Are you considering taking the next big step towards your financial goals? Securing a loan can seem overwhelming, but knowing that you've been pre-qualified can truly simplify the process. This letter serves as an exciting milestone, confirming that you meet the initial criteria for a loan, paving the way for further discussions with your lender. Curious about how to navigate the next steps? Read more to find out!

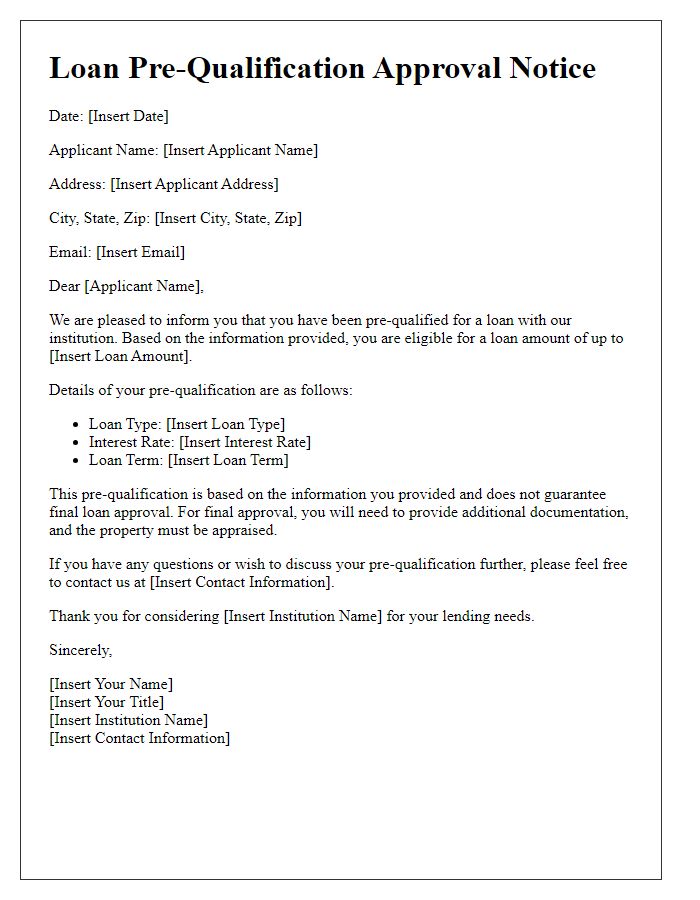

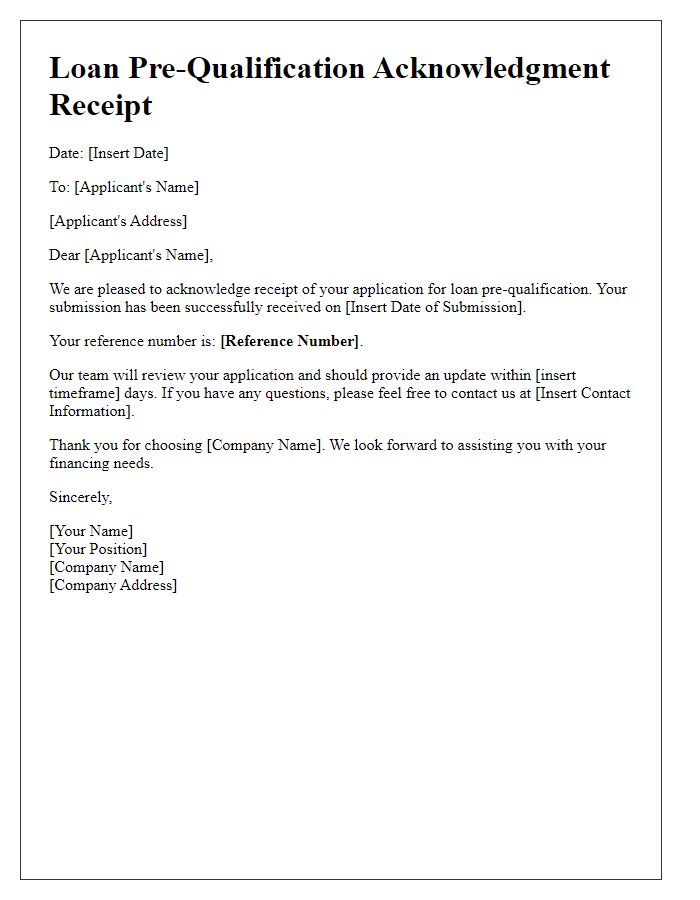

Applicant's name and contact information

Loan pre-qualification allows potential borrowers, such as individuals or couples seeking home financing, to understand their eligibility for a mortgage. Essential details include the applicant's name, such as John Doe, and their contact information, for instance, a phone number like (555)-123-4567 and an email address like johndoe@email.com. This process typically takes place with a lender, such as a bank or credit union, reviewing financial information, including credit score, income levels, and debt-to-income ratio, to determine the maximum loan amount available. Pre-qualification provides a snapshot of what a borrower can afford in relation to purchase prices in specific real estate markets, including cities like Los Angeles or New York.

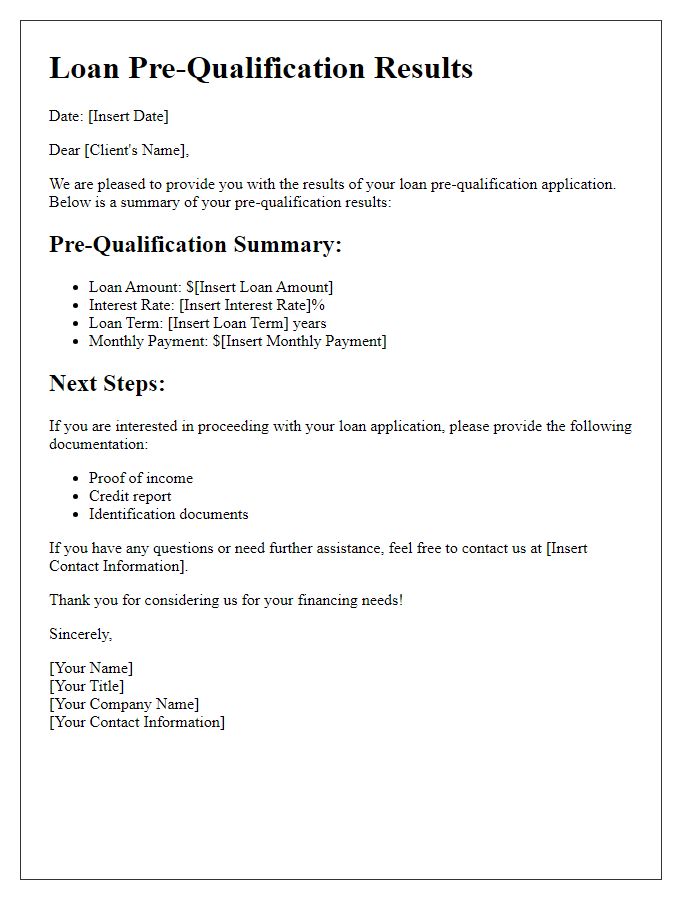

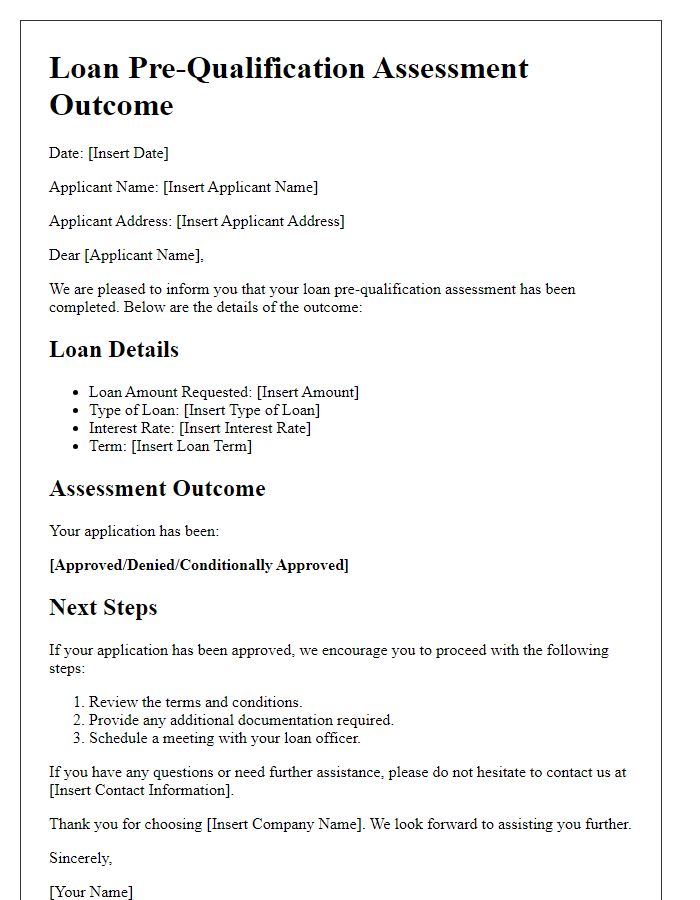

Loan amount and type

A loan pre-qualification notice typically outlines the initial assessment of a borrower's eligibility for a specific loan amount and type. This process includes evaluating financial metrics such as credit score (which may vary from 300 to 850), income verification (annual income figures often above a certain threshold, for example, $50,000), and existing debt obligations (debt-to-income ratio ideally below 43%). The notice will specify the loan type--common types include fixed-rate mortgages (with interest rates that remain constant over the term) or variable-rate loans (where rates can fluctuate based on market conditions). The estimated loan amount may be highlighted, usually up to a determined limit set by the lender, reflecting potential funding ranges, such as $100,000 to $500,000 for home purchases, projecting an estimated monthly payment based on interest rates and loan duration. This pre-qualification serves as a foundational step in the loan application process, allowing borrowers to understand their options before formally applying for financing products.

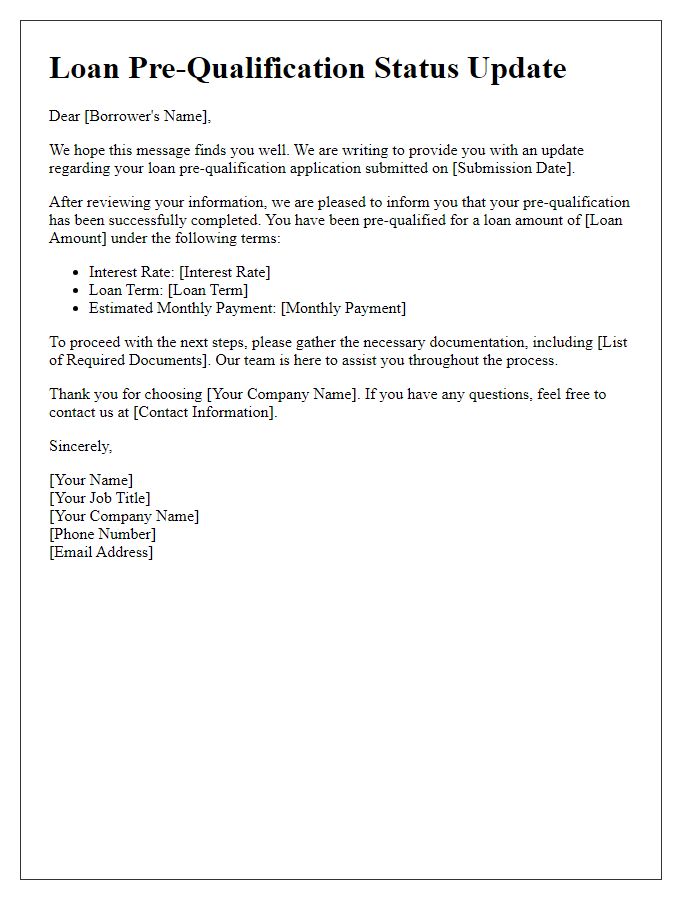

Pre-qualification terms and conditions

Loan pre-qualification involves an assessment of financial eligibility for a loan, typically conducted by financial institutions. This process generally requires documentation such as income statements, credit history, and employment verification. Key terms include loan amount (the total sum that can be borrowed), interest rate (the percentage charged on the loan), and monthly payment (the amount due each month). Conditions may involve a debt-to-income ratio (a calculation comparing monthly debt payments to gross monthly income) and credit score (a numerical expression of creditworthiness). Understanding these elements is crucial for prospective borrowers navigating their financing options at banks or credit unions.

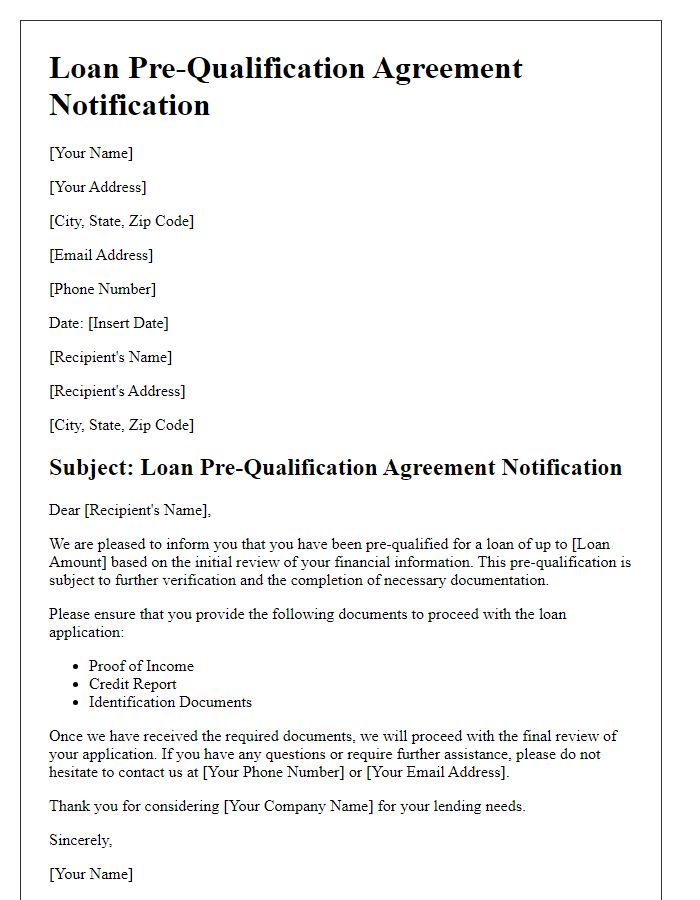

Instructions for next steps

Loan pre-qualification notices guide applicants through the initial stages of securing financing. After receiving a pre-qualification notice, applicants should gather essential documents such as income verification (W-2 forms, pay stubs), credit history reports, and identification (government-issued ID). Utilize mortgage calculators to estimate affordable loan amounts based on current financial conditions. Schedule a consultation with a loan officer, preferably at a local bank like Wells Fargo or Citibank, to discuss available loan types (fixed-rate, adjustable-rate) and interest rates (currently ranging between 3% to 5%). Additionally, be prepared for a potential credit inquiry, which may affect credit scores temporarily. Timely completion of these steps can enhance the likelihood of securing favorable loan terms.

Contact information for inquiries or assistance

A loan pre-qualification notice typically includes essential information that outlines the terms, conditions, and assessment of a potential borrower's credit profile. This document might feature contact details such as phone numbers (e.g., local branch: 555-1234), email addresses (e.g., support@loansolutions.com), or office addresses (e.g., 123 Financial St, Suite 400, New York, NY 10001) to assist individuals seeking further clarification or assistance throughout the loan process. It may also include hours of operation, like Monday to Friday, from 9 AM to 5 PM, ensuring accessibility to borrowers. Noteworthy is the importance of reaching out before proceeding, to ensure all queries regarding interest rates, application requirements, and repayment options are fully addressed.

Comments