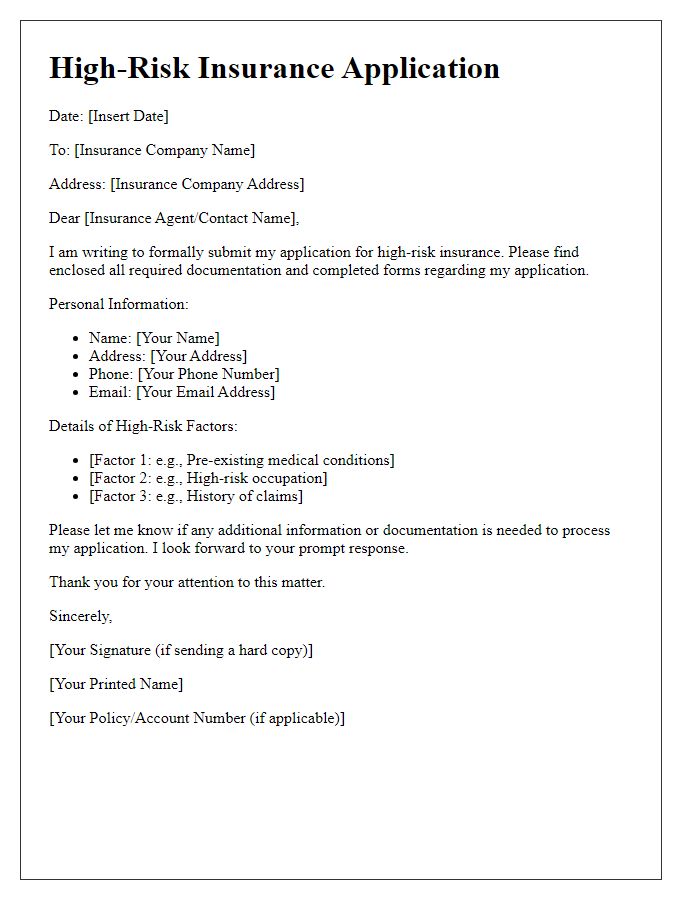

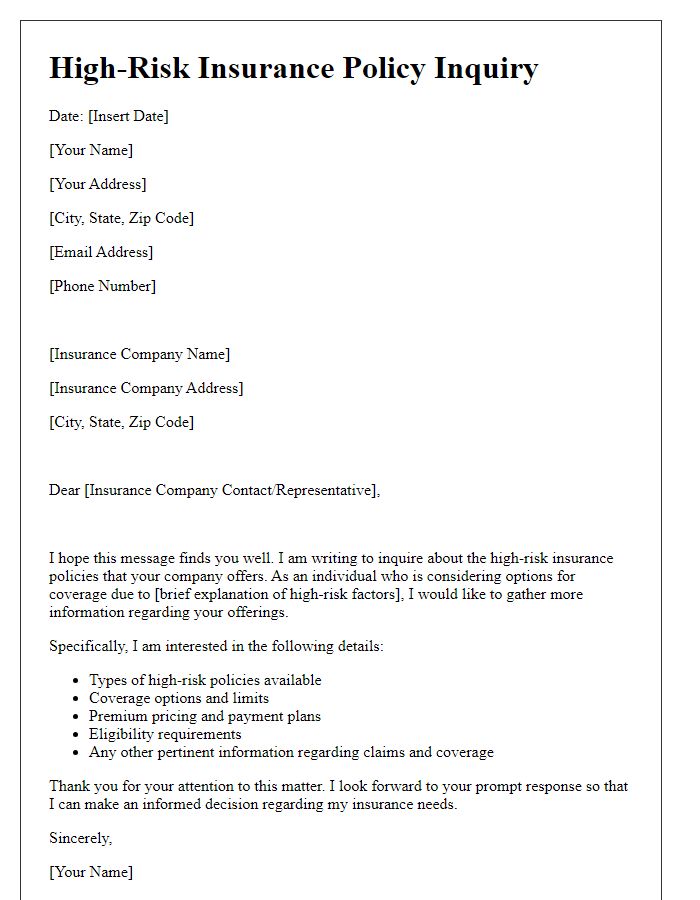

Are you looking for a straightforward way to secure high-risk insurance coverage? Whether you're navigating complex health conditions or lifestyle choices, understanding your options can be overwhelming. That's why having a solid letter template on hand is essential to communicate your needs effectively to insurance providers. Dive into our article to discover the perfect high-risk insurance letter template tailored just for you!

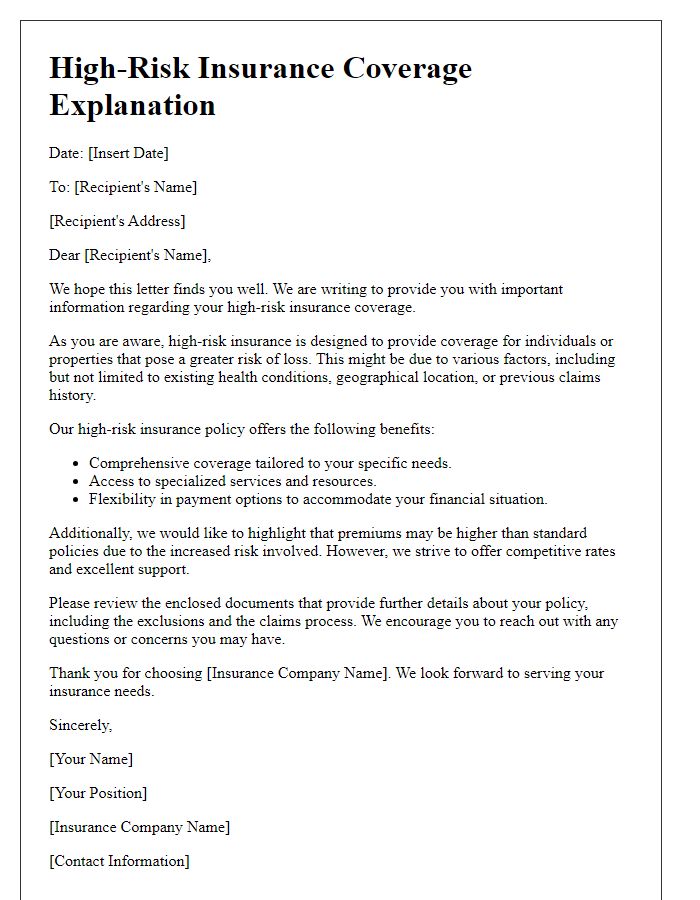

Policy Coverage Description

High-risk insurance provision encompasses specialized coverage aimed at individuals or entities engaged in activities that present heightened potential for loss or liability. This category includes insurances such as coverage for extreme sports participants (e.g., rock climbing, skydiving), businesses operating in hazardous industries (e.g., construction, mining), and properties in disaster-prone areas (e.g., flood zones, earthquake belts). Specific features of high-risk policies typically include higher premiums, tailored exclusions, and unique underwriting processes. The assessment phase involves detailed risk evaluations conducted by underwriters, considering factors such as location, previous claims history, and safety protocols. Claims processes for these policies may also demand thorough documentation to substantiate the circumstances of the loss, reflecting the complexity associated with high-risk scenarios.

Premium Details and Payment Terms

High-risk insurance provision often entails complex premium details and payment terms due to the elevated underwriting concerns. Insurance premiums for high-risk individuals, such as those with previous claims or certain pre-existing health conditions, generally range from 20% to 200% above standard rates, reflecting the increased likelihood of claims. Payment terms for such policies typically require upfront premium payments, often necessitating an initial deposit between $500 to $5,000, depending on the policy limits and coverage types. Policyholders may also face stricter cancellation clauses, with fees that could amount to up to 10% of the premium, ensuring both parties maintain commitment throughout the policy term, which usually spans 12 months but may be subject to renewal based on risk reassessment.

Risk Assessment Justification

High-risk insurance provision requires a thorough risk assessment that evaluates various factors including the insured individual's health status, lifestyle choices, and occupational hazards. Insurance underwriters analyze specific data points such as pre-existing medical conditions (e.g., diabetes affecting 30 million Americans), high-risk activities (e.g., scuba diving or skydiving), and geographical location (e.g., properties in hurricane-prone areas like Florida). Additionally, statistical information, such as accident rates from the National Highway Traffic Safety Administration, informs the underwriting process. This comprehensive assessment ensures accurate premium pricing and adequate coverage tailored to unique risk profiles, effectively balancing insurer exposure with policyholder needs.

Exclusions and Limitations

High-risk insurance provisions often come with specific exclusions and limitations that are crucial for policyholders to understand. Common exclusions include natural disasters like floods and earthquakes, typically numbered in tens of thousands of dollars in claims during peak seasons. Pre-existing medical conditions, impacting approximately 53% of applicants, may result in reduced coverage or denial of benefits. Occupational hazards, especially for professions like construction and firefighting, can lead to higher premiums or complete exclusions from certain benefits. Age limitations frequently apply, notably for individuals over 70, affecting life and health insurance eligibility. Additionally, high-risk activities such as skydiving or rock climbing may not be covered, reflecting the increased likelihood of incidents. Understanding these conditions helps individuals and businesses accurately assess their coverage needs in light of potential risks.

Contact Information for Inquiries

Inquiring about high-risk insurance provision necessitates reaching out to specialized underwriters known for evaluating unique risk factors associated with properties or individuals. For comprehensive assistance, contact the insurance company's customer service at 1-800-555-0199, available Monday through Friday from 8 AM to 8 PM EST. Alternatively, email the underwriting department at underwriters@highriskinsure.com for specific queries regarding coverage types, premium calculations, and policy requirements. For local offices, visit 123 Insurance Avenue, Suite 200, New York, NY 10001, a hub for personalized consultations concerning risk assessments and tailored policy options.

Comments