If you've ever felt anxious about unexpected events that could impact your finances, you're not alone. Umbrella insurance is designed to provide you with that extra layer of security, ensuring that you're protected beyond the limits of your standard policies. Imagine having the peace of mind knowing that you're covered in almost any situation, from accidents to lawsuits. Curious to learn more about how umbrella insurance can safeguard your future? Read on!

Personal Identification Information

Umbrella insurance provides an additional layer of liability coverage beyond standard homeowners, auto, and other insurance policies. This coverage is crucial for protecting personal assets from potential lawsuits or claims exceeding primary policy limits. In personal identification information, this includes crucial details such as full name, date of birth (which can impact insurance rates), residential address for assessing property risk, and social security number for verifying identity and determining premium eligibility. Additionally, previous insurance claims history can influence coverage options and rates, highlighting the importance of accurate representation. Lastly, understanding occupation and income level is essential for insurers to tailor appropriate policies that meet specific personal needs and financial circumstances.

Detailed Coverage Description

Umbrella insurance provides additional liability coverage beyond the limits of existing policies, such as homeowners and auto insurance. This coverage typically kicks in when claims exceed those limits, often increasing protection to a minimum of $1 million. It safeguards against various events, including personal injury (such as slip and fall accidents that occur on your property or during social gatherings), property damage (where you might be held liable for damage to another's property), and even legal fees associated with lawsuits. Some policies may also cover defamation, false arrest, and invasion of privacy, offering a comprehensive safety net. This extra layer of liability protection is particularly beneficial for individuals with significant assets or those who are at a higher risk of claims, such as business owners or public figures. Coverage varies by provider, often including specific exclusions and limits, which necessitates a thorough review to align with individual needs and risk factors.

Liability Limit Options

Umbrella insurance provides an essential layer of liability protection beyond homeowners, auto, or other insurance policies. Coverage limits often start at $1 million, significantly enhancing financial security against claims, lawsuits, or property damage events. Consumers can select various increments, such as $1 million, $2 million, or up to $5 million, catering to personal risk thresholds and asset protection needs. Certain insurance companies also offer customized limits depending on individual circumstances and overall net worth, ensuring comprehensive coverage for high-risk activities, including recreational driving or personal swimming pools. Proposals typically include considerations for deductible amounts and potential exclusions, reflecting different valuation of liability coverage and risk appetite among policyholders.

Pricing and Payment Terms

Umbrella insurance policies provide additional liability coverage beyond standard homeowners, renters, or auto insurance. Monthly premiums typically range from $15 to $50 depending on coverage limits, which can start at $1 million and go up to $10 million or more, based on individual risk assessments and asset valuations. Payment terms offer flexibility; policyholders can opt for annual billing, which may provide a discount, or choose semi-annual or quarterly payments. Many insurers require a minimum underlying liability coverage on other policies as part of their umbrella requirement, such as $300,000 in auto liability. Discounts may apply for bundling multiple policies under one insurer or for maintaining a claims-free history.

Contact Information for Further Inquiries

Umbrella insurance provides an additional layer of liability coverage beyond standard policy limits, ensuring financial protection against lawsuits, personal injury claims, and property damage incidents. For inquiries regarding umbrella insurance proposals, please contact our dedicated customer service team at 1-800-555-0123. Our office, located at 123 Main Street, Suite 300, Springfield, offers support Monday through Friday from 9 AM to 5 PM. Additionally, email inquiries can be sent to support@insurancecompany.com for prompt assistance regarding policy details and coverage options.

Letter Template For Umbrella Insurance Proposal Samples

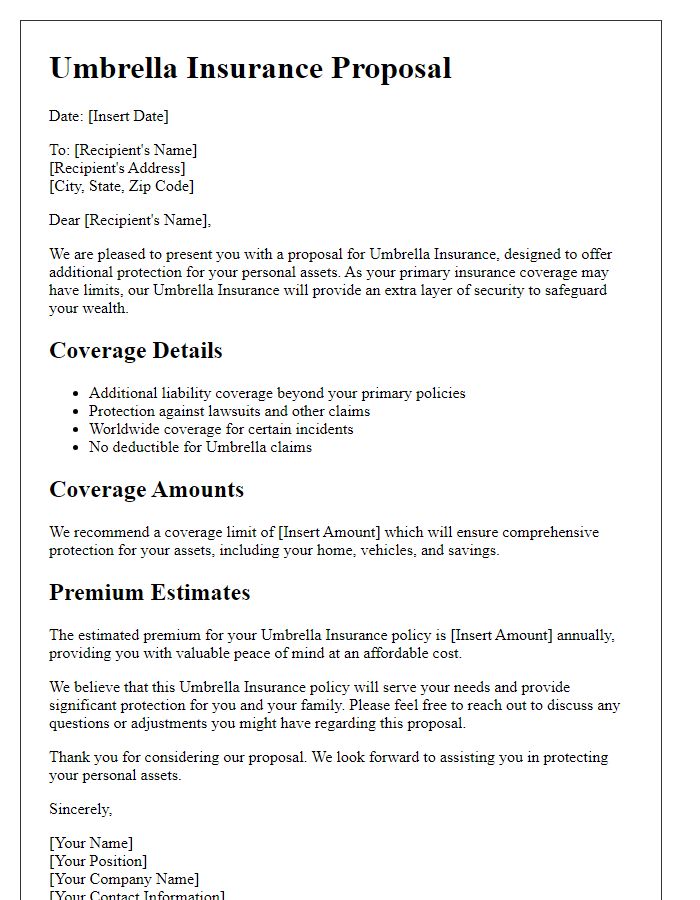

Letter template of umbrella insurance proposal for personal assets protection.

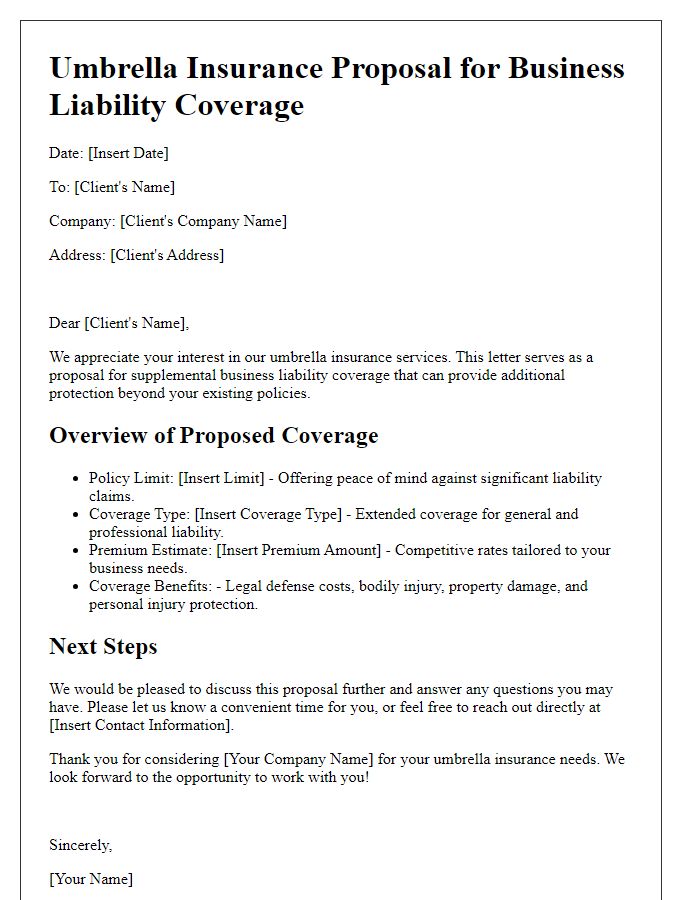

Letter template of umbrella insurance proposal for business liability coverage.

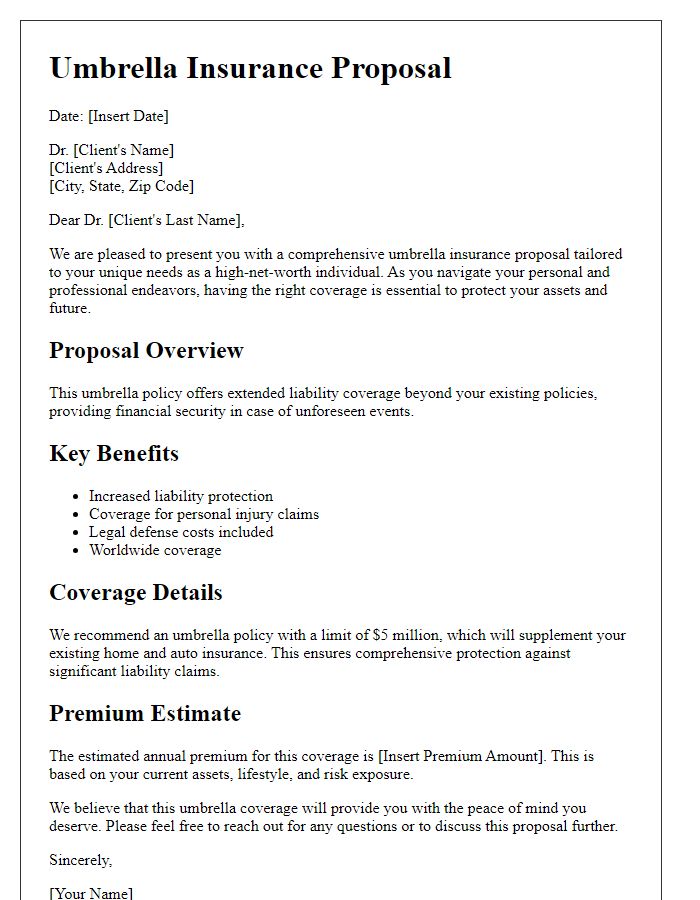

Letter template of umbrella insurance proposal for high-net-worth individuals.

Letter template of umbrella insurance proposal for families with young children.

Letter template of umbrella insurance proposal for homeowners with rental properties.

Letter template of umbrella insurance proposal for retirees and estate planning.

Letter template of umbrella insurance proposal for sports enthusiasts and public figures.

Letter template of umbrella insurance proposal for professionals with significant risks.

Letter template of umbrella insurance proposal for protecting against legal claims.

Comments