Hey there! If you're a policyholder looking to submit your identity proof, you're in the right place. We know that navigating the process can feel a bit daunting, but don't worryâthis handy letter template will make it a breeze. Ready to simplify your submission? Let's dive in!

Policyholder Information

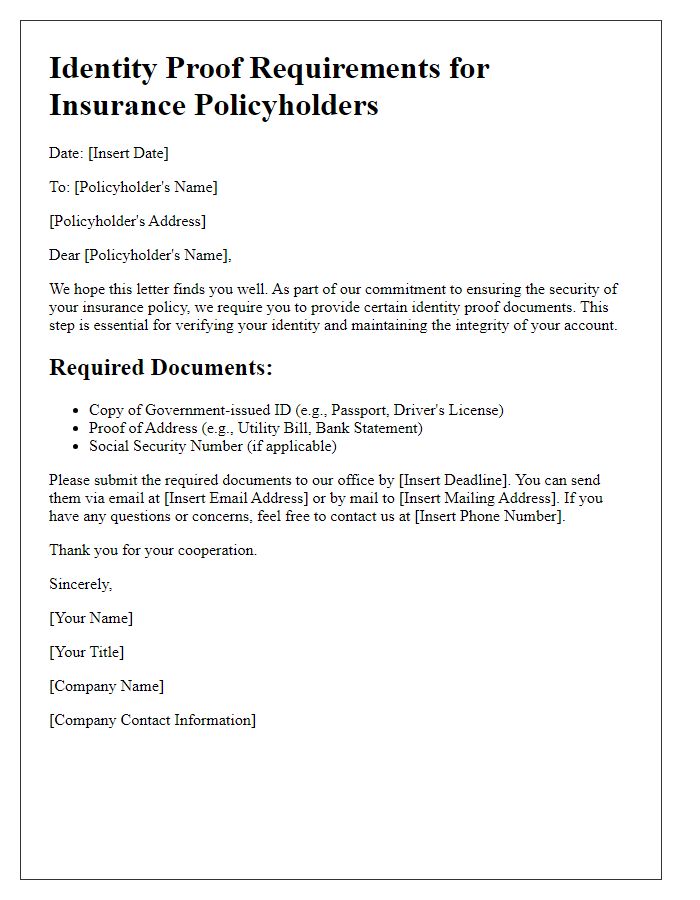

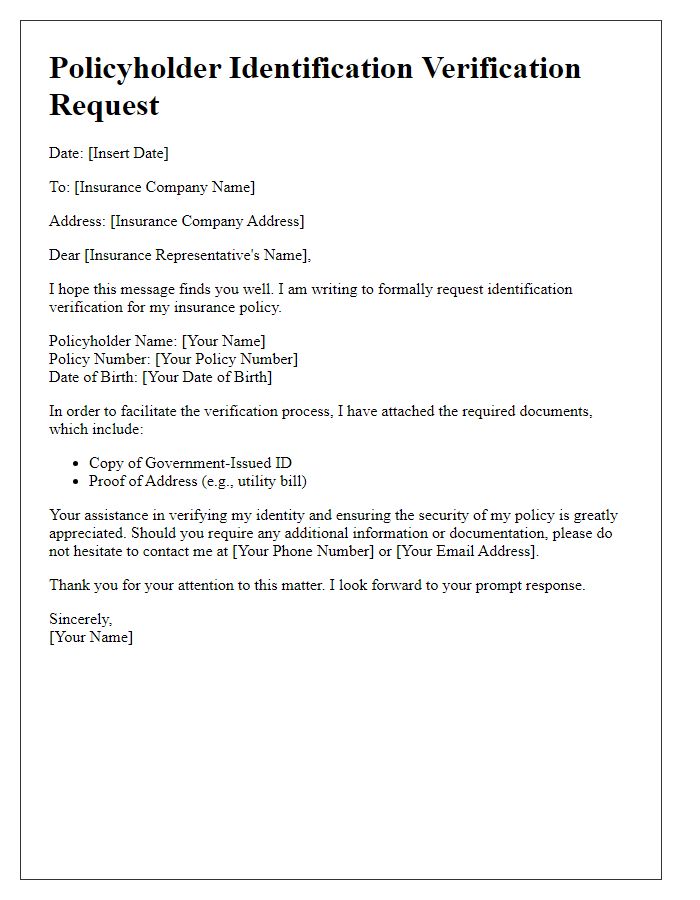

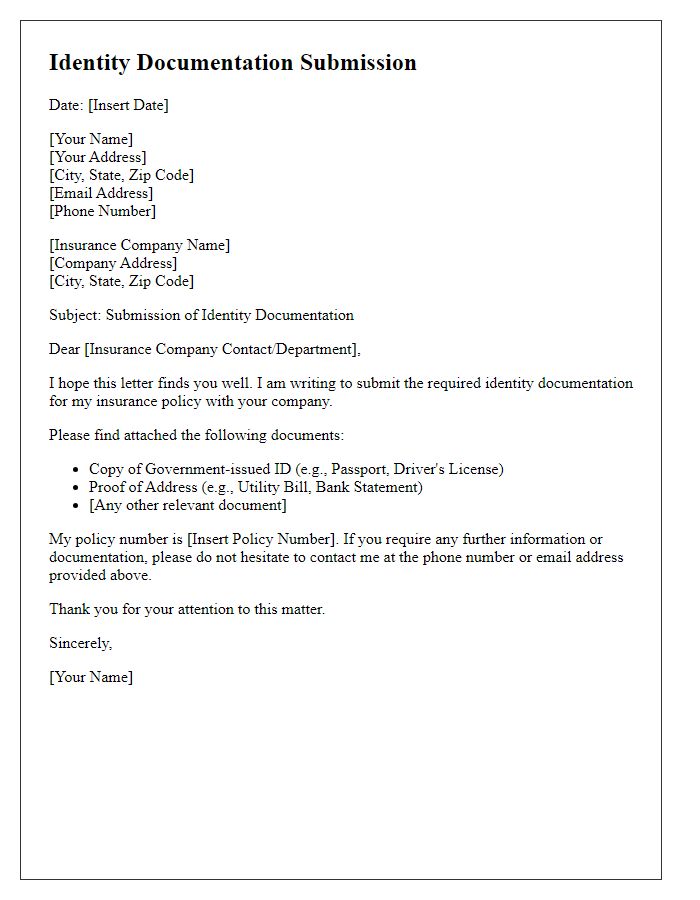

Policyholders must submit valid identity proof to verify their identity when managing insurance policies. Identity proof can include government-issued identification, such as a passport, national identification card, or driver's license. Each document must clearly display the policyholder's full name, date of birth, and photograph. For instance, a driver's license issued by the Department of Motor Vehicles in the United States will typically contain a unique identification number along with the policyholder's address. Timely submission of identity proof is essential for processing claims, updating personal information, or transferring policies. Failure to provide acceptable documentation may delay services and affect policy benefits.

Proof of Identity Documents

Proof of identity documents are essential for verifying the identity of policyholders in various insurance claims processes. Commonly accepted documents include government-issued photo identification, such as a driver's license (valid in the United States), passport (international validity), or national identity card (issued by respective countries). Additional documents may include utility bills (less than three months old) that display the policyholder's name and residential address, bank statements, or tax returns (IRS Form 1040 for the United States). Some insurance providers may also require social security numbers or taxpayer identification numbers for further verification. Maintaining accuracy in the provided documentation is crucial, as discrepancies can lead to delays in processing claims or even denial of benefits.

Submission Guidelines

Policyholders must submit identity proof documents to ensure compliance with regulatory requirements and protect against identity theft. Acceptable documents include a government-issued photo ID, such as a passport or driver's license, with clear visibility of the name and photograph. Additional verification may include utility bills not older than three months that display the policyholder's name and address, confirming residency. Digital submissions should be in PDF or JPEG format, with a maximum file size of 5MB per document. Submissions must occur via the designated online portal between 9 AM and 6 PM EST, ensuring privacy and secure transmission of sensitive information. Failure to submit valid proof may lead to delays in processing claims and benefits.

Contact Details

Policyholders must provide identity proof documents to ensure compliance and security. Required documents include government-issued photo ID, such as a passport or driver's license, along with proof of address, which could be a recent utility bill dated within three months. Submissions typically include a completed identity verification form with detailed contact information: full name, phone number, email address, and residential address. Ensuring accuracy in these details facilitates quick verification and processing by insurance companies, which may have additional requirements based on local regulations or specific policy types. Timely submission is crucial to avoid delays in claims or policy servicing.

Deadline for Submission

Policyholders must submit identity proof documents to meet regulatory compliance standards. The deadline for submission is December 15, 2023. Documents required include government-issued identification, such as a passport or driver's license, and proof of address, which could be a utility bill or bank statement dated within the last three months. Failure to submit these documents by the deadline may result in delays in claims processing or potential policy suspension. Contact the policy administration team for assistance during business hours, or refer to the official website for FAQs regarding the submission process.

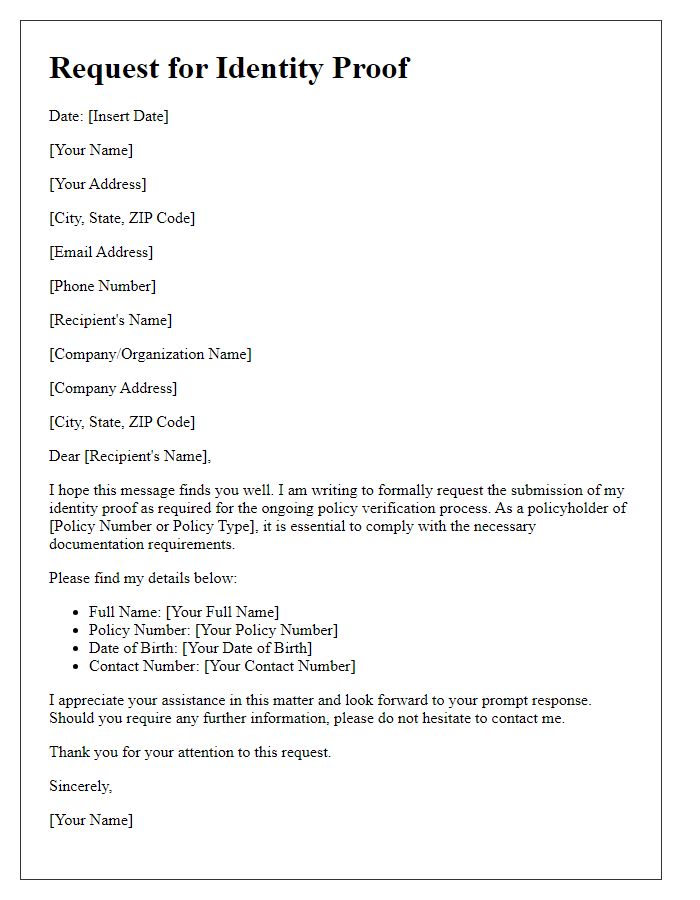

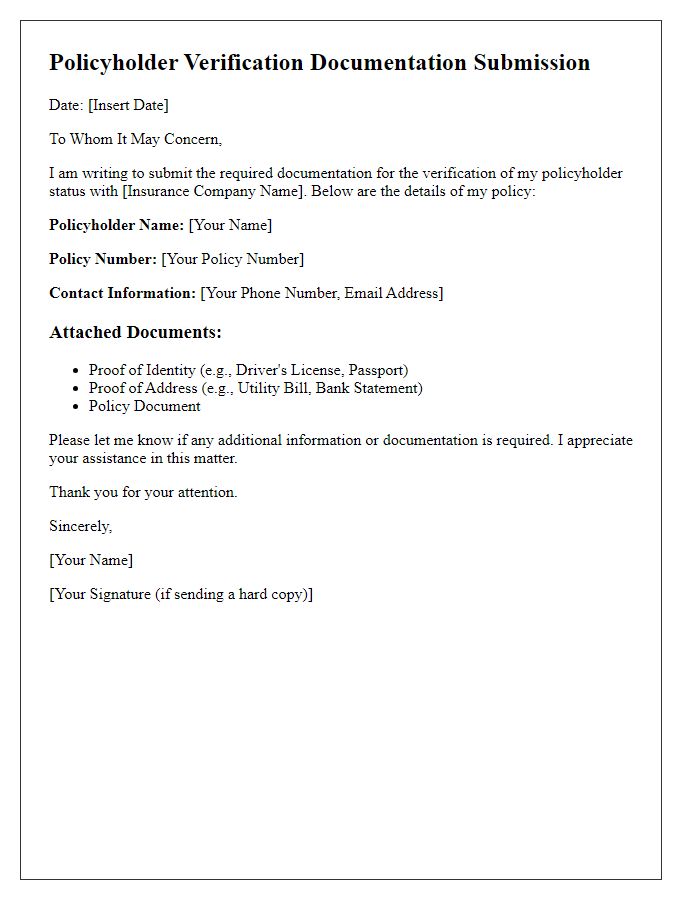

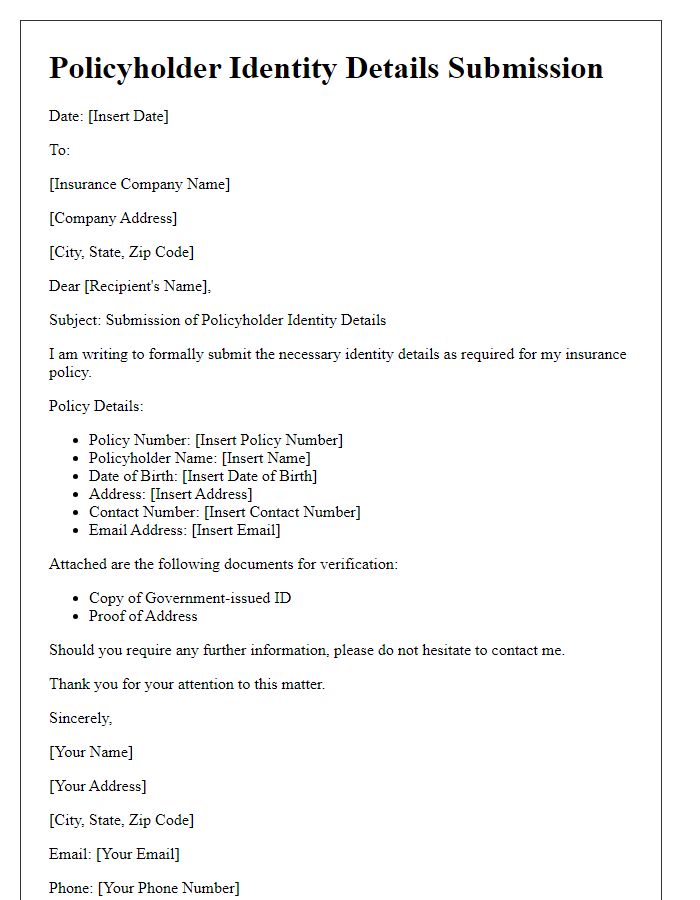

Letter Template For Policyholder Identity Proof Submission Samples

Letter template of identity proof requirements for insurance policyholders

Comments