When it comes to understanding comprehensive insurance, it can often feel overwhelming. This type of coverage isn't just about protecting your vehicle from accidents; it also safeguards against a variety of potential risks such as theft, vandalism, and natural disasters. In this article, we'll break down the key components of comprehensive insurance, making it easier to grasp its benefits and necessities. So, grab your favorite beverage and dive in to discover how comprehensive insurance can keep you and your assets safe!

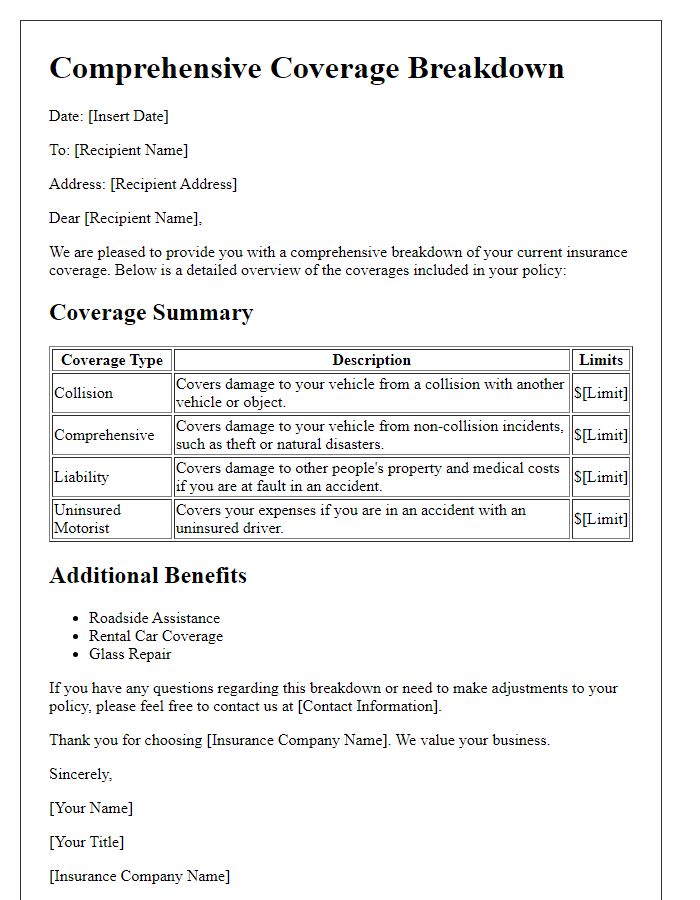

Policy Coverage Details

Comprehensive insurance policies provide extensive protection against a wide range of incidents, covering damages to vehicles from various non-collision events, such as theft, vandalism, fire, and natural disasters. This type of coverage typically includes incidents like hail (which can cause significant body damage), flooding (which affects engine components and electrical systems), and animal collisions (such as deer strikes common in rural areas of the United States). Notable exclusions may be found in specific policy terms, including but not limited to, intentional damage or wear and tear. Additionally, comprehensive insurance often provides coverage for personal belongings stored in a vehicle, with protection limits that vary based on the insurer, typically ranging from $100 to $1,000. Understanding these elements is crucial for vehicle owners seeking adequate protection against unforeseen events that can lead to significant financial loss.

Premium Calculation Factors

Comprehensive insurance premium calculations depend on several key factors, including vehicle make and model, age of the driver, driving history, location, and coverage limits. Insurance providers often assess vehicle characteristics like safety ratings (rated by organizations such as IIHS or NHTSA) and repair costs (influenced by the availability of parts and labor rates). Age of the driver significantly impacts premiums; younger drivers typically face higher rates due to statistical risk. Furthermore, geographic location plays a role, as urban areas may experience higher theft and accident rates compared to rural regions. Insurance history, including prior claims and payment history, also influences premium adjustments. Lastly, the chosen coverage limits and deductibles directly affect the overall cost, with higher limits and lower deductibles resulting in increased premiums. Understanding these factors enables potential policyholders to make informed decisions.

Claim Process Guidelines

Comprehensive insurance covers a wide range of damages and losses to a vehicle, including those caused by theft, vandalism, natural disasters, and animal collisions. The claim process typically begins with the policyholder reporting the incident to their insurance provider, such as Allstate or State Farm, within a specified timeframe--often 24 to 72 hours. After filing the claim, the insurer assigns a claims adjuster to assess the damage and determine the compensation amount based on estimates from authorized repair shops. The average processing time for claims can vary from a few days to several weeks, depending on the incident's complexity and required documentation. Additionally, policyholders may need to submit photos of the damage, police reports, and any relevant witness statements to support their claim. Understanding the specific requirements and timelines outlined in one's policy can significantly expedite the claims process and facilitate a smoother resolution.

Exclusions and Limitations

Comprehensive insurance policies encompass various protections for property and vehicles, specifically against risks like theft, vandalism, and natural disasters. Exclusions typically highlight scenarios where coverage may be denied, such as intentional damage, wear and tear, or losses from racing events. Limitations may also apply to specific items, with stipulations like claim caps or deductibles that directly affect payouts, potentially influencing financial recovery in loss events. Understanding these exclusions and limitations is vital for policyholders to avoid unexpected expenses in the event of a claim.

Customer Support Contact Information

Comprehensive insurance, often referred to as "full coverage," encompasses a range of protective measures for vehicles. This policy typically covers damages to your car from non-collision events like theft, vandalism, natural disasters (such as hurricanes or floods), and collisions with animals. For example, in 2022, over 350,000 vehicles in the United States were reported stolen, highlighting the importance of such coverage. This insurance also helps pay for repairs caused by incidents outside of your control, such as hailstorms that can cause significant exterior damage. Additionally, owners of classic cars, with values often exceeding $30,000, frequently opt for comprehensive coverage to safeguard their investments. Understanding these coverages can mitigate financial losses and bring peace of mind during unpredictable events.

Comments