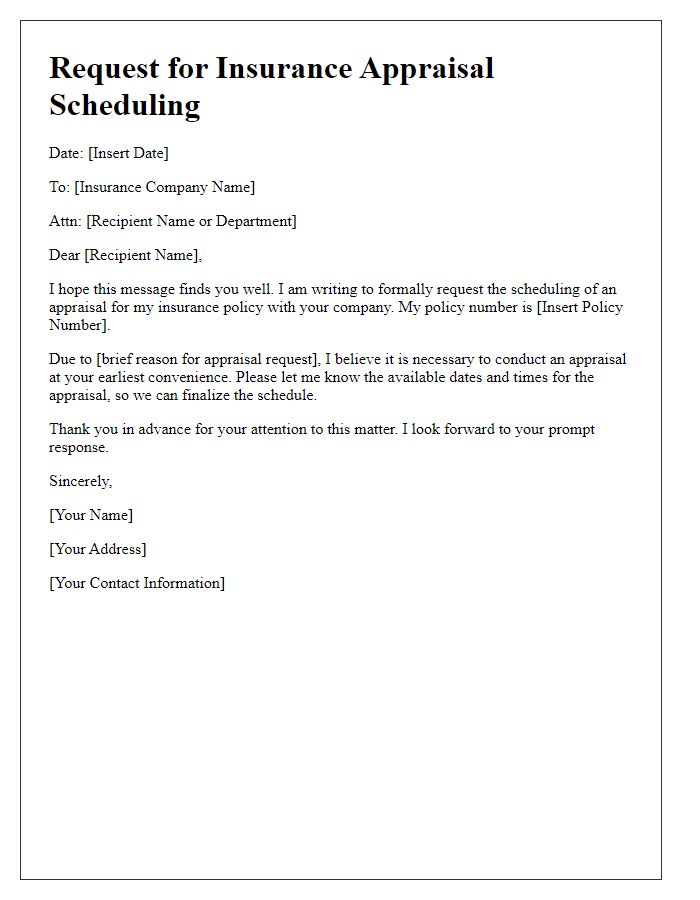

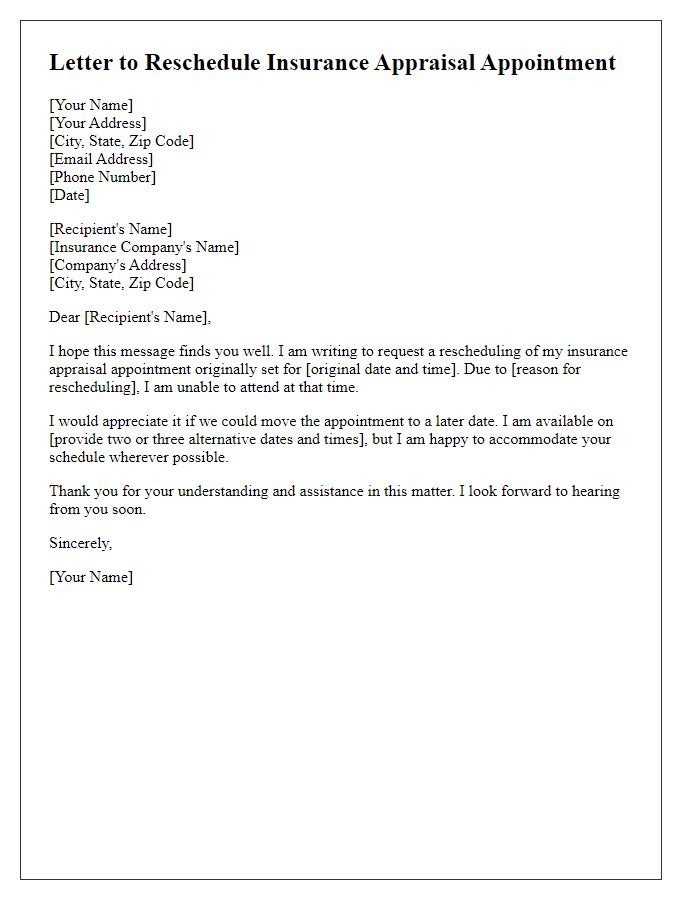

Are you preparing for an insurance appraisal appointment but unsure of where to start? A well-crafted letter can set the tone for a smooth and efficient meeting, ensuring all parties are aligned on expectations. In this article, we'll provide you with a sample template that you can easily customize for your specific needs. Join us as we dive deeper into how to create an effective letter that will pave the way for a successful appraisal experience!

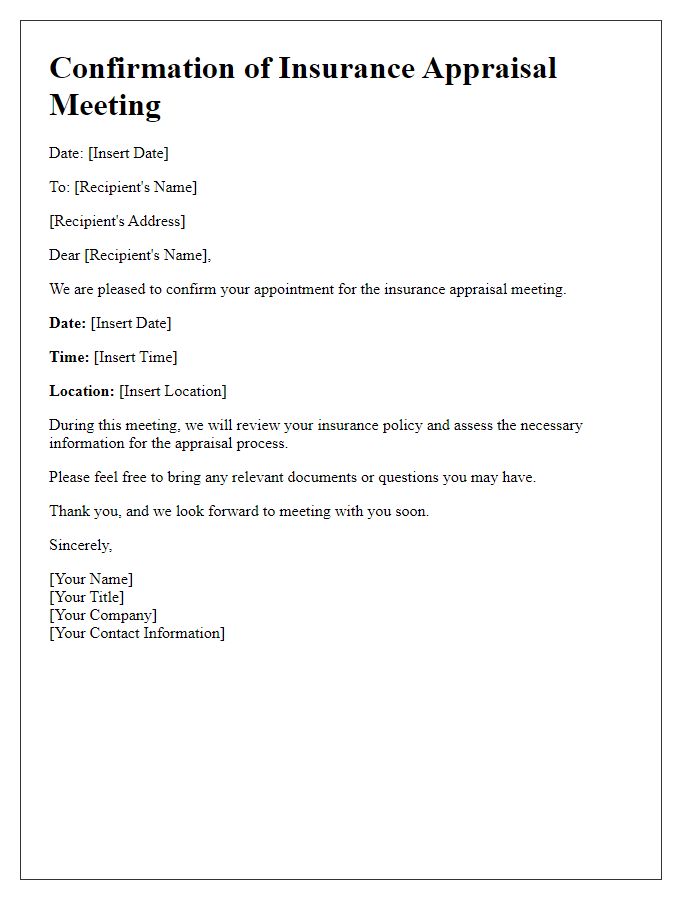

Appointment Details

The insurance appraisal appointment requires specific details to ensure a smooth process. The appointment setting will take place at the client's residence (documented address), or designated location (office address). Typically scheduled during regular business hours, which are Monday to Friday from 9 AM to 5 PM, the appointment duration may vary but usually does not exceed two hours. The appraiser, a licensed professional with extensive experience in property evaluation, will assess damages and determine the value of insured items, such as vehicles, real estate, or personal belongings. Necessary documents, including the insurance policy number, claim reference, and prior damage assessments, should be prepared and available for review at the appointment. In preparation, clients are advised to ensure that the location is accessible and free of debris to facilitate a thorough inspection.

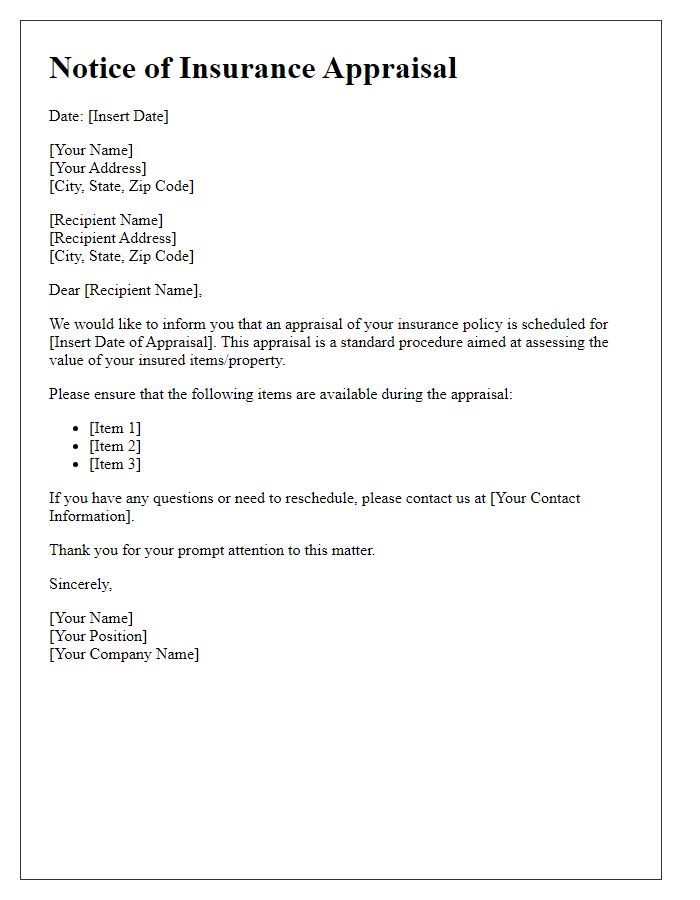

Relevant Documentation Required

During an insurance appraisal appointment, essential documentation must be prepared to ensure a smooth and efficient process. Key items include the original insurance policy, which outlines coverage limits and terms. A detailed inventory list of damaged items or losses, including photographs for visual evidence, should be compiled. Receipts for repairs or replacements add to the credibility of the claim. Recent appraisals or valuations for significant assets, such as jewelry or artwork, strengthen the case. Previous correspondence with the insurance company, such as claim forms or adjustment notes, provides context. Maintaining an organized folder containing these documents will facilitate effective communication with the appraiser and assist in achieving a favorable outcome.

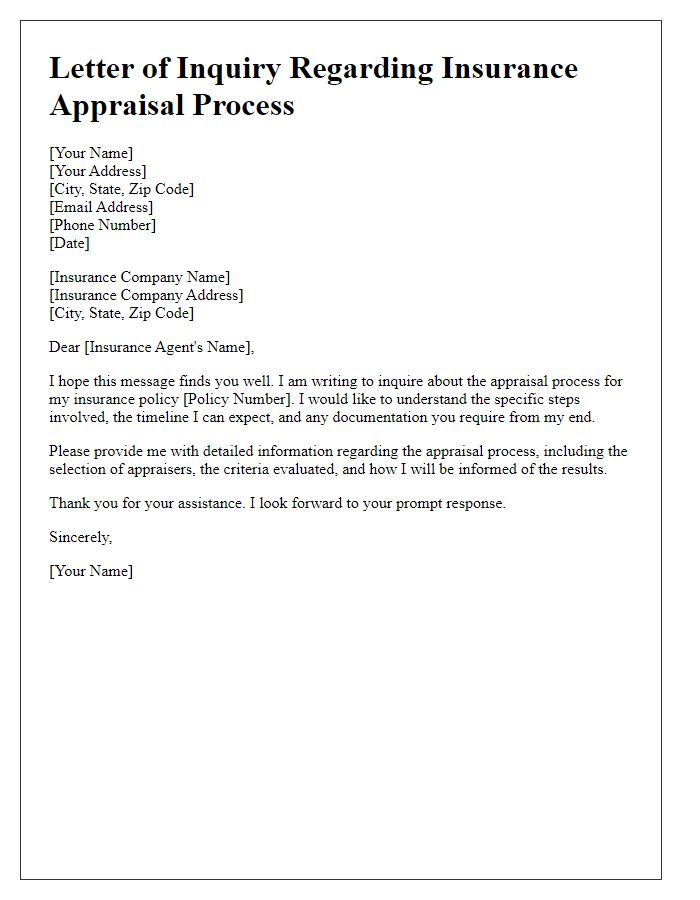

Contact Information

During the insurance appraisal appointment, gathering pertinent contact information is essential for effective communication and clarity. Full name should be provided, alongside the telephone number for direct communication. Email address is necessary for digital correspondence, ensuring timely sharing of documents. Home address can be required for verification purposes, particularly in claims involving property damage. Dates and times for the appointment should also be noted for scheduling convenience, ensuring that both the appraiser and the policyholder are aligned for the assessment process.

Confirmation Instructions

Insurance appraisals serve as essential evaluations to assess the value of property or damages for claims processing. Appraisal appointments typically involve the presence of an insurance adjuster, who analyzes various assets such as homes, vehicles, or commercial property. Meeting locations are often predetermined, ensuring easy access, with time frames usually allotted between 30 minutes to several hours, depending on the complexity of the assessment. Required documentation may include policy information, photographs of damages, and repair estimates. Clients should prepare to share any relevant personal information to establish claim legitimacy, while follow-up communications may include detailed appraisal reports, outlining findings to facilitate a transparent claims process.

Privacy and Confidentiality Notice

During the insurance appraisal appointment, privacy and confidentiality are paramount. Personal information, including policy details and claims data, remains secure and protected under regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Insurers must adhere to strict guidelines regarding the handling and sharing of sensitive information, ensuring only authorized personnel access these records. The appraisal might involve assessing damages for claims related to incidents like vehicle accidents or property loss, typically documented in reports and evaluations. Furthermore, all discussions during the appointment should focus solely on the appraisal process, safeguarding the client's personal and financial data from unauthorized disclosure. Compliance with regional privacy laws and internal data protection policies is essential to maintaining trust and integrity throughout the appraisal process.

Comments