Are you feeling overwhelmed by the responsibilities of being a loan guarantor? It's common for individuals to step in as guarantors, but circumstances can change, leading to the need for a release from that obligation. In this article, we'll walk you through the essential steps and considerations needed to navigate the loan guarantor release process smoothly. So, if you're ready to learn more about how to safely untangle yourself from that commitment, keep reading!

Loan Details and Account Information

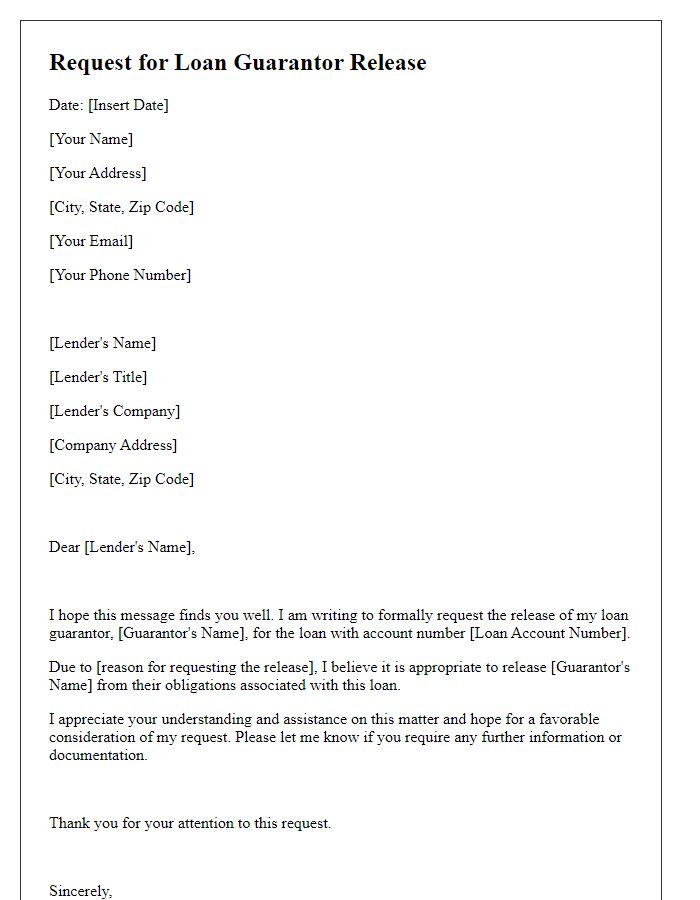

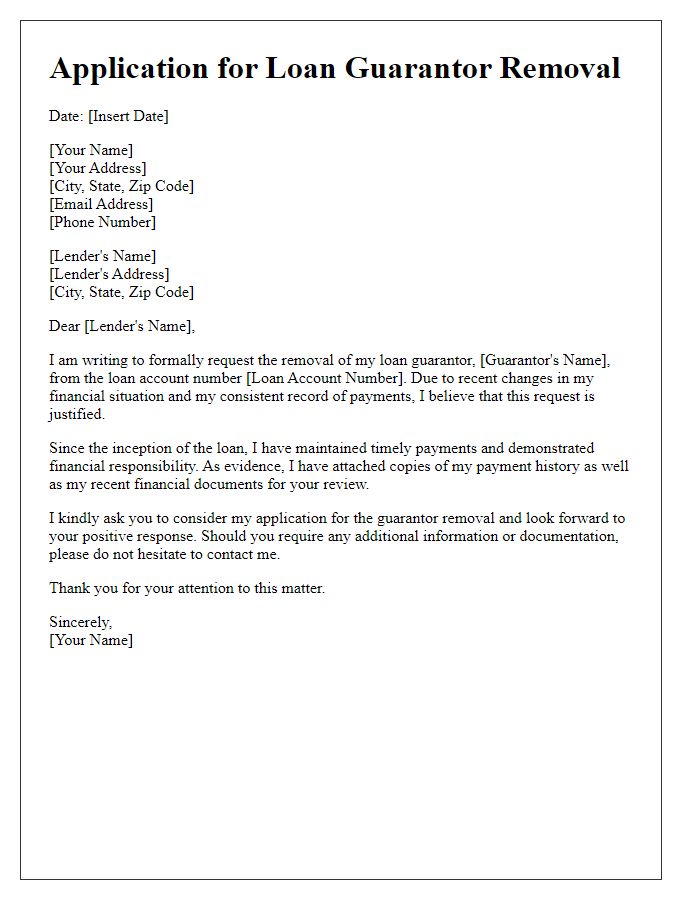

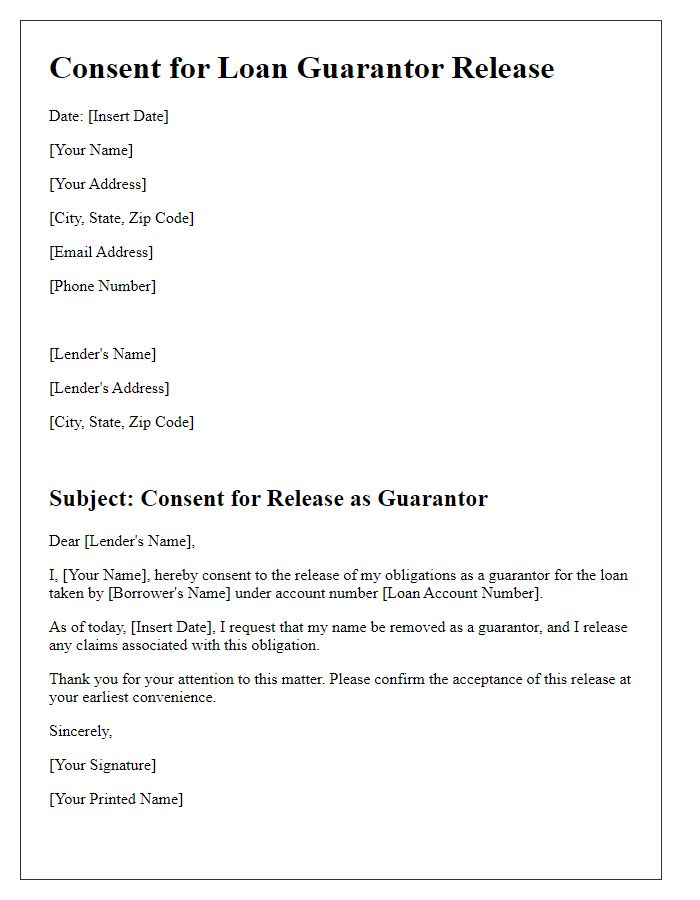

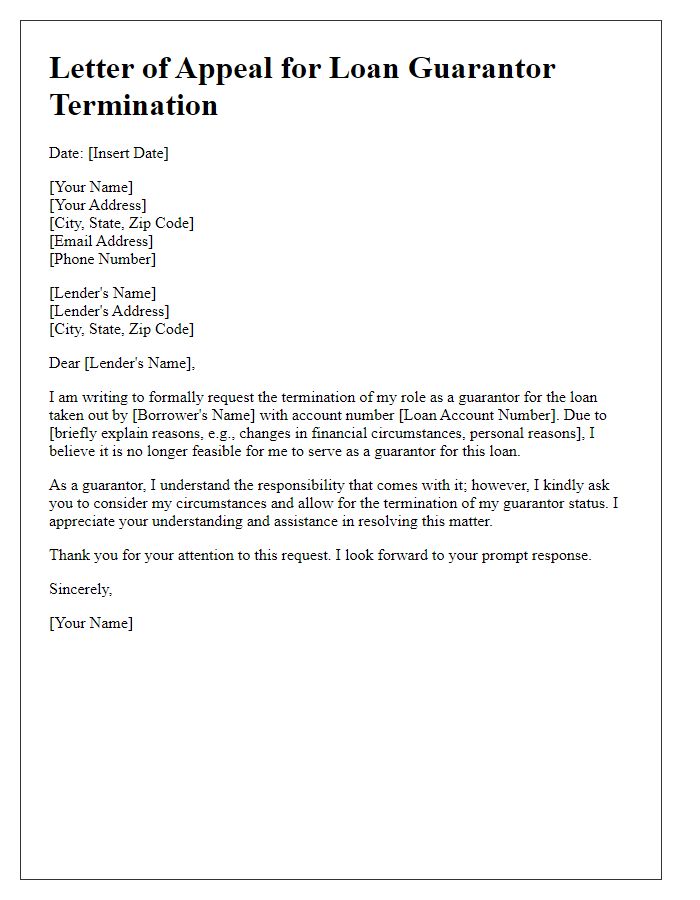

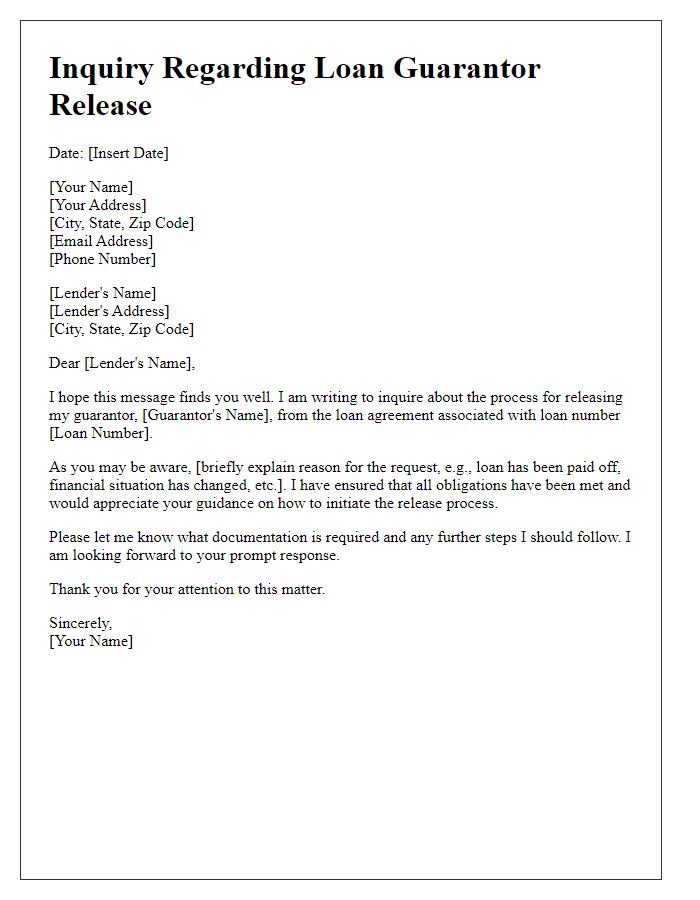

Loan agreements often require a guarantor to provide financial security for the lender. Upon completion of the loan term or fulfillment of certain conditions, a borrower may seek to release their guarantor's obligations. Essential loan details include the loan number, disbursement date (for example, January 15, 2020), and outstanding balance (e.g., $5,000). The account information should reference the borrower's name and address (e.g., John Smith, 123 Elm Street, Springfield). A letter requesting release should mention the lender's name (e.g., ABC Bank), along with any account identifiers necessary for processing. The context of the request should highlight the borrower's timely payments (e.g., on-time payments for 12 consecutive months) as a basis for the guarantor's release.

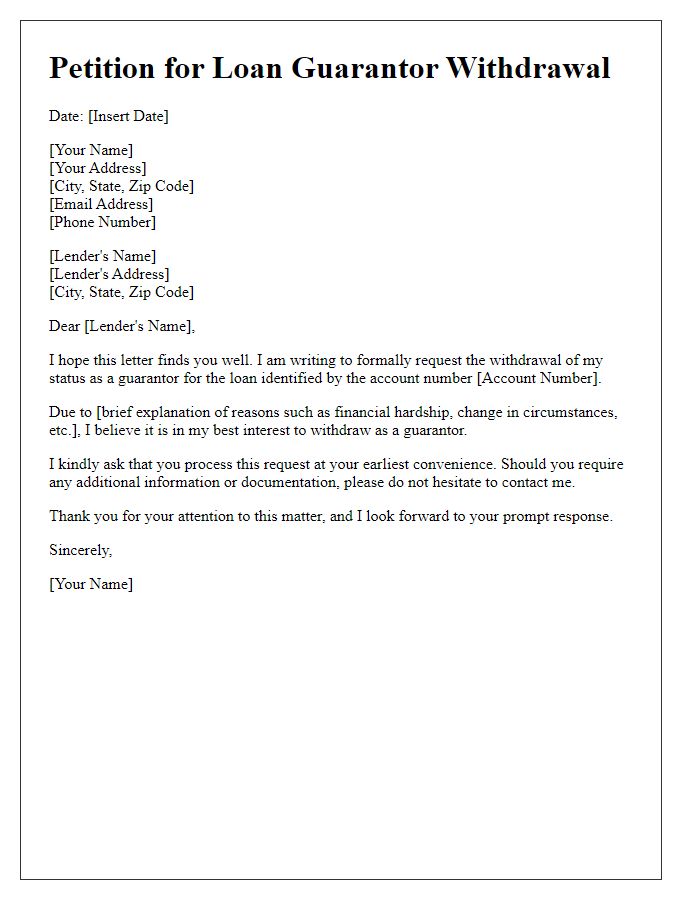

Guarantor's Personal and Contact Information

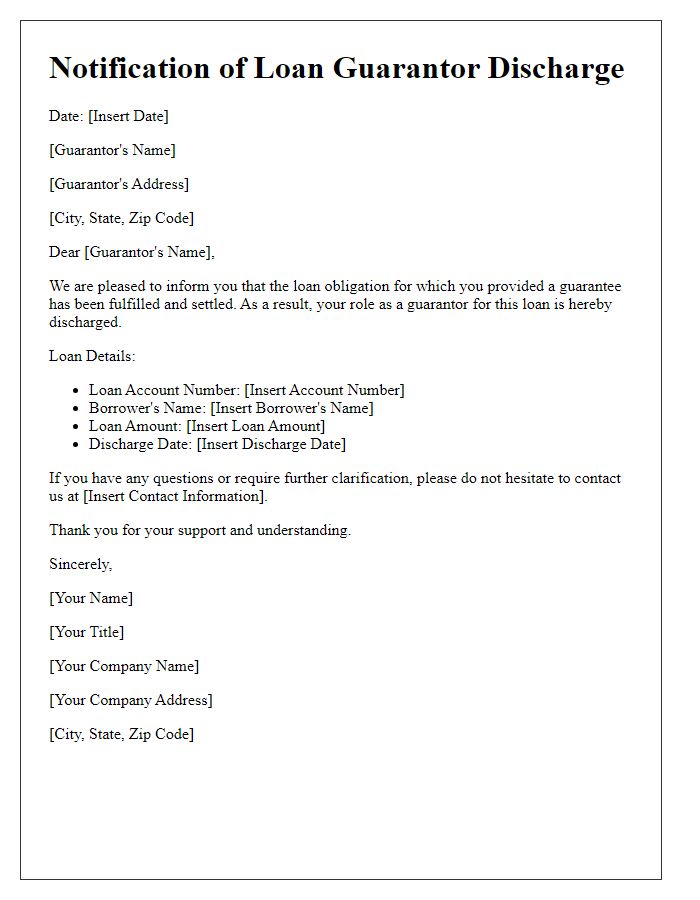

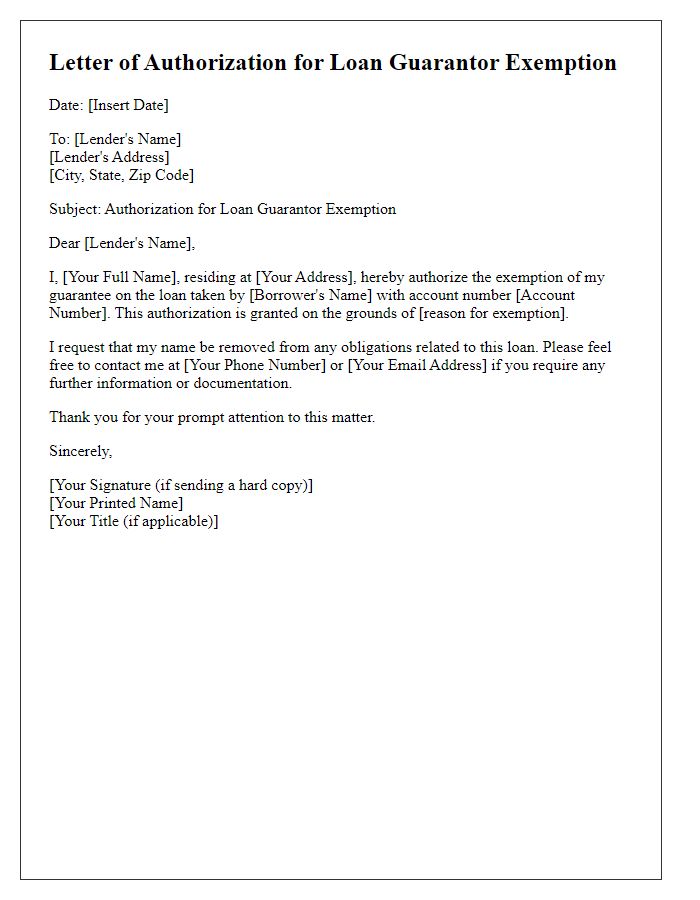

The loan guarantor release process involves the careful management of the guarantor's personal and contact information, ensuring that it aligns with legal and financial institutions' requirements. This information typically includes the guarantor's full name, current residential address, phone number, email address, and possibly their Social Security Number (SSN) or Tax Identification Number (TIN) for verification purposes. Accurate documentation is crucial for processing the release efficiently, and it may be submitted to banks or credit unions, such as Bank of America or Chase, to finalize the withdrawal of the guarantorship on loans. Timely submission is essential, especially if tied to events like loan payoffs or refinancing, which might occur in specific time frames. Detailed record-keeping of the communication regarding this process can support transparency and prevent potential disputes.

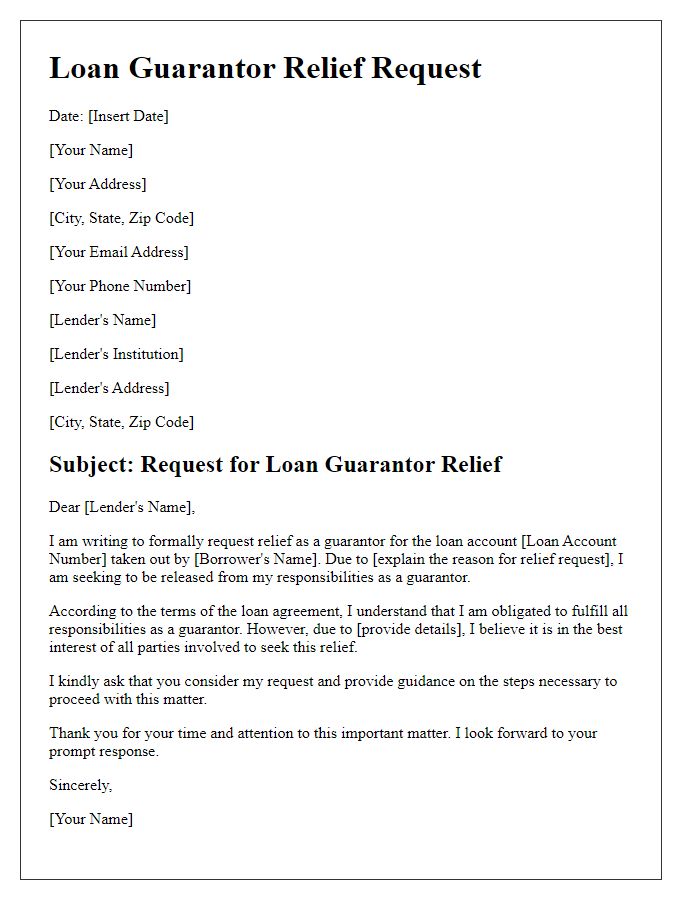

Reason for Release Request

A loan guarantor release is often requested due to significant life changes or financial shifts. Common reasons for this may include a job loss (typically influencing income stability), a change in personal circumstances (such as marriage or divorce), or the settlement of the original loan (which may have fulfilled the guarantor's obligations). Additional factors might involve improving credit scores (reflecting financial responsibility) or the primary borrower achieving a refinancing option (which relieves the guarantor from liabilities). Each of these situations can prompt a formal request for release, signaling a shift in the financial arrangement between the involved parties.

Supporting Documents and Evidence

The process of loan guarantor release necessitates the submission of several supporting documents and evidence to ensure a smooth transition. Essential documents include the original loan agreement, outlining the terms of the loan with a clear indication of the guarantor's responsibilities. Proof of repayment history, such as bank statements or payment receipts, is crucial to demonstrate that the borrower has met all financial obligations. A formal request for release letter must be provided, detailing the guarantor's request for termination of responsibilities. Identification documents of the guarantor, such as a government-issued ID or passport, validate their identity. It may also be beneficial to include a statement from the lender confirming the eligibility for guarantor release based on loan status. This compilation of documents can facilitate the approval process, ensuring the guarantor is no longer liable for the loan in question.

Contact Information for Further Communication

A loan guarantor release involves legal documentation that allows a guarantor to be removed from their obligation on a loan. Important details include the loan amount, original lending institution such as Bank of America or Chase, and the date of loan initiation, often from 2020 or 2021. Additionally, the guarantor's personal information, like their social security number and address, must be documented for verification purposes. Clear communication channels established through email (example: guarantor@email.com) or phone must be included for further correspondence regarding the release process. Legal terminology and signatures are often required on the final release document to ensure compliance with financial regulations.

Comments