Are you navigating the complex world of long-term care insurance claims? It can often feel overwhelming, but with the right guidance, the process becomes much more manageable. In this article, we'll walk you through a comprehensive letter template designed specifically for long-term care insurance claims, ensuring you have all the essential details covered. So, let's dive in and empower you with the knowledge you need to submit a successful claim!

Policyholder Information

Long-term care insurance claims often require specific details from the policyholder. The policyholder's name, registered under policy number 123456, should be prominently stated. Important contact information includes a primary phone number, such as (555) 123-4567, and an email address, like policyholder@example.com. The date of birth, for verification purposes, should be included alongside the mailing address, for example, 123 Elm Street, Springfield, IL 62701. In case of a designated representative, their details should also be mentioned clearly, ensuring that any necessary correspondence can be directed appropriately. Accurate and up-to-date information is crucial in facilitating the claim processing efficiently.

Claimant's Details

Claiming long-term care insurance benefits requires accurate documentation of the claimant's details. Relevant information should include the claimant's full name (for identification purposes), date of birth (to verify age and eligibility), social security number (for tracking and processing claims), and policy number (specific to the long-term care insurance policy held with the insurance provider). Additional details may encompass the address (to establish residence), telephone number (for communication), and email address (for digital correspondence). Furthermore, including the type of long-term care required, such as in-home care, assisted living facility, or nursing home, ensures clarity regarding the nature of the claim.

Policy Details

Long-term care insurance policies often encompass a variety of specific details that are crucial for successful claims. For instance, coverage might include nursing home services, assisted living facilities, or in-home care, with limits on daily benefits, often ranging from $100 to $400 per day based on the policy. Eligibility for benefits usually depends on the inability to perform at least two of six activities of daily living (ADLs)--bathing, dressing, eating, toileting, transferring, and continence. In addition, many policies require a waiting period, which may range from 30 to 90 days, before benefits kick in. It is essential to reference the policy number, the effective date (when the coverage started), and the name of the insured individual to ensure a smooth claims process. Policy riders may provide additional benefits for specific conditions or services, further defining what is covered under the specific plan.

Description of Care Services

Long-term care insurance claims often require a detailed description of care services provided to individuals, typically seniors or those with chronic illnesses. Home health aides deliver essential assistance with activities of daily living (ADLs), such as bathing, dressing, and meal preparation. Skilled nursing facilities, like those accredited by the Commission on Accreditation of Rehabilitation Facilities (CARF), offer comprehensive medical care along with physical therapy. Memory care units in assisted living facilities specialize in supporting individuals with Alzheimer's and other dementias, providing structured environments and tailored programs to ensure safety and cognitive engagement. Personal emergency response systems (PERS) enabled with GPS technology provide immediate assistance to policyholders, enabling quick access to emergency services 24/7. Documentation from healthcare professionals, including licensed nurses and certified caregivers, is crucial for verifying the amount and type of care received, highlighting the necessity of the services for the policyholder's well-being.

Supporting Documentation

Long-term care insurance claims require specific supporting documentation to ensure a thorough evaluation. Comprehensive medical records, including detailed assessments from healthcare providers (physicians, nurses), establish the necessity for care, documenting conditions such as Alzheimer's disease or severe arthritis. Policyholders often need their insurance policy number, along with copies of previous claims (such as for hospital stays or assisted living), to match the documentation with the policy issued by the insurance provider. Financial statements, including invoices from long-term care facilities or home health care services, are critical to substantiate the costs incurred. Additionally, any relevant forms or reports required by the insurance company must be meticulously compiled to support the claim effectively.

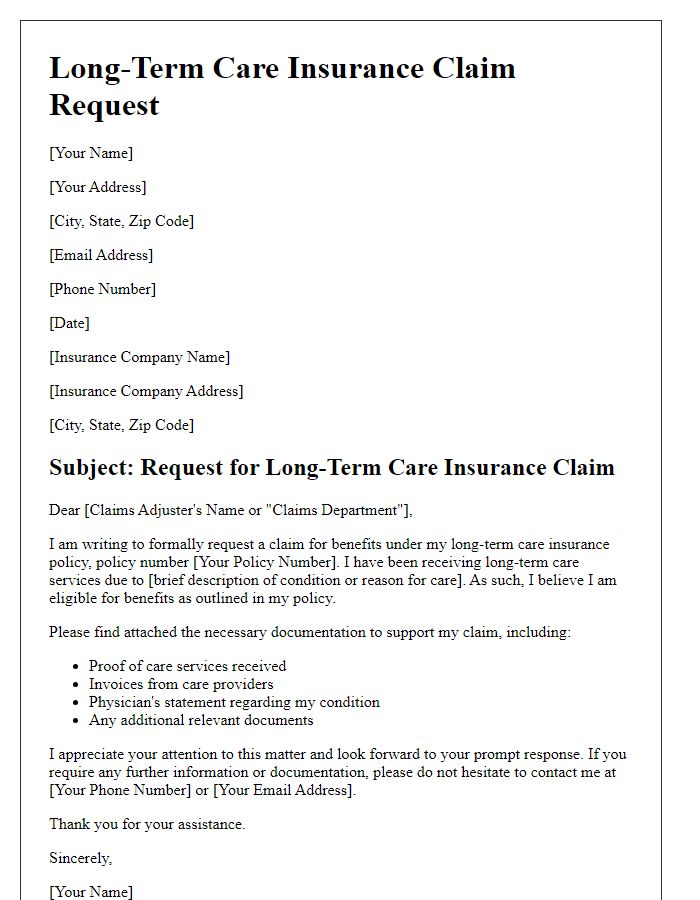

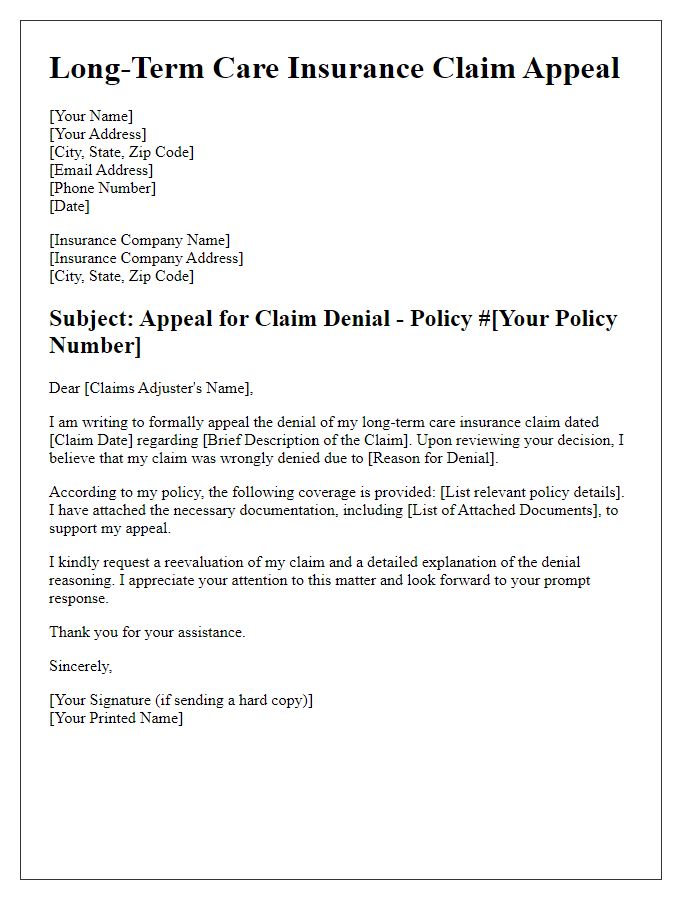

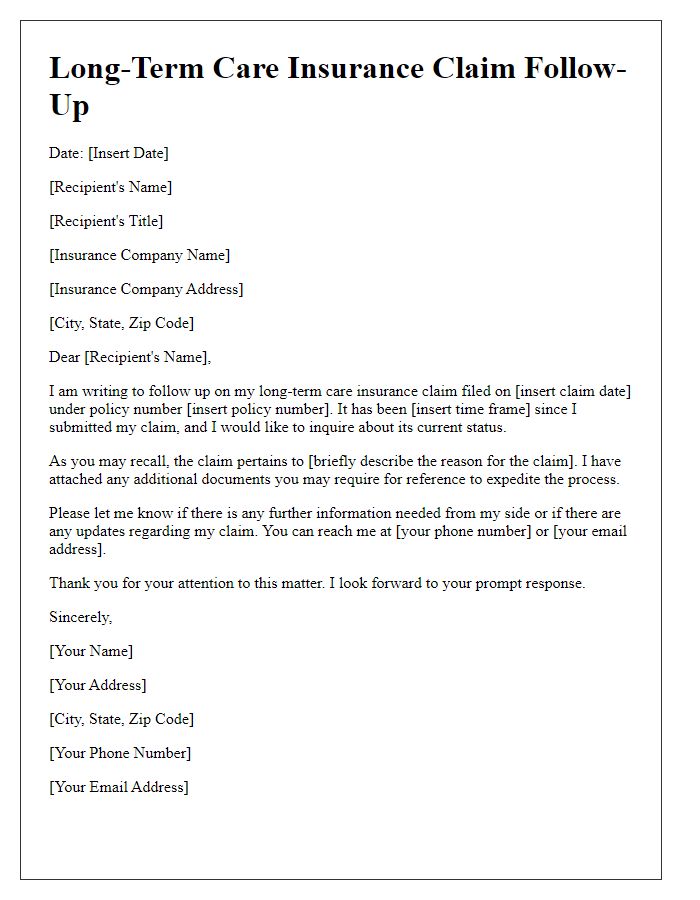

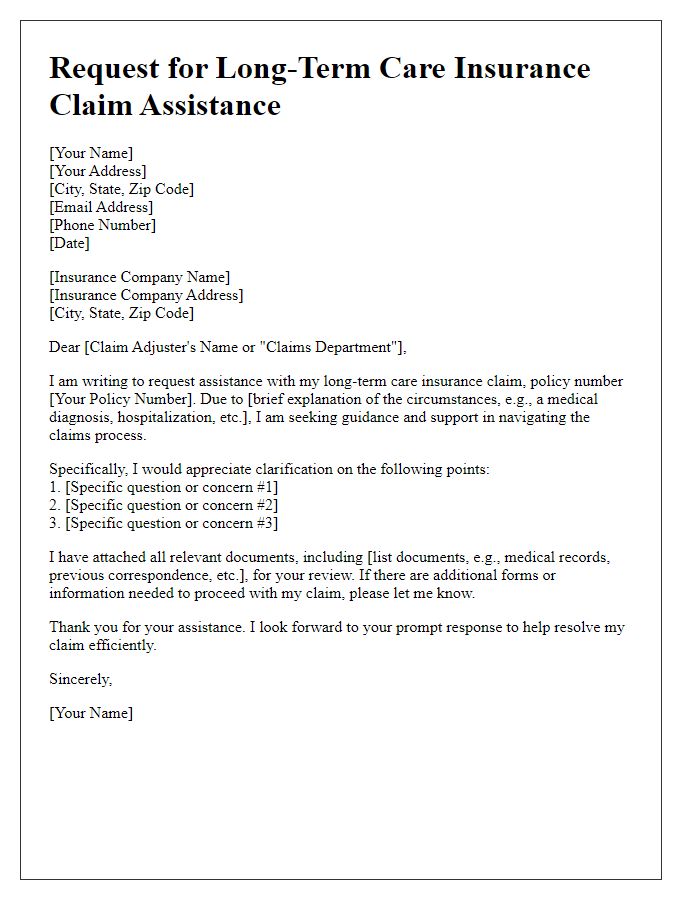

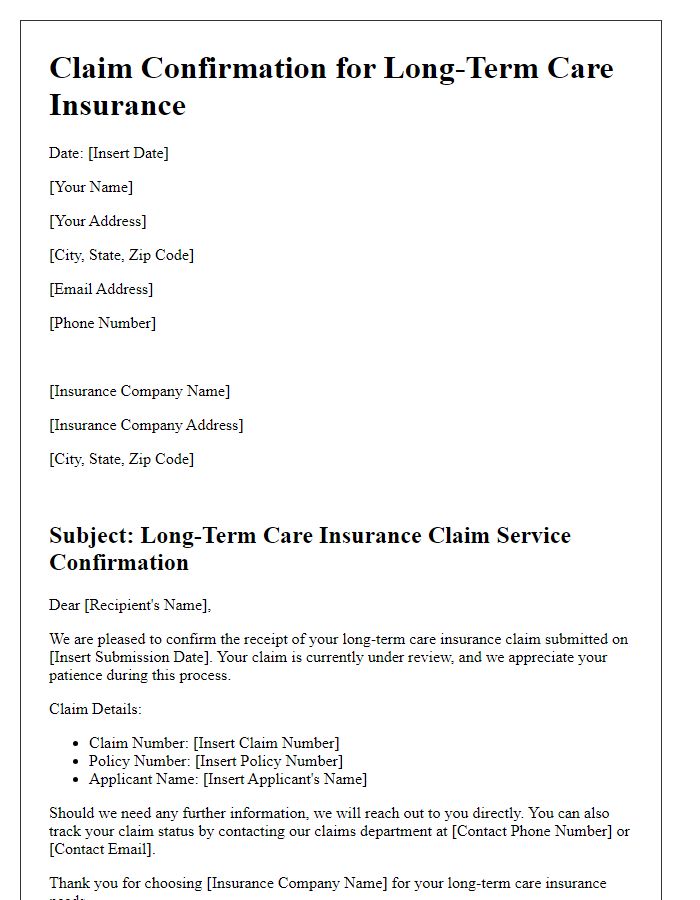

Letter Template For Long-Term Care Insurance Claim Samples

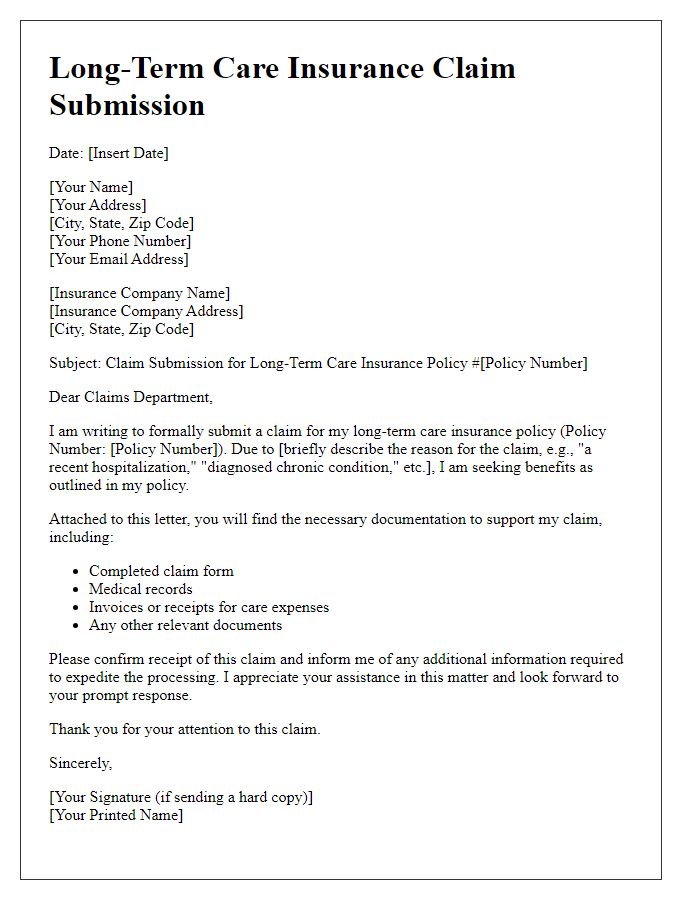

Letter template of long-term care insurance policyholder claim submission

Comments