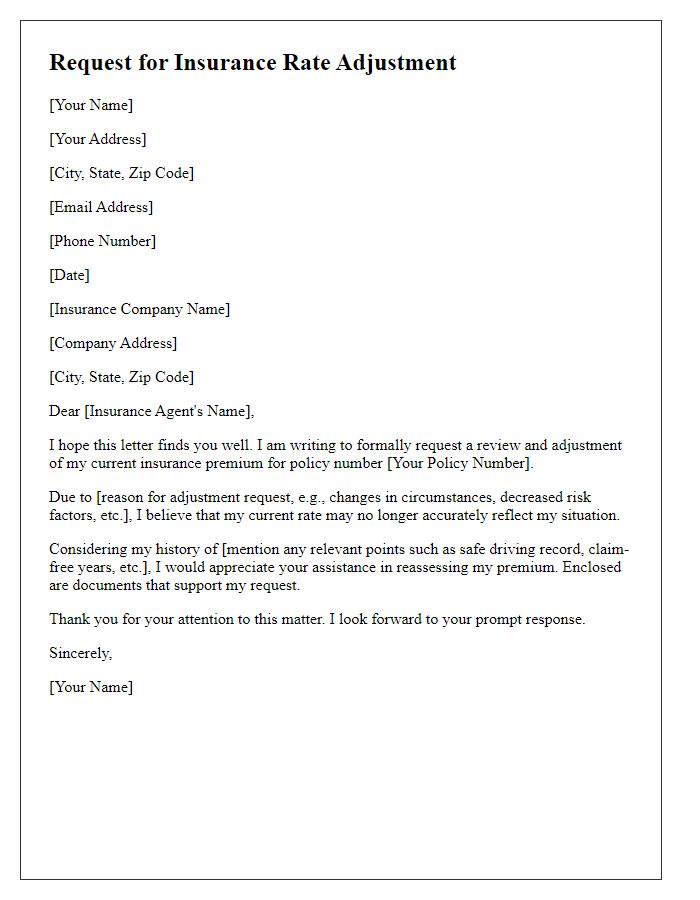

Policy Details

Navigating the complexities of insurance rate reconsideration requires a clear understanding of the specifics related to your policy. Insurance policy details, often encompassing the policy number, coverage type, and effective dates, play a crucial role in this process. For instance, a policy number, such as 123456789, identifies your coverage agreement with the provider. Coverage types, like comprehensive or liability insurance, determine the extent of protection offered against unexpected events or damages. Effective dates denote the period during which the policy is active, highlighting any recent changes that may justify a reconsideration request, especially after significant life events like home renovations or changes in driving records. Understanding these elements is essential for presenting a compelling case to the insurance company.

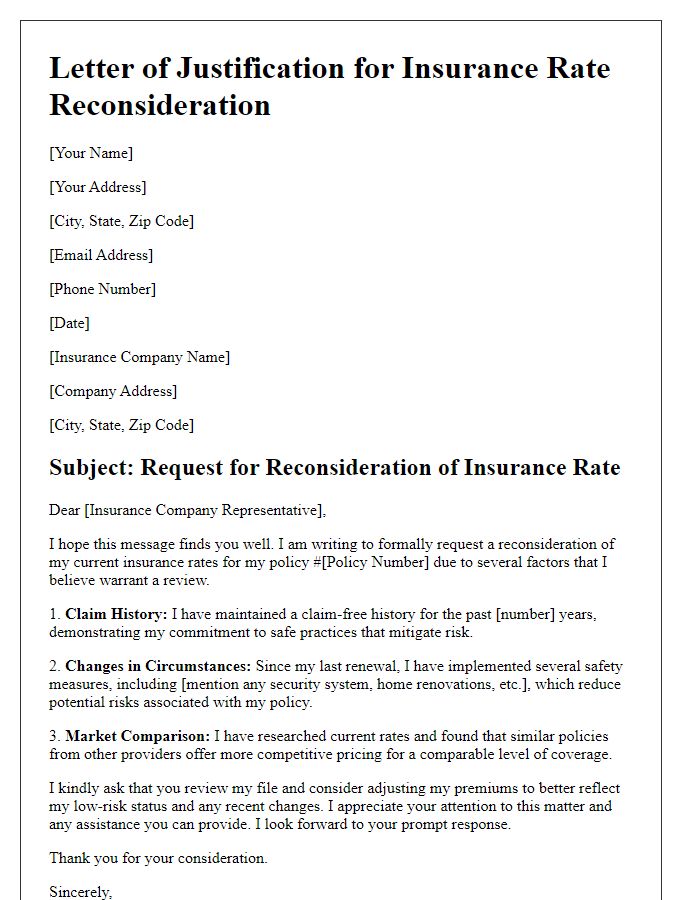

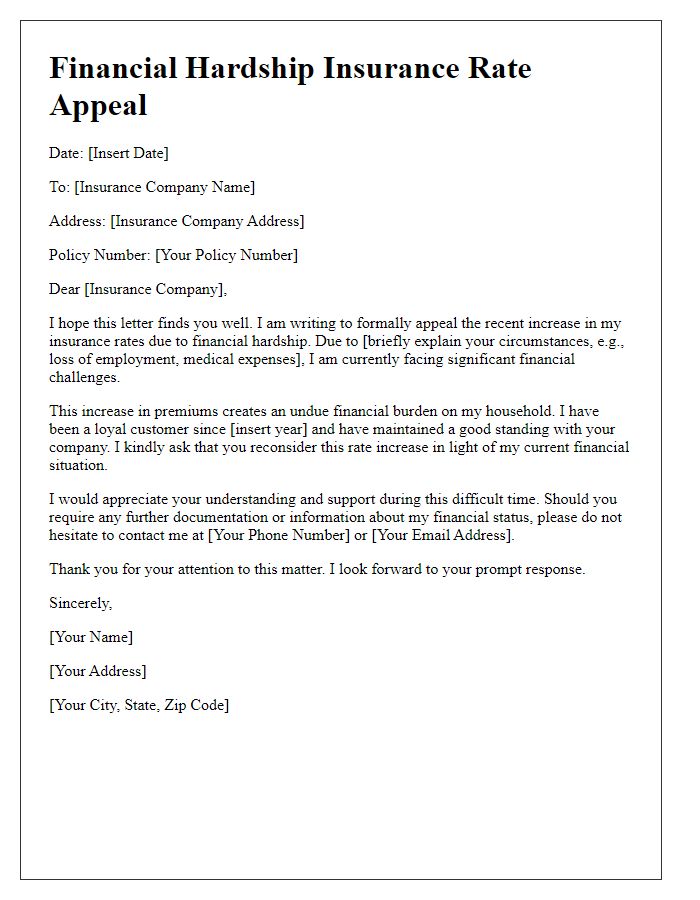

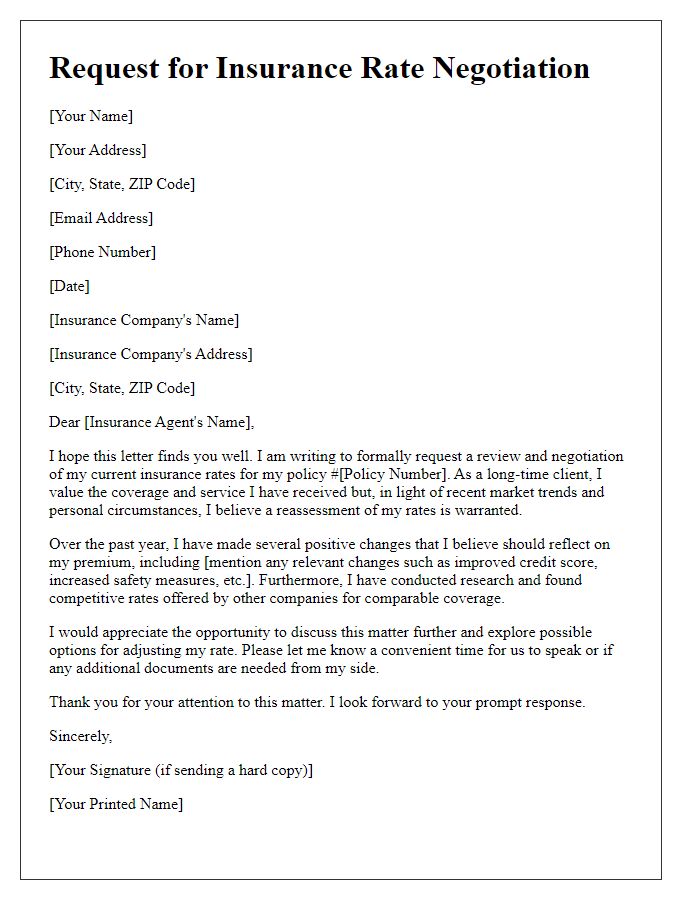

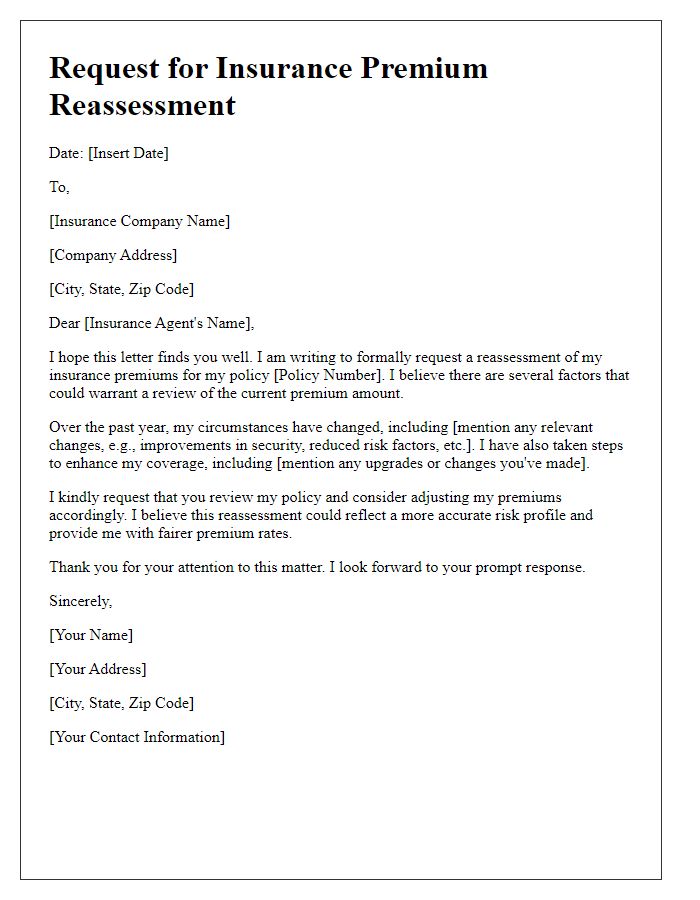

Reason for Reconsideration

Insurance rate reconsideration requests often stem from various compelling reasons. A notable factor could be a significant change in the policyholder's circumstances, such as achieving a higher credit score (for example, improving from 600 to 750), which might reflect better financial responsibility. Another reason could be the absence of recent claims; for instance, a seven-year claim-free history could significantly impact the insurer's assessment of risk. Additionally, advancements in home security systems, such as the installation of a state-of-the-art alarm system from Ring with real-time monitoring features, might lower the risk profile for home insurance. Other common factors include changes in local crime statistics or improvements in neighborhood safety measures, evidenced by a decrease in incidents reported to law enforcement in the area by 25% over the past year. All these elements can create a valid case for reconsideration of insurance premiums.

Supporting Documentation

When preparing a request for reconsideration of insurance rates, it is crucial to compile supporting documentation to strengthen your case. This could include recent policy renewals from competing insurers demonstrating lower premiums for similar coverage, claims history details that highlight a clean record (with no significant claims over the past five years), and credit score reports showing improvements (e.g., an increase in score by 50 points) which can indicate a lower risk assessment. Additionally, any changes in personal circumstances, such as a new job that enhances financial stability or upgrades made to the property (like installing a new security system in a residence located in Los Angeles), should be documented. Collecting these pieces of evidence can create a compelling narrative to persuade the insurer to re-evaluate the assigned rate.

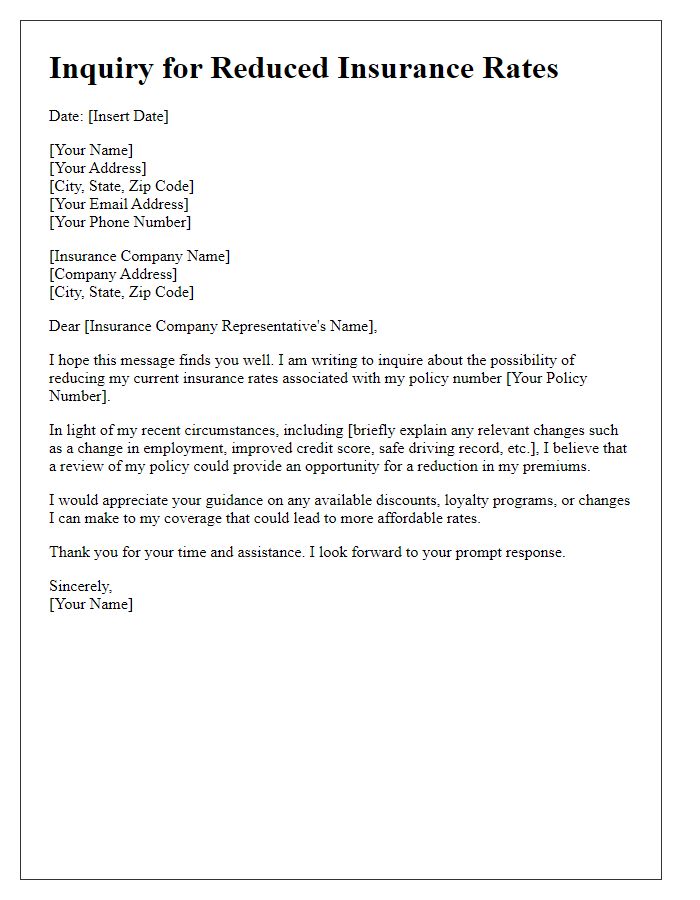

Contact Information and Next Steps

When requesting reconsideration of insurance rates, clearly outline your contact information, including full name, policy number, email address, and phone number. Provide a detailed explanation of the reasons for your request, highlighting any relevant changes in circumstances such as recent life events, improved credit scores, or additional safety measures taken. Conclude the communication with a succinct summary of the next steps, including how soon a response is expected and any additional documentation that may be required to support your request. This structured approach will facilitate a more efficient review process.

Comments