Are you looking to navigate the often complex world of trust account distributions? Understanding how to properly request distributions can make a significant difference in ensuring you receive the funds you're entitled to. In this article, we'll break down the essential elements of a trust account distribution request letter, making the process straightforward and clear. Join us as we explore the key components you'll need to include for a successful request!

Account Holder's Information

Account holder's information includes essential details such as full name, account number, date of birth, and contact information (phone number and email address). For legal and administrative purposes, the physical address must also be provided, which generally comprises street name, city, state, and zip code. Additional identifiers might include Social Security Number (SSN) or taxpayer identification number (TIN) based on jurisdiction regulations. When requesting a trust account distribution, accurate representation of this information is critical to ensuring that the distribution process proceeds smoothly and complies with both the trust's governing documents and applicable laws.

Trust Account Details

Trust accounts serve as financial entities safeguarded for specific purposes, commonly involving the management of funds held in fiduciary relationships. The details of a trust account encompass vital identifiers such as account number, trustee's name, and trust documentation reference. Accurate record-keeping ensures compliance with legal stipulations in jurisdictions like California, where trust regulations are stringent. Distribution requests necessitate comprehensive information, including the intended recipient's name, their relationship to the trust, amount requested, and purpose of distribution. For example, educational expenses for a beneficiary might require additional verification of enrollment status in institutions. Proper documentation streamlines the disbursement process and mitigates potential delays, ensuring trust beneficiaries receive funds timely.

Beneficiary Information

Beneficiary information concerning trust account distributions is crucial for accurate allocation. Each beneficiary must be clearly identified, including full legal names and any alternate names used. Unique identification such as Social Security numbers or Tax Identification Numbers (TIN) is essential for tax reporting purposes. Address details must include street numbers, city names, state abbreviations, and zip codes to ensure effective communication. The distribution percentage or amount owed to each beneficiary should be explicitly documented, referencing the trust agreement terms established on the creation date of the trust. Any additional instructions or conditions tied to the beneficiaries, such as age restrictions or stipulations for disbursement timing, can significantly impact the distribution process and should be noted diligently.

Distribution Instructions

A trust account distribution request involves specific financial allocations from a trust fund, a legal entity holding assets for beneficiaries like individuals or organizations. Commonly, these distributions occur from a trust established under state laws, citing the Uniform Trust Code as a regulatory framework. Distribution instructions typically detail the beneficiaries' names, amounts to distribute, and the purpose behind the disbursement, which could include educational expenses, healthcare costs, or general living expenses. Ensuring accuracy in the request is crucial, as errors may delay funds, impacting beneficiaries' financial needs. Oftentimes, trustees require official documentation supporting the request for transparency and accountability in managing trust assets, adhering to established fiduciary responsibilities.

Contact and Verification Details

A trust account distribution request necessitates precise contact and verification details to ensure proper processing. The requester must provide full name, including middle initials, to verify identity. Additionally, the accurate mailing address is critical for documentation and communication purposes. Contact numbers, both mobile and home, ensure swift resolution of any inquiries regarding the distribution. Furthermore, an email address is essential for electronic correspondence, especially for updates on the status of the request. Inclusion of a notarized signature may also be required to authenticate the legitimacy of the distribution request, preventing unauthorized transactions.

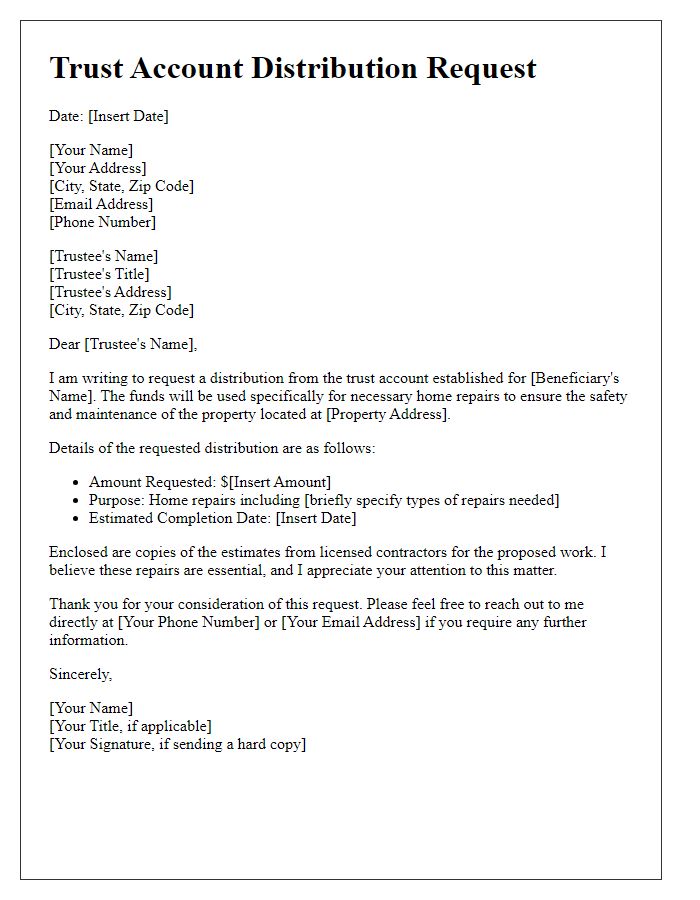

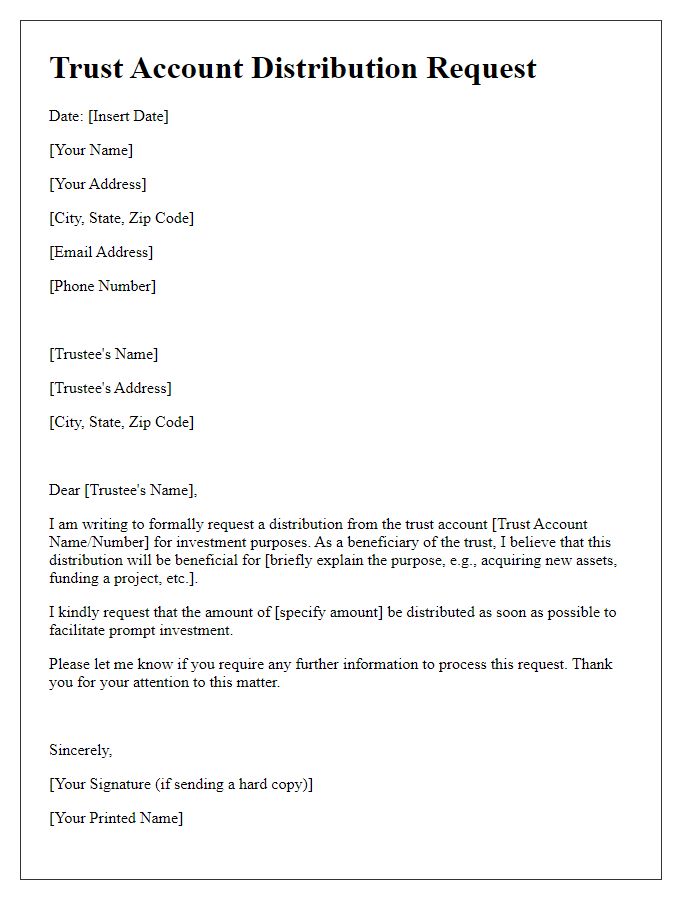

Letter Template For Trust Account Distribution Request Samples

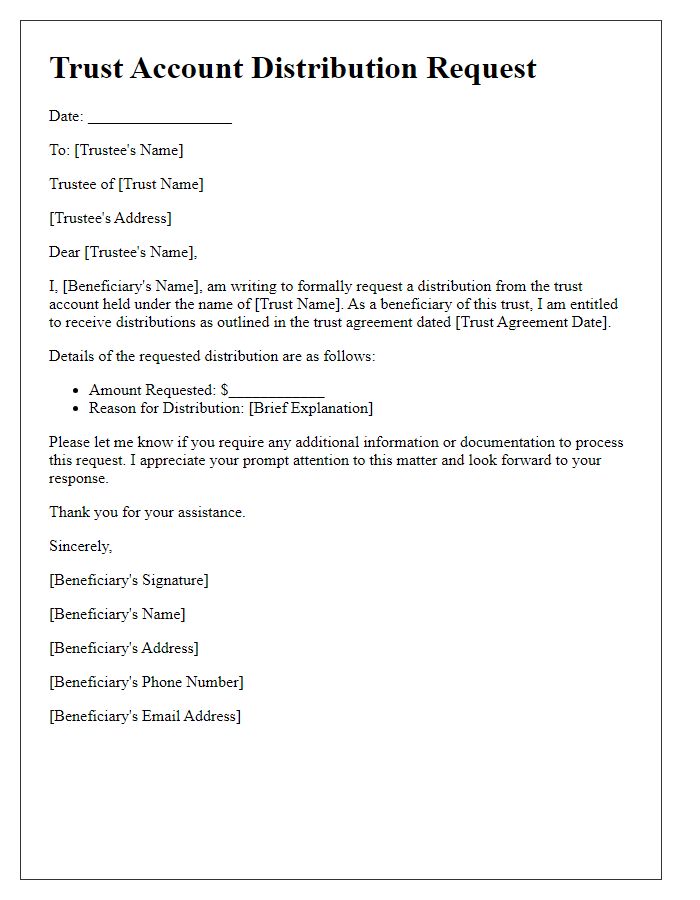

Letter template of trust account distribution request for beneficiaries.

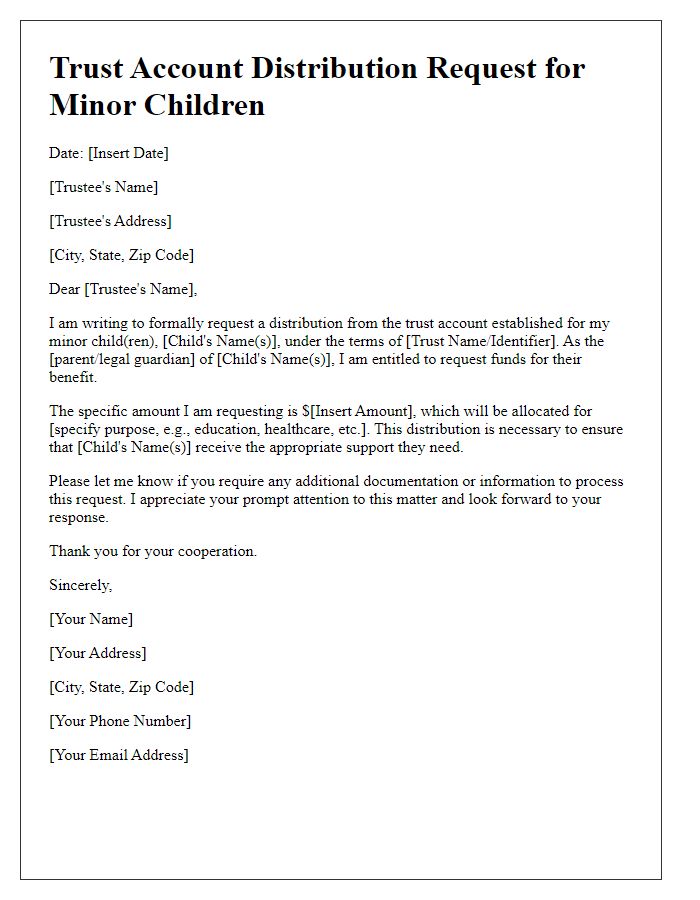

Letter template of trust account distribution request for minor children.

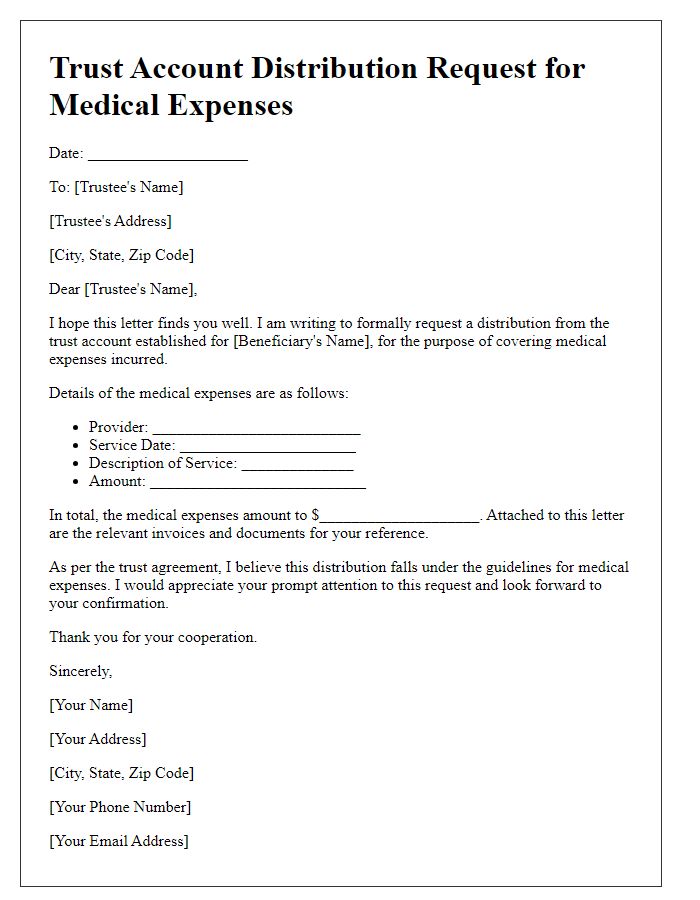

Letter template of trust account distribution request for medical expenses.

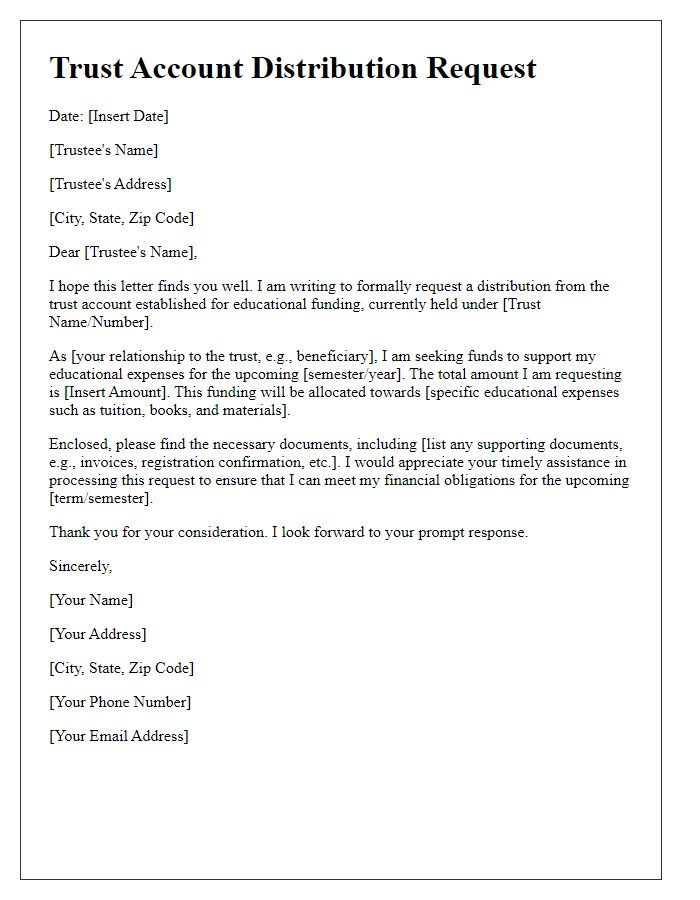

Letter template of trust account distribution request for educational funding.

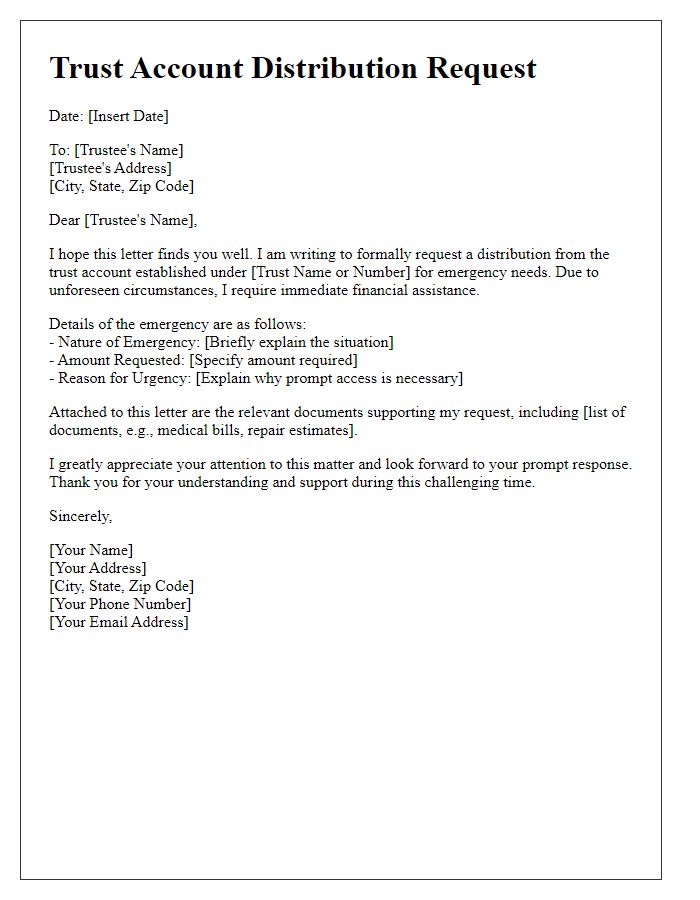

Letter template of trust account distribution request for emergency needs.

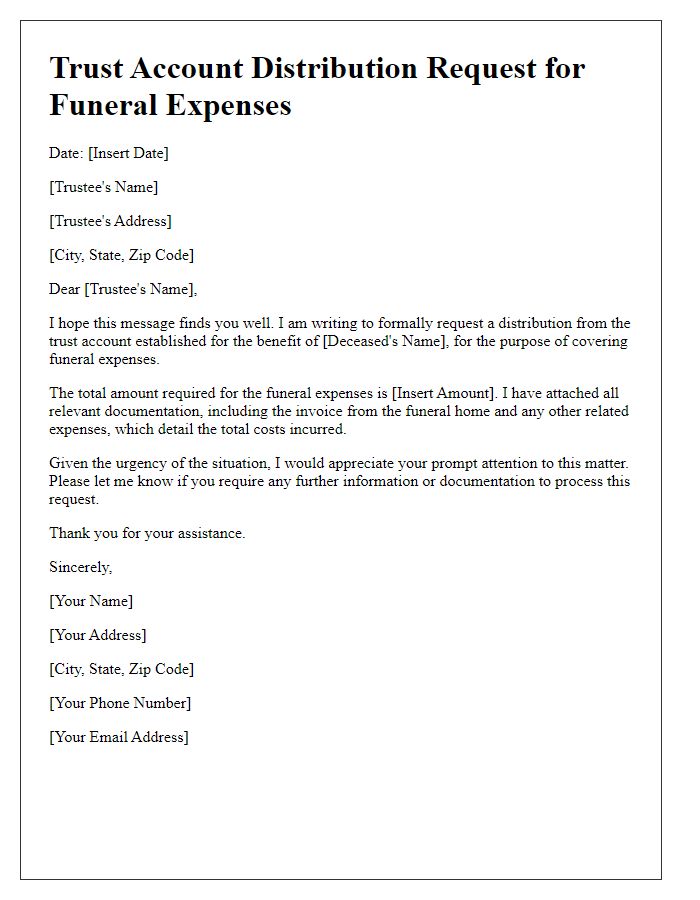

Letter template of trust account distribution request for funeral expenses.

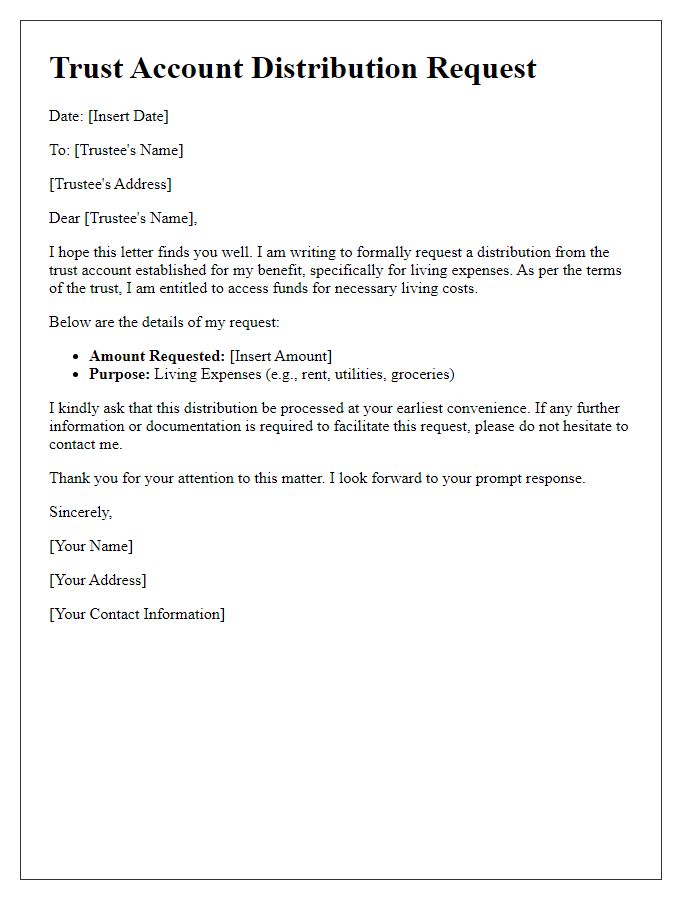

Letter template of trust account distribution request for living expenses.

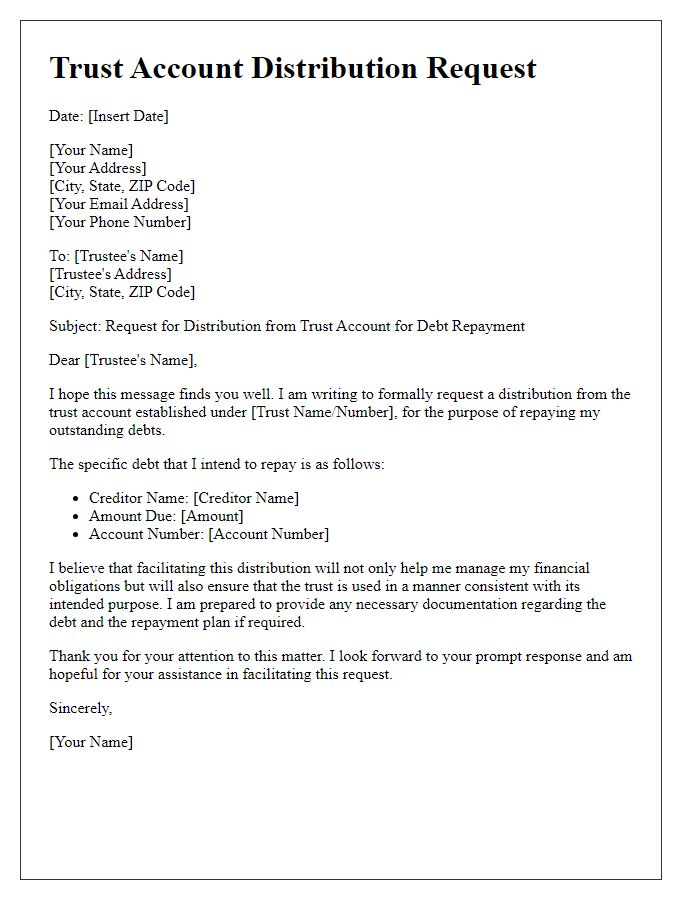

Letter template of trust account distribution request for debt repayment.

Comments