Are you feeling overwhelmed by your current loan payments and exploring options for relief? A loan principal payment reduction could be the solution you need to ease your financial burden. In this article, we'll guide you through the process of requesting a reduction and provide essential tips to make your case stronger. So, if you're ready to take control of your financial future, keep reading to discover how you can navigate this important step!

Loan account details

Managing loan principal payments can significantly impact financial strategies. For example, a borrower may request a reduction on an existing loan, such as a mortgage or personal loan, which typically includes details like account number, outstanding balance, and current interest rate. Such a request may cite financial changes, including job loss or increased living expenses, emphasizing the need for an adjusted payment plan. Timely communication with financial institutions, such as banks or credit unions, ensures clarity and potential approval of the reduced payment terms, facilitating better cash flow management.

Reason for the request

Financial hardship due to unexpected medical expenses can strain monthly budgets significantly. Medical bills, often exceeding thousands of dollars, arise from emergencies or long-term treatments. When income fluctuates or diminishes, maintaining regular loan payments becomes challenging. This situation necessitates a request for a loan principal payment reduction to alleviate immediate financial pressure and help stabilize monthly cash flow. Adjusting the payment terms could prevent defaults and support continued commitment to fulfilling financial obligations.

Financial hardship explanation

Financial hardship, often arising from unforeseen circumstances such as job loss, medical emergencies, or significant life changes, can severely impact an individual's ability to meet financial obligations. Many borrowers face challenges in keeping up with monthly loan payments, especially when principal amounts become burdensome. For instance, a sudden decrease in income by 30% can strain the budget, making it difficult to allocate sufficient funds for both essential living expenses and loan repayments. In situations where loan amounts exceed 50% of monthly income, borrowers may seek relief options such as principal payment reduction to alleviate financial stress. This adjustment can provide the necessary breathing room for recovery and stabilization, enabling individuals to manage their finances more effectively while working through their hardships.

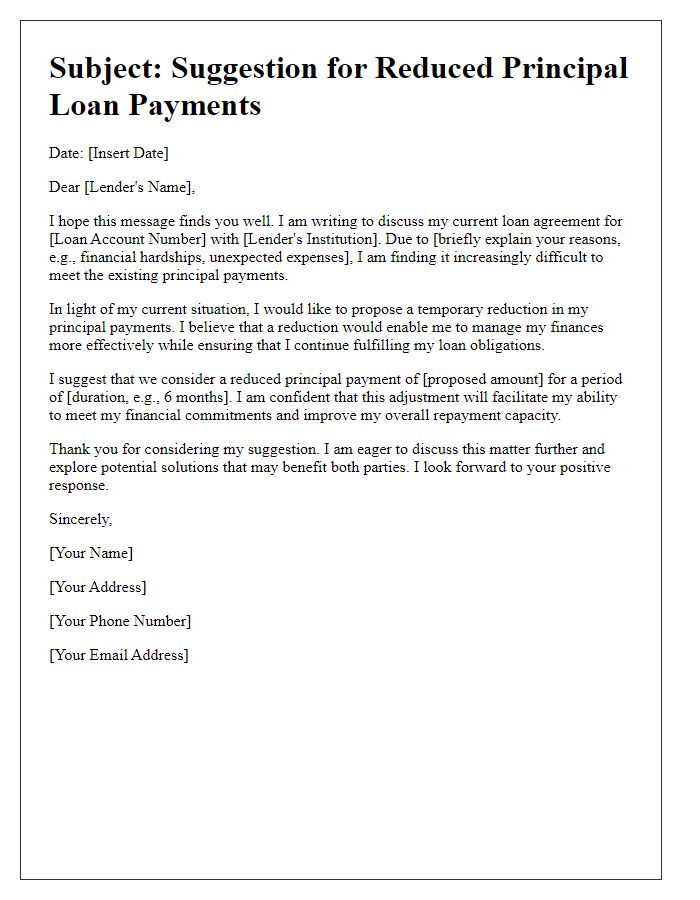

Proposed revised terms

The proposal for loan principal payment reduction requires a detailed examination of existing terms and potential adjustments. Current principal amount stands at $50,000, with an interest rate of 5% annually, leading to a monthly payment of approximately $943. An alternative plan proposes a reduction in principal to $40,000, which would adjust the monthly payments to around $857, easing financial pressure. Additionally, extending the loan term from 5 years to 7 years could further lower monthly obligations, providing a more manageable repayment structure. This adjustment considers current economic conditions, notably inflation rates around 3% and recent changes in the labor market affecting borrowers' income stability. A meeting proposed for April 15, 2024, aims to discuss these revised terms in depth and explore potential benefits for both parties.

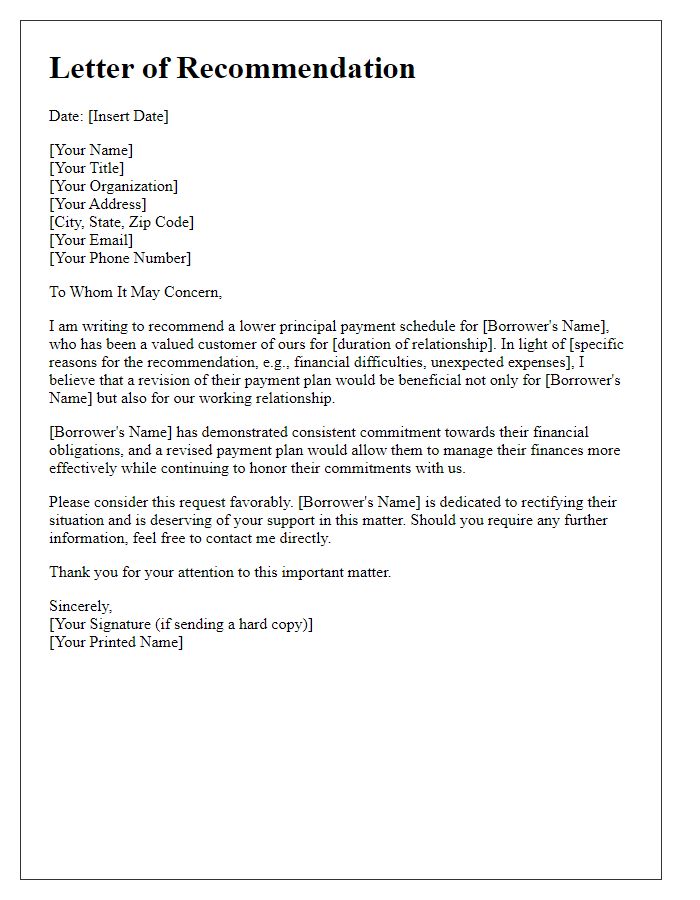

Contact information for follow-up

If a borrower is seeking to reduce their loan principal payment, they may need to contact their lender. Important details include the borrower's name, address, and account number, typically found on loan documentation. The lender's contact information, including phone numbers or email addresses, should be prominently displayed to facilitate follow-up. Additionally, the specific loan type, such as a fixed-rate mortgage or an auto loan, may need to be mentioned along with the payment terms to provide relevant context. It is important to articulate the reason for the reduction request, such as financial hardship or changes in personal circumstances, to strengthen the case for reconsideration.

Letter Template For Loan Principal Payment Reduction Samples

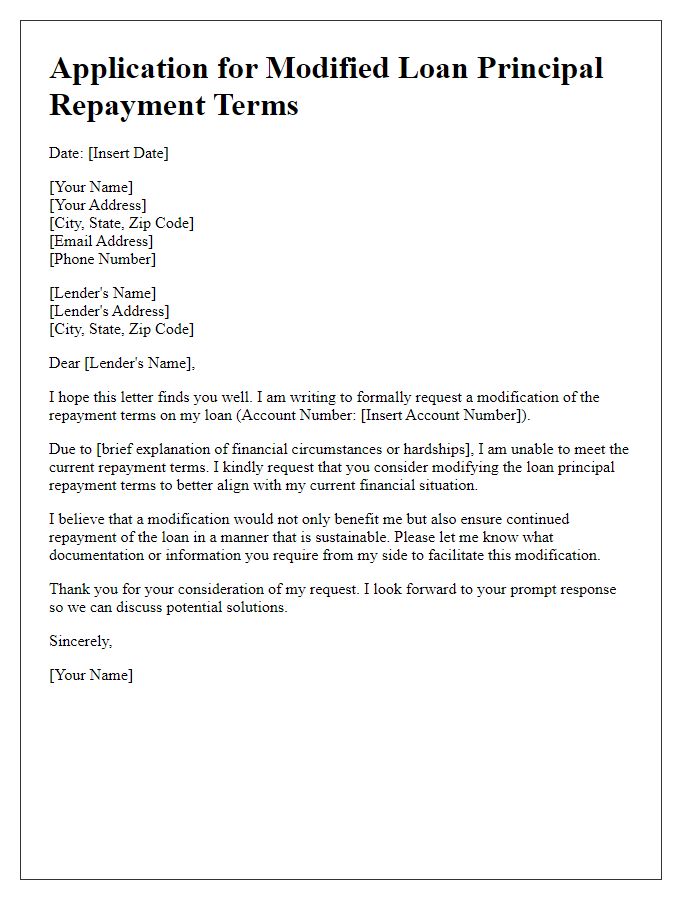

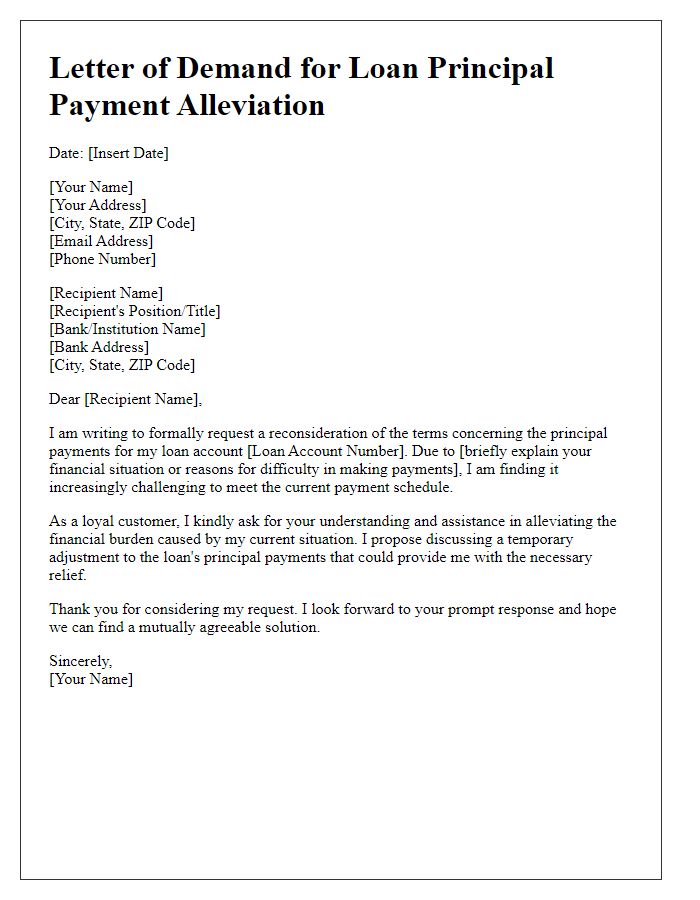

Letter template of application for modified loan principal repayment terms

Comments