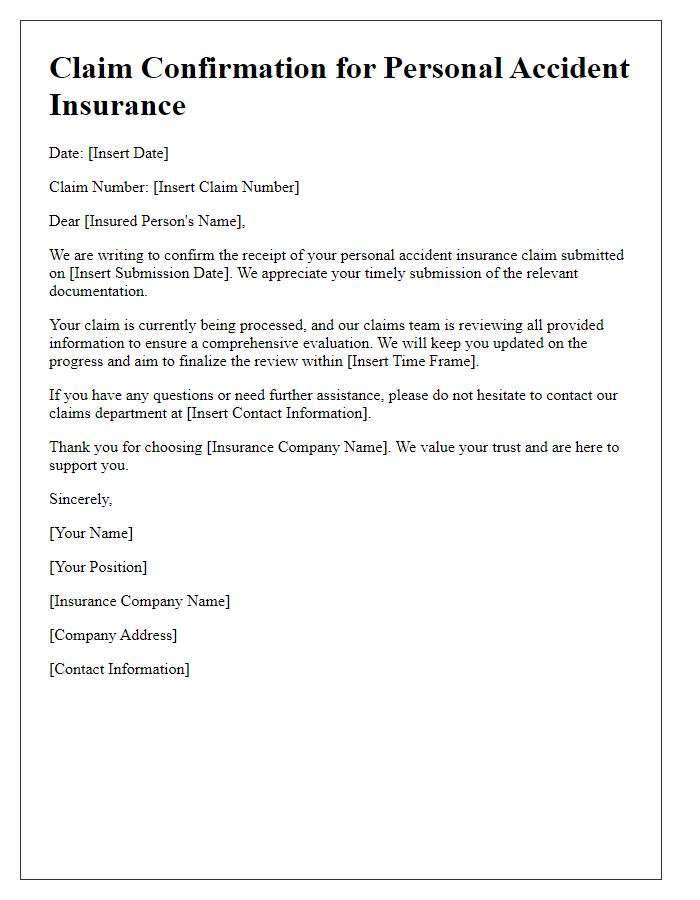

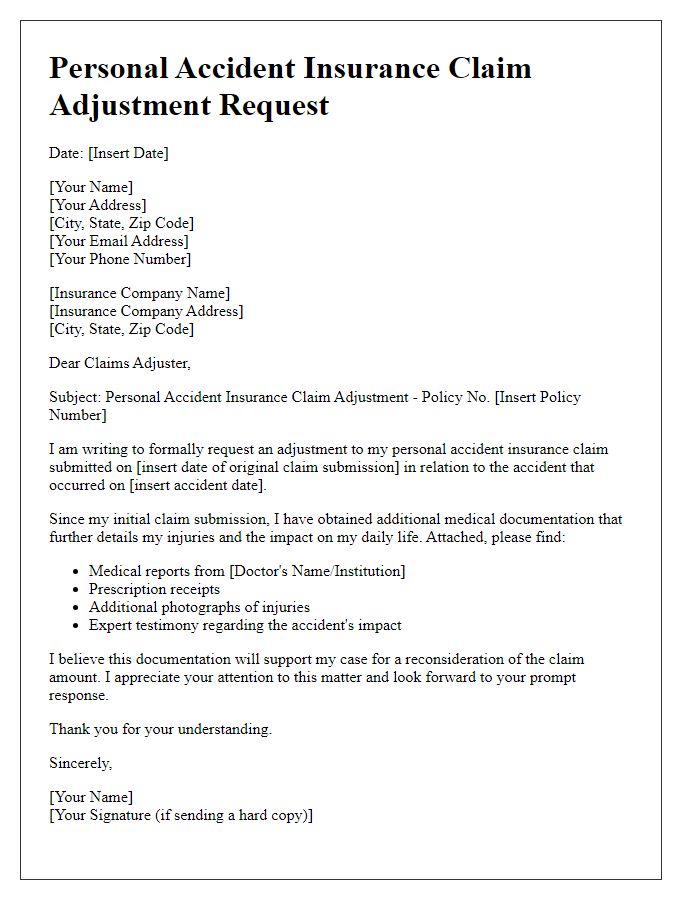

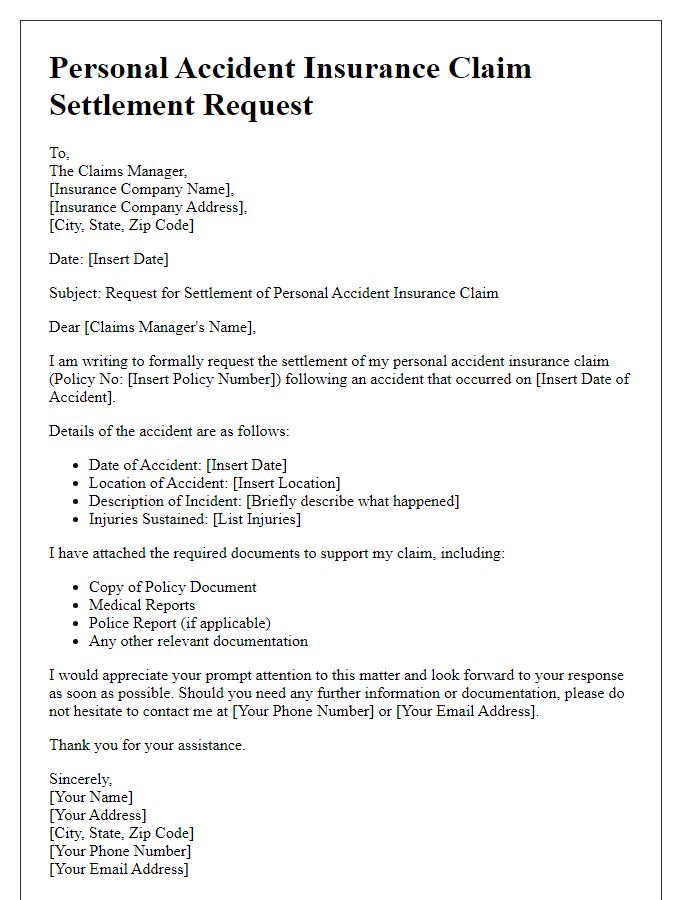

Hey there! If you've ever found yourself in a tricky situation after an unexpected accident, you know just how essential having a personal accident insurance claim can be. Writing a clear and concise letter can make all the difference in getting the support you need during these challenging times. In this article, we'll guide you through a simple letter template that outlines all the important details required for a successful claim. So, keep reading to discover how to craft the perfect letter and ensure you're covered!

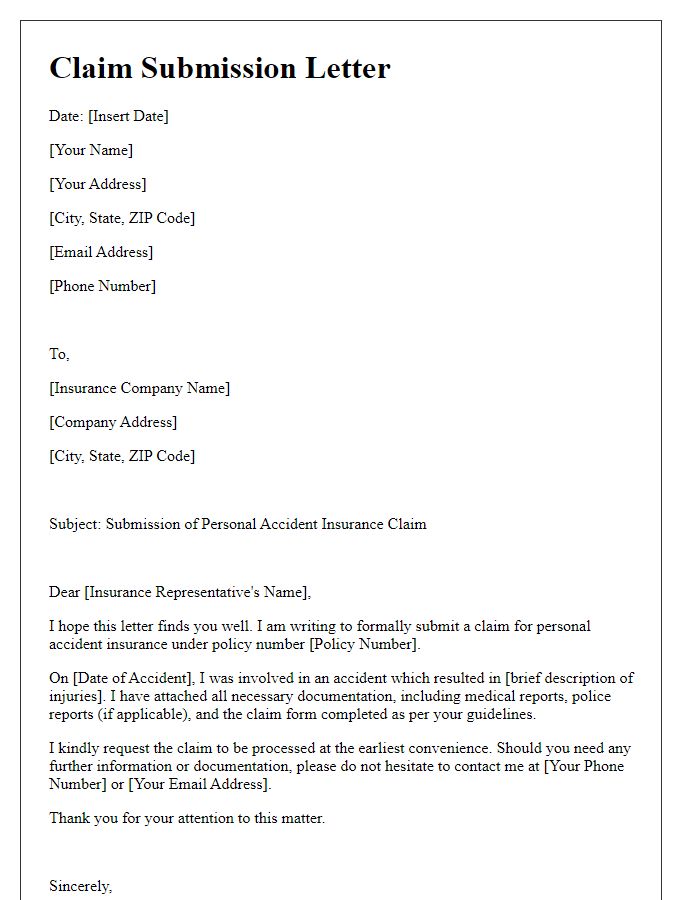

Policyholder Information

The policyholder for the personal accident insurance claim is John Smith, who resides at 123 Maple Avenue, Springfield, Illinois. His policy number, issued by SecureLife Insurance Company, is 456789-ABCD, providing coverage against accidental injuries and fatalities. Smith's date of birth is June 15, 1985, and the insurance policy was activated on January 1, 2020, extending for a duration of five years. An incident occurred on March 10, 2023, when Smith slipped and fell while hiking at Pine Valley National Park, resulting in a fractured leg. Documentation required for the claim includes medical records from Springfield General Hospital, detailing the injury and treatment received.

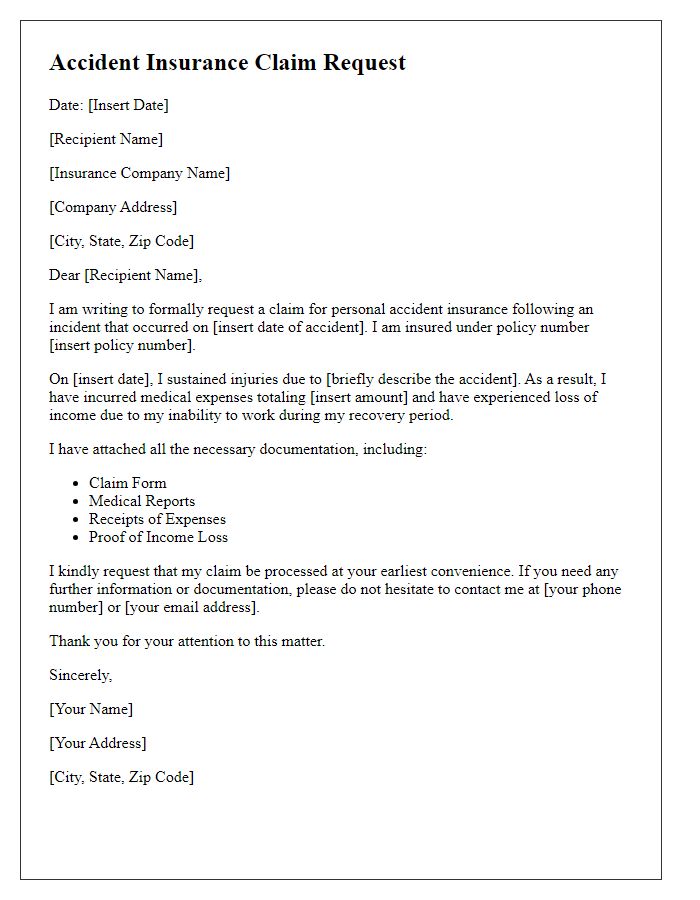

Incident Details

A personal accident insurance claim involves detailing specific incident information to facilitate the processing of the claim. The accident date, such as January 15, 2023, is crucial to establish the timeline. Precise location details, like Main Street in Springfield, provide context, while the nature of the incident, whether a slip and fall or a vehicular accident, is vital for evaluation. Claimants must document injuries sustained, including fractures or concussions, to support their case. Additional information, such as police report numbers or witness statements, enhances the credibility of the claim and ensures all relevant data is available for the insurance adjuster's review.

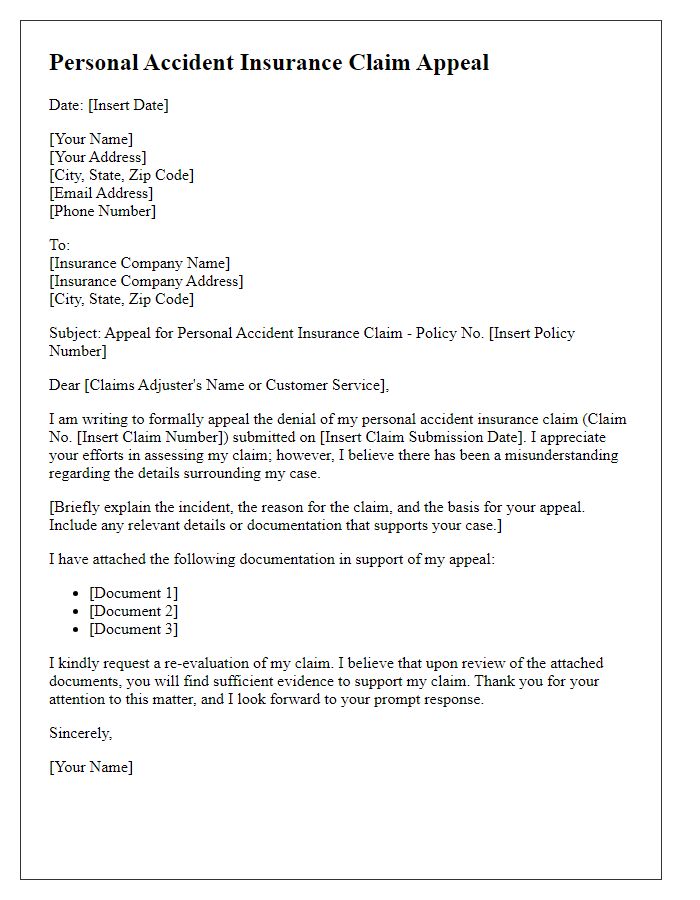

Claim Amount

Personal accident insurance claims often require careful documentation and specific information. The claim amount typically refers to the total compensation sought for injuries sustained in an accident. Insurance policies, such as those under organizations like Allianz or AIG, may cover medical expenses, lost wages, and other damages. Important details include the date of the accident, location (e.g., a workplace or public area), and nature of injuries (e.g., fractures or concussions). Claimants should provide supporting documents, such as medical reports, accident reports, and receipts to substantiate their claim amount. Accurate presentation of this information plays a crucial role in expediting the claims process.

Supporting Documents List

A personal accident insurance claim requires a variety of supporting documents to facilitate the processing of the claim efficiently. Essential documents include the completed claim form, detailing the nature of the accident and injuries sustained. The original medical report, issued by a certified healthcare professional, outlines the diagnosis, treatment administered, and prognosis. Proof of identity, such as a government-issued ID or driver's license, needs to be accompanied by policy documentation, displaying the policy number and coverage details. Additionally, records of all medical expenses incurred, including hospital bills, invoices, and receipts, are necessary to validate the financial impact of the accident. Finally, any police reports or accident reports (if applicable), provide critical context and validation of the circumstances surrounding the incident.

Contact Information

When filing a personal accident insurance claim, it is essential to provide detailed contact information to ensure prompt communication. This includes full name, such as John Smith, current residential address, for example, 123 Main Street, Springfield, IL 62704, email address, like john.smith@email.com, and a valid phone number, for instance, (555) 123-4567. Additionally, specify your policy number, such as PAI123456789, and any claim reference numbers provided by the insurance company to facilitate easy tracking of your claim. Accurate and up-to-date contact information helps speed up the processing of the claim and ensures you receive timely updates regarding your case status.

Comments