Are you curious about how to navigate the ins and outs of employer health insurance? Understanding your options can be overwhelming, but it's essential for ensuring you and your family have the coverage you need. In this article, we'll break down the key aspects of employer health insurance, from benefits to enrollment processes, in a simple, relatable way. Join us as we explore this vital topic and get ready to empower yourself with valuable insights!

Personal Identification Details

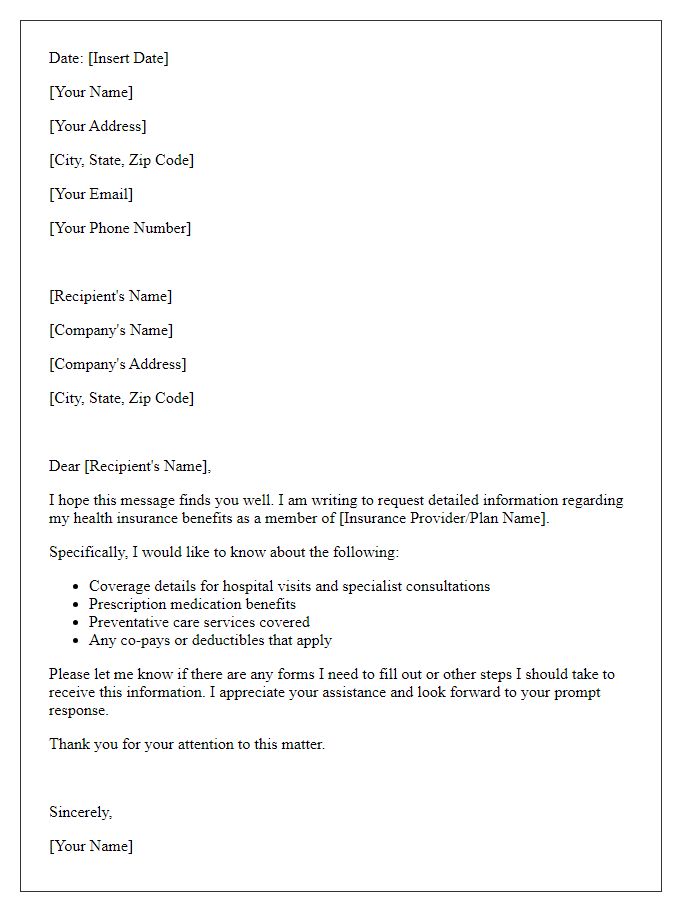

When inquiring about employer health insurance, it's essential to include personal identification details to streamline the process. Personal details typically encompass full name (such as John Doe), employee ID number (an alphanumeric code assigned by the employer like 12345A), contact information (including a phone number or email address like johndoe@example.com), and date of birth (for example, March 5, 1985). It may also be beneficial to mention the department of employment (like Human Resources) or the specific role within the company (such as Marketing Manager). This structured information ensures a timely and accurate response regarding health insurance options offered by the employer.

Specific Inquiry About Coverage

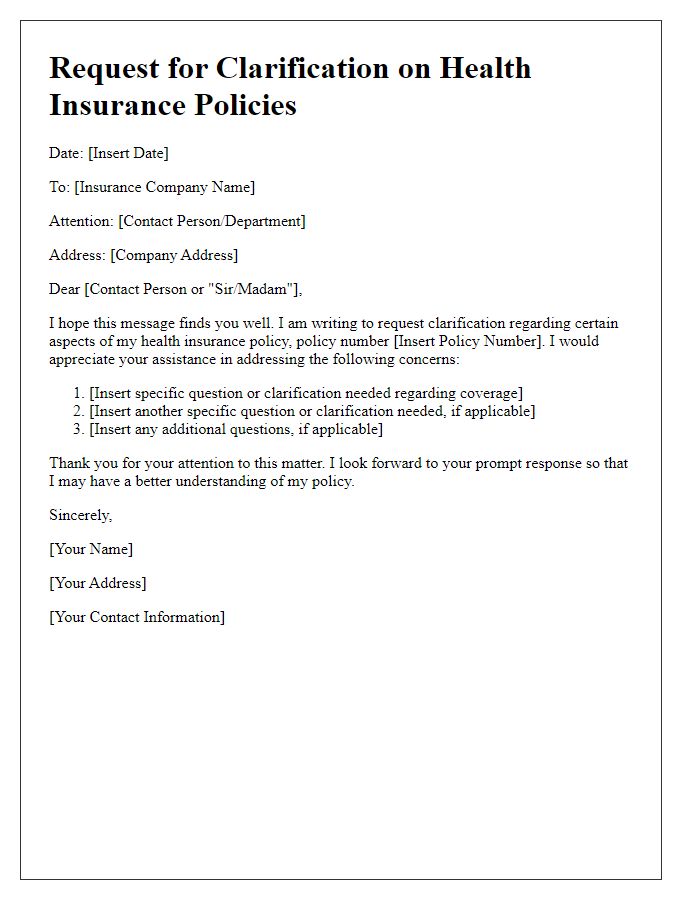

Inquiring about employer-sponsored health insurance coverage is essential for understanding the scope of benefits available to employees. Health insurance plans, such as Preferred Provider Organization (PPO) or Health Maintenance Organization (HMO), can vary significantly. Key factors to consider include coverage limits, co-payments, deductibles, and available networks such as in-network and out-of-network providers. Additional details regarding prescription drug coverage, mental health services, and preventive care options can provide clarity on the comprehensive nature of the plan. Employees may also seek information about dependent coverage and eligibility criteria, including enrollment periods, to make informed decisions regarding their healthcare needs.

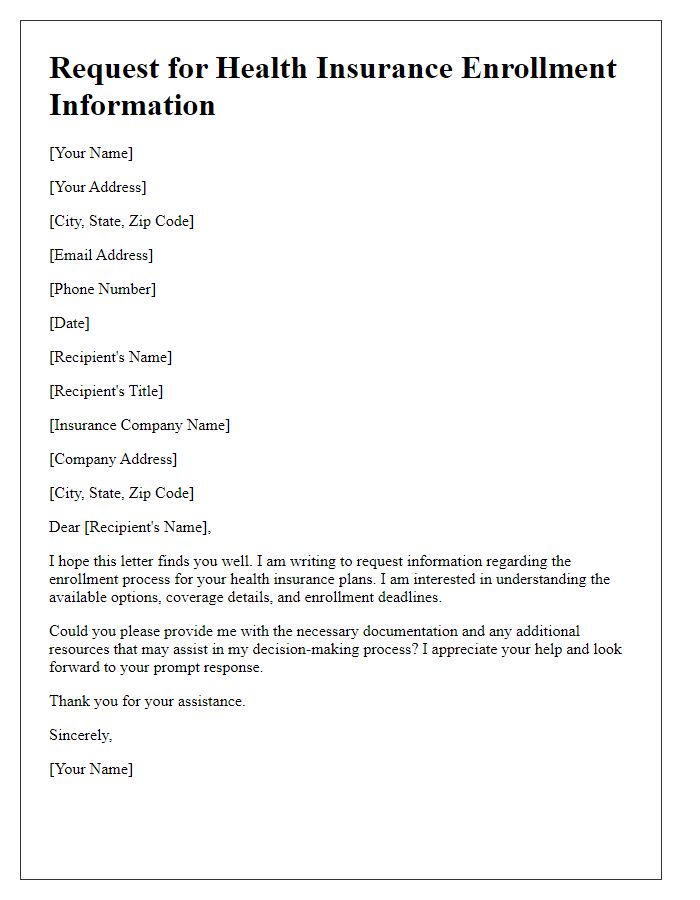

Reference to Employment Terms

Employer-sponsored health insurance plays a crucial role in employee benefits packages, particularly in the United States where approximately 49% of the population relies on employer-provided plans for coverage. Details regarding eligibility, premium contributions, and coverage specifics are often outlined in employment agreements or employee handbooks. For many companies, open enrollment periods provide a critical window for employees to review and select health insurance options, which can vary in terms of deductibles, co-pays, and provider networks. It's essential for employees to be well-informed about their rights and options under the Affordable Care Act (ACA) and any additional benefits the employer may offer, such as wellness programs or telehealth services, to ensure they maximize their healthcare benefits while managing costs effectively.

Request for Additional Documentation

Employers often require specific documentation to facilitate the processing of employee health insurance applications. Essential documents may include proof of employment, recent pay stubs, Social Security numbers, and completed enrollment forms. Providing accurate and complete information ensures compliance with regulations set forth by the Affordable Care Act, which mandates companies with 50 or more employees to offer health coverage. Incomplete applications may delay enrollment, impacting access to benefits, including preventative care and emergency services. Employers must notify employees about necessary documentation and deadlines to ensure timely processing of health insurance packages.

Contact Information for Follow-up

The employer health insurance inquiry process often requires specific contact information to ensure effective communication. Essential details include the name of the human resources representative, such as Sarah Thompson, located at XYZ Corporation in San Francisco, California. Their direct phone number, 555-123-4567, and email address, sarah.thompson@xyzcorp.com, facilitate quick follow-up. Additionally, the inquiry may involve understanding coverage options under the Affordable Care Act for employees, eligibility requirements, and open enrollment periods, which often occur annually between November 1 and December 15. Understanding these details ensures a more informed discussion regarding employer-sponsored health insurance benefits.

Letter Template For Employer Health Insurance Inquiry Samples

Letter template of inquiry about eligibility for company health insurance

Comments