Are you ready to navigate the sometimes overwhelming world of insurance inquiries? Whether you have questions about your policy, need clarification on coverage, or want to understand your rights, it's essential to approach your concerns with clarity and confidence. In this article, we'll explore a comprehensive letter template specifically designed for addressing inquiries to your insurance commission. So, grab a cup of coffee, settle in, and let's dive in to make your insurance journey easier!

Contact Information

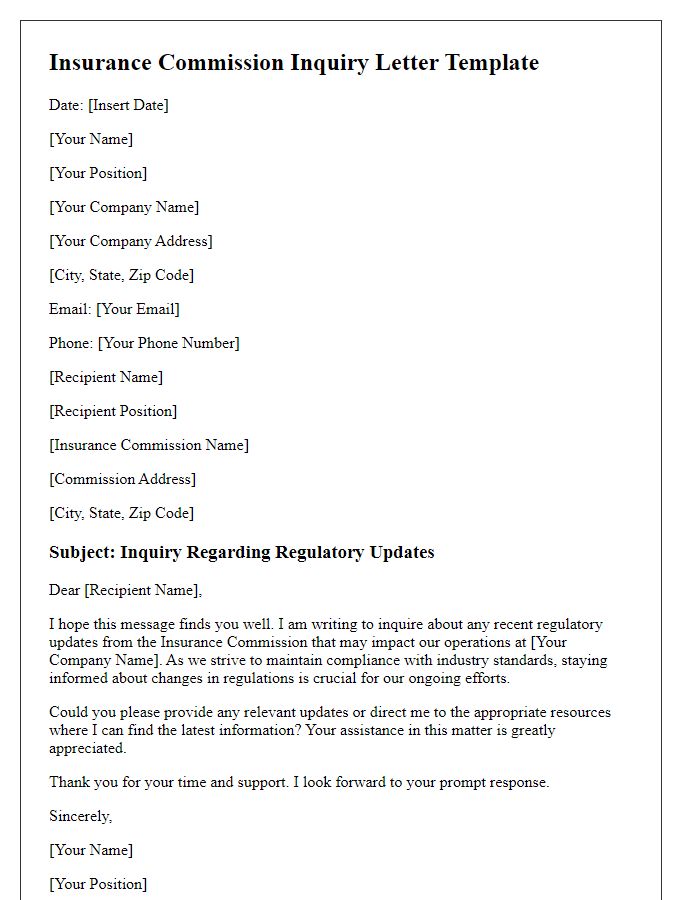

Inquiries regarding insurance commissions require precise contact information for efficient communication and resolution. Typically, such inquiries should include details such as the official name of the insurance company, which may range from large national firms like State Farm to regional specialists like Farm Bureau Insurance. Additionally, it's essential to include the designated contact person's name, who may hold a title like Regional Claims Manager. Providing a direct email address (preferably a company domain email) ensures organized correspondence. A phone number, ideally with a toll-free option, facilitates immediate dialogue. Including the physical mailing address of the insurance company strengthens transparency and ensures proper routing of any formal documents or replies.

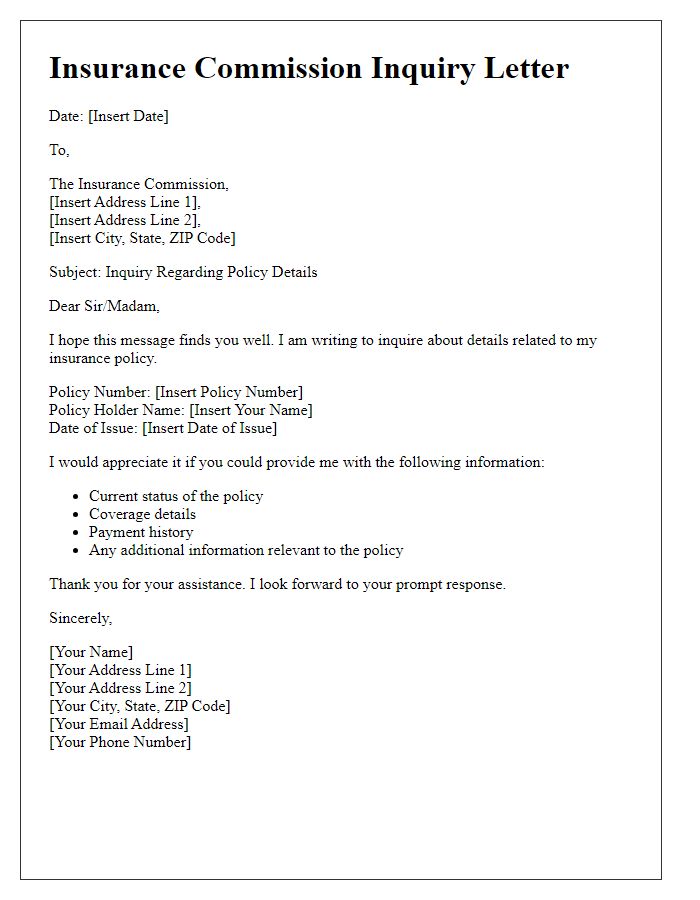

Policy Details

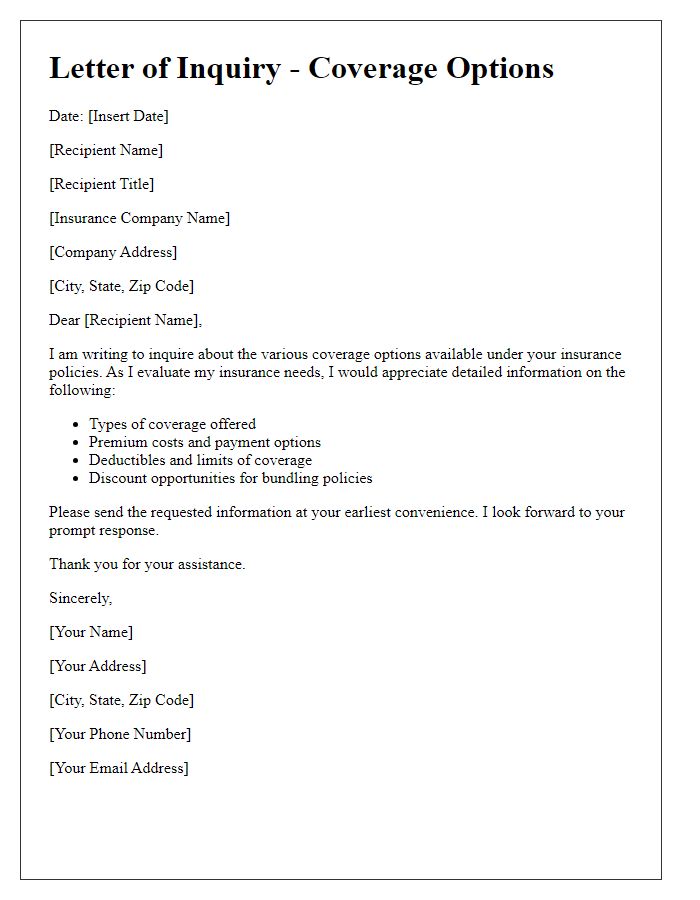

Inquiring regarding the insurance policy details can provide essential information for understanding coverage, terms, and conditions. Essential elements include policy number (unique identifier assigned to a specific insurance contract), effective date (the date coverage begins), premium amount (the cost paid for coverage), and coverage limits (maximum amounts the insurer will pay for claims). Additionally, other critical aspects might include deductibles (the amount the insured must pay before coverage kicks in), exclusions (conditions or circumstances not covered by the policy), and riders (additional benefits or coverages that can be added). Clarifying these details ensures comprehensive knowledge of the insurance product and facilitates appropriate coverage decisions based on personal or business needs.

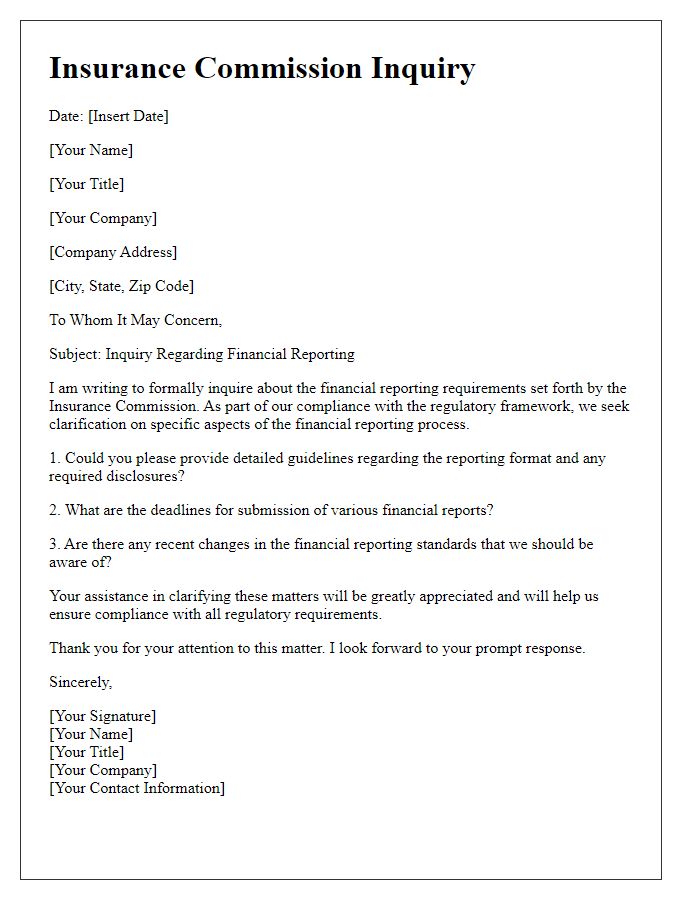

Inquiry Purpose

The insurance commission inquiry process involves various essential steps to assess the legitimacy of insurance claims and maintain industry standards. Claims frequency data from 2022 shows that over 40% of inquiries were related to property insurance, specifically in regions like California and Florida, where natural disasters frequently occur. The inquiry aims to investigate discrepancies in claim submissions, which can include missing documentation or inconsistencies in reported damages. Stakeholders involved in the process typically range from policyholders, insurance adjusters, and legal representatives to regulatory bodies that ensure compliance with state laws and regulations. Timely inquiries can help clarify situations, resolve disputes, and foster trust between providers and clients in the insurance landscape.

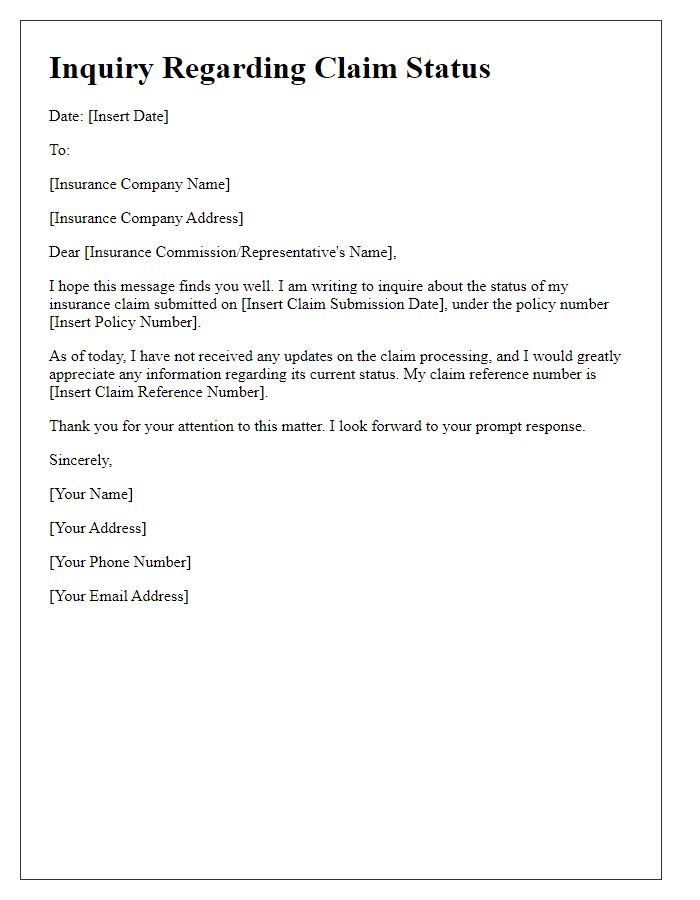

Specific Questions

Inquiries regarding insurance claims often involve detailed questions that require clarity and specificity to facilitate efficient responses. Examples of questions might include: What are the necessary documents for claims exceeding $10,000? How long does the review process typically take for comprehensive policies in the United States? Are there specific timelines for submitting claims following a significant event, such as a natural disaster like Hurricane Katrina? Furthermore, clarification on the policyholder's rights under state regulations, such as the Texas Insurance Code, can provide valuable insights. Understanding the process for appealing a denied claim through the National Association of Insurance Commissioners can also be critical for resolving disputes effectively.

Closing Remarks

The insurance commission's inquiry process often concludes with essential closing remarks that emphasize the significance of transparency and accountability within the insurance sector. These remarks highlight the commitment to protecting consumer rights and ensuring fair practices among insurance providers. A summary of findings from the inquiry may be provided, showcasing key statistics on claims processing times, customer satisfaction rates, and compliance metrics from various insurers. The commission may also outline recommendations for policy improvements and advocate for further regulatory measures to enhance industry standards. The final remarks typically stress the ongoing role of the commission in monitoring the insurance marketplace, fostering an environment of trust, and ensuring that all stakeholders adhere to ethical guidelines for the benefit of consumers and providers alike.

Letter Template For Insurance Commission Inquiry Samples

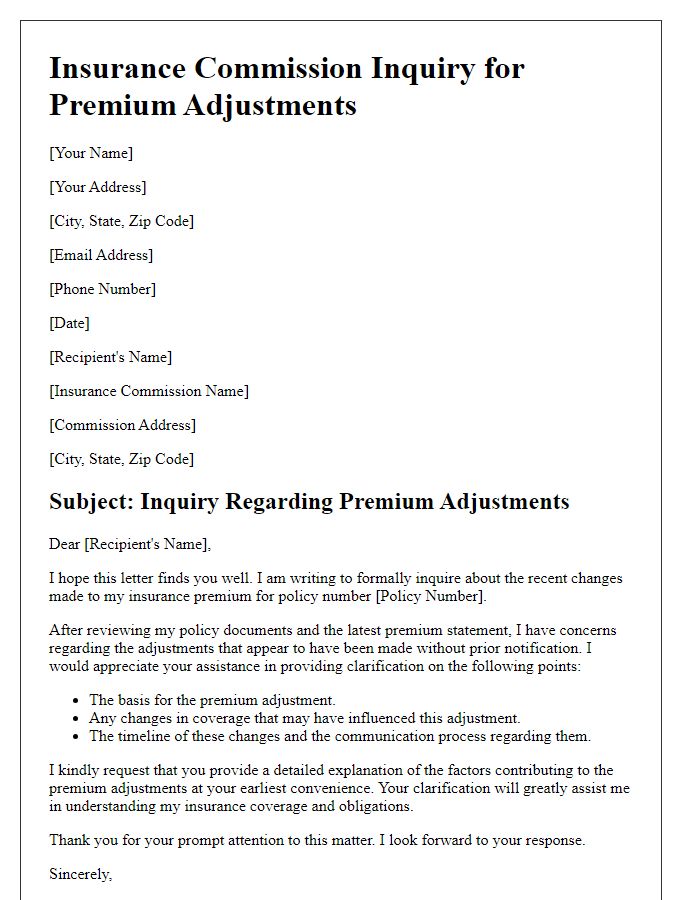

Letter template of insurance commission inquiry for premium adjustments.

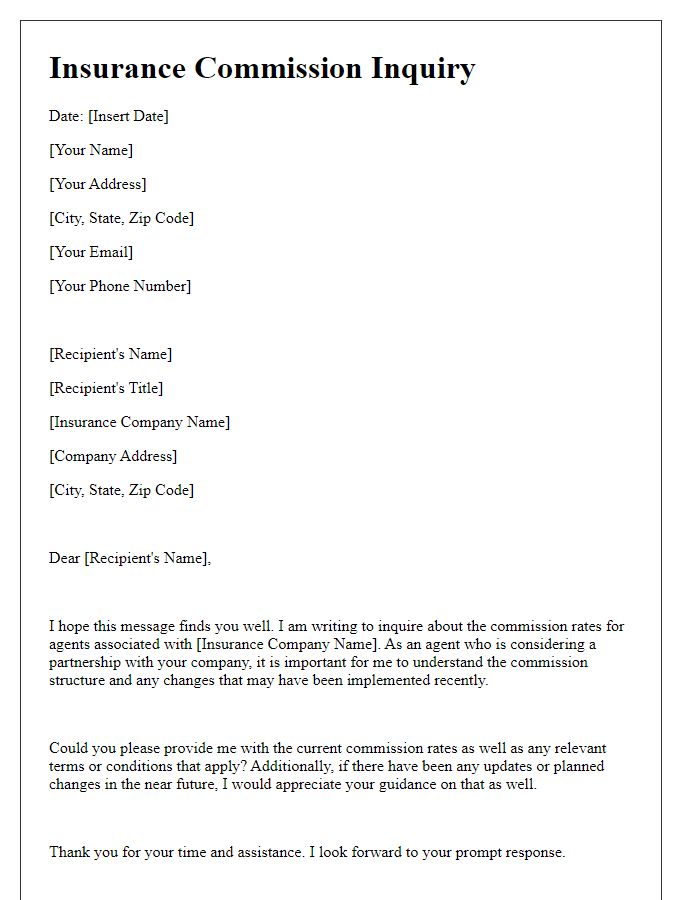

Letter template of insurance commission inquiry for agent commission rates.

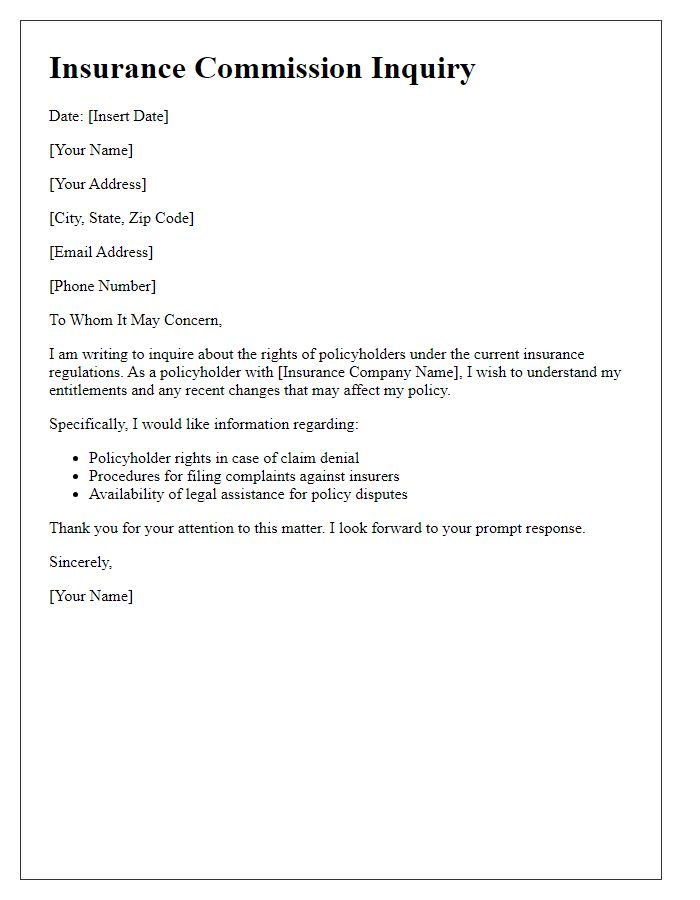

Letter template of insurance commission inquiry concerning policyholder rights.

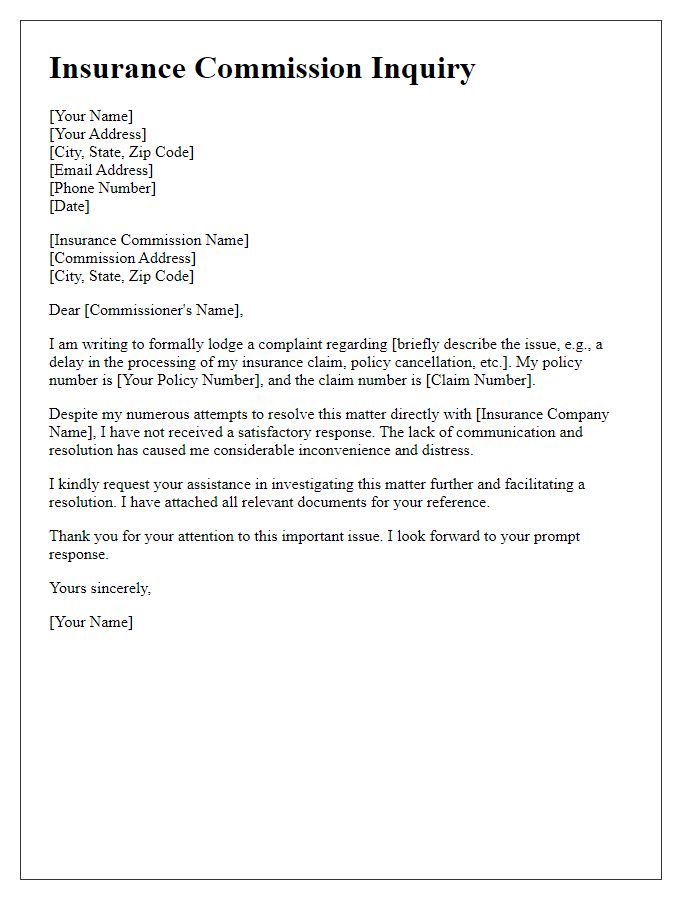

Letter template of insurance commission inquiry for complaint resolution.

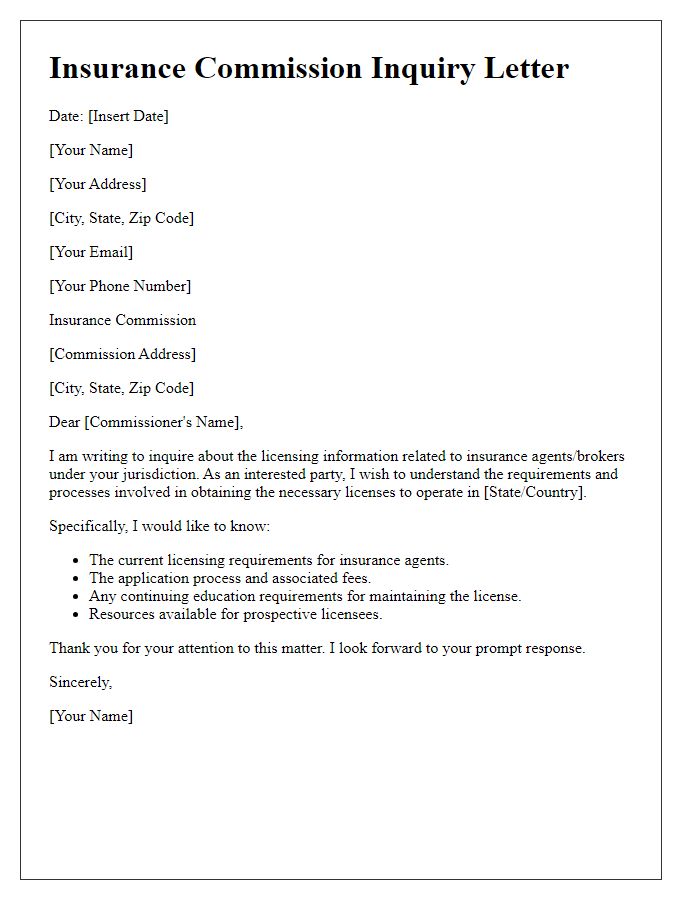

Letter template of insurance commission inquiry regarding licensing information.

Comments