Are you looking to protect your business and assets with the right liability insurance? It's essential to understand the various options available and how they can safeguard you from potential risks and unforeseen circumstances. By taking the time to research and request quotes for liability insurance, you can ensure peace of mind knowing you're covered. Join me as we dive deeper into the world of liability insurance and discover how to tailor a policy that fits your unique needs!

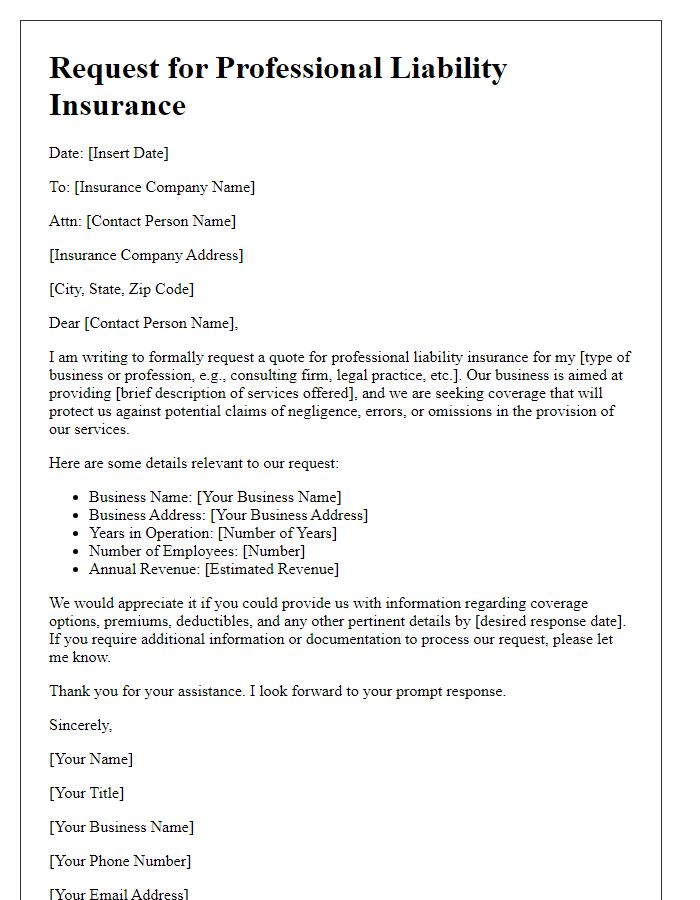

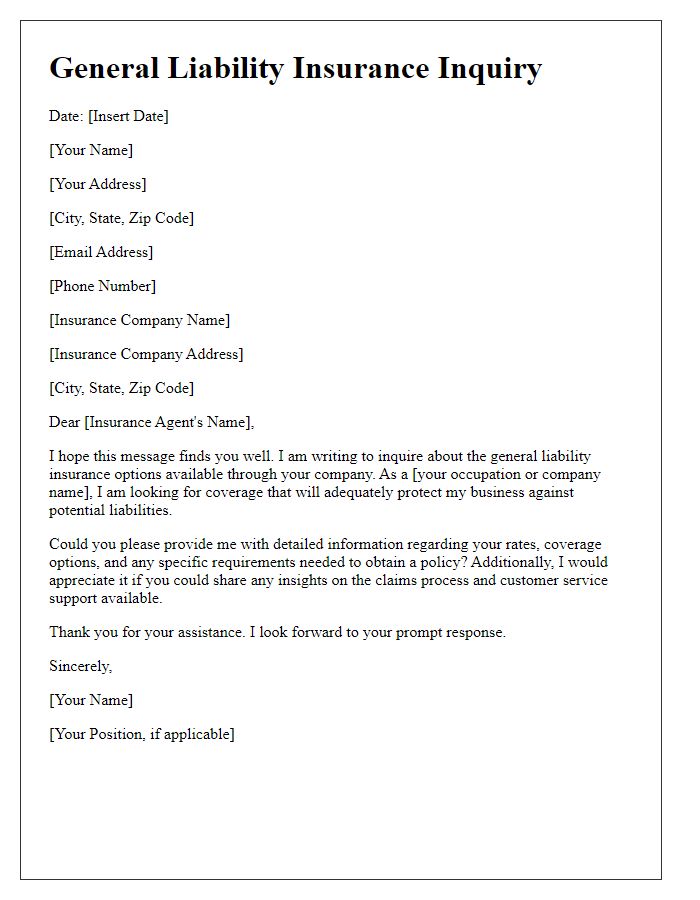

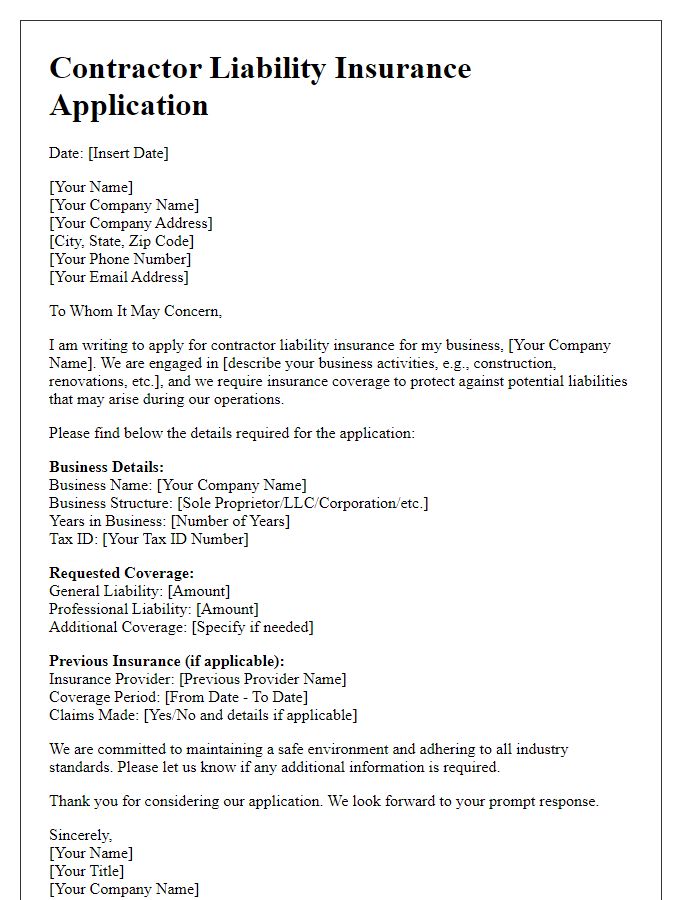

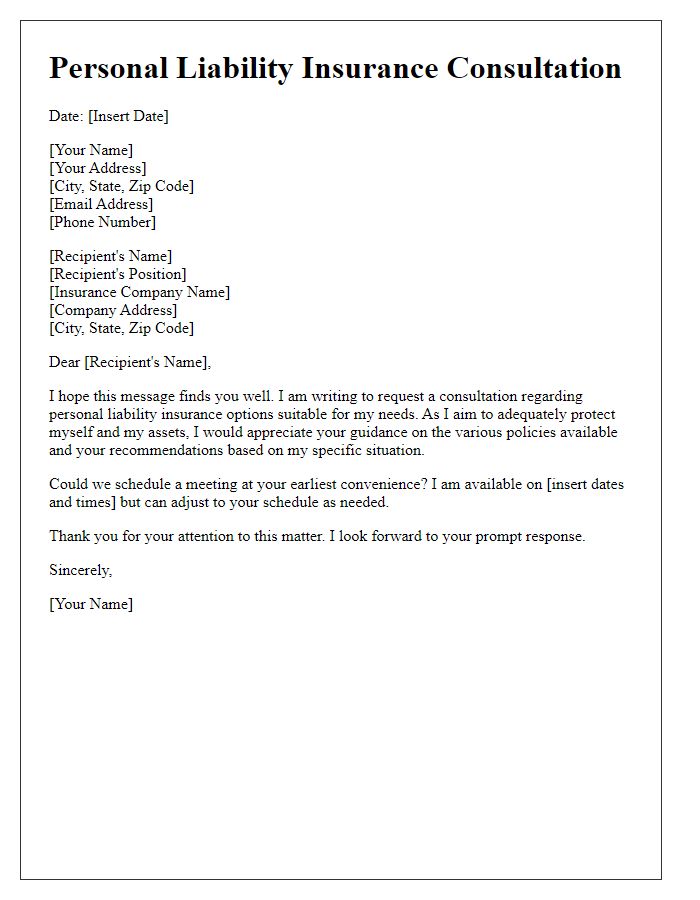

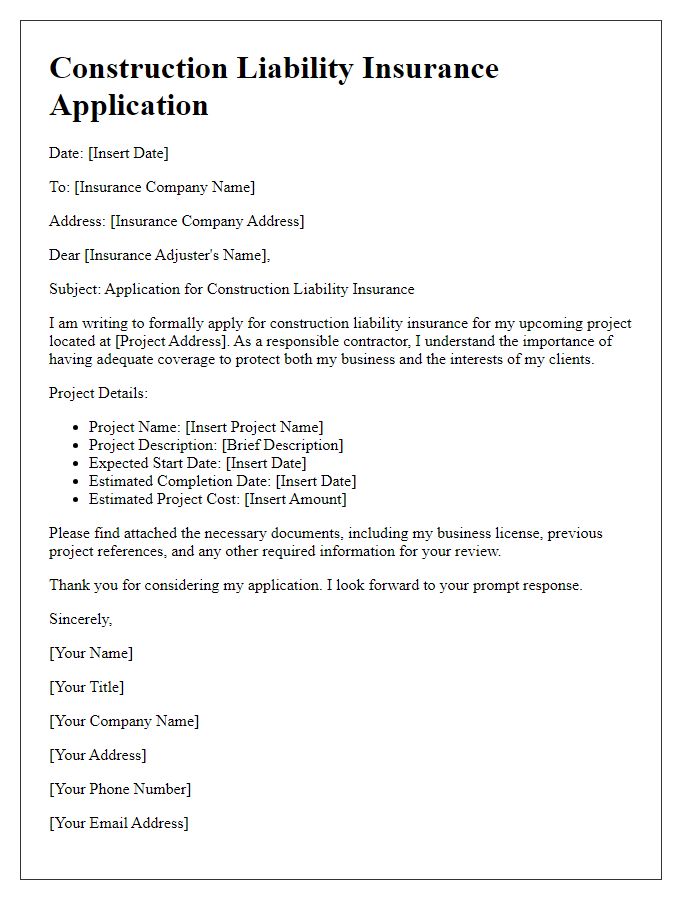

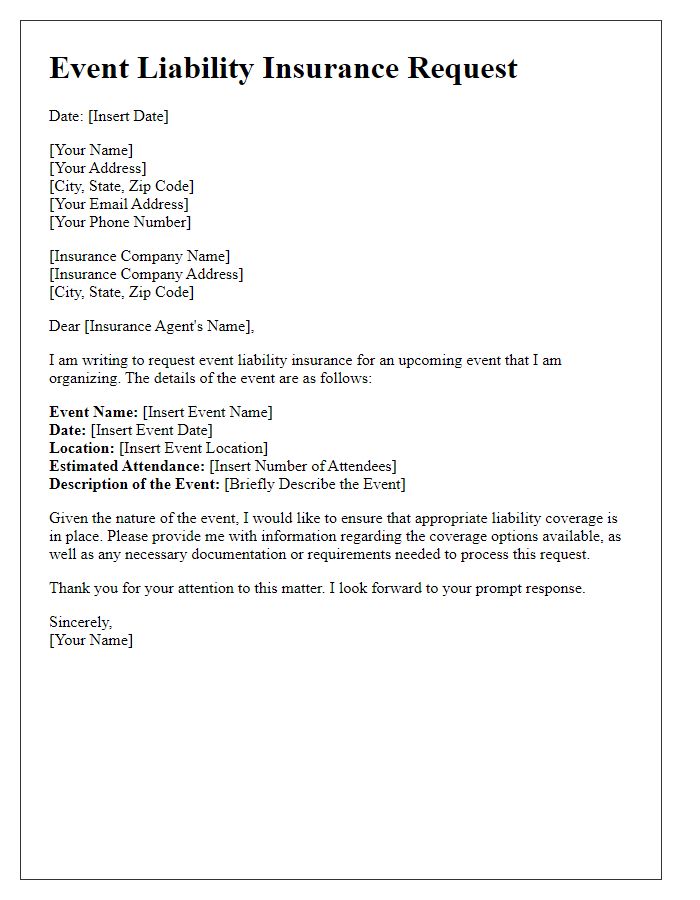

Clear subject line.

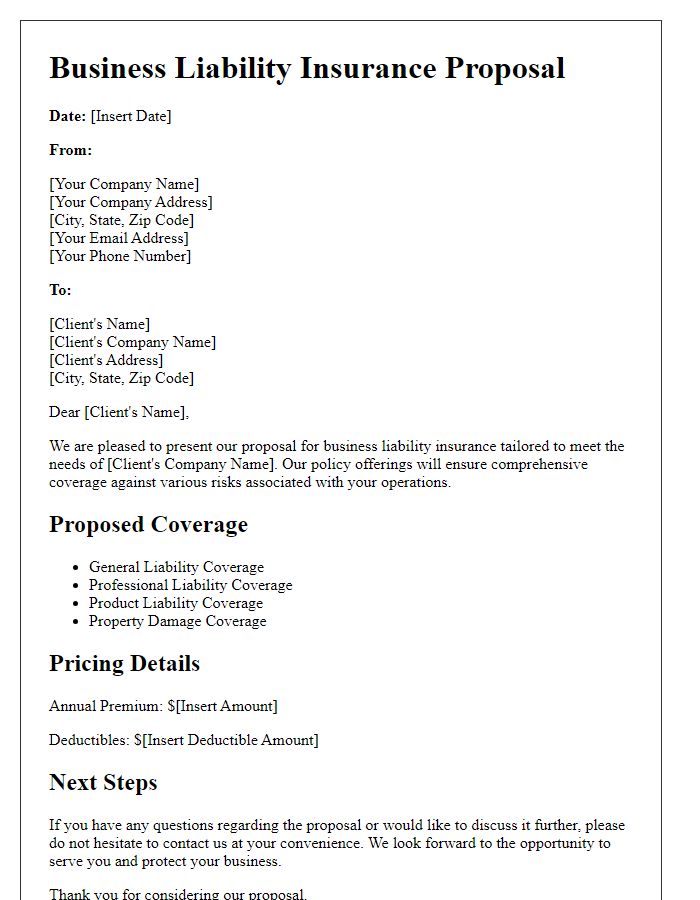

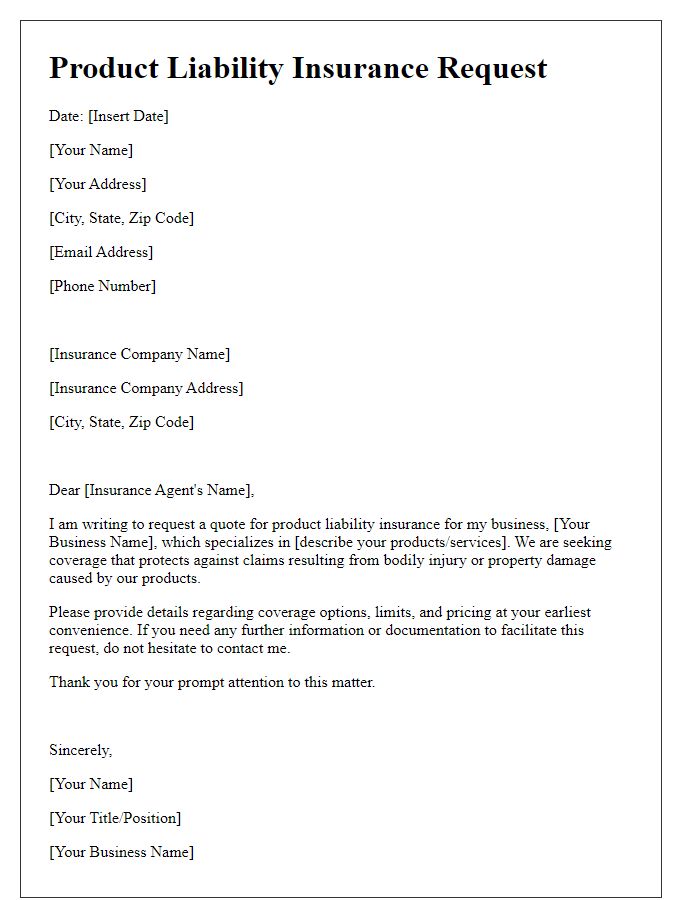

A liability insurance request requires a clear subject line that succinctly conveys the purpose of the communication. For example, "Request for Liability Insurance Coverage Information" serves as an effective subject line, highlighting the request for details regarding liability insurance terms, coverage limits, and policy options. This enables the recipient to quickly understand the nature of the inquiry, ensuring efficient processing of the request. Additional context such as specific types of liability insurance (general, professional, or product liability) or relevant dates may further enhance understanding and prompt a more precise response from the insurance provider.

Policyholder's information.

A liability insurance request form includes essential details such as the policyholder's full name, contact information (address, phone number, email), and relevant identification numbers like Social Security or Tax Identification Number. Furthermore, the document may require the policyholder's business information if applicable, including business name, type of business entity (LLC, Corporation, etc.), and operational address. Additional data may encompass the effective dates of the current liability insurance policy, previous claims history, and specific coverage needs which could range from general liability to professional liability, tailored to safeguard the policyholder against potential financial losses due to claims of negligence or harm.

Detailed coverage requirements.

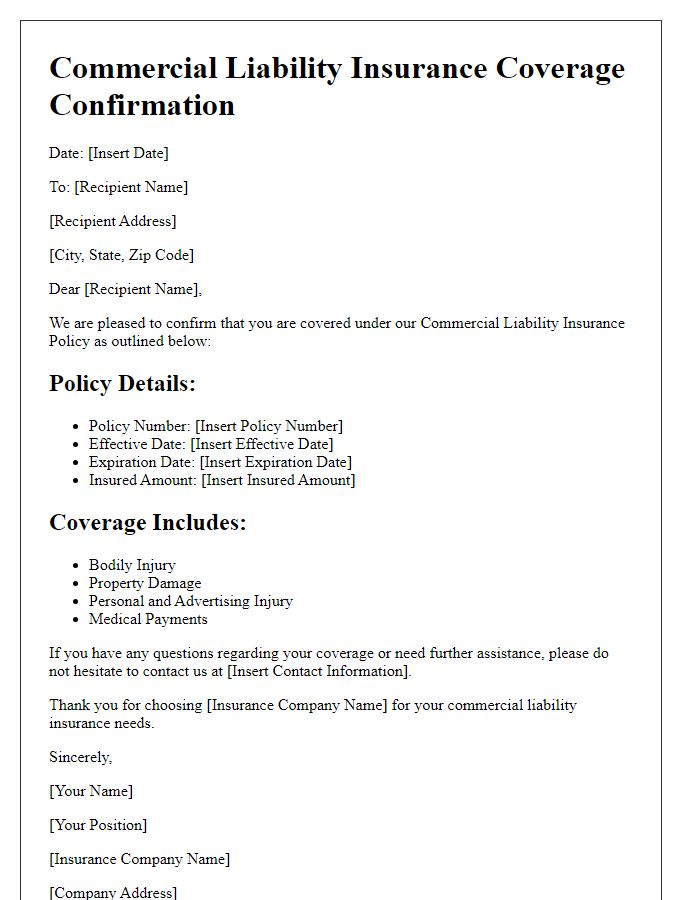

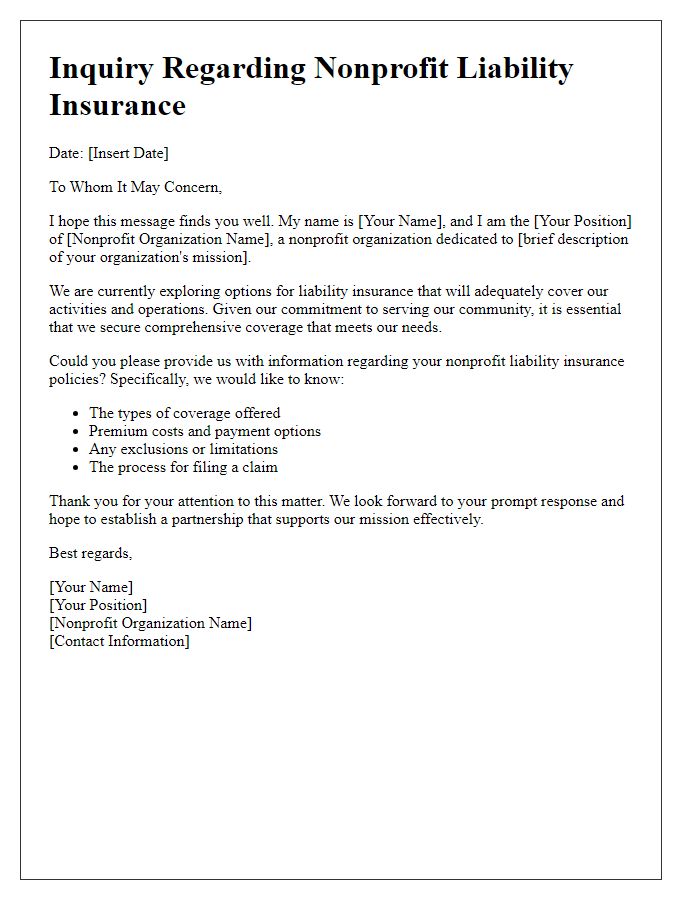

Liability insurance provides essential protection for individuals and businesses against potential legal claims. Comprehensive coverage often includes commercial general liability (CGL), which safeguards against bodily injury claims (hospitalization costs exceeding $10,000) and property damage (repair costs exceeding $5,000). Professional liability insurance, also known as errors and omissions insurance, is crucial for service providers, covering legal fees for claims related to negligence or malpractice. Product liability insurance protects manufacturers and sellers against damages caused by defective products, often requiring coverage limits of at least $1 million per occurrence. When requesting coverage, specifying high-risk activities (construction, manufacturing) or industries (healthcare, technology) is vital to ensure tailored protection. Annual policy limits and deductibles are significant in determining premiums, with recommended limits of at least $1 million per occurrence and $2 million aggregate. Additional coverage options, like cyber liability insurance, offer protection against data breaches, essential in today's digital landscape.

Relevant risk factors.

Liability insurance encompasses protection against legal claims due to negligence or harm caused to others. Common relevant risk factors include the nature of the business operations, such as contact with clients or hazardous materials, exposure to possible accidents on premises, and the volume of transactions or interactions with customers. Industries like construction, healthcare, and food service often present heightened risk levels due to physical labor, patient care responsibilities, and food safety regulations, respectively. Additionally, geographical location may influence risk, particularly in areas prone to natural disasters such as hurricanes or floods. Employee training and safety protocols also play crucial roles in minimizing potential liabilities, alongside compliance with local laws and regulations. Understanding these factors can significantly aid in evaluating the appropriate coverage needed for effective risk management.

Contact information for follow-up.

Liability insurance protects businesses against claims resulting from injuries and damage to people or property. Types of coverage include general liability, professional liability, and product liability, each tailored to different business needs. Accurate estimation of policy limits depends on factors such as industry type and potential risk exposure, with premium costs varying significantly across sectors. Local regulations often dictate minimum coverage requirements, emphasizing the need for comprehensive protection. Understanding terms like deductibles and exclusions is vital for informed decision-making. Analyzing past claims history can also influence insurance arrangements.

Comments