Are you feeling overwhelmed by your mortgage payments and considering the possibility of prepaying? You're not aloneâmany homeowners are looking for ways to reduce their financial burden and save on interest over time. A mortgage prepayment can be a strategic move to help you achieve financial freedom faster, but navigating the process can be a bit tricky. If you're curious about how to draft a letter requesting a mortgage prepayment, keep reading for practical tips and a helpful template!

Borrower's personal information

Borrowers seeking mortgage prepayment options must typically provide personal information to streamline the request process. Essential details include the borrower's full name, often required for identification purposes, and contact information such as a phone number and email address, crucial for effective communication. The property address should also be provided, specifying the exact location of the mortgaged property, which assists lenders in retrieving relevant records. Additionally, the loan number, a unique identifier for the mortgage account, is critical for ensuring accuracy in processing the prepayment request. Finally, any supporting documents that verify the borrower's identity or financial status may be requested, further facilitating the prepayment procedure.

Loan account details

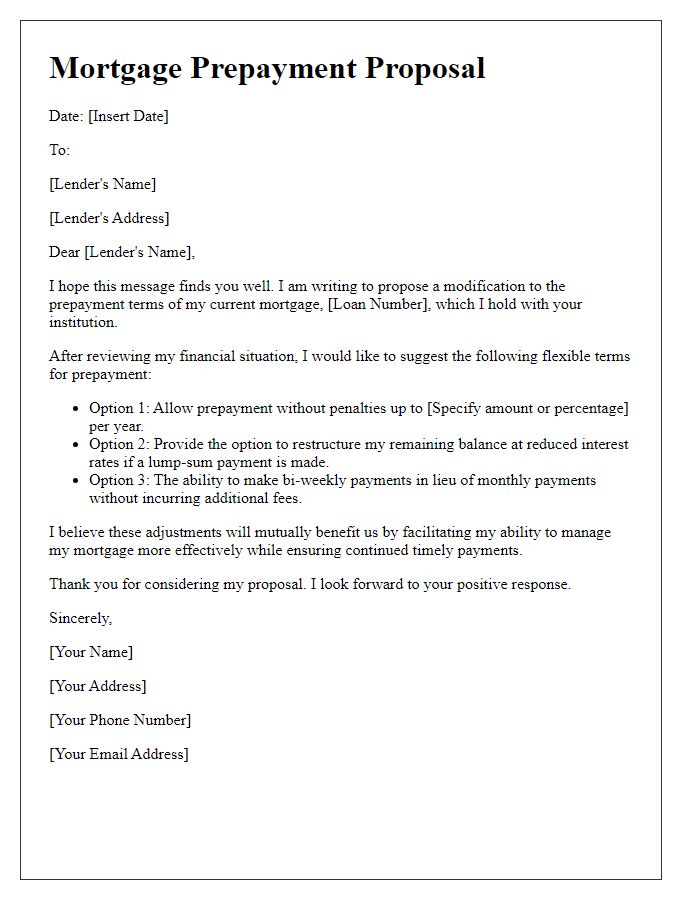

Mortgage prepayment requests often relate to loan account details, such as account number, loan type (fixed-rate, adjustable-rate), outstanding balance, and current interest rate. Prepaying a mortgage can involve varying amounts, typically based on applicable terms or policies set by lenders, often around 20% of the principal. Borrowers may seek specific instructions from their lenders about prepayment penalties or any associated fees, as these can significantly impact overall savings. Lenders usually provide a prepayment calculator tool, which can help borrowers understand potential reductions in interest costs and adjustments to repayment schedules after making early payments on the loan.

Prepayment amount specification

A mortgage prepayment request involves financial transactions and specific terms that require careful consideration. Homeowners looking to make an early payment on a mortgage loan often specify the prepayment amount to reduce the principal balance and potentially save on interest payments. Each lender may have particular requirements regarding minimum prepayment amounts, penalties, or fees associated with such actions. The precise amount, whether a fixed dollar value or a percentage of the loan, is crucial for easing overall debt obligations. Many borrowers also inquire about the effects of prepayment on future monthly payments or the loan term, ensuring that they understand how this financial decision impacts their overall mortgage strategy.

Intended date for prepayment

Prepaying a mortgage can significantly reduce overall interest costs and shorten the loan term. Homeowners often seek to make prepayments during favorable financial periods, typically around tax return season in April, or after receiving a bonus. The intended date for such prepayment could be aligned with a specific financial strategy, such as the first of the month when funds are more readily available. Lenders may have specific guidelines regarding prepayments, which can include minimum amounts or early payment penalties, emphasizing the importance of reviewing loan agreements before proceeding. Providing detailed documentation, including account numbers and payment information, ensures clarity in the transaction process.

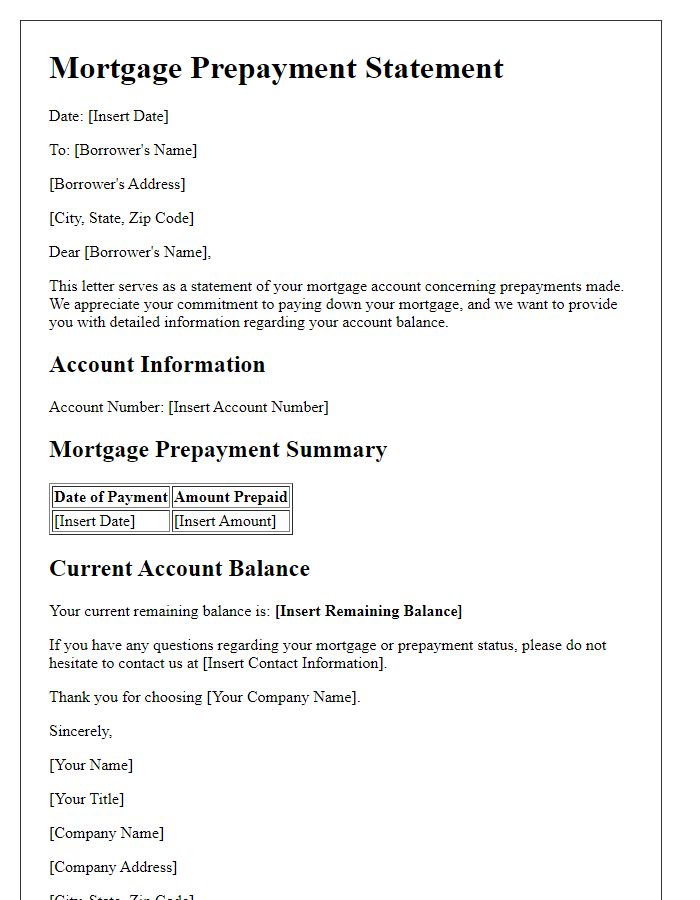

Request for confirmation and updated amortization schedule

A mortgage prepayment can significantly impact the overall loan balance, particularly for a Fixed Rate Mortgage. Homeowners exploring prepayment often require a written confirmation from their lender, detailing how this early payment affects their loan terms. The updated amortization schedule is essential, showcasing the new balance, monthly payments, and interest reduction. Lenders may provide specific terms regarding penalties or fees related to prepayment, influencing the homeowner's financial strategy. Knowing the remaining principal, the interest rate (for example, 3.5% annually), and understanding how the prepayment interacts with the overall mortgage process can help in making informed decisions.

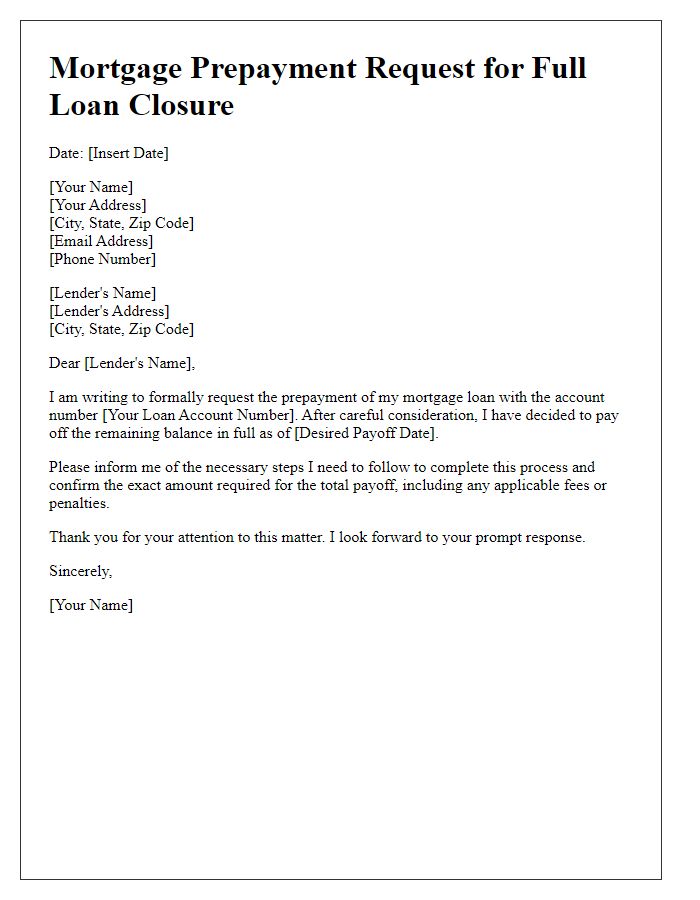

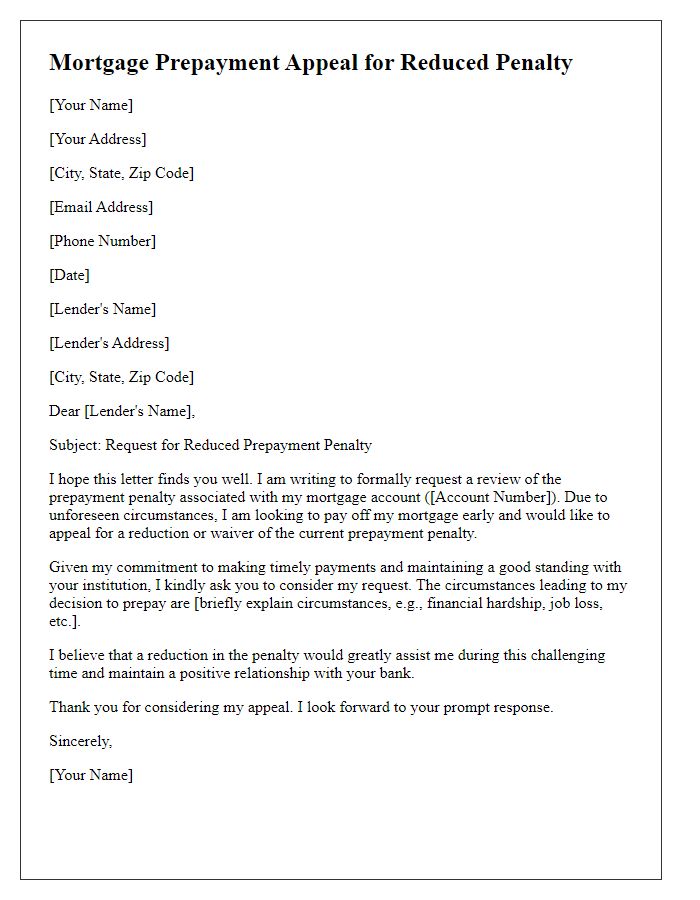

Letter Template For Mortgage Prepayment Request Samples

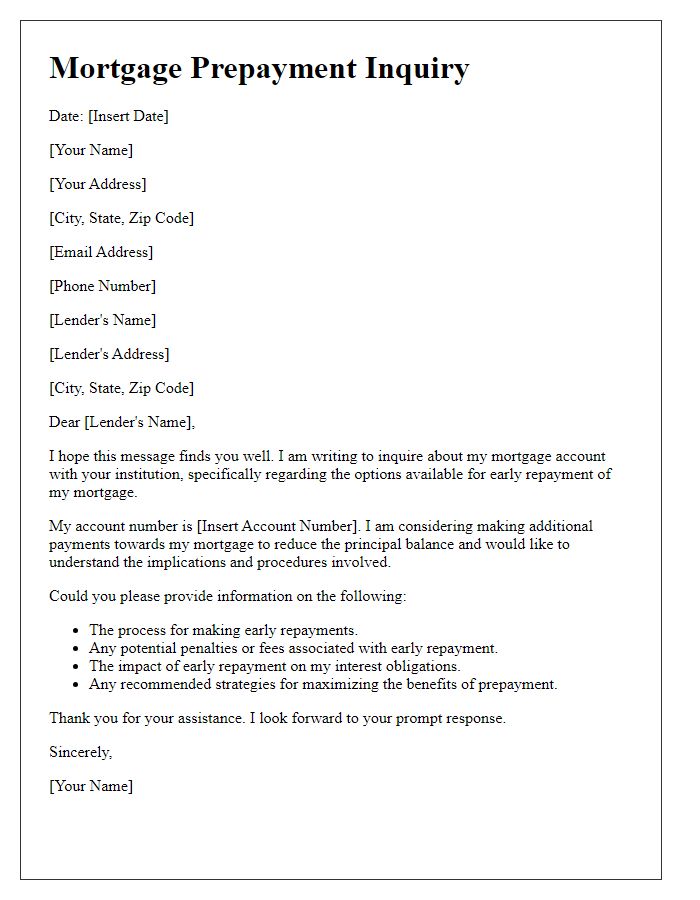

Letter template of mortgage prepayment inquiry for early repayment options

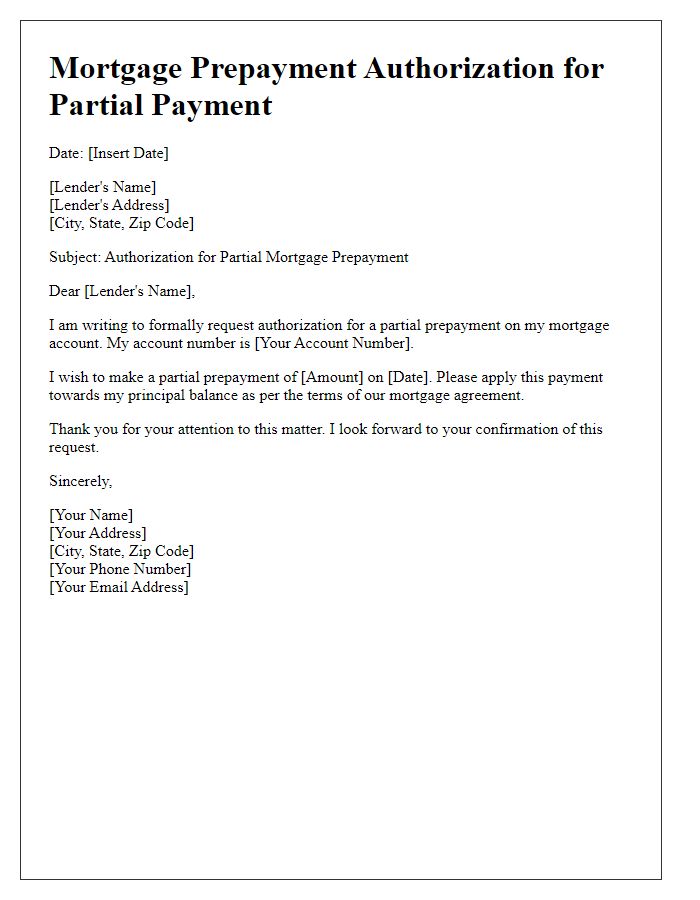

Letter template of mortgage prepayment authorization for partial payment

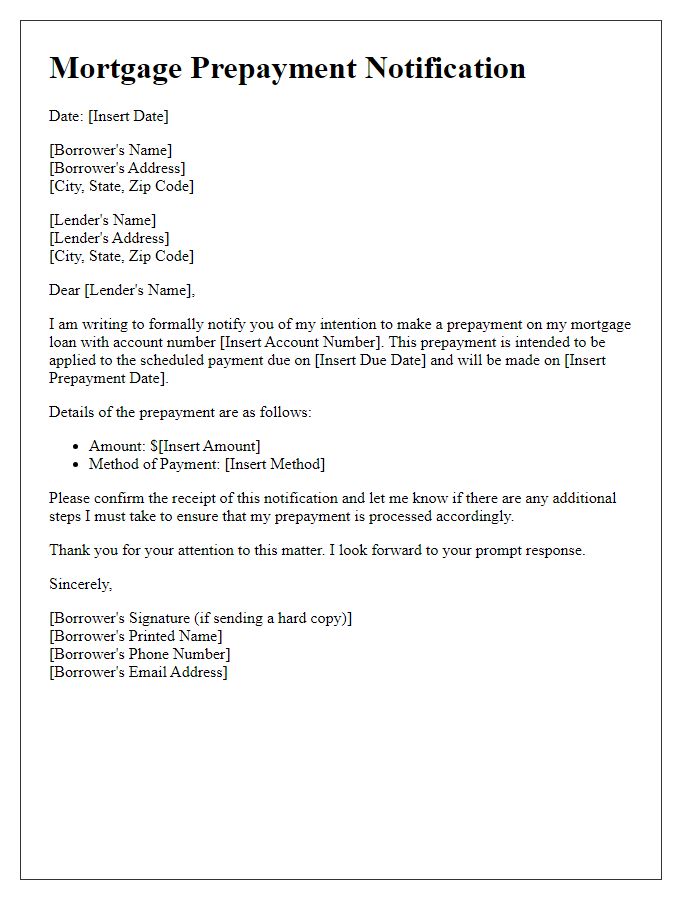

Letter template of mortgage prepayment notification for scheduled payments

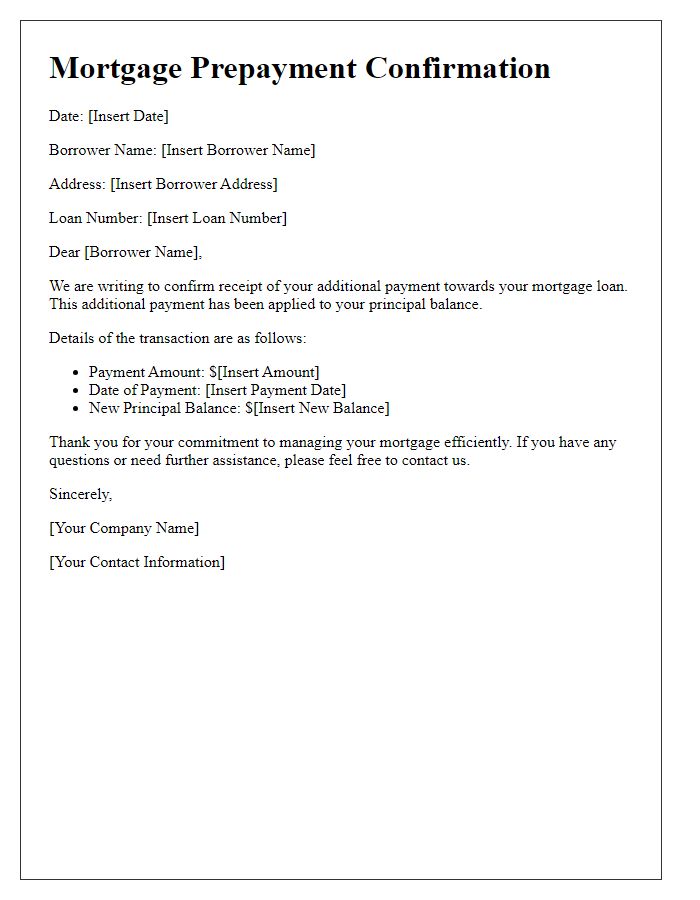

Letter template of mortgage prepayment confirmation for additional payment

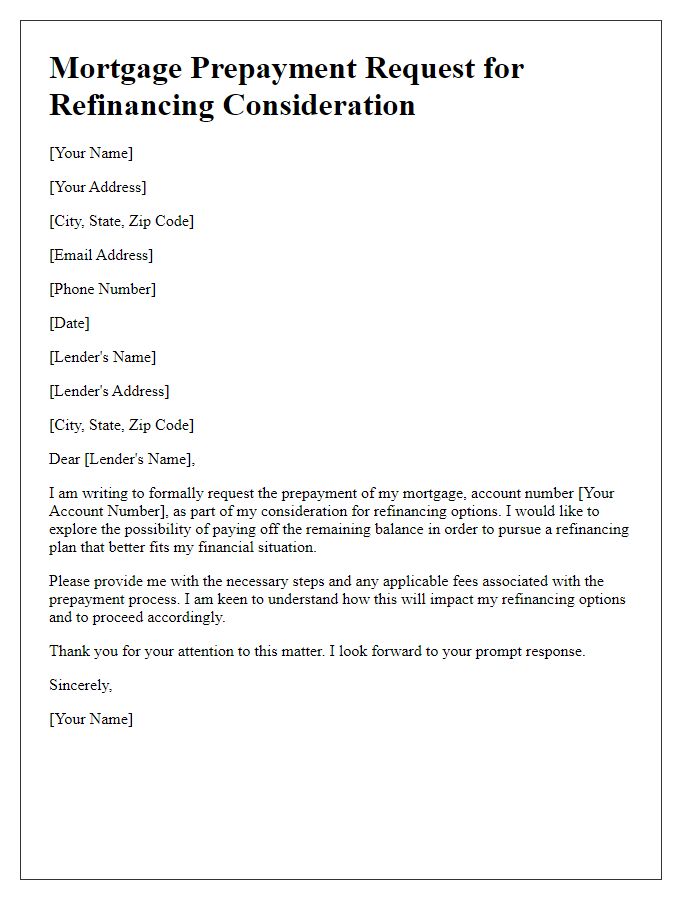

Letter template of mortgage prepayment request for refinancing consideration

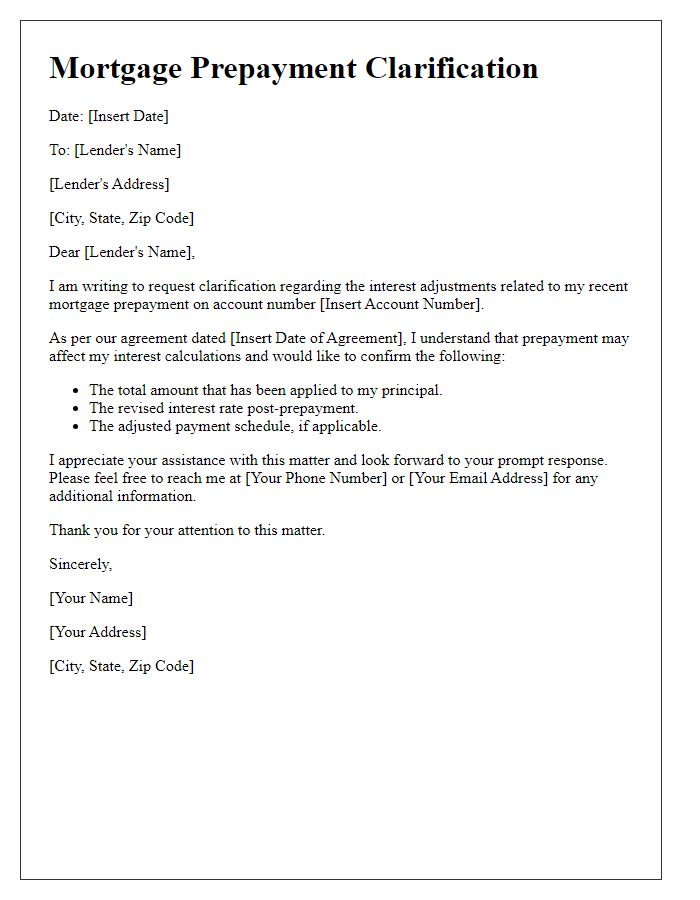

Letter template of mortgage prepayment clarification for interest adjustments

Comments