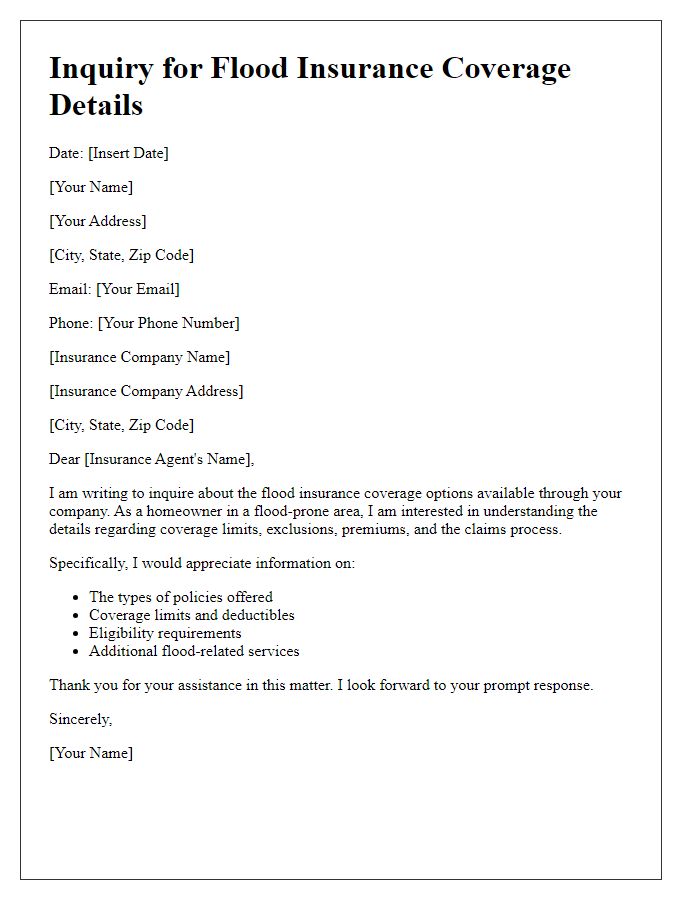

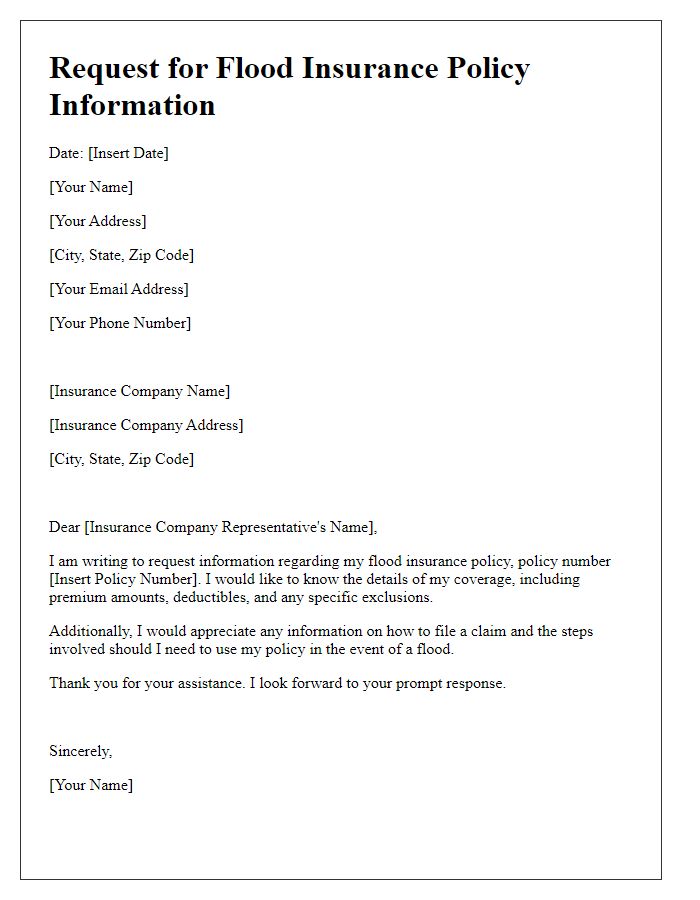

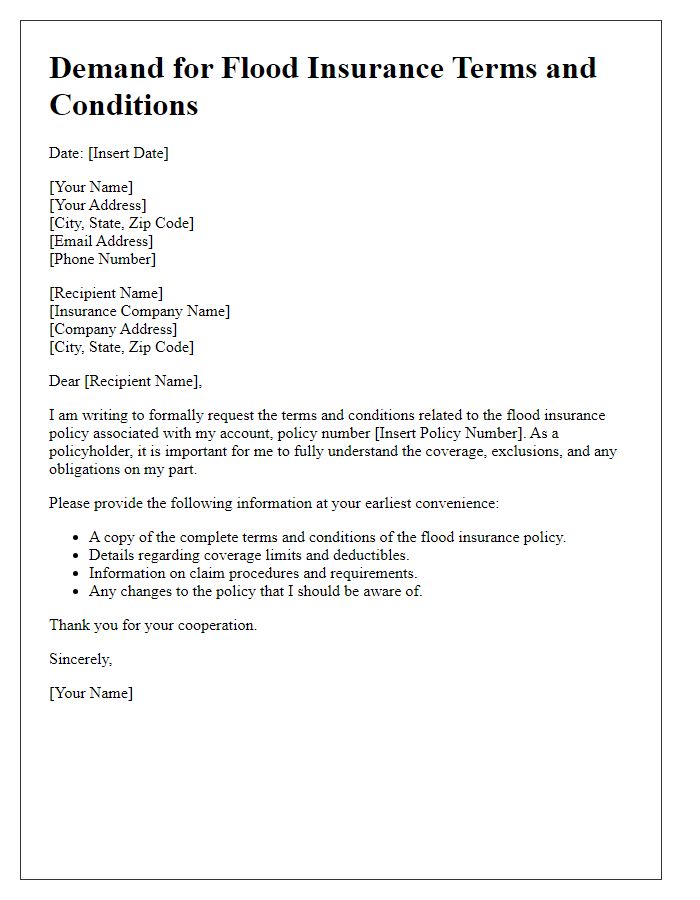

Are you feeling overwhelmed by the complexities of flood insurance? You're not alone; many homeowners struggle to navigate the intricacies of coverage options and policy details. Understanding your flood insurance needs is crucial for protecting your investment and ensuring peace of mind. Read on to discover valuable insights and practical tips to help you make informed decisions regarding flood insurance.

Policy Coverage Details

Flood insurance policies, such as those offered by the National Flood Insurance Program (NFIP), provide important coverage for property owners in flood-prone areas like New Orleans or Miami. Standard policy limits typically include coverage for both building property (up to $250,000 for residential structures) and personal property (up to $100,000 for belongings). Additionally, specific endorsements can enhance coverage for items such as basements, which often face significant damage due to flooding. It's crucial to understand the waiting period, usually 30 days from the purchase date, before the policy becomes effective. Premium costs can vary based on factors like the property's elevation, location, and the degree of flood risk, highlighted by FEMA's Flood Insurance Rate Maps. Discussing these aspects with an insurance agent familiar with local regulations and environmental risks can ensure comprehensive protection against future flood events.

Premium Costs

Flood insurance premiums depend on various factors, including location (often designated by FEMA Flood Zone classifications), property elevation, and coverage amount. For instance, properties in high-risk areas (Zones A and V) may incur premiums ranging from $1,000 to over $10,000 annually, while structures in moderate-risk areas (Zones B and X) may see premiums as low as $300 to $1,200 per year. Additionally, the specific insurer's underwriting guidelines affect premium pricing, with variations based on claim history and risk assessment. Understanding these factors allows policyholders to better navigate the costs associated with obtaining adequate flood insurance coverage.

Claim Procedure

Flood insurance claims require meticulous attention to detail. Initial steps include contacting your insurance provider, typically housed within a large national or regional office. Specific documentation, like the National Flood Insurance Program (NFIP) claim form, must be completed accurately. This form involves key details about the insured property located in a flood-prone zone. You will need to provide evidence of the flood event--such as photographs of damage and a flooded basement--to substantiate your claim. An adjuster, appointed by your insurer, will inspect the property, assessing damages and evaluating repair costs. Final claims processing may take several weeks, contingent upon the complexity of the flood event and the thoroughness of the submitted documentation.

Exclusion Clauses

Flood insurance policies often contain exclusion clauses that delineate the specific circumstances under which coverage may not apply. These clauses, frequently found in policies provided by major insurers like FEMA (Federal Emergency Management Agency) and private entities, typically exclude damages resulting from flooding due to rising water levels, overflow of rivers, or conditions exacerbated by a lack of property maintenance. Important details can include timeframes (for example, a 30-day waiting period for new policies), specific geographical limitations (such as properties in high-risk flood zones), and the definition of "flood" as per underwriting guidelines. Understanding these exclusions is essential for policyholders, especially in locations with a history of severe weather events, as they directly impact the financial protection provided during disasters.

Renewal Terms

Flood insurance policies protect property owners from financial loss due to flooding. Renewal terms often include factors like premium rates, coverage limits, deductible amounts, and necessary documentation required for continuation. Specific policies, such as the National Flood Insurance Program (NFIP) managed by FEMA, may dictate renewal conditions and potential adjustments based on risk assessments and previous claims history. Understanding these terms is crucial for homeowners living in at-risk areas, particularly coastal regions or floodplain zones identified in Federal Emergency Management Agency (FEMA) maps. Renewal notices typically arrive 30 days before expiration, urging policyholders to review changes and confirm coverage to ensure uninterrupted financial protection.

Comments