When it comes to protecting your home and personal belongings, having renters insurance is crucial, but knowing how to submit a claim can feel overwhelming. In this article, we'll guide you through the essentials of crafting a clear and effective renters insurance claim letter, ensuring you have all the necessary details at your fingertips. We'll cover everything from the basic structure of the letter to key information you should include, so you can navigate the process with confidence. Ready to simplify your claims submission? Dive in to learn more!

Policyholder information

Submitting a renters insurance claim requires detailed policyholder information to ensure accurate processing. Essential details include the policyholder's full name, enrolled address (noting city, state, and ZIP code), contact number (with area code), and email address for correspondence. Additionally, provide the policy number associated with the claim, as this helps insurers quickly locate the coverage specifics. When detailing the incident, include the date and time it occurred, the type of loss (theft, fire, water damage), and an itemized list of damaged or lost items with estimated values. Including photos and any police reports enhances the claim's legitimacy, aiding in a smoother claims process.

Detailed incident description

On June 15, 2023, at approximately 2:30 PM, a significant water leak occurred in Apartment 3B of Maple Tree Apartments, located at 127 Oak Street, Springfield. The source of the leak was identified as a burst pipe in the ceiling, which resulted in extensive water damage to personal belongings, including furniture, electronics, and clothing. Rapidly rising water levels soaked the carpet and walls, leading to mold growth within 48 hours. The estimated cost of damage exceeds $5,000, encompassing replacement and restoration efforts. The incident has been documented with photographs and a maintenance report submitted to the property management for review.

Inventory of damaged or lost items

A comprehensive inventory of damaged or lost items is crucial for renters insurance claims processing. Each item should include specific details such as the description, brand, model number, purchase price, and date of purchase. For example, a damaged Samsung 65-inch LED TV may have a purchase price of $900, acquired in March 2021. Important items like clothing should also be listed, detailing brands and estimated costs, such as a set of Nike sneakers valued at $120. In addition to this, including any damaged furniture, like a wooden dining table from IKEA worth $400 purchased in July 2019, provides an accurate assessment of losses. It is beneficial to document these details with photographs and receipts, adding crucial evidence for the insurance claim process.

Supporting documentation and evidence

Submitting a renters insurance claim requires thorough documentation to support your case for recovery. Essential items include photographs of damaged property, capturing the extent of the loss, particularly water damage or theft of belongings, alongside a detailed inventory list that outlines each item's value and purchase date. Relevant documents such as police reports, if applicable, should accompany claims related to theft or vandalism incidents, while repair estimates provide evidence of necessary restoration or replacement costs following a disaster such as a fire or natural calamity. Correspondence with your insurance provider, including initial policy documents featuring coverage limits, ensures clarity on your entitlements during the claims process. Keep copies of all submitted paperwork to maintain a record for future reference or appeals, especially if discrepancies arise later.

Contact information for follow-up

Contact information for follow-up in renters insurance claim submissions typically includes essential details such as full name, address, phone number, and email address. Providing accurate contact information ensures efficient communication with the insurance company during the claims process. The full name should be as listed in the policy document, while the address must correspond to the rented property relevant to the claim. A reliable contact number, ideally a mobile phone, should facilitate quick updates and necessary discussions. An active email address allows for documentation sharing and claims updates. Additionally, including a preferred method of communication aids in streamlining the process.

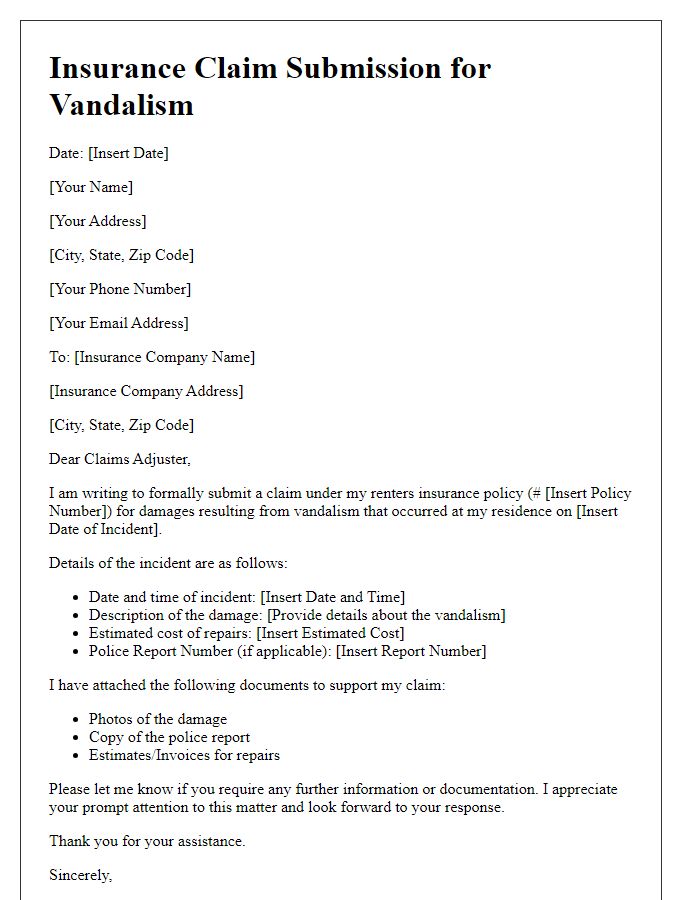

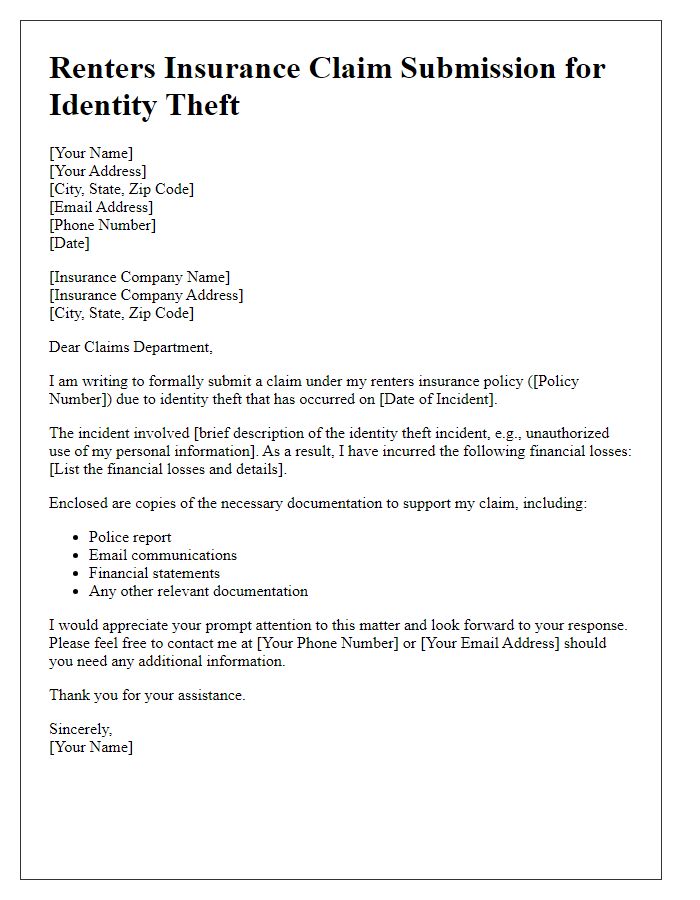

Letter Template For Renters Insurance Claim Submission Samples

Letter template of renters insurance claim submission for theft incident.

Letter template of renters insurance claim submission for personal property loss.

Letter template of renters insurance claim submission for natural disaster.

Letter template of renters insurance claim submission for liability claims.

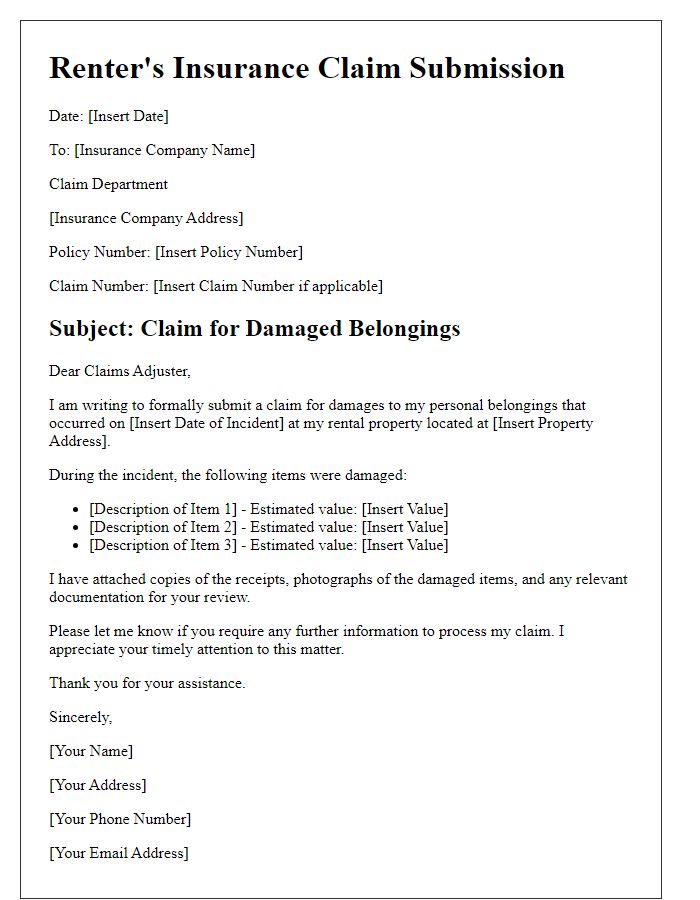

Letter template of renters insurance claim submission for damaged belongings.

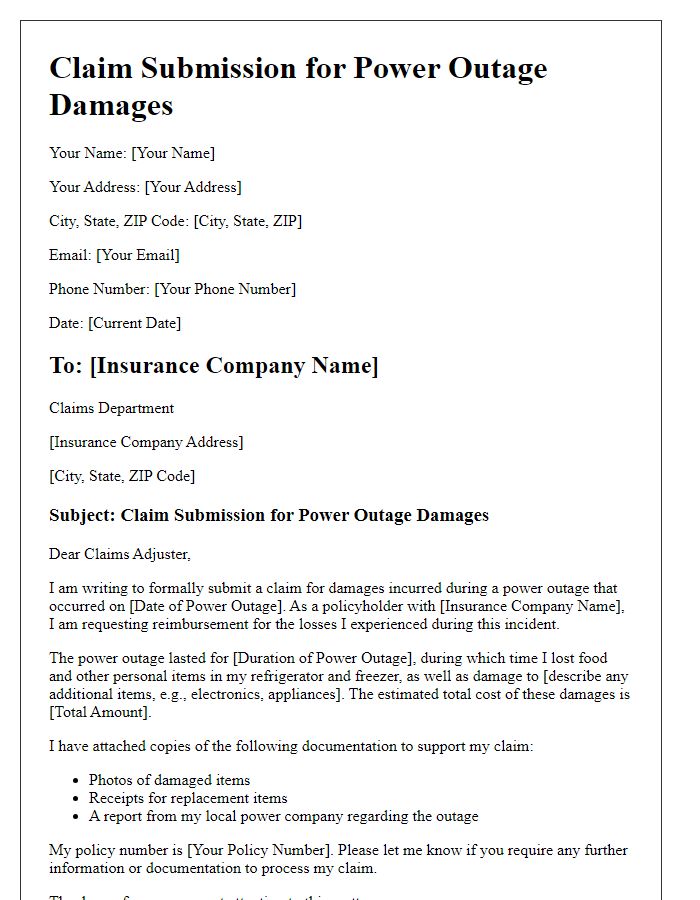

Letter template of renters insurance claim submission for power outage damages.

Comments