Hello there! If you're looking to schedule an insurance inspection, you've come to the right place. It's essential to get these inspections done promptly to ensure you're fully covered and to avoid any surprises down the road. In this article, we'll guide you through a simple and effective template you can use, making the process as smooth as possible. So, let's dive in and explore the details together!

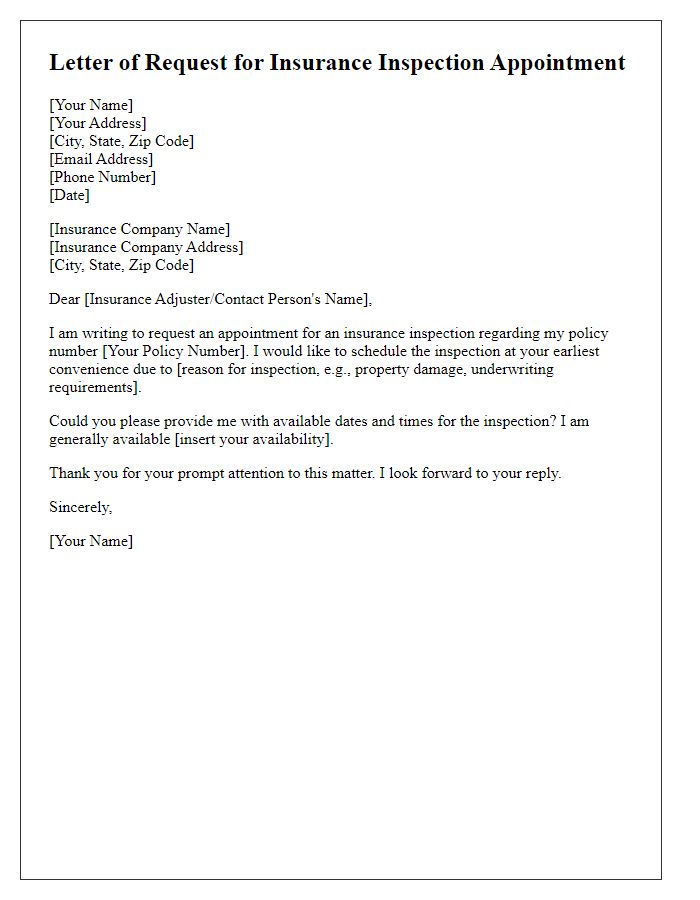

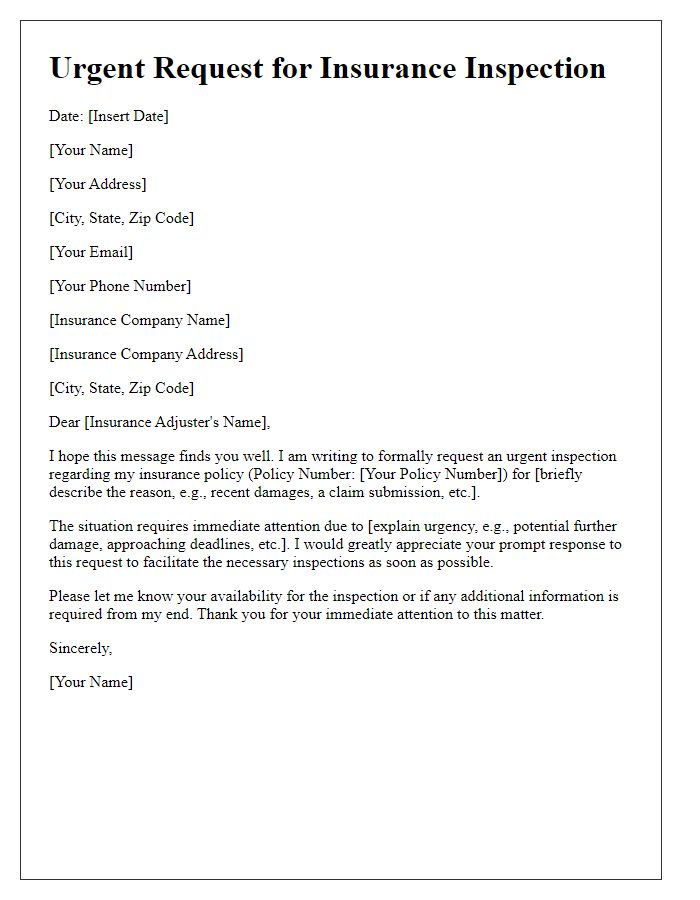

Clear purpose statement

The specific purpose of an insurance inspection scheduling request is to arrange a comprehensive evaluation of property or assets to assess risk, ensure compliance with policy terms, and verify the accuracy of provided information. This inspection allows insurance representatives to document condition, identify potential hazards, and ultimately determine appropriate coverage levels. A timely and efficient scheduling of this inspection is crucial, allowing both parties to maintain transparent communication and facilitate a smooth claims process in the event of future incidents.

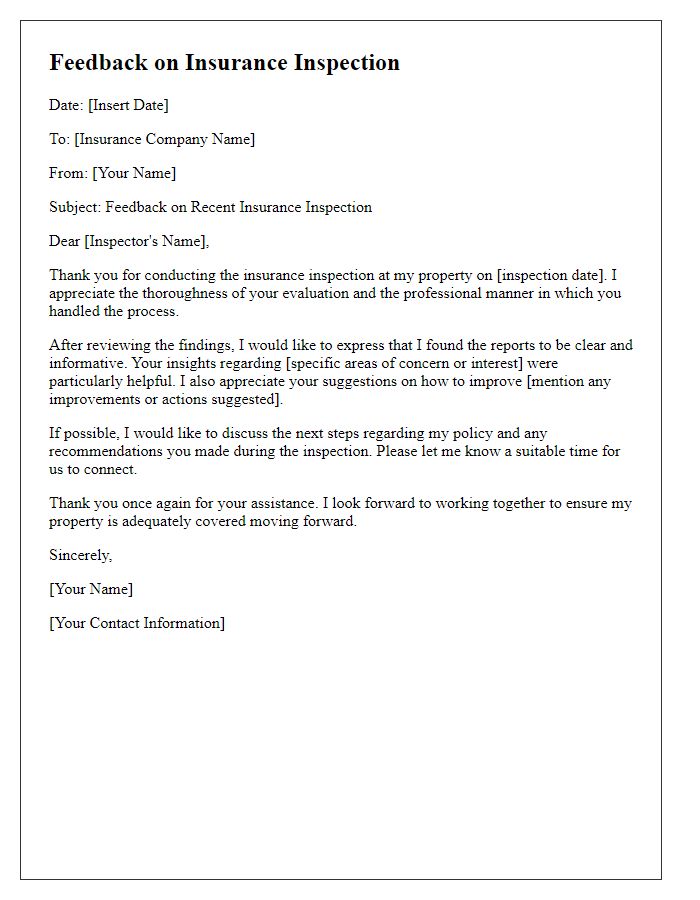

Contact information

Insurance inspections are crucial steps in the claims process, helping assess property conditions and risks. Typically, these inspections involve qualified professionals visiting locations to examine areas such as roofs, plumbing systems, electrical wiring, and overall structural integrity. Precise scheduling is essential, often requiring the insured party's contact information, including phone numbers and email addresses, to facilitate communication. Additional details, such as preferred timing and accessibility, also play vital roles in ensuring timely evaluations. This administrative process ensures that all necessary inspections conform to insurance guidelines, ultimately contributing to accurate claims resolution.

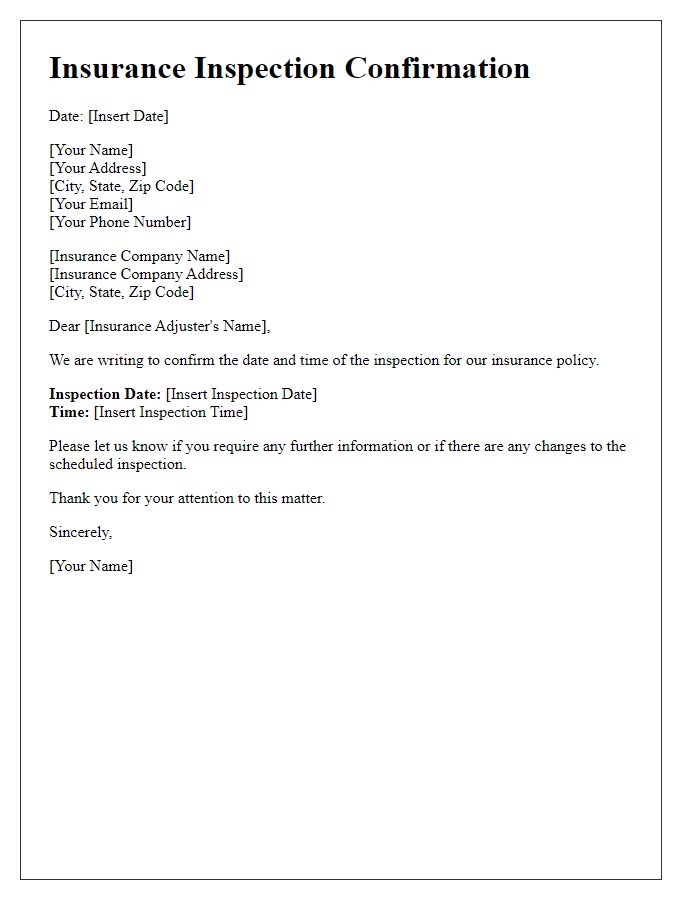

Preferred scheduling options

Preferred scheduling options for insurance inspections often include specific days and time slots that align with the property owner's availability. For instance, weekdays, particularly Tuesday and Thursday mornings, between 9 AM to 11 AM, are commonly preferred due to lower traffic. Weekends can also be useful, particularly Saturday afternoons, allowing homeowners to be present without disrupting their workweek. Providing a timeframe of at least 7 days prior to the desired inspection date allows for better coordination and ensures adequate preparation for both the inspector and the homeowner. Different options reflect consideration for both parties' needs, leading to a smoother inspection process overall.

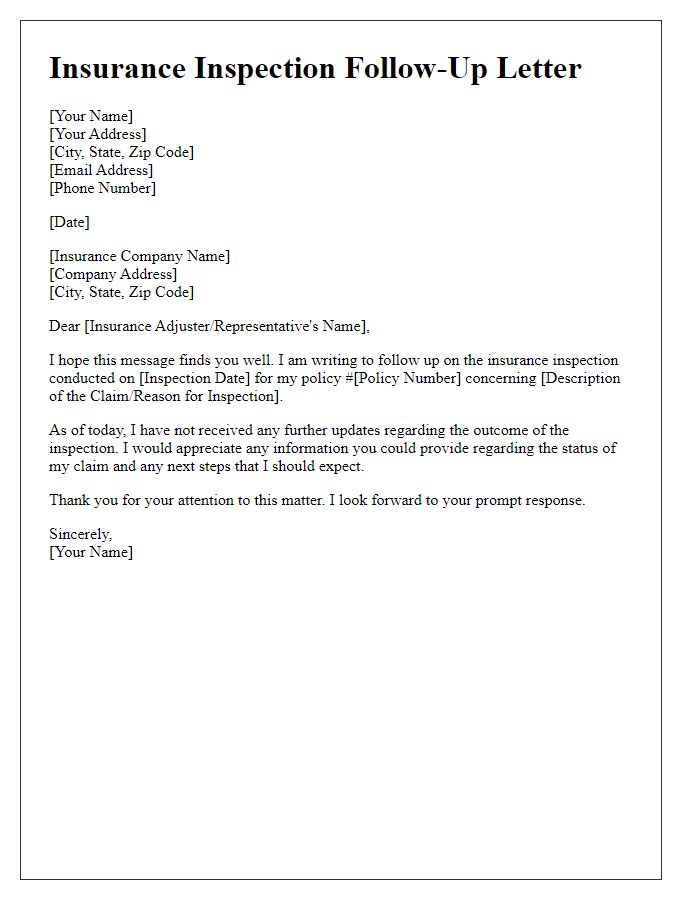

Policy and claim details

Insurance inspections play a crucial role in assessing claims related to property damage or loss, ensuring accurate evaluations for policyholders. An insurance claim, typically associated with events such as fire, flood, or theft, requires detailed documentation including the policy number (usually a unique identifier for each policy) and specific claim identification (often a numerical reference assigned during the claim filing). The inspection usually occurs at the insured location, which could be residential properties (homes, apartments) or commercial entities (business buildings, warehouses). Every inspection aims to verify the details surrounding the claim and the extent of damage, guiding insurance adjusters in determining the compensation amount. Additionally, a thorough inspection includes photographing damages, talking to witnesses, and reviewing police reports or maintenance records, providing a comprehensive overview to process the claim effectively.

Instructions and requirements

Insurance inspections play a crucial role in assessing property conditions, risks, and coverage eligibility. Inspectors typically require access to various locations on the property, including attics, basements, and garages, for a thorough evaluation. Documentation such as previous claims, maintenance records, and proof of improvements should be prepared for review. It's advisable to schedule the inspection during daylight hours to ensure proper lighting conditions for the inspector's assessment. Locations with high-risk factors, like swimming pools or structural modifications, may require additional scrutiny, affecting insurance premiums. Coordinating with insurance representatives can streamline the process, facilitating clear communication regarding expectations and ensuring compliance with specific insurance policies.

Comments