Navigating the complexities of insurance disputes can feel overwhelming, but you're not alone in this journey. Often, policyholders find themselves at odds with insurers over denied claims or insufficient payouts, leading to frustration and confusion. Understanding the ins and outs of your insurance policy is crucial to making a compelling case. If you're ready to gain clarity on these disputes and learn how to effectively communicate your concerns, keep reading for expert tips and a helpful letter template!

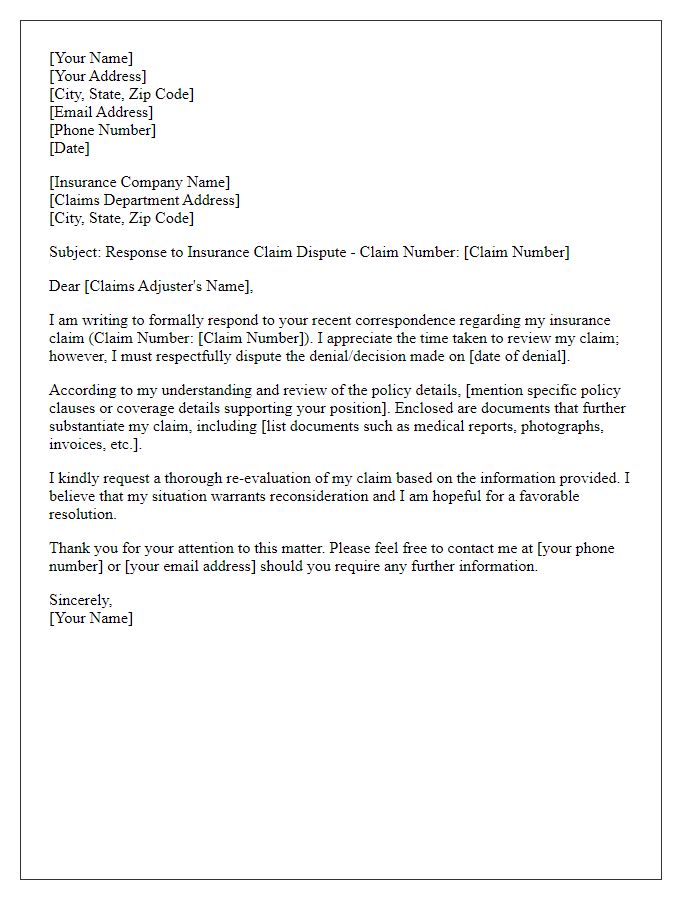

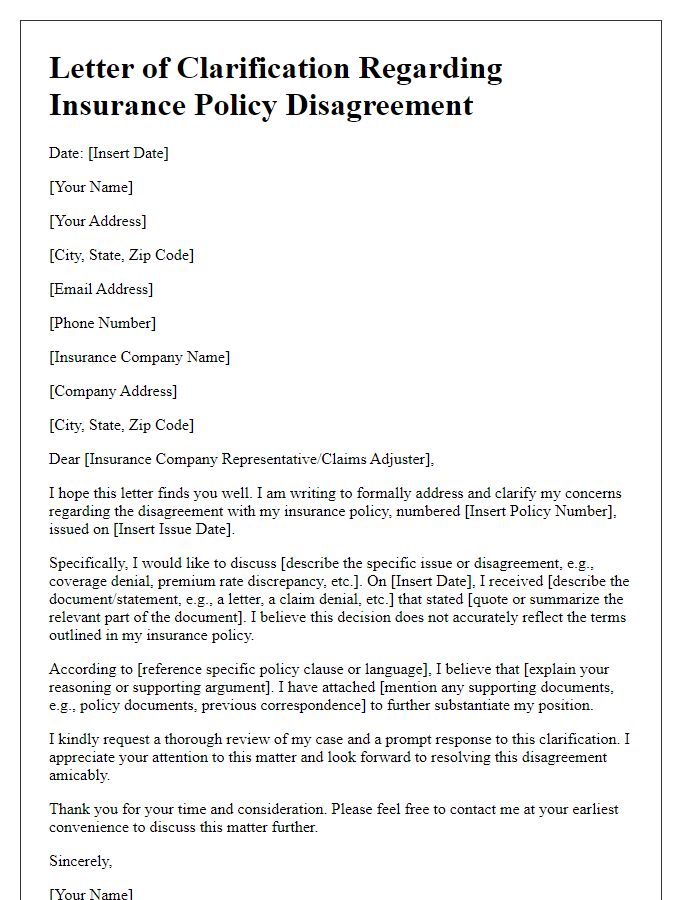

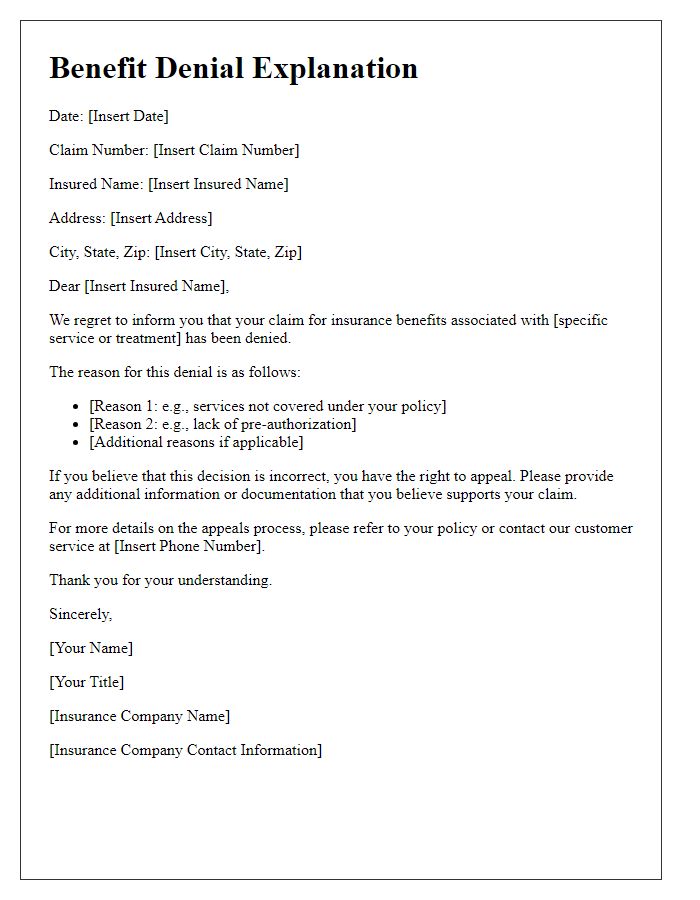

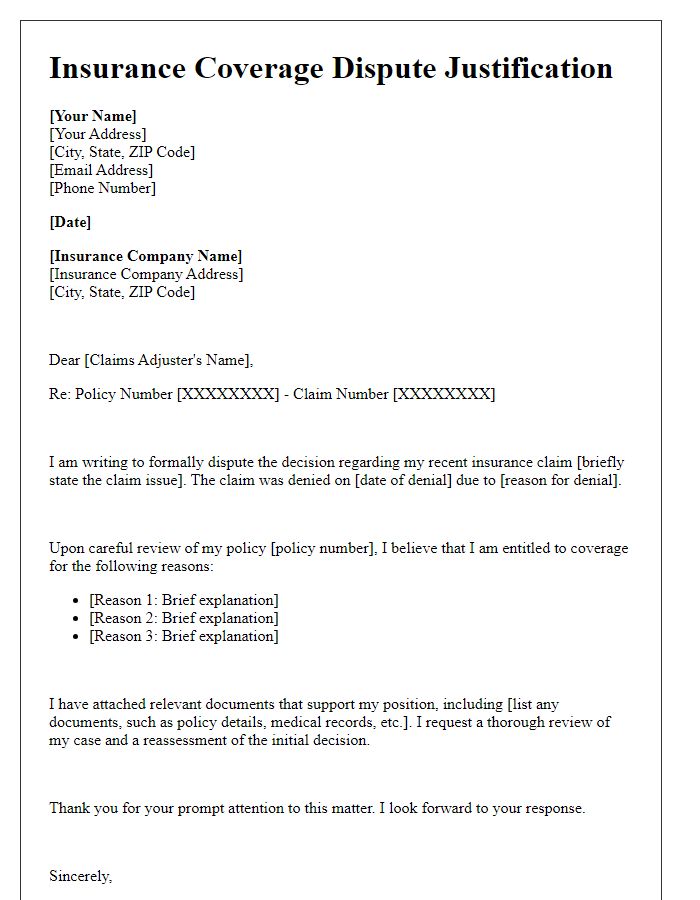

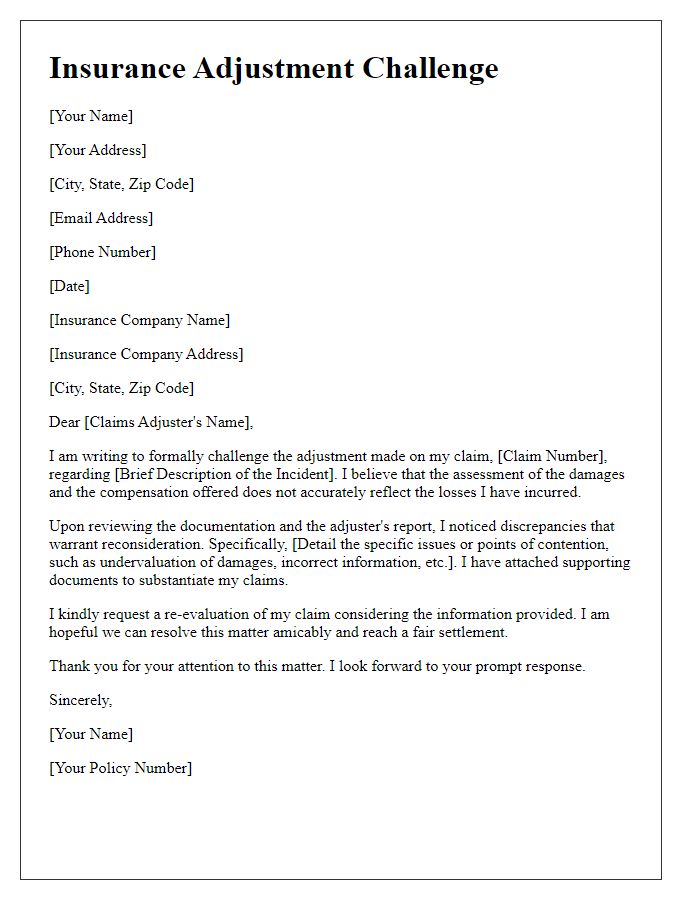

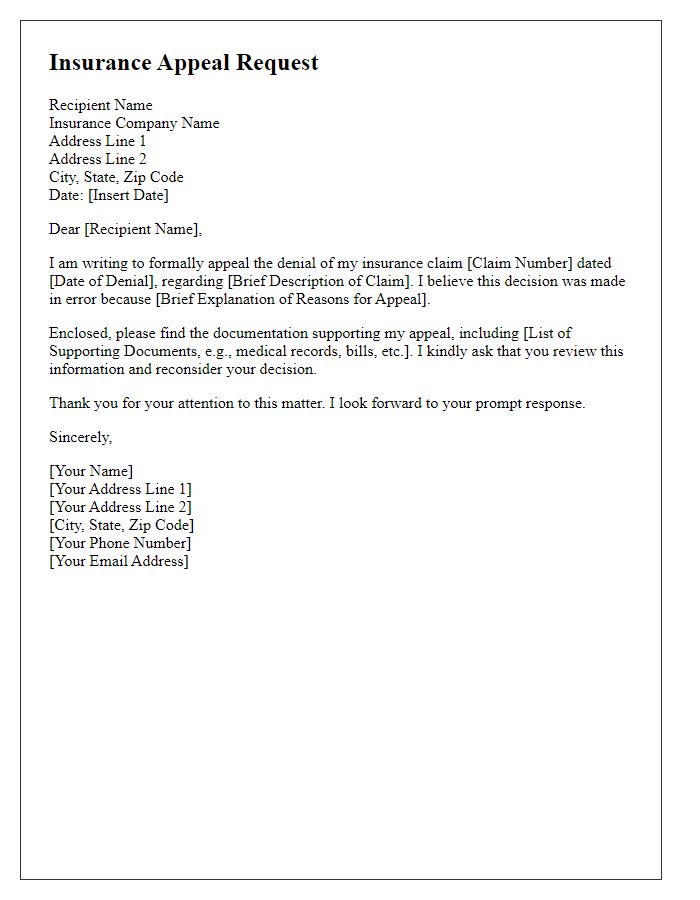

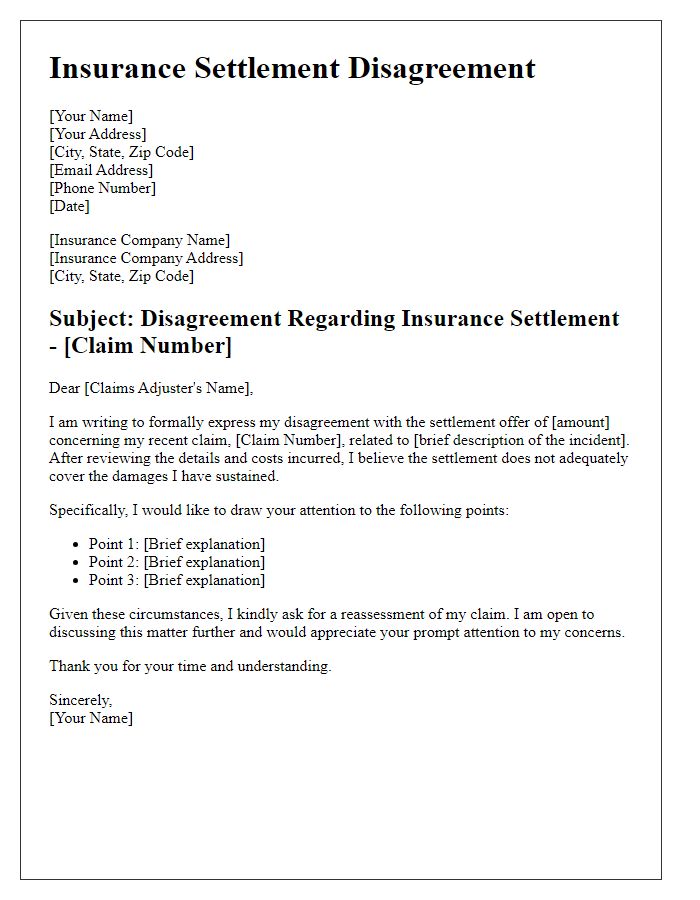

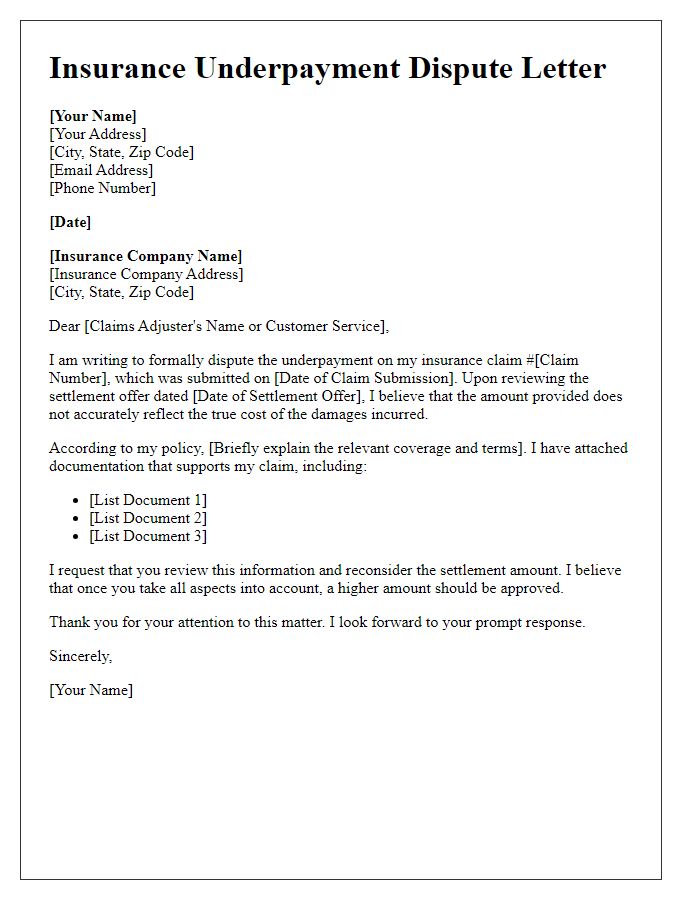

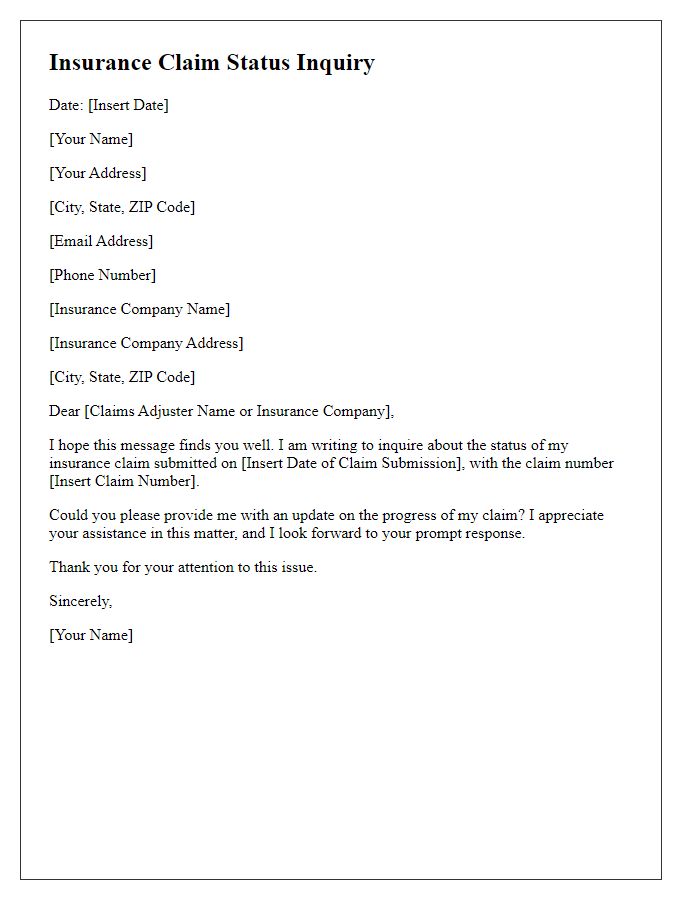

Clear and concise subject line

Disputes over insurance claims often arise due to misunderstandings regarding coverage limits or exclusions specified in the policy. Consider referencing specific policy numbers, claim dates, and relevant incidents to provide context. For example, an individual may dispute a denial of a claim for water damage that occurred on January 15, 2023. The policy document stipulates the coverage for such damages, emphasizing the need for clarity on terms such as "sudden and accidental" versus "gradual." Documentation such as photographs of the damage, inspection reports, and correspondence with the insurer will strengthen the case. Additionally, citing state insurance regulations could provide a legal basis for resolving the dispute.

Policyholder information and claim details

Policyholders, identified by their policy number, face challenges in navigating insurance claims, especially within the realm of disputes. Disputes often arise from denied claims tied to specific incidents, such as property damage or medical expenses, leading policyholders to seek clarification and resolution. Relevant details include the date of the incident, the claim number assigned by the insurance company, and the specific coverage being contested (for example, homeowners or auto insurance). It is crucial to reference the insurance policy terms, which outline the coverage limits and exclusions, as this information serves as the baseline for all claims. In instances where additional documentation is required, such as estimates from repair services or medical reports, the documentation should be organized and presented to strengthen the position of the policyholder during the dispute resolution process.

Specific reasons for dispute

Disputes over insurance claims often arise from specific factors that can include inadequate coverage terms, unexpected claim denials, or discrepancies in policy interpretation. For example, a homeowner's insurance claim for water damage might be denied due to the insurer's classification of the damage as maintenance-related rather than sudden and accidental. Similarly, discrepancies can occur regarding policy limits, such as a claim for stolen property that exceeds the stated limit of personal property coverage. Additional concerns might involve the claims process itself, where delays in communication or insufficient documentation lead to frustrations. Each of these factors contributes to the complexity of insurance disputes, necessitating a clear understanding of policy language and regulations governing claims.

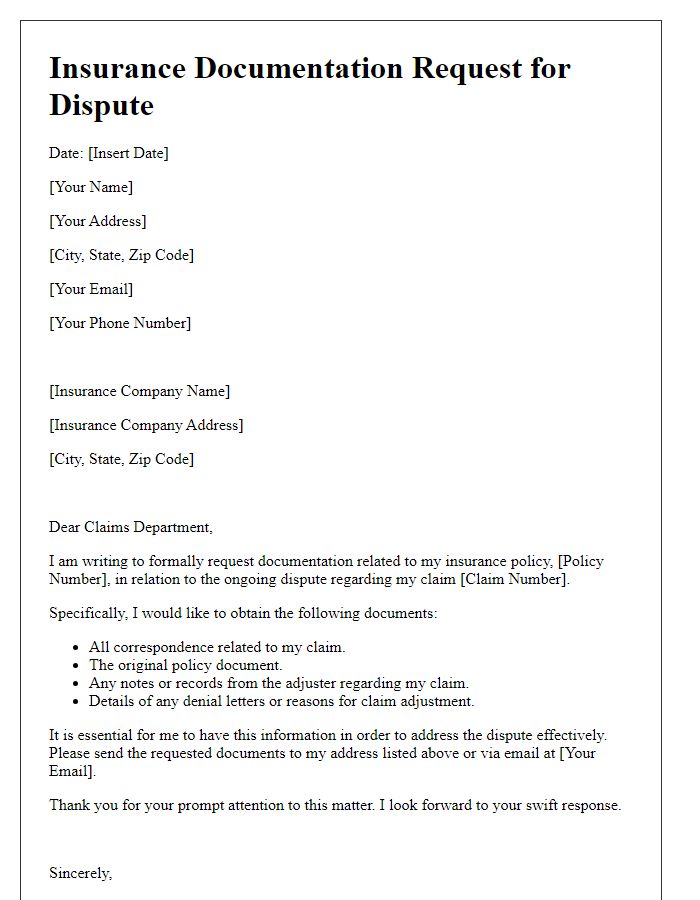

Supporting documentation and evidence

Submitting supporting documentation and evidence is crucial in resolving insurance disputes effectively. Essential documents include the insurance policy (detailing coverage limits and exclusions), claims forms (including dates of submission and any reference numbers), photographs related to the claim (such as property damage or injuries), and medical records (in case of health-related claims) that substantiate the medical expenses incurred. Relevant correspondence with the insurance company (emails or letters outlining claim discussions) should also be included to provide context and a timeline. Furthermore, expert opinions or reports (for instance, from a damage assessor or a medical professional) can lend credibility to the dispute, helping to validate your position and encourage a fair resolution.

Request for specific resolution or action

Insurance disputes can arise over claims, coverage denials, or payment issues, requiring a clear explanation of the situation. Policyholders often submit documents, such as claims forms and denial letters, highlighting specific incidents or damages, e.g., a car accident on Main Street, Springfield. Important details include the policy number, claim number, and date of incident, conveying urgency in resolution. Specific actions, such as a request for claim re-evaluation or payment adjustment, should be clearly outlined, ensuring the insurance company understands desired outcomes to expedite the process. Additional evidence, such as photographs or medical reports, can support the case, demonstrating the necessity of resolution in alignment with policy terms.

Comments