Welcome to our guide on addressing title insurance discrepancies! If you've ever found yourself puzzled by unexpected issues with your title insurance, you're not alone. Navigating the complexities of real estate can be challenging, especially when it comes to understanding the fine print. Let's dive into the important steps you can take to clarify any discrepancies and ensure your peace of mindâread on to learn more!

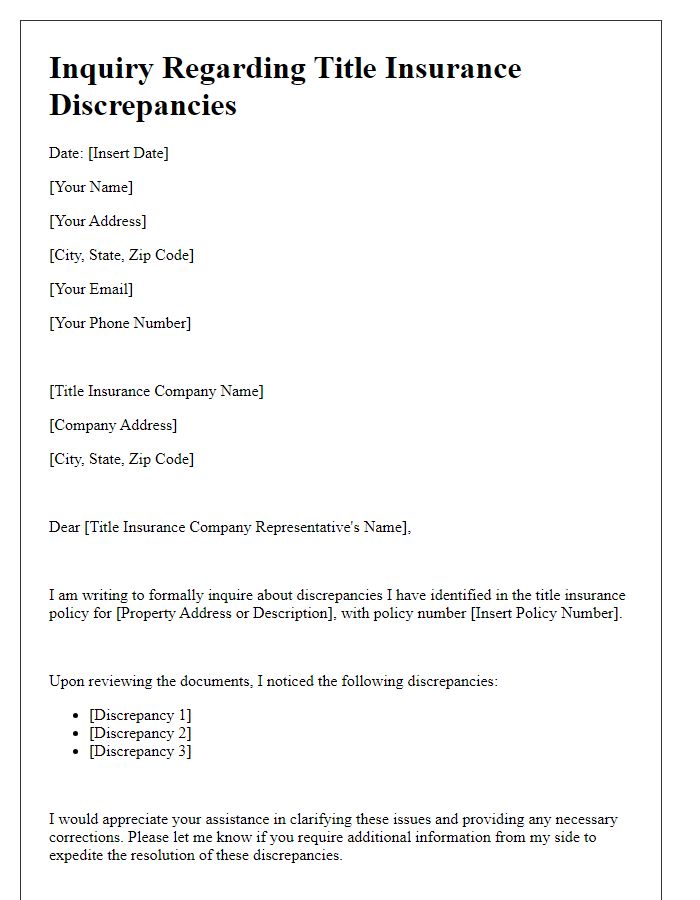

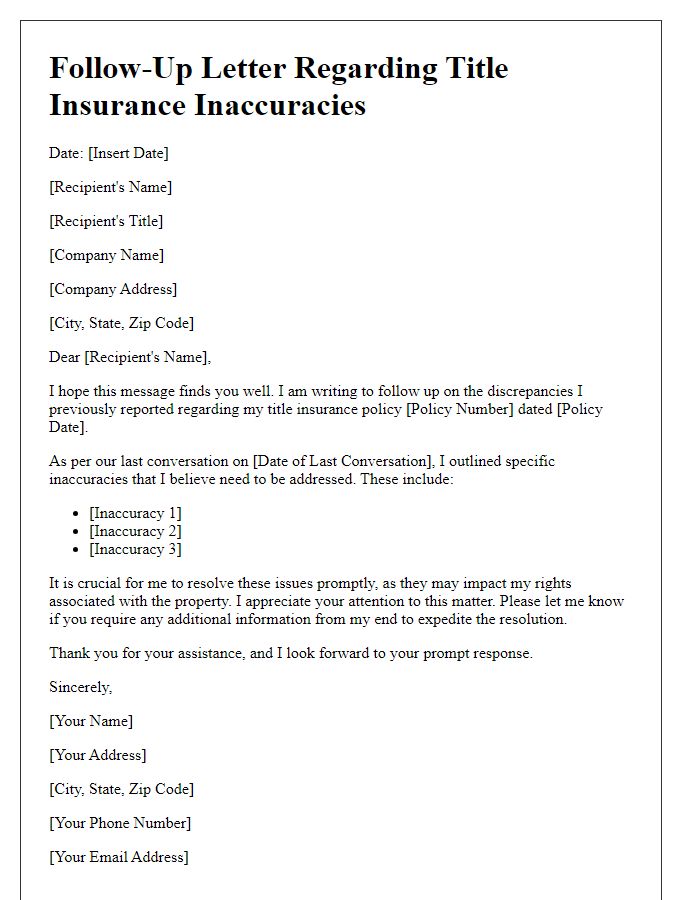

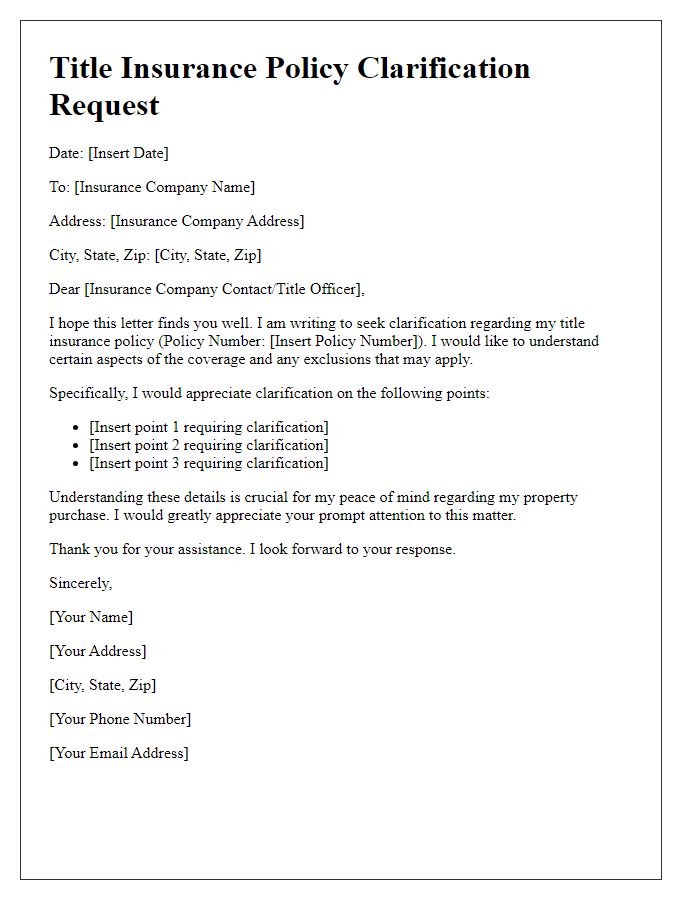

Accurate Description of Discrepancy

Title insurance discrepancies can arise from various factors, including boundary disputes, property liens, or clerical errors. For example, a serious mistake may occur when a parcel of land is inaccurately described in public records, often involving square footage (for instance, a discrepancy of 500 square feet) or incorrect legal descriptions referencing outdated surveys. Local entities, such as county assessors in Harris County, Texas, may also contribute to these discrepancies if property tax assessments do not align. Identifying and clarifying specific aspects of discrepancies is crucial, such as date of survey, the involved parties, and previous ownership history, to rectify issues effectively and ensure that the title remains clear and insurable.

Pertinent Property Details

Title insurance discrepancies can arise from various factors, including incomplete information, prior claims, or legal disputes related to property ownership. Relevant property details may include the parcel identification number (PIN), legal description, previous owners' names, and the date of the last title search, which is crucial for verifying ownership history. For example, if a property located in Los Angeles County, California, shows conflicting information about its boundaries or easements recorded in the title deed, it may lead to complications during a property transaction. Such inconsistencies can potentially delay closing processes or expose buyers to unforeseen liabilities, emphasizing the importance of clarifying these discrepancies promptly.

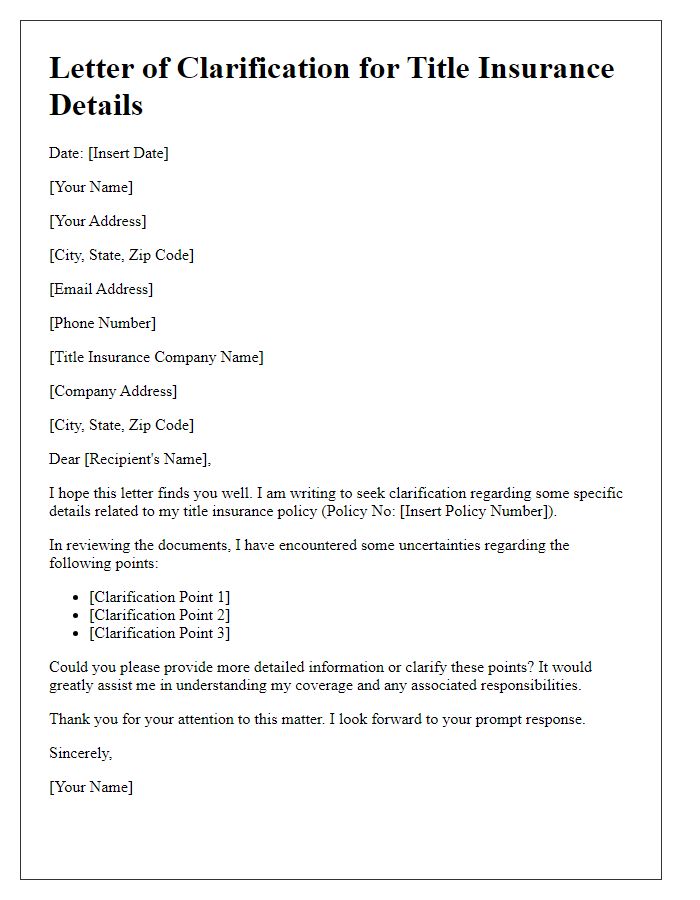

Policy Number and Insured Information

A title insurance discrepancy can occur when there are inconsistencies in the policy number or insured information, leading to potential issues during property transactions. For example, an incorrect policy number may not reflect the actual coverage on a property located in Los Angeles, California, impacting the buyer's insurance protection in case of claims. Moreover, variations in insured names or addresses can create confusion during the underwriting process, risking delays in closing transactions. Accurate data, such as the insured's legal name and the property description, is critical for compliance with title insurance regulations and ensuring satisfactory coverage. Timely clarification of these discrepancies can help maintain a smooth real estate transaction process and protect the interests of all parties involved.

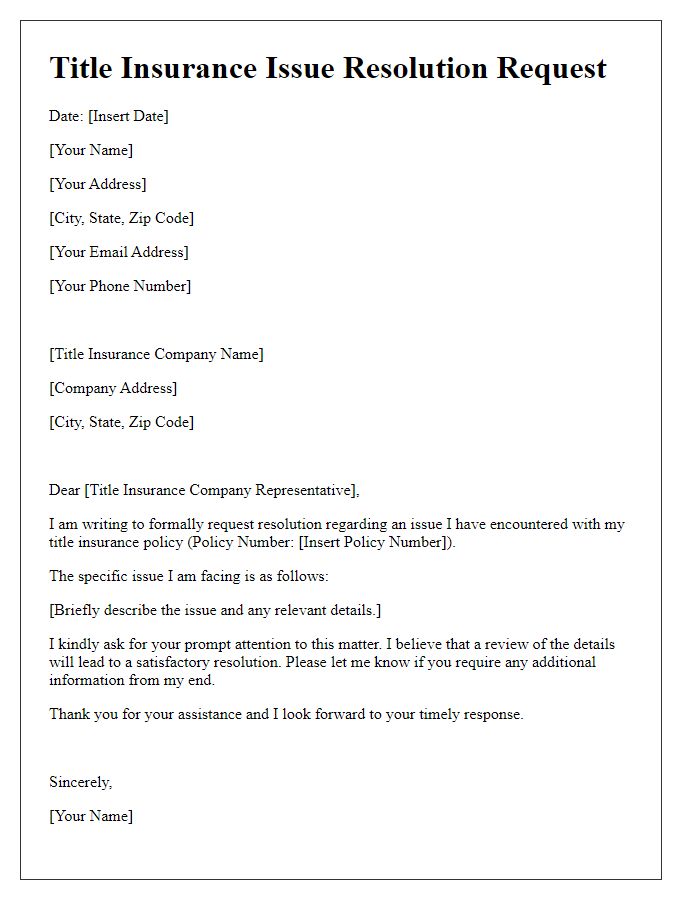

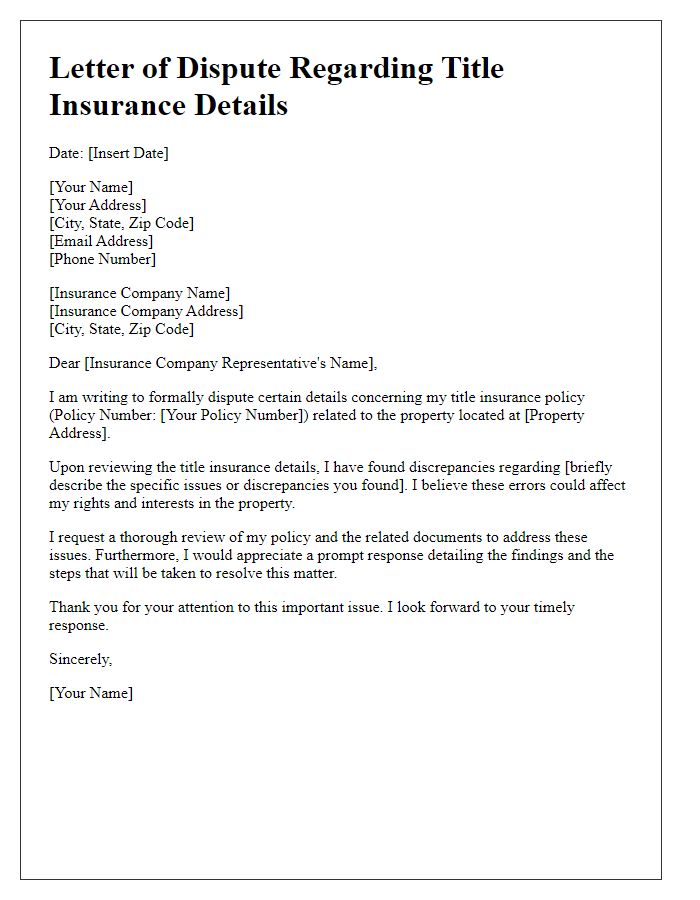

Clear Request for Resolution

Title insurance discrepancies can lead to significant issues in real estate transactions, affecting property ownership and financial security. Common discrepancies may include incorrect property descriptions, title defects, or unrecorded liens. These issues can hinder mortgage approvals or even result in legal disputes. Timely resolution is crucial; a well-documented request for clarification should highlight specific discrepancies, such as the title report's inconsistent boundary descriptions or unresolved claims dating back to previous owners. Engaging with professionals from title insurance companies, such as Fidelity National Financial or First American Title, ensures clear communication and expedites the resolution process. Accurate correction of these discrepancies typically requires a thorough investigation and may involve local registries or legal counsel to confirm ownership rights and obligations.

Supporting Documentation or Evidence

Title insurance discrepancies can arise from various factors, including errors in legal descriptions, outstanding liens, or ownership disputes. For instance, a property in Miami, Florida, may have conflicting tax records indicating two different owners, leading to confusion regarding rightful ownership. Supporting documentation such as the property's deed, prior title insurance policies or updated surveys can validate ownership claims and rectify discrepancies. Additionally, evidence of resolved liens, such as a release of lien letter from a contractor, is crucial for ensuring the accuracy of the title. Detailed analysis of these documents provides clarity and assists in rectifying any issues with the title insurance policy.

Comments